Sunday, June 04, 2023 2:04:46 AM

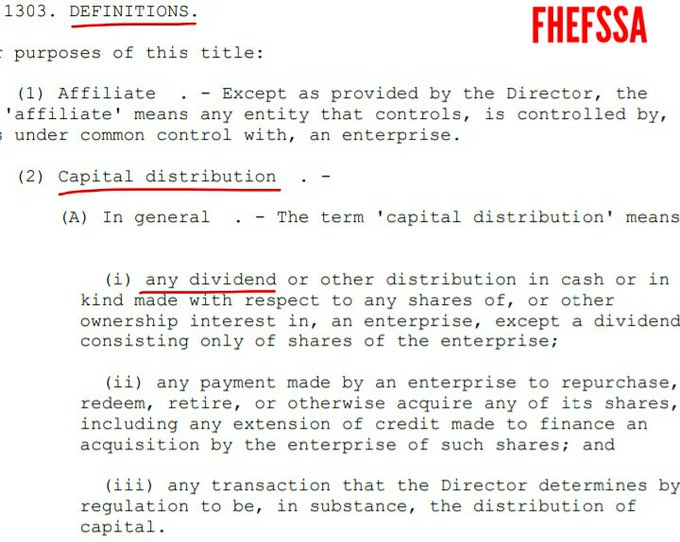

Yesterday, I commented that all the UST's actions are capital distributions (initial $1B gifted SPS reduced Paid-In Capital, the Warrant, 10% dividend, NWS dividend and today's gifted SPS in the absence of dividend) that took their common equity away and more, because the 10% dividend prompted negative Net Worth and the need of more draws from UST and subsequent SPS (death spiral)

The courts are precluded from taking any action that affects the conservatorships (12 U.S. Code §4617(f)), because they don't understand the financial concepts and are subject to political interference, as it's been proven.

So, all the court rulings are tossed to the garbage bin.

With the 6th and 5th Circuit Courts of Appeals stating that "may put FnF in a sound condition" (the conservator's power or mandate) was achieved with "the return to profitability, despite that later the profits are sent to the Treasury's coffers", and the 6th Circuit also about "may put FnF in a solvent condition", met with the UST's funding commitment, when it's related to FnF becoming solvent on their own, not with the UST's assistance.

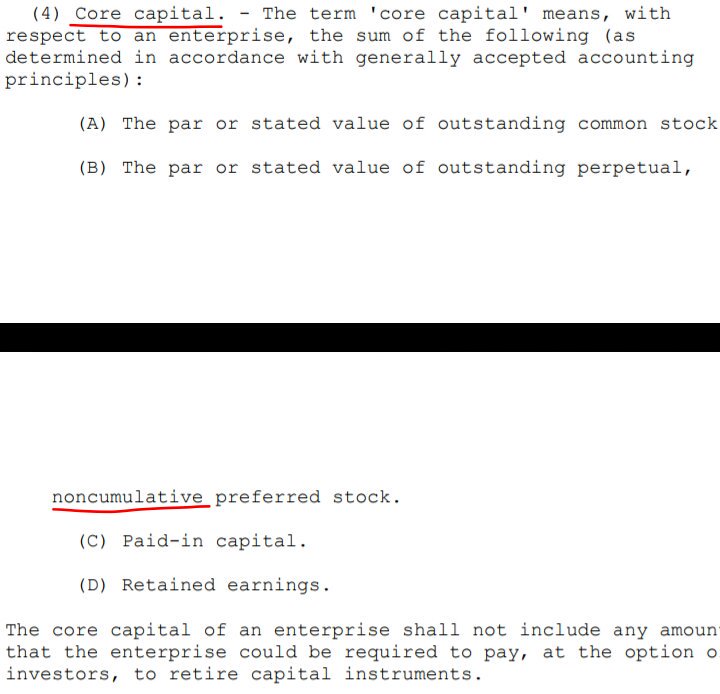

"'May' is permissive" said another courts, when "may" is mandatory once the capital is built, because the quarterly earnings must be retained in the balance sheets, to be recorded in the Core Capital (the Retained Earnings account is Core Capital) necessary to meet the capital requirements.

Then, the corrupt litigants needed constitutional issues like the constitutionality of the FHFA director, to attach statutory provisions, otherwise the Supreme Court couldn't be activated by the hedge funds through a petition of writ of certiorary.

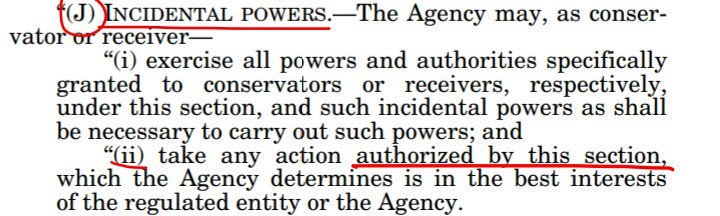

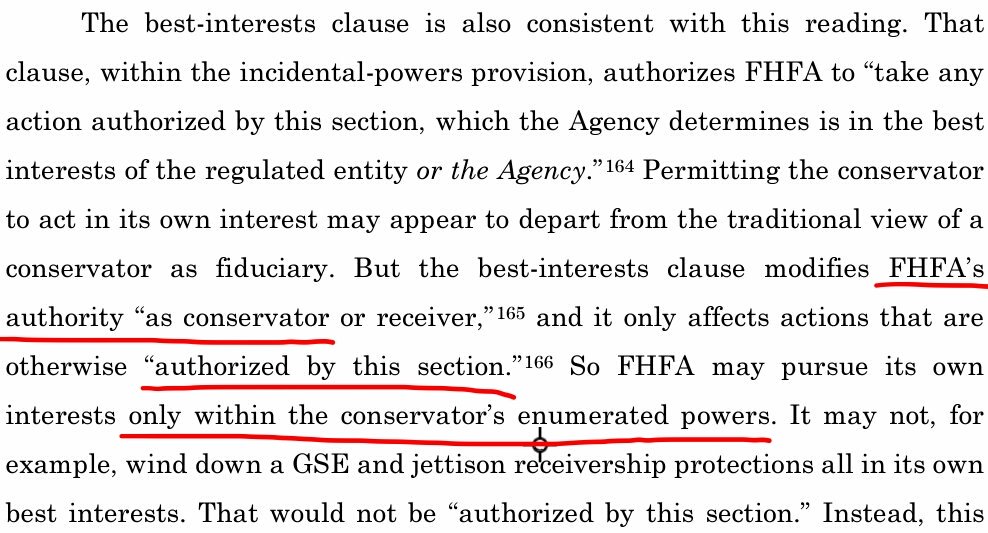

The Supreme Court targeted what was left, the conservator's Incidental Power,

stating that the NWS dividend was "beneficial to the Agency", but it refused to indicate as to what for, because the law states "in the best interests of the Agency", nothing about monetary gain. Justice Alito switched it for "beneficial" to transmit the idea of monetary benefit, which isn't what "best interests" is about. The fact that he omitted in the same sentence he based his opinion on, that any action must be "authorized by this section", is evidence that he didn't want to highlight that the law restricts the actions to the enumerated powers of the conservator, as judge Willett explained in his en-banc hearing ruling in the Collins case. This is humiliating for the Supreme Court, because the Collins case was the very case in the Supreme Court, so the Justices read judge Willett's explanation of the Incidental Power.

Therefore, the NWS dividend might be in the best interests of the Agency, but the funds must be applied towards the recapitalization (soundness: capital levels) or reduction of the obligations SPS (solvency), which are also exactly the exceptions to the Restriction on Capital Distributions in the FHEFSSA (to reduce the SPS) and the CFR 1237.12 (for recapitalization). That is, the common equity is held in escrow, in the best interests of the Agency or as Justice Alito claimed "beneficial to the Agency", the benefit of lying so that Fairholme can seek back dividends and call for a conversion Preferreds to Common Stocks.

The 6th Circuit Court of Appeals again, refusing to count the 210 days in the Time Limitation of Acting Directors, July 20, 2011, because it coincides with the effective date of the CFR 1237.12 that enabled the 3rd amendment in question, in order to pave the way for the attorney for Fairholme, the omnipresent almighty David Thompson now in the Rop case (also Bhatti case and Robinson case), to seek damages, as a way to get back dividends on its noncumulative dividend JPS.

So, the Judiciary is a sad spectacle and humiliating, beginning with the corrupt litigants that embarked on a conspiracy that covers up many statutory provisions (crime of Making False Statements) and FHFA/UST's actions remain unchallenged to use them as a negotiation with the Govt, like the Warrant, the 10% dividend, and today's gifted SPS ("the Govt has to come to me" said D.Thompson in a conference call hosted by Pagliara. The internet link to the audio no longer works), in their chase for back dividends, now only based on constitutional issues after depriving of meaning all the laws pertaining to FnF (the FHEFSSA and the Charter Act) using the Department of Justice as counterparty of their Government theft story, which just shows how powerful some politicians are, all day mulling on new conspiracies.

Because the law and the financial concepts say otherwise: the Separate Account plan.

There's been already a "restructuring". It's called Conservatorship. The idea that the conservator can take all the Common Equity away of the conservatees, is racketeering activity in collusion with the Treasury Department, leaving FnF with $-193 billion of core capital, when a Conservatorship is, precisely, for Critically Undercapitalized enterprises, and it's required that there must be corrective actions to restore capital levels, that is, they have to build capital. Every action, with the objective that a bunch of hedge funds, which includes the Treasury Department, can call for a restructuring 15 years later, while others bottom-fish the stocks in a clear case of stock price manipulation, by misrepresenting their financial condition and using Financial Statement fraud ($103B worth of SPS are missing on the balance sheets) and Accounting fraud ($0 EPS, when gifted SPS are Equity transactions) to that end. Trampling their congressional Charters, which are a fortress against Government abuses, with a clause called "PROHIBITION of United States", says it all.

The DOJ's response: "PROHIBITION... Lol. Nice going!"

The SCOTUS-appointed amicus, Professor Nielson, slammed the DOJ:

Please, stick to your worthless court scheduling table.

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM

VPR Brands (VPRB) Reports First Quarter 2024 Financial Results • VPRB • May 17, 2024 8:04 AM

ILUS Provides a First Quarter Filing Update • ILUS • May 16, 2024 11:26 AM

Cannabix Technologies and Omega Laboratories Inc. enter Strategic Partnership to Commercialize Marijuana Breathalyzer Technology • BLO • May 16, 2024 8:13 AM

Avant Technologies to Revolutionize Data Center Management with Proprietary AI Software Platform • AVAI • May 16, 2024 8:00 AM