Sunday, December 03, 2023 2:44:18 AM

"par paper at some point that’s taken years to accumulate"

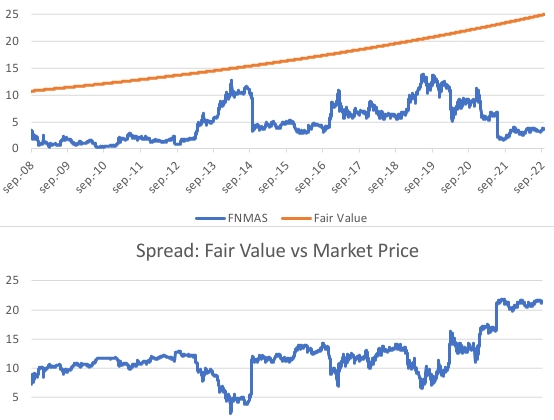

The JPS holders should have expected this annual rate of return that I have estimated at 6% in this chart with the fair value of FNMAS, the most liquid among all the series of preferred stocks, with the stock trading according to its fundamentals.

That is, a fixed-income security without a "coupon payment", trades at a discount to its "face value", that, in the case of JPS, they would recover the par value with the resumption of dividend payments upon becoming Adequately Capitalized again (threshold increased further in the Table 8: Payout ratio, of the 2021 Capital Rule), as a dividend rate is calculated over its par value, so if you want that rate, people would have to buy at the par value.

Exactly the opposite as you claim, laying out the financial theory of Pillaging a là Blackrock's Flink & Co, known sponsor of the scam "unbacked crypto" (without fundamentals, this security needs a collateral to back it up). He even claims that it's a safe-haven asset (CNBC video posted a few weeks ago). Or the Fed's Powell, making up a new asset class: "Speculative asset".

All the investors that lack knowledge about the fundamentals of each security, must be snubbed. Let alone the S.E.C. chairman and S.E.C. commissioners, like nowadays a previous staffer for Pelosi.

Guys who own these pieces don’t care abt a few dimes

Those "few dimes", are now a 6% annual compound rate of return in the absence of dividend.

But what happens is that, during the "Pillaging without accountability ages", they want more. The plotters rather manipulate the stock prices for this big payday at some point in the future that would give them an outstanding annual rate of return, greater than the estimated 6% rate under a normal conservatorship and Transition Period to build capital to meet the new standards after being hit with Regulatory Risk (Basel framework for capital requirements, known since the 2011 UST Report to Congress for the endpoint of the conservatorships. Up to 263% more than 2008 in Freddie Mac, for instance), and, in the meantime, they attempt the assault on the ownership of FnF with a swap JPS for common stocks, in collusion with the Treasury restructuring shop (a wannabe Moelis shop) and Glen Bradford endorsing it on social media daily, following orders. An assault that also leads to multiple stock offerings for other investors currently lying in wait, as a scheme to secure them future annual rate of returns in the follow-on stock offerings.

This is why we are requesting a compensation for Punitive Damages, both to the DOJ and to its counterparty in court along with all other peddlers of the government theft story in formal documents, that also settles the 8 securities law violations during conservatorship, as one of them is stock price manipulation.

A compensation based on the average spread between Fair Value and Market price during 15 years, because it's the real damage: the Separate Account plan prevented the stocks from trading at their fair value all along. $12 exactly (See the image posted above) through the moment it fetched its par value with the resumption of dividend payments under this Separate Account plan that they concealed with multiple cover-ups of statutory provisions and financial concepts, and an estimated $12.5 through today, exactly half its par value.

So, applying a 0.5% IRR (Compound rate. Rate equal to the spread the UST earned in its UST backup of FnF as per the Charter Act "taking into consideration the Treasury yields as of the end of the month preceding the purchase"/no-purchase, totalling an estimated weighted average 1.8% dividend rate until the SPS were fully repaid) to half a JPS par value, during 15 years, gives us an amount of interests today of $0.97 per stock.

The common stocks match a $50 par value JPS, as their spread Fair Value vs Market Price, would always be closer to a $50 par value JPS than a $25 par value JPS.

This penalty will be extended to the accessories writing on social media like mad, because it's no longer a simple opinion, but they ostensibly are paid shills.

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM