Thursday, November 16, 2023 1:53:32 AM

The JPS are valued at par value in Equity regardless of the market price, but they ARE NOT part of the Net Worth if there is $304B SPS outstanding, but only $118B Net Worth. It was explained in this reply.

He adds a new lie in this post:

The market price of the juniors has absolutely nothing to do with FnF's capital levels.

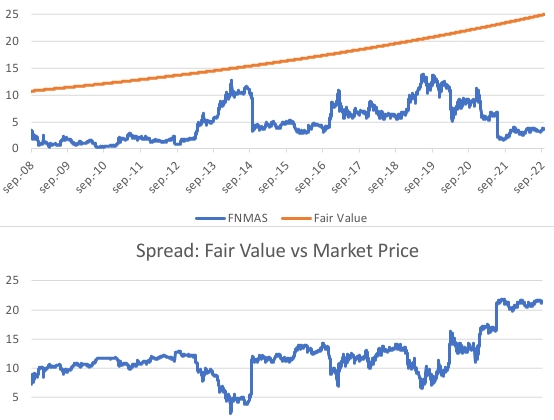

The JPS had the dividend suspended, subject to the Restriction on Capital Distributions when FnF are undercapitalized, and it's not resumed until FnF are Adequately Capitalized again, plus 25% of the Capital Buffer (Table 8: Payout ratio). The percentage of dividend rate is calculated over the par value. This is why the market price won't fetch its par value until then.

In the meantime, due to the time value of money, a fixed income security that won't trade at face value until some point in the future and without a "coupon" payment, trades at a discount to its face value (par value), like the zero coupon 30-year callable MTN in FnF.

It was estimated that the market would have demanded a 6% discount rate.

Any security trades always according to its fundamentals and if it doesn't have (a token), it must have a collateral that becomes its fundamentals (currency, etc), otherwise we would be talking about the SEC's and the Federal Reserve's massive scam of unbacked crypto to raid the people's savings.

The attorney kthomp19 isn't interested in learning, which is fine.

The problem comes when these attorneys are involved in Fanniegate, filing frivolous lawsuits in an attempt to rip off the shareholders and colluding with the government. Then, these attorneys become dangerous because their stance is detrimental to our economic interests and they are just using the courts as a backdoor negotiation with the government aiming to share the booty (JPS holders and the government)

To begin with, they must pay us Punitive damages for stock price manipulation with their "Govt theft story" (One of the three rounds of $4.8B requested by our negotiator on the Fanniegate hashtag.)

Notice that one of the rounds serves as a settlement of the 8 Securities Law violations during conservatorship.

The third round is related to the accounting standard chosen for the upfront g-fee. A valuable Deferred Income that otherwise would have recapitalized FnF sooner, by calling the upfront g-fee "Delivery fee" (the ones that pay this fee, the banks, aren't the beneficiaries of the guaranty service)

kthomp19 sounds a lot like the DOJ's Mooppan: financial illiterate and all made up. "The third amendment was a typical renegotiation of obligations. Thus, within the FHFA-C's power", in the Supreme Court. It must be investigated if he could take the place of the Solicitor General, if he wasn't a member of the Solicitor General Office at the time. Soon after, he shamelessly rejoined his prior law firm Jones Day.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM