Saturday, October 07, 2023 2:41:17 AM

With the same case, Collins. And both had the same outcome, necessarily there is a Separate Account plan that complies with the FHFA-C's statutory mission (Power): put FnF in a sound and solvent condition, which Justice Alito called "the rehabilitation of FnF".

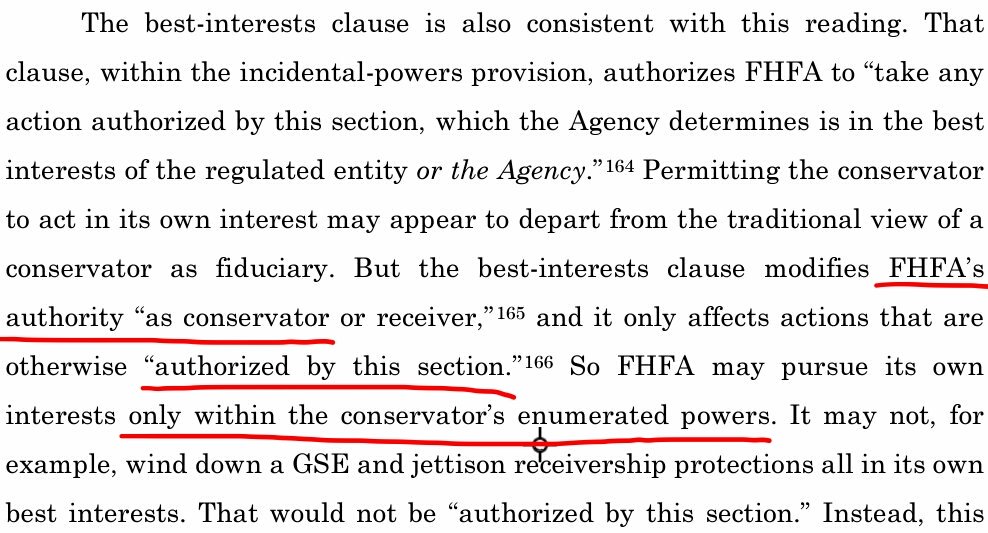

And both judges coincided in the interpretation of the Incidental Power as well. Justice Alito, in addition, interpreted the second part of the Incidental Power that Judge Willett (5th Circuit) missed. This is why it's been determined that both were synchronized:

Judge Willett stating that "take any action authorized by this section" means actions "within the enumerated powers" (Rehab)

and Justice Alito, after interpreting "authorized by this section" with "rehabilitate FnF", he followed up interpreting what "in the best interests of FHFA" means, with:

It may aim to rehabilitate FnF in a way that, while not in the best interests of FnF, is beneficial to the FHFA and, by extension, the public it serves.

Basically authorizing the extortion of resources out of FnF, beneficial to the public and to FHFA, whose actions are echoed by the media, currently being carried out through the investment banks and hedge funds that act as Special Purpose Vehicules for the polticians. E.g. Trump initiated the program where FnF are compelled to sell their RPL at a deep discount, should the borrower need debt forgiveness down the road (principal reductions have never been authorized before, until Trump and Goldman Sachs' Mnuchin came to power), expressly written in the press release of FnF in each operation:

In addition, non-performing loan buyers must offer delinquent borrowers a waterfall of loss mitigation options, including loan modifications, which may include principal forgiveness,

It isn't an authorization to steal their profits once they've been generated, as they are necessary for "the rehabilitation of FnF" (the conservator's authority or power)

The rehabilitation in a financial company is solely measured with their capital levels and debt levels (including their obligations SPS and JPS that, at some point, will have to be paid back, and substituted for Retained Earnings account, much cheaper to keep than Preferred Stocks), that is, sound condition and solvent condition, respectively. The conservator's statutory mission.

The attorney Hamish Hume, here in the CFC and in the Lamberth court, represents the hedge funds that lie in wait for the return of FnF but severely beaten up, with huge capital needs.

This is why the Equity holders request $4.9B in Punitive Damages to all the peddlers of the Govt theft story and plotters that have covered up the key statutory provisions and financial concepts.

Duane Forrester Joins INDEXR as SVP of Search • MONI • Jul 31, 2024 11:46 AM

Lingerie Fighting Championships Help Fulfill Death-Bed Promise With First Major Motion Picture • BOTY • Jul 31, 2024 9:00 AM

Kona Gold Beverage Significantly Reduces Debt from Multiple Holders • KGKG • Jul 31, 2024 9:00 AM

Avant Technologies Opens Equity Line with GHS Investments as Company Explores Expansion into Additional Technologies • AVAI • Jul 30, 2024 8:00 AM

ELEMENT79 GOLD CORP PROVIDES UPDATE ON CHACHAS COMMUNITY CHARTER AND REVENUE GENERATION, M&A ACTIVITIES • ELMGF • Jul 30, 2024 8:00 AM

INDEXR AI Merges With Moon Equity Holdings Corp. (MONI), Creating a Leading-edge Technology Company • MONI • Jul 29, 2024 9:59 AM