Friday, August 25, 2023 6:50:31 AM

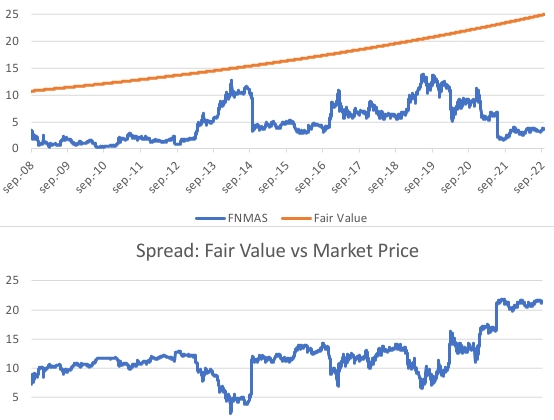

Damage: the Separate Account plan prevented the stocks from trading at their fair value all along. Therefore, the damage is the spread Fair Value vs Market Price. It's been calculated an average spread for the 15 years of deception, using FNMAS (a $25 par value JPS), the most liquid series among all the series of Preferred Stocks issued by FnF. Actual number $12 through September 2022, when it's estimated that the fair value would have fetched the par value with the resumption of the dividend payments. As of today, the average is estimated at $12.5, half its par value.

This is a real damage provoked by both counterparties in the Fanniegate scandal: the DOJ and the peddlers of the government theft story ("We've been robbed!") in formal documents: books, articles, court briefs, financial analyses, letters, etc (the plaintiffs, Howard, Ackman, Bradford, law firms, Moelis and the sponsors of its infamous plan, etc). Which will suffer the same penalty, by the way ($4.8B)

Now, the real compensation. Because the economic harm of loss, on both Cs and Ps, is fully redressed unveiling the Separate Account plan, I'm talking about Punitive damages (deterrence). It's estimated that the Treasury earned a 0.5% rate (Net Interest Yield) in the bailout of FnF under the Charter Act ("take into consideration the Treasury yields as of the end of the preceding month to the purchase"), netted out with the interests owed to FnF on the $152B due. Now, I'll be a loss for its misbehavior.

The amount of interests on $12.5 during 15 years using a 0.5% compound interest rate, sum $0.97 today.

For a $50 JPS, it's $1.94.

The Cs' fair value is subject to more variables than a JPS (straight forward: a 6% annual discount rate to par value). Then, the Cs match a $50 JPS in damages.

This amount represents a 0.254% annual rate if the calculations are made with the par value. Which is how we can now assess whether this amount requested is high or low. A 0.25% rate on a JPS is extremely low, but assessed with thoughtful criteria.

Breakdown of the $4.8 billion worth of compensation (estimation):

Fannie Mae

Ps: $752mll

Cs: $2.2B

Freddie Mac

Ps: $533mll

Cs: $1.3B

On the other hand, the plaintiffs with a fiction claim (breach of implied contract) attempt to make up for the lawful suspension of their non-cumulative dividend on JPS, stipulated in their contract with FnF, calculating a false damage with the one-day stock price reaction to the third amendment and that the Equity holders love it, as the fastest speed for the Separate Account plan that reduced the SPS and recapitalized FnF under the guise of restricted dividend payments and even without available funds for its distribution (accumulated deficit Retained Earnings accounts)

The fact that the "doctor" that calculated the interests used a simple interest rate (Left. Table circulating on the internet), when in the financial world, it's always a compound rate, denotes that these expert witnesses are brought for their confict of interests, like the medical doctor Mason in question, who worked for a consulting firm with links to China. Source.

On the right, it was submitted yesterday both simple and compound interest rate, after the attorney representing the Hedge Funds, Hamish Hume, saw that I was using a compound rate.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM