Monday, September 04, 2023 8:09:21 AM

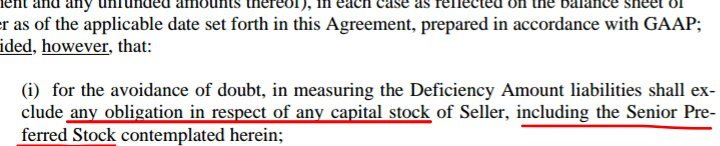

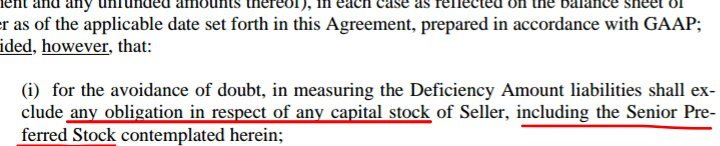

Obligations in respect of Capital Stock (SPSPA)

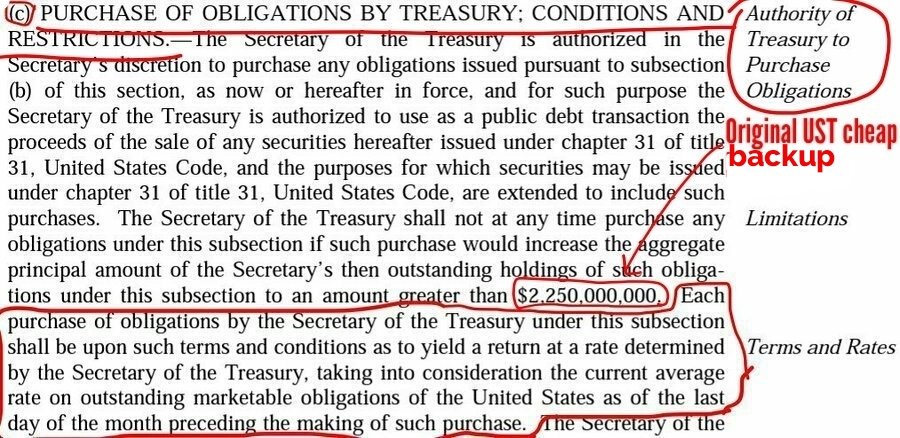

The Charter Act since its inception, gave UST in the subsection (c) the authority to purchase at a rate similar to Treasury yields, any of the obligations authorized in the subsection (b), which are redeemable obligations, such as JPS and SPS.

Redeemable obligations that can be repurchased "at any time and at any price" in the "open market", which is what FnF have done with the Separate Account plan, using the exception to the Restriction on Capital Distributions in the FHEFFSA.

Another important factor, these redeemable obligations must be redeemable at the option of the issuer, as seen with the JPS.

It was not until the amendment of the SPS Certificate of Designations, effective September 30, 2019 (in light of the September 27, 2019 SPSPA amendment), when it was incorporated for the first time:

3. Optional Pay Down of Liquidation Preference. Following termination of the Commitment. By that time, the SPS were already fully repaid long time ago (estimated at the end of 2013 in Freddie Mac. End of 2014 in Fannie Mae) with the aforementioned exception to the Restriction on Capital Distributions, like dividends.

Calabria and Mnuchin read that the Separate Account plan made sense and tried to thwart it. Then, the SCOTUS was activated. Both attempts failed.

The remaining SPS would be the $111B SPS increased for free, considered a joke by the Conservator, as they reduce the Core Capital and a breach of its Rehab Power (we don't see this effect due to the Financial Statement fraud in FnF: these gifted SPS are absent from the Balance Sheets, in order to avoid posting the offset with reduction of Retained Earnings account) and thus, the Common Equity is held in escrow awaiting unwinding this operation with the cancelation of these gifted SPS, that are also barred in the same Restriction on Capital Distributions that bars the dividends to UST, pointed out before, besides the payment of securities litigation claims.

This is part of the Charter dynamics in exchange for their Public Mission that makes them take on more credit risk and not properly compensated.

When things go sour, the government and the Congress can't void this UST backup that enables FnF to get low cost funding on the market, by inserting just below it in the Charter Act, with HERA, another subsection (g) with a Temporary Authority of UST to Purchase Obligations at an unlimited rate and in an unlimited amount, instead of simply having updated the obsolete $2.25B limit, set 60 years ago, when Fannie Mae had only $15B of Debt.

Then, skip the December 2009 deadline on purchases, with the Securities Law violations of SPS "increased", so there's been no purchase. Evidence of trickery.

In a final resolution, we blend everything together, not like the plotters that cling only to the amendments incorporated by HERA and the SPSPA, disregarding the rest of the law, making the original conditions prevail.

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM

Branded Legacy, Inc. and Hemp Emu Announce Strategic Partnership to Enhance CBD Product Manufacturing • BLEG • Jun 27, 2024 8:30 AM

POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • POET • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM