Saturday, November 25, 2023 3:28:02 AM

The Warrant Prospectus doesn't explain what this concept is for, because it doesn't contemplate the case of cashing-in the Warrant through differences: 20-day VWAP - Exercise Price. The Warrant had other objective as explained below: the assault on FnF by the banks and Wall Street.

The VWAP data for one trading day is used a lot by traders.

This has nothing to do with FnF and the broad scheme of conservatorship. To begin with, neither the UST is a trading desk, nor it's a Moelis-like restructuring shop. The role of the UST in the Charter Act is very limited.

Guido wants to pass this "Fair Market Value" off as the "Fair Value" that we calculate for the stock valuation.

Read the definition of fair value as per warrant agreement

The Fair Value of a stock is adjusted for the Separate Account plan according to the law, currently in the Phase 3 (Gifted SPS and $0 EPS, a joke. Capital distribution, restricted. The Common Equity is once again, held in escrow to comply with the CFR 1237.12, through the offset attached to these gifted SPS, concealed with Financial Statement fraud -Gifted SPS and offset, absent from the balance sheets-) and I don't consider the Warrant, as it's a security issued for free to evade the prerequisite in its authorization, of purchases "(iii) to protect the taxpayer". Source (collateral of the SPS). Collaterals are illegal in the Fee Limitation clause. And, if it was used as a higher compensation, it's barred also in the original low cost UST backup of FnF.

So, the security Warrant is a legal-illegal collateral.

And also, he is mistaking it for the Exercise Price of the Warrant ($0.00001ps)

The warrant exercise price is NOT FAIR VALUE!

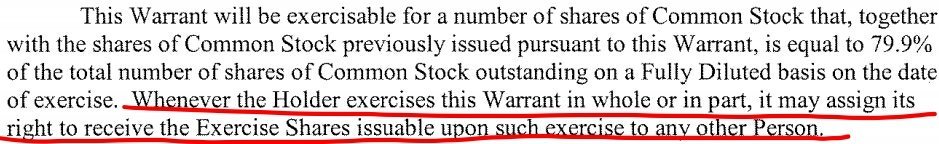

The Warrant had the objective of the assault on the ownership of FnF by Wall Street and the Community Banks, paying nothing, as the shares issuable upon exercising it, can be "assigned" to any Person. So, a non-transferable Warrant (clause 7) can be transferred upon exercising it, as the right to receive shares is the security Warrant itself (It could be voided just for this)

Now that FnF have been rehabilitated, we are requesting the adjusted fair value for the stocks, PER 14 times.

Likewise, the fair value of a JPS, under the Separate Account plan, is currently its par value, as this fixed-income security recouped its dividend payment long time ago (Table 8: Payout ratio) and thus, it's no longer trading at a discount to its par value (zero coupon callable security)

The fact that FnF keep on building capital in a conservatorship, can only be explained with the FHFA-C's Incidental Power "in the best interests of the Agency". Harsh, but legal. Now, FnF can redeem the JPS and still meet the threshold of TIER 1 Capital > 2.5% of Adjusted Total Assets. The JPS holders can't change the outcome out of pity, hand-in-hand with the FHFA in the fiction of implied contract, in order to get back dividends. Their contract authorizes it too.

Guido works for Pagliara. More laymen chosen by chamber investors in their plan of deception called Fanniegate. This gang typically ends up with "It's complicated", a telltale sign in all the scams they've put in place worldwide: unbacked crypto, the Central Banks' Payment Systems Target2 and TIPS in Europe, etc.

It's not complicated: the security unbacked crypto, like any token (Bus ticket, etc) needs a collateral to back it up, otherwise it's a scam.

Payment Systems: they call "real-time settlement" when the obligation to pay is discharged, but this obligation is never paid down. So, there is always a country with Claims and others with Liabilities, but there is no actual settlement of the operation, with a wire transfer.

Bundesbank's TARGET claims

As of October 31, 2023:

€ 1,058,984,800,994.73

In Fanniegate, if you lie using a formal document (books, court briefs, public letters to investors, articles, financial reports, etc) you will have to pay us Punitive Damages for stock price manipulation. $4.8 billion.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM