Wednesday, August 23, 2023 3:08:43 AM

what SCOTUS "actually said"

Because it denotes that you will spin it. A half-truth is a lie.

Just what your colleague in this conspiracy, Glen Bradford, has done.

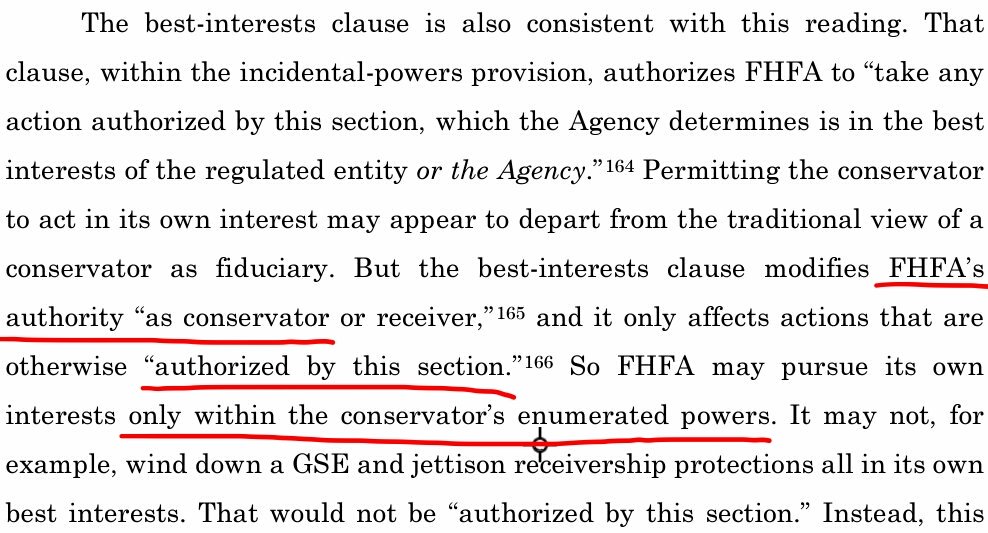

First of all, Justice Alito refused to comment about the "authorized by this section" that appears in the same sentence of the FHFA-C's Incidental Power that he based his opinion on, in its entirety.

Unlike judge Willett in the same case at the prior enbanc hearing, explaining that "any action" must be among the enumerated powers of the conservator.

This is what Justice Alito really said:

It may aim to rehabilitate FnF in a way that, while not in the best interests of FnF, is beneficial to the FHFA and, by extension, the public it serves.

He expressly highlighted as prerequisite, that FnF must be rehabilitated, which I take it because it's also what "authorized by this section" in the law, is about, as rehabilitation of FnF is what lies behind the FHFA-C's power:

There is no other way to rehabilitate a financial company than building Common Equity.

Today, FnF are NOT rehabilitated "on paper". What Justice Alito meant with "not in the best interests of FnF". Instead, a Separate Account behind the scenes is what is really rehabilitating FnF.

This is FnF as of end of June, 2023:

- $-216 billion Retained Earnings accounts tasked with absorbing future losses.

- $304 billion SPS outstanding that will have to be paid back sooner or later.

- $-194 billion Core Capital

- $402 billion capital shortfall over Minimum Leverage Capital requirement.

- FnF would be declared Critically Undercapitalized with such awful financial condition.

-Let alone the Financial Statement fraud with the $111 billion worth of SPS LP increased for free that is missing on the balance sheets.

BOTTOM LINE

By agreeing with the NWS dividend (the second UST backup inserted by HERA in the Charter Act allows unlimited dividend rate on SPS. The original cheap UST backup prevails), with an absolute disregard for other laws that restrict it (Restriction on Capital Distributions; Fee Limitation of U.S.) and breach of financial concepts (unavailable funds for distribution as dividend, out of a Retained Earnings account with deficit all along), Justice Alito, in truth, was endorsing the Separate Account plan when he pitched the rehabilitation of FnF in a way that is beneficial to the Agency and the public, also known as the Marxist way: it enables a lengthy conservatorship so that more time is spent with policies that are based on the extortion of the resources out of FnF and social recognition of officials in numerous luncheons, in Congress, books, etc.: NPL and RPL sold to Goldman Sachs & Co, sales that include the option of loan forgiveness, this is why the loans are sold at a discount, which makes the Investment Banks and hedge funds de facto intermediaries in the administration's social policies; REO inventory sold to Neighborhood Associations, etc.

At some point, the Common Equity held in escrow has to be returned to the enterprises, so FnF are rehabilitated in the real world (Balance Sheets), complying with the prerequisite of Justice Alito, and FnF resume independent operations.

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM