Saturday, November 18, 2023 1:47:21 AM

Also, it proves the fact that she has the intention to commit a felony: this payment of Securities Litigation claims, is a capital distribution, restricted when FnF are undercapitalized. Once spotted, it uncovers the Separate Account plan, as dividends and today's SPS LP increased for free, are also capital distributions restricted in the same statutory provision, U.S. Code §4614(e). Thus, the exceptions to this restriction kicked off. The outcome is that the Common Equity is held in escrow and the Equity holders didn't suffer any damage, other than Punitive damages. But it wouldn't be the case for this payment.

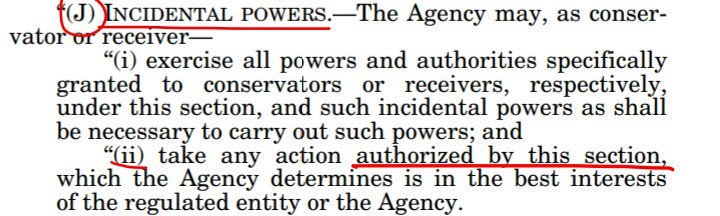

This happens when you use the United States courts, colluding with hedge funds that act as counterparty in the phony court proceedings, in a plan to save the image of the FHFA (The use of courts for a PR campaign), in its clear Separate Account plan according to the law, a plan that already happened in the past with both ST and DeMarco (1989 bailout of the FHLBanks: statutory provision entitled Separate Account) and corroborated by justice Alito ("Rehabilitate FnF", which has only one meaning in a financial company, adding the case for actions that may increase losses or risk "beneficial to the public", instead of the text as it's written: "in the interests of the FHFA". So playing with the word "beneficial" and "Federal Agency/the public", but the Incidental Power he was referring to, was never meant to authorize taking their regulatory capital away. That's not "authorized by this section") and judge Willett (5th Cir.) that explained what justice Alito missed, in a prior ruling over the same case ("Any action within the enumerated powers": Rehab power)

This is why it's been determined that both judge Willett and judtice Alito were synchronized. One interpreted the first part of the Incidental Power ("Take any action authorized by this section,...."), the latter the second part ("...in the best interests of FnF or the Agency"). But both parts must be considered together.

The conservator saw an opportunity to use this Incidental Power for a Separate Account plan that is financially rehabilitating FnF, and mislead about it "in its best interests".

Good for you! At some point, the conservatorship will be over, the Separate Account, unwound, and the powers and rights returned to the Equity holders, the management and the BOD, as usual.

ST NOW OUTRAGED: PLAINTIFFS OMITTED A PLAN OF ALLOCATION

— Conservatives against Trump (@CarlosVignote) November 18, 2023

The attys demand fees +nontaxable costs taken from the FnF's coffers,for collaborating in a campaign to save:

-The FHFA's image after a Separate Acct plan

-@TheJusticeDept's vicarious liability

-Back divs on JPS.#Fanniegate https://t.co/lEWcGP2OUL pic.twitter.com/WEhFRBYwlf

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM