Tuesday, November 28, 2023 1:47:11 AM

JPS cannot be diluted because they are contractually protected.

The Net Worth is $118 billion, but there is $312.5 billion worth of SPS LP outstanding that you advocate.

So, only $118B SPS can be converted to common stock.

The JPS are worth $0 in that case. Didn't you see the AT1 securities of Credit Suisse in its restructuring with the purchase of UBS?

The scammers think that they are holders of securities from different companies, and they aren't affected by their battered financial condition.

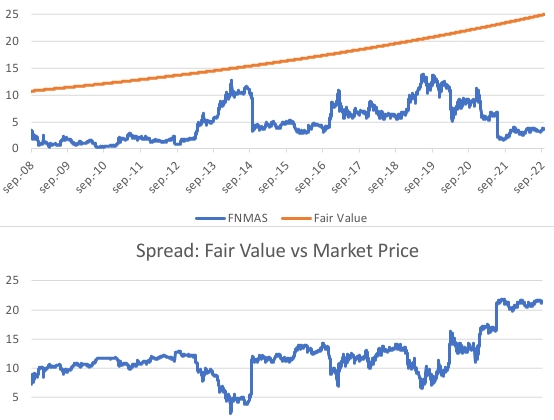

The $25 par value JPS FNMAS' fair value is worth $9.8 to reflect the 16 years left to resume the dividend payments, with the adjusted capital shortfall over minimum Leverage capital requirement shown in the ERCF tables, and assuming that the SPSs increased for free come to an end. But, in a restructuring, they are wiped out to reflect other theme, which is their Net Worth.

So, be careful what you wish for, Glen Bradford alias LuLeVan.

The JPS aren't protected in their contract with FnF. They are subject to the financial condition of the issuer of these securities. You are selling smoke.

You have to thank the attorneys working for Wall Street firms that seek stock offerings, and, another possibility is that some of them work for the political parties, as Coopers and Kirk LLP is known for being the go-to law firm of the GOP in Washington. Law firms lying in court (Damage for the "for cause" removal restriction), fabricating evidence with the Trump letter and covering up the key statutory provisions and financial concepts (no actual dividend was ever possible)

On the other hand, in accordance with the law and basic Finance, with the Separate Account plan that upholds the Charter Act and the FHEFSSA, as amended by HERA, and taking into account that it was already carried out in 1989 by DeMarco and Sandra Thompson with the FHLBanks, the JPSs are worth par value. In the case of FNMAS, its adjusted fair value fetched its par value one year ago exactly with the 3Q2022 earnings report.

So, you'd better join this plan.

Everything will be adjusted, something the scammers didn't count on.

BOTTOM LINE

You won't achieve anything as a snake oil salesman and internet troll bashing the prospects for the common stocks, and instead, you are just manipulating the stock price, which is a felony and for which we are requesting Punitive Damages if it's done with formal documents: books, articles, letters, court briefs, etc.

Part of an organized group that bases its opinion on what other member of the group said: Financial Statement fraud in FnF, the DOJ attorneys' stance in court, the SPSPA called "contract" on social media, etc.

Everyone wins if the Rule of Law and financial orthodoxy are upheld.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM