Monday, November 20, 2023 2:47:19 AM

It has more to do with the word "may" in the conservator's power ("May put FnF..."), jointly with the "take any action authorized by this section, in the best interests of the Agency" in its Incidental Power.

So, they are always binding and it can only mean that the FHFA has some leeway during conservatorship to fix their operations because it's supposed that the companies are bleeding or, as Freddie Mac explained better what "may" and the FHFA-C's Incidental Power might be about:

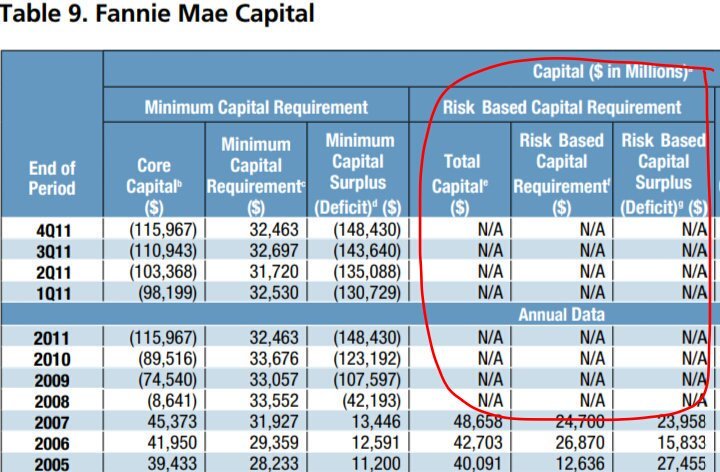

By the way, I guess you noticed that the amendment of HERA of the FHEFSSA's Minimum (Leverage) Capital requirement, was related to "revise" the existing percentages (1992 FHEFSSA), but until then, FnF have been posting the figures with the old requirements every quarter in their SEC filings and also in the FHFA Reports to Congress, because they are statutory, regardless of the FHFA's "not binding" remark. So, the game between Calabria withholding the publication of the ERCF tables until January 1st, 2022, despite being effective since February 16th, 2021, and the congressmen French Hill and McHenry, of keeping the ERCF tables from the Congress (now in the 2022 Report to Congress) at the time of the annual testimony of the FHFA director, so congressmen make up the figures in a convo with Sandra Thompson: "$100B vs $300B. I'm a former examiner", said one of them ($100B was the Net Worth at the time, not the Core Capital, and $300B was the official capital shortfall, not the Minimum Leverage Capital requirement. Adjusted $400B capital shortfall over $207B capital requirement), is pointless, because there is always the Minimum (Leverage) capital requirement with the old percentages, posted every quarter since day one.

There is nothing new "as of the passage of HERA", as the low profile DOJ attorneys peddle all the time, but a continuation of the FHEFSSA (and the Charter Act with the old low cost UST backup), as amended by HERA.

FEATURED ZenaTech, Inc. (NASDAQ: ZENA) Launchs IQ Nano Drone for Commercial Indoor Use • Oct 10, 2024 8:09 AM

FEATURED CBD Life Sciences Inc. (CBDL) Targets Alibaba as the Next Retail Giant for Wholesale Expansion of Top-Selling CBD Products • Oct 10, 2024 8:00 AM

Foremost Lithium Announces Option Agreement with Denison on 10 Uranium Projects Spanning over 330,000 Acres in the Athabasca Basin, Saskatchewan • FAT • Oct 10, 2024 5:51 AM

Element79 Gold Corp. Reports Significant Progress in Community Relations and Development Efforts in Chachas, Peru • ELEM • Oct 9, 2024 10:30 AM

Unitronix Corp Launches Share Buyback Initiative • UTRX • Oct 9, 2024 9:10 AM

BASANITE INDUSTRIES, LLC RECEIVES U.S. PATENT FOR ITS BASAFLEX™ BASALT FIBER COMPOSITE REBAR AND METHOD OF MANUFACTURING • BASA • Oct 9, 2024 7:30 AM