Sunday, November 19, 2023 3:17:48 AM

More evidence that khomp19 is the former DOJ attorney Mr. Soopprise, because the DOJ is also obsessed with HERA to conceal the FHEFSSA: "As of the passage of HERA...."

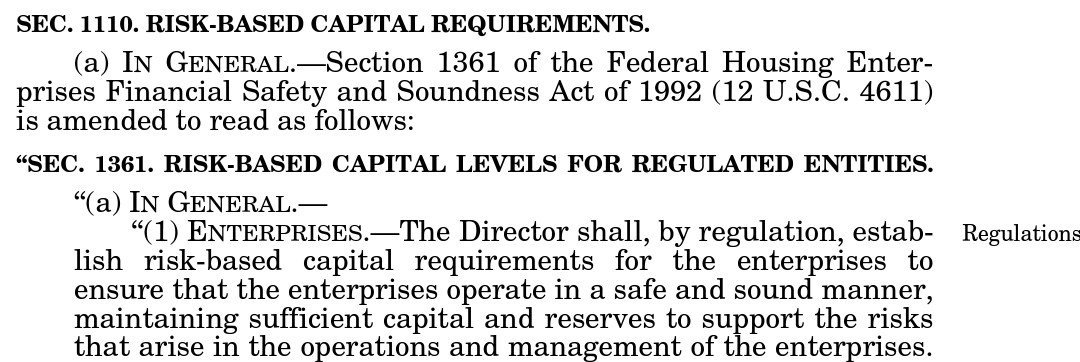

It's a law passed by Congress (HERA) that directs the FHFA Director to issue regulatory capital requirements. There are two types of capital requirements: risk-based and minimum.

Can't you read that all HERA did is to amend the FHEFSSA (and the Charter Act), as always? Then, you can't say that the law is HERA, but the FHEFSSA as amended by HERA.

This is the Risk-Based Capital requirement. This is HERA stricking the section in the FHEFSSA that had the prior formulaic and inserting a new section. HERA forgot to include the 18-month period that was given in the first capital ratios of 1992 and a standard in the rulemaking process, for the FHFA director to come up with a new one.

This why we have had N/A data in the FHFA reports to Congress since then. Source.

One thing I don't know is why Lockhart and DeMarco never issued capital standards, or why Watt waited until his term was almost over to do so. At least Calabria fulfilled this requirement, though his final rule wasn't published until 20 months after he took office.

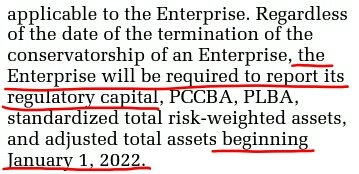

Don't forget to add that the publication was withheld from the effective day February 16, 2021, until January 1, 2022, so it doesn't appear in the 2021 Report to Congress when representative French asked Sandra Thompson about it in the annual testimony in Congress. Likewise, representative McHenry, for 2023, he scheduled the annual testimony for one week before the release of this 2022 Report to Congress with the new ERCF. They don't know that the Minimum Capital requirement is statutory and, in the absence of ERCF, it has been published every quarter by the enterprises.

One thing? The reason for the delay in the final Capital Rule effective 2021, instead of within the 18-month period since it was required by law, mentioned before, is to distance it from the February 2011 UST Housing Finance System revamp, a Report to Congress with the 3 recommendations on ending the conservatorships, no later than January 31, 2011, at the request of the Dodd-Frank law (Wall Street Reform and Consumer Protection Act), because the 3 options have one thing in common: a Privatized Housing Finance System, which means that the guarantors are subject to the Basel framework for capital requirements or, as the option 3 states: "Stringent capital requirements".

This way, it's been concealed for the broad population, that the 15 years in conservatorship and, to be more precise, the last 10 years, have been the typical Transition Period to build capital given by any Federal Agency when there are changes in the capital requirements and thus, the JPS holders and shareholders have suffered Regulatory Risk.

All of this is because the plotter Calabria removed the prior Mandatory release Undercapitalized (Capital Classification: when the Core Capital is greater than the Minimum -Leverage- capital requirement), when he helped to draft HERA.

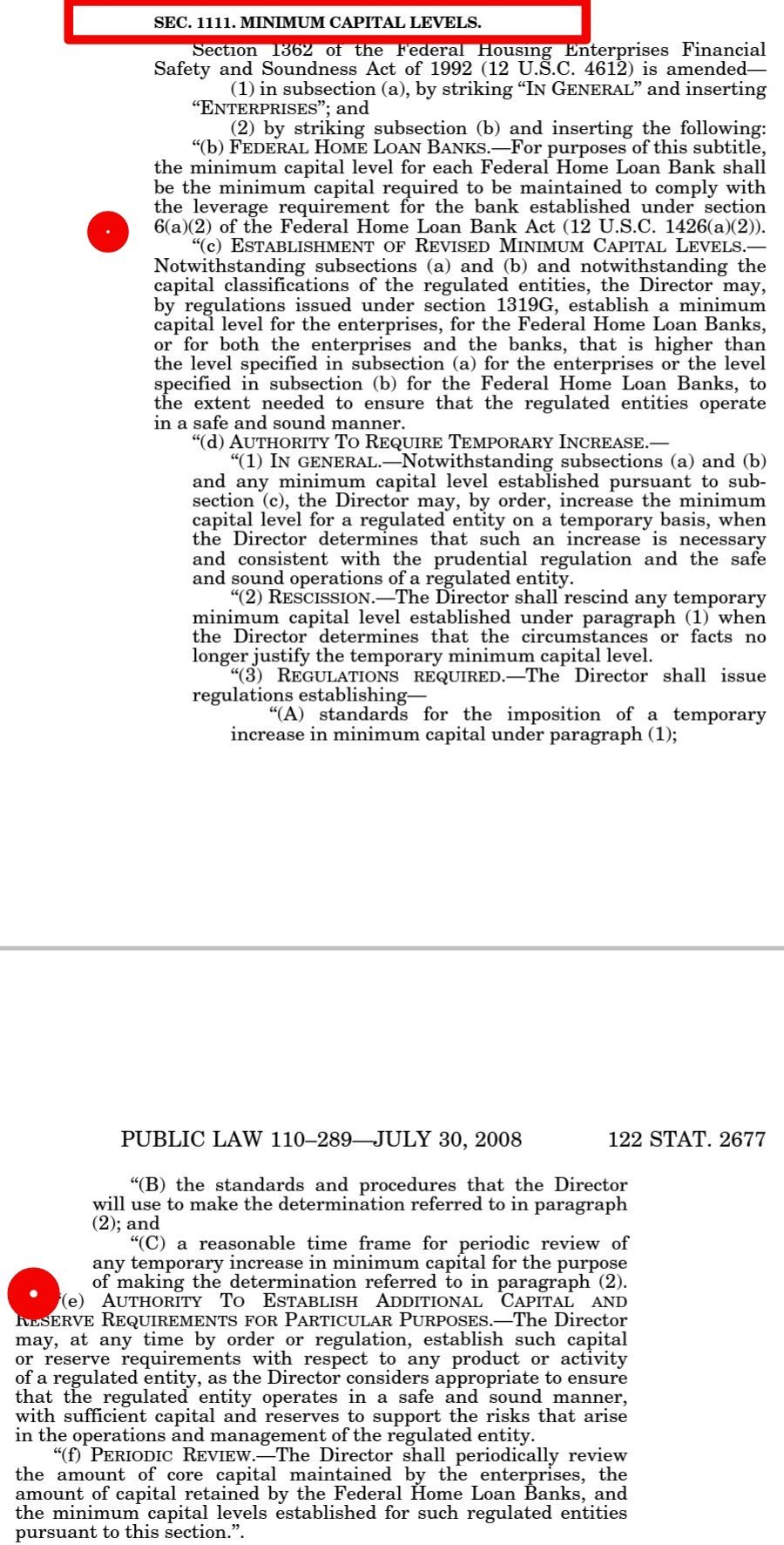

This is the second capital requirement: the Minimum (Leverage) Capital requirement, plus an authorization to add new capital metrics, like CET1 and TIER 1 Capital. We see how HERA simply amended the FHEFSSA.

Finally, you should know that there are 3, not 2 capital requirements. The FHFA has omitted in the ERCF the third capital requirement set forth in the FHEFSSA, the Critical Capital requirement, because HERA didn't direct it to amend it, so it stays as is:

The FHFA and its hedge funds guard have determined that not meeting a capital requirement considered "critical" is not good for their slogan of "release as is" by the plotters: recently Hindes: "What are you waiting for?", with an adjusted $-194 billion Core Capital combined, which is evidence in itself of a Separate Account that upholds the statutory provisions that Hindes removed from his lawsuit, when he submitted an amended lawsuit. Other statutory provisions covered up from the beginning.

Last Shot Hydration Drink Announced as Official Sponsor of Red River Athletic Conference • EQLB • Jun 20, 2024 2:38 PM

ATWEC Announces Major Acquisition and Lays Out Strategic Growth Plans • ATWT • Jun 20, 2024 7:09 AM

North Bay Resources Announces Composite Assays of 0.53 and 0.44 Troy Ounces per Ton Gold in Trenches B + C at Fran Gold, British Columbia • NBRI • Jun 18, 2024 9:18 AM

VAYK Assembling New Management Team for $64 Billion Domestic Market • VAYK • Jun 18, 2024 9:00 AM

Fifty 1 Labs, Inc Announces Acquisition of Drago Knives, LLC • CAFI • Jun 18, 2024 8:45 AM

Hydromer Announces Attainment of ISO 13485 Certification • HYDI • Jun 17, 2024 9:22 AM