Saturday, December 09, 2023 1:29:39 AM

Either for concealing the key statutory provisions and financial concepts, or for not challenging the Warrant.

Their stance in court doesn't recover even $1 of core capital, out of $420 billion worth of capital generated by FnF in 15 years ($301 billion cash dividend to UST and $118 billion through the offset when the SPS were increased for free with the new compensation to UST now in place), that would more than offset today's adjusted $402 billion capital deficit over Minimum Leverage capital requirement, FnF together and as of end of September 2023.

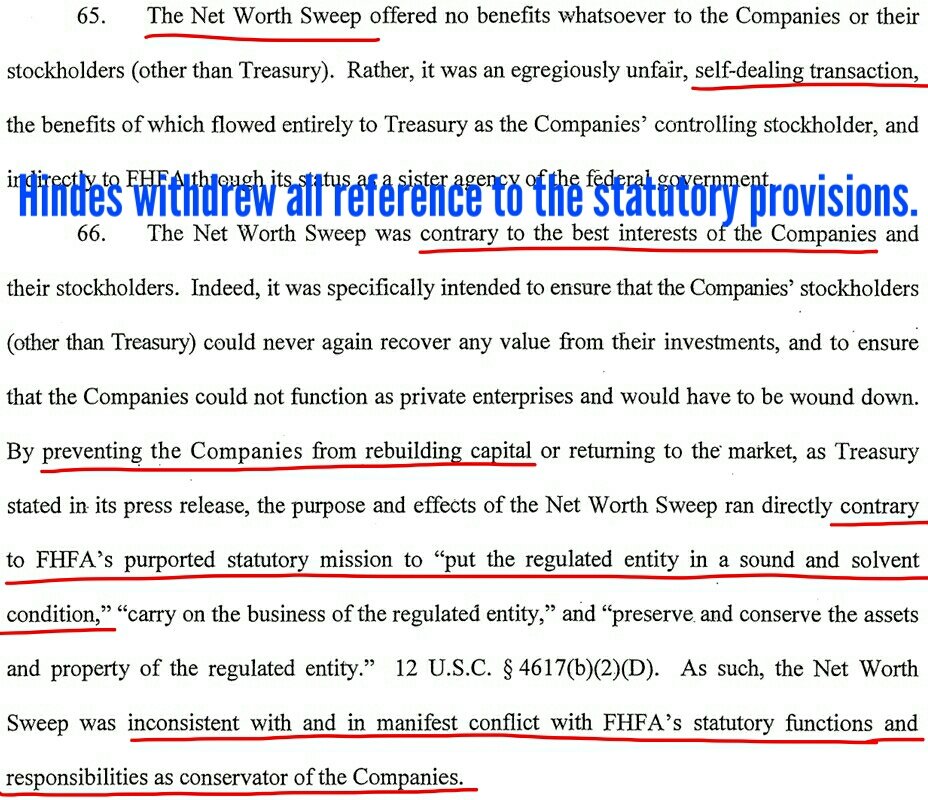

In order to have a sense of this misbehavior in court, we have the example of the hedge fund manager Gary Hindes, who filed an amended complaint on March 16, 2017, with the objective to remove every prior reference to the breach of statutory provision laid out in his first complaint filed on August 17, 2015.

The gang read in my tweets that the plaintiffs' take was insane, challenging the NWS dividend but not the 10% dividend, when both are the same breach of the FHFA-C's Rehab power that they were complaining about (a dividend depletes capital).

It's when the plaintiffs reagrouped and the Supreme Court was activated to target the FHFA-C's Incidental Power instead. Justice Alito only could play with words and attempt to mislead changing "best interests of the Agency" for "beneficial to the Agency" and adding "...and the public it serves" that isn't written in the law, in order to hold up the plotters' Government theft story a few more years, as counterparties of the DOJ in court, and try the fiction of Implied Contract breach, instead of the reality of the Separate Account plan, already carried out by the same officials in the 1989 bailout of the FHLBanks (Sandra Thompson at the FDIC and DeMarco at GAO first, the auditor, later at the UST)

The corrupt litigants and company face a $4.8 billion penalty for stock price manipulation in both Cs and JPS, in their conspiracy to defraud the shareholders in favor of the JPS holders, betting on a "restructuring" to share the booty with the UST.

Court delays directly impact FNMA/FMCC PPS.

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM

ECGI Holdings Targets $9.7 Billion Equestrian Apparel Market with Allon Brand Launch • ECGI • Jun 25, 2024 8:36 AM

Avant Technologies Addresses Progress on AI Supercomputer-Driven Data Centers • AVAI • Jun 25, 2024 8:00 AM

Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • GRLF • Jun 24, 2024 8:30 AM

Bemax Inc. Positions to Capitalize on Industry Growth with New Improved Quality of Mother's Touch® Disposable Diapers • BMXC • Jun 24, 2024 8:00 AM

Last Shot Hydration Drink Announced as Official Sponsor of Red River Athletic Conference • EQLB • Jun 20, 2024 2:38 PM