Sunday, December 10, 2023 3:23:45 AM

A Conservatorship preserves their status as private shareholder-owned enterprises, and it's a process for the financial rehabilitation of the enterprises, as Justice Alito stressed with "Rehabilitate FnF..." (adding the Marxist-way for the extortion of resources in the process), also according to the FHFA-C's Power (stance removed by Gary Hindes in an amended complaint, pointed out yesterday) and the fact that the FHEFSSA established a mandatory release Undercapitalized, though conveniently struck by Calabria's HERA (Source). Undercapitalized, a Capital Classification: Core Capital greater than the Minimum Leverage Capital requirements. Source) just in case that someone thinks that during Conservatorship, a company doesn't have to build capital.

Definition of Core Capital.

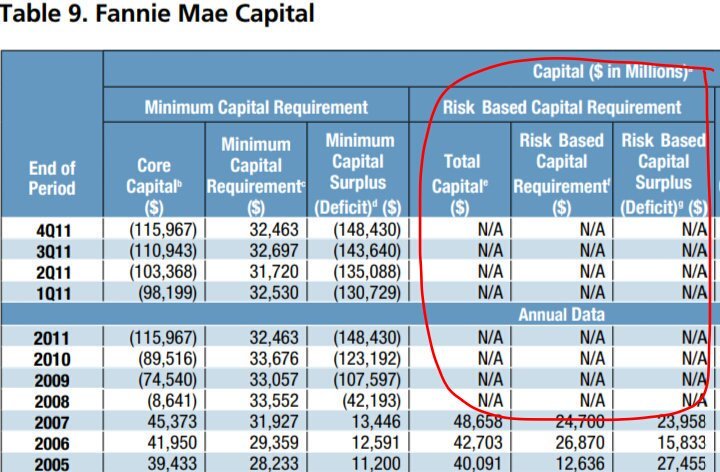

A conservatorship established for Critically Undercapitalized enterprises (Source) and banks (FDI Act), these people intend to make us believe that it's a status where they can start to decapitalize them on a great scale, with fat dividends to the government, SPS increased for free and the payment of Securities Litigation judgments (the 3 of them, capital distributions: 12 U.S.Code §4502(5)(A), amended by the FHFA to add the number 3 pointed out: CFR 1229.13, currently a breach in the Lamberth court, as FnF have already charged this payment in their Q3 reports. It's restricted for a reason (Recapitalization) and thus, you can't even set aside a reserve that has already deprived FnF of the capital they must retain. The FHEFSSA's Restriction on Capital Distributions, U.S.Code §4614(e) was inserted by HERA subtitle "Prompt Corrective Action" at the end of the section Capital Classifications in an attempt to make it go unnoticed, isn't just a fancy name), leaving FnF with an adjusted $-216 billion Accumulated Deficit Retained Earnings account combined. A CET1 account meant to absorb future losses (Today's Core Capital = $-194 billion combined). And later beg the UST to pardon the debentures. This isn't how it works. So much for rehabilitation, which is not the return to profitability as a judge claimed in the Federal Circuit, but those earnings must be retained to be considered the capital that measures the soundness in a financial company, as Calabria pointed out (Source). But "retained" for real, not retained and later eliminated with the offset (reduction of Retained Earnings) when the SPS are increased for free every quarter in the same amount (operation concealed with fraud: gifted SPS and offset, absent from the Balance Sheets, but we can see this effect in table).

returning the companies to their former states of shareholder-owned companies,

This Restriction on Capital Distributions in the FHEFSSA, was later supplemented (follow-on plan: for the recapitalization in a Separate Account) with the CFR 1237.12 of the July 20, 2011 Final Rule. Source.

Capital requirements with a Capital Rule that came into effect on February 16, 2021 (Source) and kept secret until January 1st, 2022 (Source), so representative French Hill could ask Sandra Thompson about the 2021 FHFA Report to Congress in the annual testimony (The next year, McHenry did the same, scheduling the 2023 testimony for one week before the 2022 FHFA Report to Congress was released)

A back-end Capital Rule thanks to the removal of Calabria of the typical 18-month period (Section IMPLEMENTATION in the FHEFSSA. Source), to write regulation when HERA amended the FHEFSSA to strike the prior formulaic in the Risk-Based Capital requirement (Source), but, the Minimum (Leverage) Capital requirement has been in force during the entire Conservatorship, because HERA only authorized the director to change the percentages and add new capital metrics (CET1, Tier1), Source, and until then, the prior percentages are still in force because they are statutory.

Therefore, the capital deficit over statutory Minimum (Leverage) Capital requirement, has been known every quarter and reps. Hill and McHenry's attempt to conceal the new standards was futile.

For instance, this was posted by Freddie Mac in the earnings report filed with the S.E.C..

So, the idea that the Congress has had no idea about the soundness of FnF because there hasn't been a FHFA Report to Congress in time for the annual testimony in Congress, is groundless, because without the new Capital Rule, there's been others tables in the FHFA reports to Congress with the capital deficits as a result of the prior capital requirements in force until the FHFA change the percentages in the Minimum Leverage capital requirement.

This is why the plotters like Howard and Bradford call the new Capital Rule "HERA capital requirements". They want to transmit the idea that everything before 2008 HERA doesn't exist anymore, just like the DOJ's attorney with "as of the passage of HERA...", when HERA just amended the laws in force, the FHEFSSA and the Charter Act. Therefore, there is no HERA law, but FHEFSSA and Charter Act, as amended by HERA. The rogues can't understand that HERA always starts with "section XXXX of the FHEFSSA/Charter Act is amended by striking/inserting.....".

This is what the congressmen saw in the FHFA Reports to Congress, awaiting the Director to change the percentages in the Minimum (Leverage) Capital requirement and come up with a new formulaic with the Risk Based Capital requirement from scratch.

Likewise, the Critical Capital level must appear in the Capital Rule ERCF tables because it's statutory. The rogue officials didn't want to show that FnF don't meet this third capital level considered Critical, so they can continue peddling their lie of "everything is fine", "release from conservatorship as is now", as seen in Gary Hindes' letters and others that call for the release "as is" without unveiling the Separate Account plan in the first place.

All the statutory definitions pointed out in this comment. This is why the Mnuchin's Treasury recommended Congress to repeal them. They rather make up their own rules, like Mnuchin-Calabria's September 2021 PA amendment: "Capital Reserve End Date: when the capital reserve meets the capital requirements". So, they want the capital requirements be met with the Net Worth ($118 billion), instead of with the capital metrics like every other financial institution in the world: Core Capital ($-194 billion), Total Capital, CET1 and Tier 1 Capital.

Sorry but you have to uphold the law in the first place, not the other way around, using the Congress to back up your conspiracy for the assault on the enterprises without paying the (adjusted) fair value for the stocks.

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM

Branded Legacy, Inc. and Hemp Emu Announce Strategic Partnership to Enhance CBD Product Manufacturing • BLEG • Jun 27, 2024 8:30 AM

POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • POET • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM