| Followers | 679 |

| Posts | 141164 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Thursday, August 04, 2022 1:11:01 PM

By: Lyn Alden Schwartzer | August 4, 2022

This remains a challenging macro environment. Economic indicators continue to show clear signs of economic deceleration, likely pointing to weak corporate earnings in the quarters ahead.

Meanwhile, the Federal Reserve is tightening monetary policy into that deceleration, which historically is a very bad mix for asset prices.

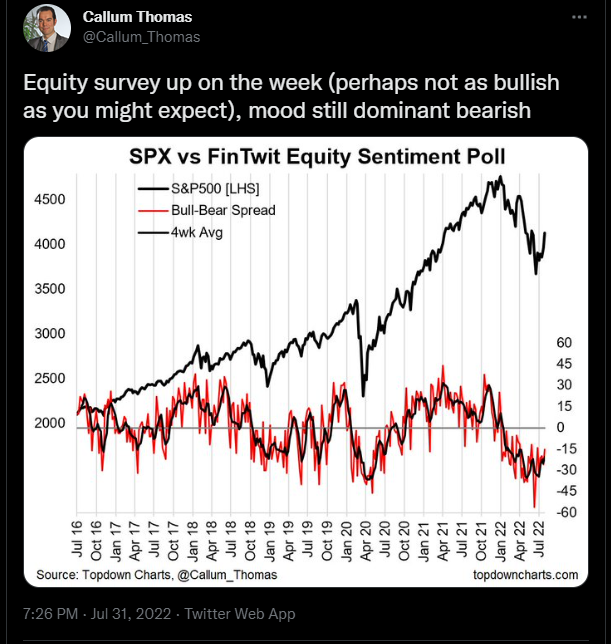

However, sentiment already reached very bearish levels. We can see that among the recent spike in small trader puts as well as sentiment polls like this one that I like to track from Twitter's financial community or "FinTwit":

Chart Source: Callum Thomas

During truly cataclysmic bear markets, the market sometimes falls sharply even during historically low sentiment. For example, back in 2008 sentiment was very weak, but then the market crashed anyway because the entirety of that bad sentiment was warranted, without exaggeration. However, outside of those situations, negative sentiment is usually at least an intermediate-term contrarian indicator.

This issue of Where Fundamentals Meets Technicals takes a look at two companies that should provide decent long-term appreciation, although naturally they both face a lot of uncertainty in this difficult time.

Amazon

Amazon (AMZN) had a growth spurt in the early months of the pandemic and stimulus, but since has been on a slowing trend as excess liquidity and stimulus is withdrawn from the market.

During this time, the company is slowing down its pace of new logistics locations, as it re-assesses its supply chain plans and puts a break on growth to play some defense.

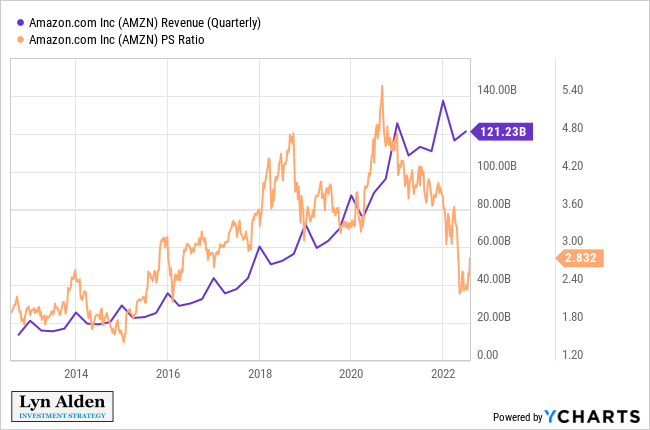

Meanwhile, the market has lowed its valuation on the company, to under 3x sales:

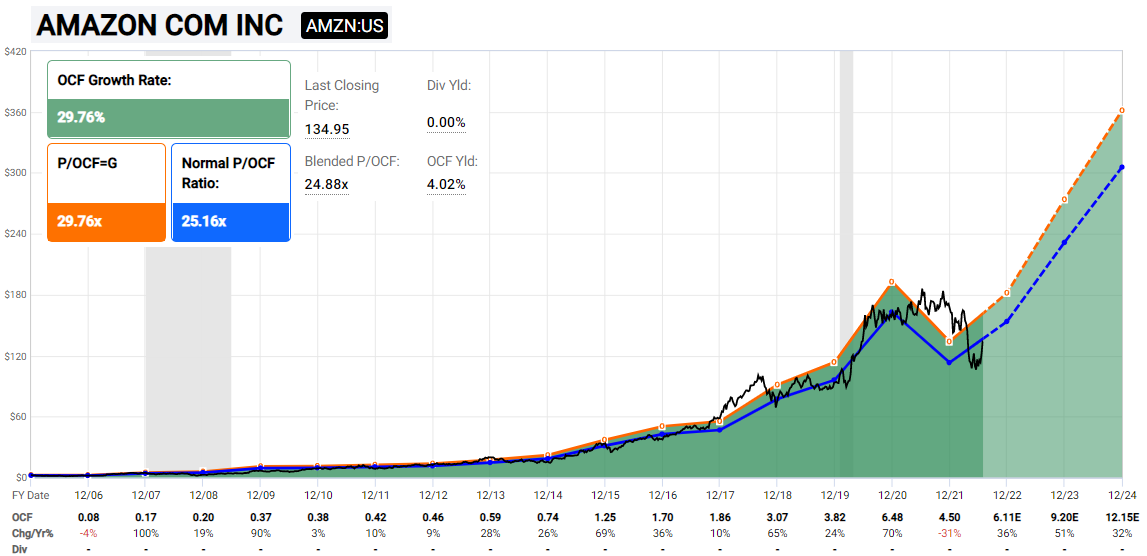

Analysts are rather bullish on operating cash flow over the next couple years, although I would personally discount that somewhat to account for recessionary conditions.

Chart Source: F.A.S.T. Graphs

Zac’s technicals suggest some weakness this month, but with a probable bull market in place:

Overall, I view Amazon as being one of the better big tech companies out there. The bull case for what investors are really buying is the company’s profit center (Amazon Web Services) and fast-growing advertising business, while the more complex retail side is more of a rider at this point.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent AMZN News

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 05/09/2024 02:44:06 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/08/2024 08:42:00 PM

- Meta Platforms Expands AI Ads, Apple Boosts iPhone Shipments, and More Highlights • IH Market News • 05/08/2024 12:27:48 PM

- Tesla’s April Sales Down 18% in China, Amazon’s Multi-Billion Dollar Cloud Expansion in Singapore, and More News • IH Market News • 05/07/2024 11:44:00 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 05/06/2024 05:42:04 PM

- CrowdStrike and AWS Extend Strategic Partnership to Accelerate Cloud Security and AI Innovation • Business Wire • 05/02/2024 12:00:00 PM

- Amazon Business Celebrates Third Annual Small Business Month with New Immersive Educational Hub and Over $250,000 in Grants • Business Wire • 05/01/2024 04:52:00 PM

- Interest Rate Concerns May Continue To Weigh On Wall Street • IH Market News • 05/01/2024 01:09:57 PM

- Amazon Business Celebrates Third Annual Small Business Month with New Immersive Educational Hub and Over $250,000 in Grants • Business Wire • 05/01/2024 01:00:00 PM

- Amazon.com Announces First Quarter Results • Business Wire • 04/30/2024 08:01:00 PM

- AWS Announces General Availability of Amazon Q, the Most Capable Generative AI-Powered Assistant for Accelerating Software Development and Leveraging Companies’ Internal Data • Business Wire • 04/30/2024 01:00:00 PM

- U.S. Index Futures Point to Mild Decline Ahead of Key Earnings and Fed Rate Decision • IH Market News • 04/30/2024 11:59:59 AM

- Philips Stocks Soar 47% Following US Deal, Tesla Bolsters Presence in China, and More News • IH Market News • 04/29/2024 11:11:24 AM

- Anglo American Rejects BHP Group’s Offer, Toyota Invests $1.4 Billion in Indiana, and More News • IH Market News • 04/26/2024 11:48:07 AM

- Prime Video to Become the Home of National Monday Night NHL Games in Canada Beginning in 2024-25 Season, with Prime Monday Night Hockey • GlobeNewswire Inc. • 04/25/2024 03:00:39 PM

- Prime Video devient le diffuseur officiel des soirées de hockey du lundi soir de la LNH au Canada avec le lancement de Prime Monday Night Hockey dès la saison 2024-2025 • PR Newswire (Canada) • 04/25/2024 03:00:00 PM

- Prime Video to Become the Home of National Monday Night NHL Games in Canada Beginning in 2024-25 Season, with Prime Monday Night Hockey • PR Newswire (Canada) • 04/25/2024 03:00:00 PM

- Amazon Bedrock Launches New Capabilities as Tens of Thousands of Customers Choose It as the Foundation to Build and Scale Secure Generative AI Applications • Business Wire • 04/23/2024 01:40:00 PM

- Apple Loses Market Share in China, GM Surges in Pre-Market Following Upward Revisions for 2024 Projections, and More News • IH Market News • 04/23/2024 11:25:34 AM

- Amazon Introduces Low-Cost Grocery Delivery Subscription for Prime Members and Customers Using EBT • Business Wire • 04/23/2024 10:00:00 AM

- Apple to Invest $250 Million in Singapore Expansion, Oracle Commits $8 Billion to Japan Infrastructure, and More News • IH Market News • 04/18/2024 11:11:52 AM

- United Shares Surge 5.3% in Q1 2024 Earnings Beat; Take-Two Cuts 5% of Workforce, and More News • IH Market News • 04/17/2024 10:57:39 AM

- Amazon.com to Webcast First Quarter 2024 Financial Results Conference Call • Business Wire • 04/16/2024 08:01:00 PM

- Samsung Surpasses Apple in Q1 Smartphone Market; Salesforce in Talks to Acquire Informatica, and More News • IH Market News • 04/15/2024 11:06:48 AM

- Paramount Global Board Shrinks, Morgan Stanley Faces Regulatory Probe, and More News • IH Market News • 04/12/2024 11:05:29 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM

Moon Equity Holdings, Corp. Announces Acquisition of Wikolo, Inc. • MONI • May 7, 2024 9:48 AM