Monday, December 12, 2022 11:59:59 AM

https://seekingalpha.com/article/4563888-express-inc-my-latest-liars-poker-bet

Dec. 12, 2022 7:38 AM ETExpress, Inc. (EXPR)AVYA, CSSE, CVNA, GME, REVRQ9 Comments

Summary

Express reported very poor Q3 FY 2022 results and indicated Q4 FY 2022 results would be similarly challenging.

Despite the really poor second half FY 2022, Express signed a transformative deal with WHP Global, that will result in pro-forma debt moving from $211 million net to $31 million net.

As a result of this WHP Global deal, I've moved from long time bearish to tactically bullish and got long at $1.38 (in pre-market on December 8, 2022).

The short thesis, at least in the near term, has been defused!

This idea was discussed in more depth with members of my private investing community, Second Wind Capital . Learn More »

IMG_2478.jpg

Vincent Besnault

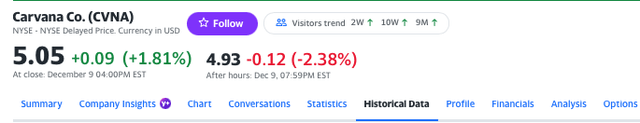

We have a lot of ground to cover here, so if I can pull this off, you're in for a good read. Let's start with the title of today's piece: Express, Inc. (NYSE:EXPR): 'My Latest Liar's Poker Bet'. This should naturally lead you ask what was my most recent game of Liar's Poker. Well, I'm glad you asked. And just to be clear, I only selectively play Liar's Poker. It is a really difficult game to play well. The last time I played Liar's Poker and wrote a small mini series of articles, here on Seeking Alpha, was on Carvana Co. (CVNA). Back then, Carvana shares were trading in the low $20s to mid $20s, the stock was highly shorted, and the Twittershpere and stock whispers were calling for an imminent bankruptcy. I was told, unequivocally, that Carvana would file bankruptcy on or before September 30, 2022.

To just to be clear, on the timing, as timing is everything on these one month to three month Liar's Poker bets, the Carvana mini series was written from June 21, 2022 - July 21, 2022.

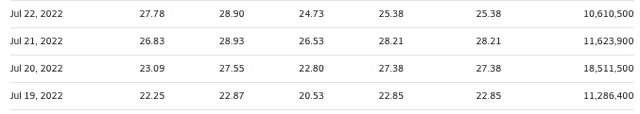

And just to set the record straight, enclosed below, I provide the time and sale data, on Carvana, at times of article publications, and then captured the subsequent rally that topped out when Carvana shares hit $58, on August 16th.

On June 21st, Carvana shares moved from $25 to as high of $32.37 and closed at $23.11, on June 29th.

On July 21, 2022, the date of the final piece, in the series, Carvana shares closed at $28.21.

From August 11, 2022 - August 17, 2022, Carvana shares traded north of $50 per share, eventually peaking at $58.05, on August 16, 2022.

My long winded point here is that Carvana was a much more difficult contrarian and shorter term Liar's Poker bet (three months in this case), given its very elevated balance sheet leverage and associated interest expense service requirements. The company needed to hit all green lights coming home, as it turns out, the rally in rates, when the 10YR yield moving under 3%, in August 2022, proved fleeting. Making matters worse, and then macro conditions worsened and used car prices tumbled. So instead of hitting all green lights, they hit a few green lights and then mostly red lights.

Later in a piece, as an observer of short squeezes, I'm going to discuss a few other short squeezes. The point I'm driving home here is that shorting companies with $100 million to $150 million market capitalization is at best bad risk management and at worse kind of crazy.

Let's Talk Express

On the morning of December 8, 2022, Express, Inc. reported very poor Q3 FY 2022 results. Q3 FY 2022 Adj. EBITDA was negative $14.5 million and Adj. EBITDA for the first nine months of FY 2022 was $17 million, down from $38.9 million, in the comparable period.

Express, Inc.'s Q3 FY 2022 10-Q

Express, Inc.'s Q3 FY 2022 10-Q

There is simply no sugar coating it, these were very poor results, with comps down 8%, and gross margins down 540 Bps (from 33.2% to 27.8%). Also, SG&A was up $9.5 million in Q3 FY 2022 compared to Q3, last year. On the Q3 FY 2022 conference call, management admitted that they misgauged the macro headwinds, citing a highly promotional competitive landscape coupled with a few fashion misses in the women's business.

The Q4 Outlook

The Q4 outlook is forecasted to continue the Q3 FY 2022 weakness. And as Q3 FY 2022 results marred the year, management took down its full year guidance.

Seeking Alpha / Express, Inc.'s Q3 FY 2022 Earnings Release

Seeking Alpha / Express, Inc.'s Q3 FY 2022 Earnings Release

During the analyst Q&A section, of the Q3 FY 2022 conference call, Tim Baxter, Express, Inc.'s CEO encapsulated management's pivot in Q4 FY 2022 and into early FY 2023. He noted that they will get inventory back in-line and entering FY 2023, Express will be in a much cleaner inventory position. Again, though, they expect Q4 FY 2022 to be very tough and incorporated that into guidance.

Absolutely, Jay. So, the outlook that we provided for 2022 clearly indicates that we're seeing the same behavior in the fourth quarter from the consumers that we saw in the third quarter. And so that is slightly different than our expectation. Coming into the fall season, our previous outlook we did expect to see improvement in the fourth quarter based on Omicron and the impact of that last year and all sorts of other factors.

The macroeconomic environment and the consumer sentiment that I described earlier, spending less on discretionary categories like apparel, and looking for deep-deep discounts that still seems to be in play in the quarter. And I would say the discount side of that is even more in play in the fourth quarter as it is typically a more promotional quarter anyway. Thinking, you know going forward, we have not shared an outlook for 2023, yet we will do that when we share our fourth quarter results, but we are approaching 2023 with conservatism, particularly in how we're buying merchandise.

And we have a great go to market process that as the supply chain challenges and bottlenecks have, sort of evened out, we're going to be able to get back into chase mode, which is something that works very, very well for us. So, we are testing things right now in the southern part of the country that will influence product we chase into for the [indiscernible] first quarter and the second quarter. So, we're going to approach it with conservativism and we have the mechanisms and the ability to chase into trends as we see consumer behavior rebounding.

That said, with the supply chain set to get significantly better, in FY 2023, they don't need to carry as much inventory or absorb the once sky high container costs of second half calendar 2021 through first half calendar 2022. Also, as there is a lag between when the inventory is ordered and when it sells through, at retail (with the higher associated cost of vintage 2022), this will be a gross margin tailwind for FY 2023.

Next, let discuss Express, Inc.'s debt.

The Debt, as of October 29, 2022

A $290 Million Revolver (11/26/2027) SOFR +165 to +185 Bps

On November 28, 2022, Express announced that they refinanced and termed out its capital structure. This consists of a Revolving Credit Facility getting increased from $250 million to $290 million, at a lower rate, and with a maturity date of November 26, 2027. In case you are wondering, the rate of interest rate is now SOFR +165 to +185, which is a slight decrease from the previous terms of LIBOR +200 Bps to +2.25%.

As you can see, as of October 29, 2022, $144 million was drawn on the revolver.

A $90 Million Term Loan (11/26/2027) SOFR +750 Bps

As part of the refinancing, the term loan was reduced from $140 million to $90 million. The maturity dates mirrors the revolver and terms are SOFR + 750 Bps. As of October 29, 2022, this was fully drawn.

Express, Inc.'s Q3 FY 2022 10-Q

Express, Inc.'s Q3 FY 2022 10-Q

Just to be crystal clear, whenever you refinance first and second lien debt, the bankers are well aware, at least directionally of the current quarterly results and near term outlook. Lenders aren't in the business of getting blind sided, otherwise they wouldn't be around and won't be able to weather different economic cycles. Therefore, I would argue that lenders were apprised, at least directionally, of the underwhelming Q3 FY 2022 results and management's tepid expectations for Q4 FY 2022, and assumed similarly tough trends when they agreed to refinance the debt at favorable terms.

The Elephant In The Room - WHP Global

When we are playing Liar's Poker, I had to be thorough and get into the weeds in the above sections, as I wanted to 1) established that Express, Inc.'s Q3 FY 2022 Adj. EBITDA and Q4 FY 2022 Adj. EBITDA outlook is uninspiring and 2) so we talk about the real elephant in the room - the transformative WHP Global deal!

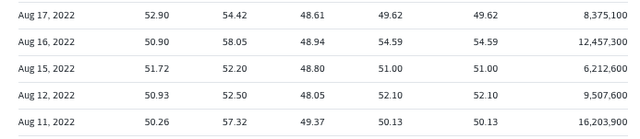

To be crystal clear, I've been negative on Express, the stock, since its two meme spikes of Q1 FY 2021. I even wrote this bearish article, on January 24, 2021, when Express was trading at $3.89.

Since then, on multiple occasions, when Express was trading at around $3 per share, I've been pitched the long case on Express. I have had zero interest whatsoever in owning Express as I just didn't see the bull case and I didn't love the valuation per se.

So let the record show, until December 8, 2022, I've been neutral to bearish on Express and had zero long exposure here. Lo and behold, and despite the really poor Q3 FY 2022 results (and subsequent weak Q4 FY 2022 outlook), I actually got long Express shares, at $1.38 (in pre-market), on December 8, 2022. The reason was simple - the WHP Global deal is transformative and completely destroys the short thesis, at least over the near term. In other words, I would argue that prior to this deal, the shorts had a valid short thesis (although shorting stocks with a sub $100 million market cap. seems a bit reckless). However, the WHP Global deal has defused the short thesis!

The Deal

When the deal closes, WHP global is buying 5.4 million newly issued shares at $4.6 per share ($25 million) and then paying $235 million for a 60% stake in a newly formed joint venture. The new JV owns global intellectual property rights of the brands. Express retains a 40% interest in the JV.

When the deal closes, WHP Global wires Express, $235 million and then Express pays $60 million, the first year royalty payment, to the JV. The next payment won't be due until Q1 FY 2024.

Express, Inc. December 8, 2022 Investor Deck

Express, Inc. December 8, 2022 Investor Deck

(Source: Express, Inc. IR Deck)

In addition, once the funds are received, the $90 million term loan will be paid off.

To be crystal clear, post deal, and including the TL breakage fee, Express corporate will have $114 million of cash, a $145 million revolver, and only $31 million of net debt!

You can like or dislike the deal all you want. The shorts can say the 3.25% royalty rate is too high (yet Express owns 40% of it). That doesn't matter! At least in the near term, the short thesis has been completely defused!

Express, Inc.'s December 8, 2022 Investor Deck

Express, Inc.'s December 8, 2022 Investor Deck

Next, and I want to discuss what I would argue is a bunch of outright propaganda on the Twittersphere. Some people, folks probably short, have suggested the lenders won't somehow sign off on the WHP Global deal.

Let's think this through.

On a pro-forma basis, post deal, the $95 million TL gets paid off, including breakage fee (hmm...I wonder why there was a breakage fee in this newly refinanced TL) and Express now has $114 million of cash. Secondly, if you look at EXPR's balance sheet, the company has $422 million of inventory, at quarter end Q3 FY 2022. With a difficult macro backdrop, on the Q3 FY 2022 conference call, management noted their short term focus was getting inventories in-line and well positioned entering FY 2023. Positively, an improved supply chain (both velocity and cost) means they don't need to hold nearly as much inventory. Arguably, $100 million of excess inventory gets permanently converted to cash, providing lenders with more comfort. Lastly, it is my understanding that Express expects to receive a $53 million tax refund from the CARES act on or around Q1 FY 2023.

Quite frankly, if anyone knows anything about how a capital structure works, the ABL or Revolver always sit at the top of the credit stack. With Express' balance sheet transformed, what is the risk to the first line lenders? Yes, you could make a point that a second lien lender might object to the new royalty terms, but that piece of capital structure is eliminated once the deal closes.

Express Q3 FY 2022 10-Q

Express Q3 FY 2022 10-Q

And just one other point to consider. I would argue Yehuda Shmidman is a reputable businessman, and the back that he is indirectly backed by Oaktree and Howard Marks, solidifies that view. The notion, that Yehuda somehow entered into this transaction as a backdoor way to take over Express in bankruptcy is unfounded and incendiary Twitter babble! Yet, sadly, that is the world we live in. The shorts will simply make stuff up if it suits them. Therefore, you need people like me to take on those arguments and point out how ridiculous they are, in the public square, as sunlight is a good disinfectant.

The Stock Price

Express shares have been a wee tad volatile. Initially, Express shares reacted favorably. As on December 8, 2022, when the 9:30am bell rung, Express shares leapt to $2.03, hit an intra-day high-water mark of $2.14 and closed at $1.77 per share. 74 million shares, or more than 100% of Express, Inc.'s total share count changed hands. And in case you're wondering, as of November 26, 2022, Express only had 68.3 million total shares in existence. The next day, Express shares opened lower, had a brief rally, and then very persistent and uniform selling took hold. It was as if the stock was being walked lower. I've been doing this a long, long time and my hunch is that the shorts shorted the heck out of Express shares, on Friday. It is highly, highly unusual for a stock to trade up so much on what the market perceives as good news and then literally fall out of the sky, as if it was shot down. The only logical explanation is aggressive short selling, at least in my view.

Yahoo Finance

Yahoo Finance

Other Short Squeezes

Nothing for nothing, over the past five years, I've spent a lot of time fascinated trying to understand and follow short squeezes. It is my version of torpedo chasing.

Incidentally, enclosed below and on April 26, 2020, I wrote this GameStop Corp. (GME) article. So although it is impossible to bat thousand, in this wild and high stakes game, I've had a lot of at bats, and am fairly well versed when it comes to short squeezes and understand the conditions that create a good setup.

Seeking Alpha

Seeking Alpha

Likewise, I want to draw readers attention to three recent short squeezes. All three squeezes occurred to companies when their market capitalization were low in absolute and market capitalization terms. Also, one company actually filed bankrupt, one narrowly avoided a bankruptcy through a take under, and the other is likely to file.

On June 16, 2022, Revlon, Inc. (OTCPK:REVRQ) filed for bankruptcy. Days before the filing, Revlon shares tanked from the mid $4s to as low at $1.08, on June 13, 2022. On June 16, 2022, the day of the actual bankruptcy filing, Revlon shares kissed $1.25 and then rebounded to $1.95, by the closing bell. By June 22, 2022, Revlon leapt from that $1.25 (June 16, 2022) low and actually hit a high-water mark of $9.89.

Revlon is Exhibit A on why don't short stocks with sub $100 million market caps.

Revlon's Stock Price (Yahoo Finance)

Revlon's Stock Price (Yahoo Finance)

Moving along, let's discuss Chicken Soup for the Soul Entertainment, Inc.'s (CSSE) take under of Redbox. As we don't have precise time and sales data, as Redbox has been delisted, post transaction, I'm going provide relative numbers, going off of memory. On May 11, 2022, CSSE announced it's take under of Redbox.

The deal priced implied an equity value for Redbox of $0.65, on the day of the deal announcement. Lo and behold, over the ensuing weeks, as a big short squeeze gather paced, and Redbox shares hit a pinnacle of roughly $18 per share!

Seeking Alpha

Seeking Alpha

RedBox is Exhibit B on why you just don't short $2 stocks!

Finally, to round out our recent list of wacky short squeezes, let's consider Avaya Holdings Corporation (AVYA). Avaya can only be described as a Greek tragedy. The company provided guidance earlier in the year and then dramatically cut that guidance. The management team got the boot and a very high level of debt and interest coverage burden crushed the stock.

Prior to the sudden business collapse, Avaya had roughly 86 million shares outstanding. Lo and behold, and despite being in dire straits, financially, AVYA shares squeezed from an August 9, 2022 closing price of $0.61 to a high of $2.30, on September 6, 2022!

Avaya's Stock Price (Yahoo Finance)

Avaya's Stock Price (Yahoo Finance)

Putting It All Together

Post closing, Express will have transformed its balance sheet via this WHP Global deal. The company will pay off its expensive term loan, should be able to convert approximately $100 million of excess inventory into cash, and still expects a $53 million CARES act refund, in Q1 FY 2023. Lastly, the company's revolver was not only refinanced, it was increased, extended, and at modestly better terms.

If bankrupt Revlon can squeeze massively, Redbox moved up 9X during its epic short squeeze, and even Avaya bounced nearly 4X, off the trough, who in their right mind is shorting Express at $2 per share, let alone sub $1.50 per share?

The short thesis has been completely defused by the WHP Global news and on November 28, 2022 its debt was just termed out and refinanced at favorable terms!

In closing, this long time Express bear has flipped to tactically bullish here. Admittedly, Q3 FY 2022 results and Q4 FY 2022 guidance left much to be desired. That said, at $1.24 per share, that really doesn't matter, as the balance sheet safety, on a pro-forma have shifted from weakness to strength. This is the elephant in the room. So, if you like swimming in the high risk/ high reward waters then I would argue Express is a great tactical and Liar's Poker bet, at any price under $1.50.

Second Wind Capital is a value oriented investment service with a strong recent track record of exceptional outperformance. The focus is mostly small cap value and special situation equities. From January 1, 2020 - November 30, 2022, the flagship account has compounded at 43% per year.

C4urself the 1st Ammendment.

Don't assume that i don't know, and i wont assume, that you have no idea.

Recent EXPRQ News

- Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405 • Edgar (US Regulatory) • 05/06/2024 08:35:26 PM

Greenlite Ventures Completes Agreement with No Limit Technology • GRNL • Jul 19, 2024 10:00 AM

VAYK Expects Revenue from First Airbnb Property Starting from August • VAYK • Jul 18, 2024 9:00 AM

North Bay Resources Acquires Mt. Vernon Gold Mine, Sierra County, California, with Assays up to 4.8 oz. Au per Ton • NBRI • Jul 18, 2024 9:00 AM

Nightfood Holdings Signs Letter of Intent for All-Stock Acquisition of CarryOutSupplies.com • NGTF • Jul 17, 2024 1:00 PM

Kona Gold Beverages Reaches Out to Largest Debt Holder for Debt Purchase Negotiation • KGKG • Jul 17, 2024 9:00 AM

Avant Technologies Welcomes Back Former CEO with Eye Toward Future Growth and Expansion • AVAI • Jul 17, 2024 8:00 AM