Friday, October 13, 2023 1:39:22 AM

Yet more paid shills pile up (Robert from Yahoo, Alex Mazo, now FoFreddie) to claim that the ERCF will change to 2.5%. That's it. Without specifying what is 2.5% of what, because there are 8 combinations: CET1, T1 Capital, Core Capital, Total Capital and as % of RWA (Risk-Based) or % of Total Assets (Leverage ratio). This is why the ERCF data is presented with tables. Evidence that we are dealing with an organized group.

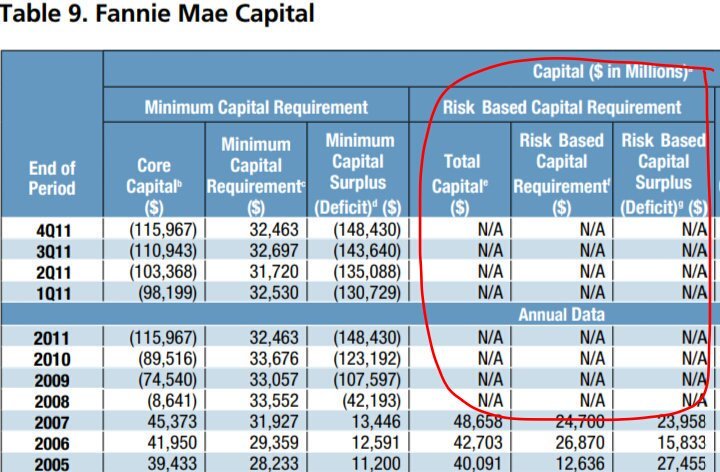

As I commented before, it seems that they want to alienate the Leverage ratio because it's the binding one (the highest), previously called Minimum Capital level in the FHEFSSA, by calling the Risk-Based capital requirement "Minimum Capital requirement", as always any requirement is called "minimum capital" for that variable. So, the ERCF table is reduced to one capital standard, instead of two, when the correct is three, as the statutory Critical Capital Level is absent from the ERCF tables (Don't meet a level considered critical, bothers for the FHFA director's propaganda "FnF remain undercapitalized", when the actual Capital Classification is Critically Undercapitalized enterprises. Adjusted $-194B Core Capital every quarter, to be precise.)

They attempt to distance the February 16, 2021 capital standards Basel framework adopted by the FHFA, renamed "back-end Capital Rule", from the 2011 Housing Finance System revamp chosen for the release by the UST, accompanied by guarantee fee hikes to the same endpoint: Basel framework ("capital standards in the private banks"). Hence, "back-end" Capital Rule that should have been unveiled within the typical 18-month period after the Risk-Based Capital requirement in the FHEFSSA was struck by HERA, directing the FHFA Director to come up with a new one ("The director shall", without a time frame). Primarily because you can't submit reports to Congress with data N/A. Conservatorship isn't an excuse. Just do it.

So, 2021 is linked to 2011 and they are after the Basel framework to prove it wrong.

Once proven that the Conservatorship turned into a Transition Period to meet the Basel capital standards, chosen for the release, the plotters are exposed, because this is the same organized group that initiated in 2012 the corrupt litigation that covers up the key statutory provisions and financial concepts, aiming to overshadow the aforementioned Privatized Housing Finance System endgame and the Transition Period to build capital typical every time that a Federal Agency imposes increased capital standards (For instance, recently the Fed and the FDIC gave the banks 5 years to meet the new capital standards and other rules. Or the Congress giving 10 years to the FHA for its 2% "economic net worth" ratio). In the end, they cover up that the dividend was impeccably suspended to build capital, as always, and that it's been concealed with a Separate Account plan similar to the 1989 statutory Separate Account with the FHLBanks (same assessments to a separate account. The difference is that the FHLBanks had to pay interests on RefCorp obligations at a time when they stood at a 10% rate and the remainder, reinvested in zero coupon bonds, reduced the obligation; Whereas with FnF, the dividends on SPS are suspended, so the whole assessment reduces the obligation SPS. Then, applied towards their recapitalization. Cumulative dividend with a small spread over Treasuries (weighted average 1.8% dividend rate. 5- and 6-year investments), is netted out with the interests on the $152B "credit due to FnF". Another difference is that with FnF, the assessment has been concealed under the guise of dividends to UST (Not actual dividends: restricted by law and unavailable funds for distribution as dividend, out of an Accumulated Deficit Retained Earnings account)

Notice that one of the 3 rounds of $4.8 billion in Punitive Damages requested by the Equity holders, is against this organized group counterparties of the DOJ in court for the Govt theft story, as opposed to the reality of the Separate Account plan.

On one hand we have these paid shills, on the other hand the big players with deep pockets behind: Moelis and the sponsors of its plan, Ackman, law firms, the plaintiffs, ACG Analytics, Pagliara, Howard, Rosner, financial analysts, etc.

It will be funny to see the breakdown of the $4.8B penalty.

Now, why don't you find another person claiming that there is expectation of 2.5% ERCF?

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM

ECGI Holdings Targets $9.7 Billion Equestrian Apparel Market with Allon Brand Launch • ECGI • Jun 25, 2024 8:36 AM

Avant Technologies Addresses Progress on AI Supercomputer-Driven Data Centers • AVAI • Jun 25, 2024 8:00 AM

Green Leaf Innovations, Inc. Expands International Presence with New Partnership in Dubai • GRLF • Jun 24, 2024 8:30 AM

Bemax Inc. Positions to Capitalize on Industry Growth with New Improved Quality of Mother's Touch® Disposable Diapers • BMXC • Jun 24, 2024 8:00 AM

Last Shot Hydration Drink Announced as Official Sponsor of Red River Athletic Conference • EQLB • Jun 20, 2024 2:38 PM