Friday, August 25, 2023 2:53:44 AM

Another rabbit pulled out of the plotters' hat: Saying "law" when talking about two pieces of regulation enacted with the July 20th, 2011 Final Rule "for the transparency of the conservatorship". An excuse to sneak the CFR 1237.12 that surprisingly added up another exception to the FHEFSSA's Restriction on Capital Distributions (as amended by HERA) when FnF are undercapitalized, that has the same effect as the restriction itself: the Recapitalization of FnF. It enabled this Recap through a capital distribution, which means that the capital exits the Balance Sheet, but necessarily has to be held in a separate account "to meet the Minimum and Risk-Based Capital levels". It was necessary for the case when the SPS were fully reduced under the guise of dividend payments (estimated in late 2013 in Freddie Mac, as seen in my signature image. End of 2014 in Fannie Mae), so that FHFA and UST can continue to distribute capital that otherwise would be forbidden. That is, a Separate Account plan authorized in the FHFA-C's Incidental Power: "Take any action authorized by this section", with a Rehab power of "restoring FnF to a sound and solvent condition", so forget that FHFA-UST can steal the profits (core capital) from FnF in the public interest, because it'd break this power, which is the prerequisite of "Rehabilitation of FnF" laid out by Justice Alito, synchronized with Judge Willett in the prior enbanc hearing in Collins (5th Circuit), who stated that "authorized by this section" means "any action within the enumerated powers". That is, its Rehab power.

Both the word "may" in the Power and "best interest of FHFA" in the Incidental Power, is related to other activities different from stealing the capital once it's built. For intance: building the CSP, UMBS, or even activities that increase the risk, etc. Today, FnF are not rehabilited but in the worst financial condition possible. Explained here.

A company restricts dividends because Retained Earnings is Core Capital, as a dividend is a distribution of earnings.

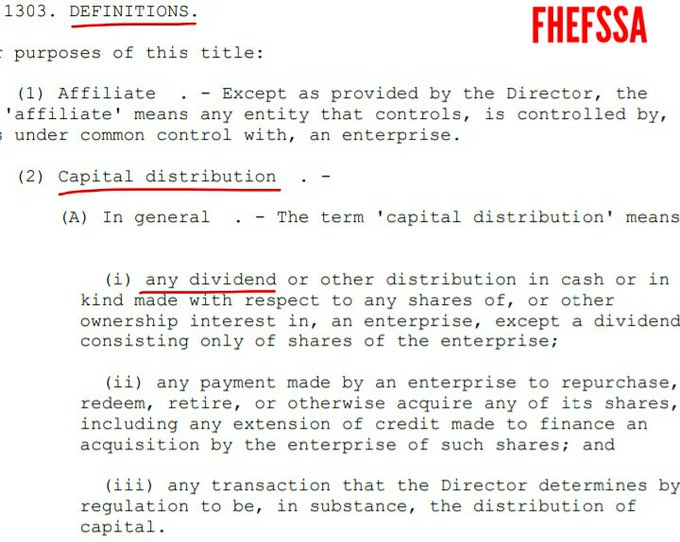

HERA states:

This statutory restriction -IN GENERAL- complies with the FHFA-C's Rehab power (statutory mission): put FnF in a sound and solvent condition, both soundness (Recap) and solvency (reduce the obligations SPS)

Just so that you know, a law can't be overriden using regulation. This is why I've written Recap in all the 4 exceptions, including "in the public interest" as pointed out before.

As stated in the same regulation:

(c) This section is intended to supplement and shall not replace or affect any other restriction on capital distributions imposed by statute or regulation.

Therefore, you can't override a restriction on dividends "because the law authorized the Director to first make it", when you are talking about its own regulation, not the law that bars this "distribution" when FnF are undercapitalized.

Distribution? Do you understand that a dividend is a distribution of earnings? Then, there weren't funds available for distribution, out of a Retained Earnings account with deficit all along. A dividend payment is, in reality, a change in Equity and that Equity is Retained Earnings (Common Equity and core capital)

This is a second reason why a dividend is restricted, besides by law: by Finance.

The same occurs with the CFR1237.13: Payment of Securities Litigation claims, where the FHFA states that it's barred in conservatorship, without specifying why, and adds:

except to the extent the Director determines is in the interest of the conservatorship.

This is a made-up sentence without any legal basis. It's set aside right away.

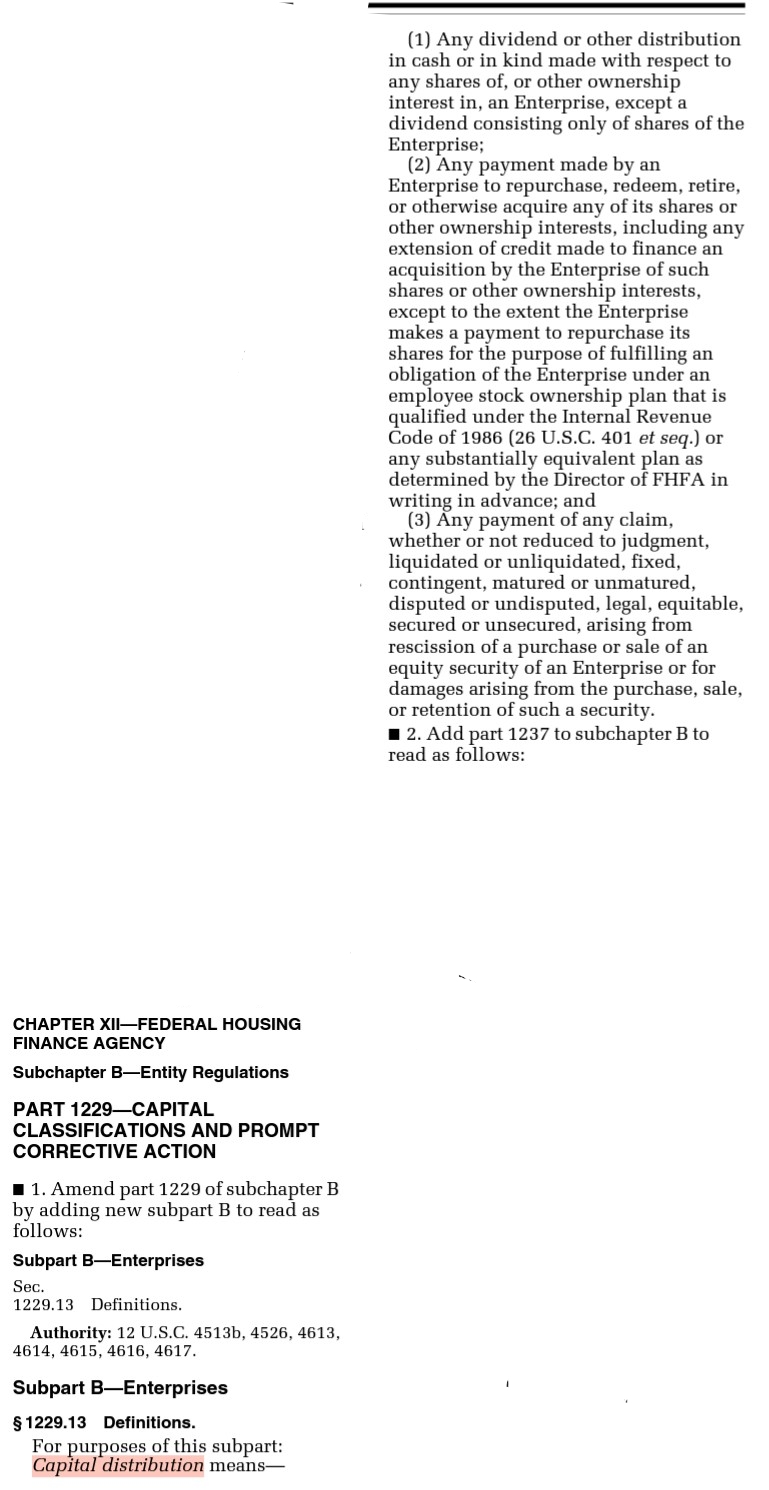

The reason why this payment is restricted is because the FHFA added it up to the definition of Capital distribution (#3) and thus, restricted in the same statutory provision pointed out before for dividends, and it can be used for another capital distribution: today's SPS LP increased for free every quarter as compensation to UST in the absence of dividends.

Definition of capital distribution in the FHEFSSA, where it allows in #3 to add by regulation more capital distributions to the definition.

This is the new definition of capital distribution with the additon of payments of Securities Litigation claims as #3.

Then, the real reason why the payment of Securities Litigation judgments is restricted in conservatorship, is the statutory provision Restriction on Capital Distributions when FnF are undercapitalized, as the FHFA explained in the preface of the Final Rule that enacted the CFR 1237.13:

An explanation that can be used to explain why the FHFA is carrying out a Separate Account plan according to the law: Rehabilitation of FnF, restriction on capital distributions.

An explanation in the preface of the Final Rule that ended up pointing out when the Equity holders shall expect the resumption of dividend payments: once FnF become Adequately Capitalized again (now 25% of the Prescribed Capital Buffer, with the new Capital Rule)

Adequately Capitalized is one of the 4 Capital Classifications outlined in the FHEFSSA (when the Total Capital is greater than the Risk-Based Capital requirement. Total Capital = Core Capital + the Allowance for Loan Losses account). Another reason why the plotters conceal the FHEFSSA and talk about HERA instead or, directly, GS's Mnuchin recommended Congress to repeal these statutory definitions.

Then, the bankers at the MBA targeted the capital metrics in the Basel Framework that the FHFA adopted for its Capital Rule: CET1 and TIER 1 Capital, in a letter submitted last week in the Request for Input on pricing.

In the end, the plotters don't want laws and rules, they just want to own a Federal Agency with only one rule: you will do as the FHFA Director says.

The plotters covering up many statutory provisions, Bill Ackman implying that the FHFA has absolute discretion in a Pershing's letter, and his subordinate, Glen Bradford, in the tweet below, showed us the role that they would like the FHFA to become, but the laws say otherwise.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM