Friday, December 08, 2023 2:07:39 AM

The second part of the SCOTUS, was correct, stressing that FnF must be rehabilitated, which, as Calabria pointed out, it has only one meaning

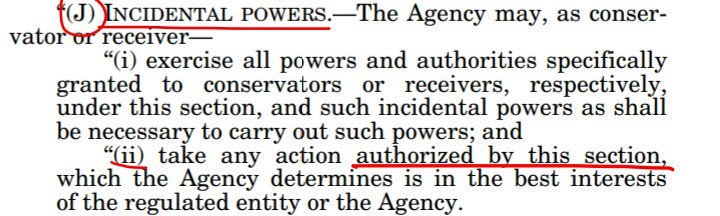

and judge Willett spotted as well when interpreting the conservator's Incidental Power, with: any action "within the enumerated powers"

to later focus on the "in the best interests of the Agency" part, that judge Willett missed,

attempting to mislead passing it off as "beneficial to the Agency", because it's not about monetary benefit but a benefit related to Housing Finance System revamp as we have witnessed building up through today, with the FHFA finalizing on November 22nd a Final Rule for the Catastrophic-Loss Reinsurance "supers" or commingled securities (option 3 in the 2011 UST's recommendations on ending the conservatorships in the case of Government reinsurance, otherwise option 1 or 2), with a Risk Weight of 5% and a Credit Conversion Factor of 50%.

Plus other "interests", not benefits, like currently extending the Conservatorship beyond what is reasonable (upon Undercapitalized: Core Capital > Minimum Leverage Capital requirement, like in the prior mandatory release in the FHEFSSA -source- or with the resumption of dividend payments with the 3Q2022 results in Fannie Mae on year ago, as the exact moment when the FNMAS' fair value fetched its par value) with the objective to redeem the JPS when the CET1 > 2.5% of Adjusted Total Assets under the Separate Account plan -Fannie Mae as of the 3Q2023 results-, complying with Tier 1 capital > 2.5% once they are redeemed -ERCF-, in time for the announcement of release from Conservatorship and Housing Finance revamp, as per the UST's recommendations for the release from conservatorship outlined in its 2011 Report to Congress, at the request of the Dodd-Frank law of 2010.

Justice Alito, with his after-thought: "and the public it serves", simply wanted to add up more "interests of the Agency", with an authorization to sell NPL, RPL at a deep discount to capture the "debt forgiveness" string attached, and REO inventory, to special interest groups.

So, zero government policy but the sacking of FnF and the utilization of the enterprises to leverage the political negotiation between the GOP and Democrats.

This is very different from your "FHFA can do whatever the hell it wants" (source), echoing what your mentor Bill Ackman implied with: FHFA has absolute discretion (Source), in an attempt to pave the way to a negotiation outside the Rule of Law that your buddy David Stevens referred to as "old and tired". No wonder why yesterday he came up with a Govt Explicit Guarantee on MBSs and Utility Model.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM