Tuesday, November 07, 2023 2:36:55 AM

Here is why:

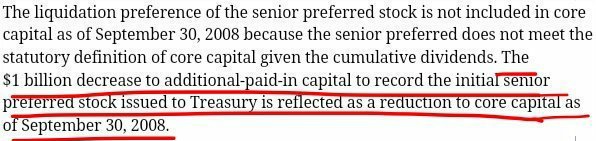

It shows how the offset attached that happens always when a company issues a security for free (without receiving the corresponding cash): stock dividends, Employee Stock Ownership Plan (ESOP), or the very FnF when they issued $1 billion SPS for free on day one of conservatorship, reducing APIC account (Core Capital), now exhausted, this is whey it's debited from Retained Earnings (SEC rules)

There is nothing "for free". It always comes out from someone's pockets. In this case, from the shareholders' pockets.

It also shows the objective: peddle the lie of "FnF continue to build capital" or "Retained Earnings, happy emoji, smile emoji" by the plotters. The reality is that FnF are building SPS, not regulatory capital, which remains stuck at $-194 billion Core Capital, FnF combined, every quarter ($402 billion capital shortfall over Minimum Leverage Capital requirement)

So, the full $44,661 million Net Worth in Freddie Mac as of September 30, 2023, belongs to the UST, as they are the $44,661 million gifted SPS currently absent from the balance sheet. Besides there is $117,308 million SPS outstanding in total.

The key: it shows how the Common Equity is held in escrow. Gifted SPS are a capital distribution restricted. Then, we consider it a joke and the Common Equity is held in escrow to comply with the exception to the Restriction on Capital Distributions (Recap) and also with the FHFA-C's Rehab power.

Another objective of this concealment is that people would begin to wonder if it occurred the same with the dividend payments to UST, as it's another capital distribution restricted, and there is the exception in the law: reduction of SPS and, later on, the Recapitalization in the CFR. It would have put an end to the Separate Account plan. This is the broad population, as the savvy investors spotted the Separate Account plan from the onset.

Finally, I post the two tweets from Calabria mentioned in my prior post.

He doesn't like the Charter's UST backup of FnF that he calls "government guarantees" and he proposed to revoke the Charter. Good. A Taking will do it or, simply, Charter revoked, as FnF are private shareholder-owned enterprises.

@schulte_stef you provide a gov't guarantee, then shareholders have strong incentive to capture it's value, need to minimize guarantees

— Mark Calabria (@MarkCalabria) February 8, 2016

@DoNotLose my own view is that shareholders can have the assets/liabilities, take 'em, but charters should go away, those are "public"

— Mark Calabria (@MarkCalabria) January 17, 2015

ECGI Holdings Announces LOI to Acquire Pacific Saddlery to Capitalize on $12.72 Billion Market Potential • ECGI • Jun 13, 2024 9:50 AM

Fifty 1 Labs, Inc. Announces Major Strategic Advancements and Shareholder Updates • CAFI • Jun 13, 2024 8:45 AM

Snakes & Lattes Opens Pop-Up Location at The Wellington Market in Toronto: A New Destination for Fun and Games - Thanks 'The Well', PepsiCo, Indie Pale House & All Sponsors & Partners for Their Commitment & Assistance Throughout The Process • FUNN • Jun 13, 2024 8:18 AM

HealthLynked Introduces Innovative Online Medical Record Request Form Using DocuSign • HLYK • Jun 12, 2024 8:00 AM

Ubiquitech Software Corp (OTC:UBQU) Posts $624,585 Quarterly Revenue - Largest Quarter Since 2018 • UBQU • Jun 11, 2024 10:13 AM

Element79 Gold Corp Files for OTCQB Uplisting, Provides Financial Update • ELEM • Jun 11, 2024 9:25 AM