Friday, December 08, 2023 4:06:07 AM

Because the underlying security in a Preferred Stock is a fixed-income security. An obligation to be precise and, as any obligation, they are unique and the issuer must issue the securites so they are dated and attached to a certificate of designations.

The UST hasn't purchased even one security. Everything "increased" or issued for free, like the Warrant to skip the prerequisite on purchases of "to protect the taxpayer" (collateral)

The increase in the SPS Liquidation Preference is, therefore, a Securities Law violation that others will call "deregulation", for which we are requesting a compensation for Punitive Damages, jointly with other 7 violations.

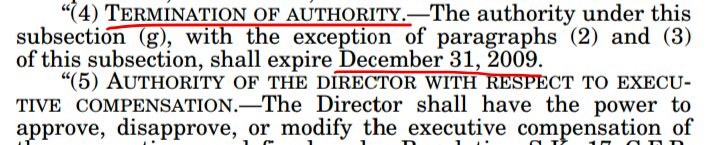

The objective was to skip the December 31, 2009 deadline in the "TEMPORARY authority of Treasury to purchase (high yield) SPS" inserted by HERA in the Charter Act for the Separate Account plan (the original one at a rate similar to Treasuries prevails. An estimated weighted-average 1.8% dividend rate, with a 0.5% spread over Treasuries in each "no-purchase" -LP increase-).

Another reason why GS's Paulson needed the initial $1 billion SPS issued for free, besides to reduce the Core Capital with its offset (source), he wanted to enable the following scheme of SPS LP increase, thinking of the deadline.

This deadline had an exception (3) FUNDING, that the UST and FHFA wanted to pass off as the UST Funding Commitment, when the PA was amended for a second time on December 24, 2009, just a few days before the aforementioned deadline, replacing Treasury’s $200 billion Funding Commitment with new formulaic commitments.

But this is false. The exception (3) FUNDING is related to how the UST funds the purchases it was authorized, using Public Debt, and unrelated to a funding commitment in FnF.

This subsection TERMINATION OF AUTHORITY would have compelled the UST to make a one-time investment in SPS, but Hank Paulson needed more time for the assault on the ownership of FnF through the Warrant: "shares assigned to any Person" (covenant 2.1) that never came to light, and Obama needed more time for the "Obama's programs" paid for by the FnF shareholders. Huge money still due, in the MHA programs (HAMP and HARP), estimated in $15 billion, even money that FnF advanced to the banks (mortgage servicers) under TARP, but later FnF weren't reimbursed for this cost. TARP deemed a success. Of course, after concealing that $15 billion is still due.

This $15 billion could be considered that falls squarely within the "beneficial to the Agency and the public it serves" laid out by justice Alito, commented in my prior post. So, more extortion of their resources.

Another windfall for the UST during conservatorship, like the estimated $46 billion in "legislative fees", barred in the Charter's Fee Limitation of the United States.

Good, but these windfalls must be considered in a final resolution, in the case of "as is" or takeover scenarios, where the UST will earn $0 in the bailout (cumulative dividend netted out with the interests on $153 billion due)

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM