| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Saturday, May 21, 2022 9:46:58 AM

Weekly Investment Strategy

By: Raymond James Financial | May 21, 2022

Key Takeaways

• Rate hikes cannot solely resolve pricing pressures

• Sentiment may become a self-fulfilling prophecy

• Retailer earnings calls conveyed cautionary trends

We remain in the camp that the US economy will not enter a recession over the next 12 months. For the most part, neither our long nor our short-term indicators suggest any sign of an impending recession. However, we do think there is a conundrum confronting the Federal Reserve (Fed): Can it aggressively raise interest rates to slow the pace of inflation in an environment in which anecdotal evidence suggests signs of strain? With inflation largely driven by factors out of the Fed’s control (e.g., war, weather), we believe the Fed should not raise rates as much as the market is expecting. This is especially true as the major retailers share insights on what is stressing their outlook. The Fed should take note, as these are real-time insights into the most important driver of the US economy – the consumer.

• The Fed’s Fight Against Inflation | Chair Powell hardened the hawkish stance this week, saying the Fed “won’t hesitate” to increase interest rates until prices start to normalize and financial conditions are in an appropriate place even if “that involves moving past broadly understood levels of neutral.” According to the market’s expectations, the fed funds rate will approach 3% by year end. This would equate to the largest annual increase in interest rates since 1994. The Fed has only hiked rates twice so far—increasing the fed funds rate by 0.75%—but it has already started to make investors nervous as it appears to be dampening some economic activity. And remember, historically, the impact of rate hikes acts with a lag of at least six months. Yes, inflation is still near the highest levels since the 1980s, but steadily increasing rates cannot solely resolve pricing pressures —especially when the catalysts for higher prices are out of the Fed’s control (e.g., energy prices driven by the war in Ukraine).

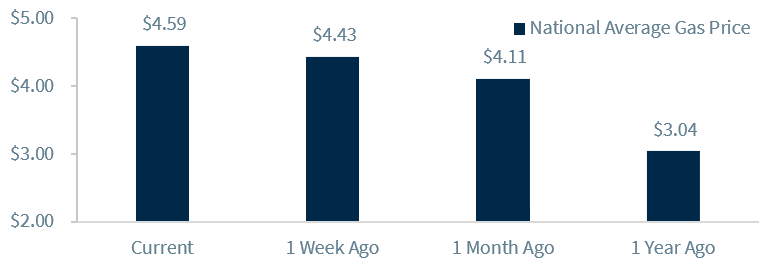

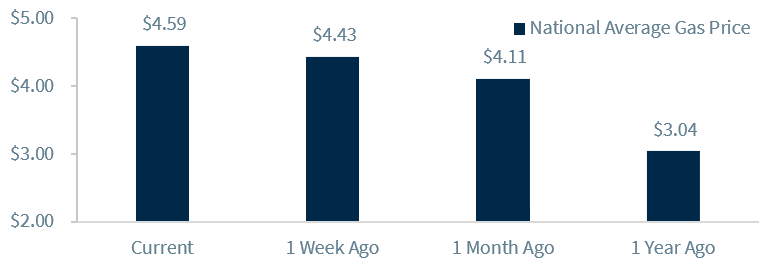

• How Many Hits Can The Consumer Absorb? | The consumer has been buoyed by wage gains and job creation—two primary reasons why a recession can be avoided. But there are limits to the resiliency as negative forces begin the mount. Gas prices are at a record high ($4.59/gallon) ahead of the summer driving season, food prices are rising at the fastest pace since 1981, and $8.4 trillion in wealth has been wiped out due to the declines in the equity and fixed income markets—just to name a few. The culmination of these pressure points has rightfully weakened confidence. Confidence can be fickle and change quickly, but it must be monitored. Why? The longer it stays weak, the more likely it could develop into a self-prophesizing recession.

• Retailers Reveal Struggles | This earnings season for retailers provides some early warning signs to the Fed to proceed cautiously when raising interest rates. Below are a few cautionary trends management teams conveyed during their calls:

• Overstaffing / Two of the biggest employers in the US – Amazon and Walmart – highlighted plans to slow hiring. While this may dampen job creation, it may also slow wage gains, which tend to be a long-term driver of inflation.

• Inventory / Target admitted it failed to anticipate the pace at which consumer spending would shift from categories such as TVs and appliances to luggage, toys for birthday parties, and attire for events. With inventory levels in many cases up 20% from the average, a reduction in inventory is likely to lead to more discounting—placing downward pressure on inflation.

• Substitutes / Both Target and Walmart noted a shift in spending from brand name labels to lower cost generic options. This bargain hunting behavior suggests that consumers, particularly at the lower end of the income spectrum, are struggling.

The Fed must take note of these messages, and next week should provide additional insights from leading retailers as we get earnings from Best Buy (consumer electronics) and other discounters (Dollar Tree, Dollar General, and Costco).

• Bottom Line – A Slowdown Is Not A Contraction | We caution the Fed against aggressively hiking into what seems to be a slowing (not contracting!) economy. If it hopes to achieve a soft landing as it did in 1994, it needs to pivot its rhetoric and not hike too aggressively. Our expectation is that the fed funds rate will ultimately increase to 2-2.5%, well below market expectations. After two 0.5% increases at the June and July Fed meetings, we hope to see a dovish shift at the Jackson Hole Symposium (August 25) as inflationary pressures should begin easing. If 1994 serves as the example of what may occur if a soft landing is accomplished, the S&P 500 was up more than 20% in each of the proceeding five years. While we don’t anticipate these gains being repeated, the equity market should at least recover its losses and move higher by year end. And even if a recession does occur (again, not our base case), it should be mild/moderate given the overall health of consumer and corporate balance sheets and the lack of an ‘excess’ (e.g., overleverage in the housing market leading to the 2008 recession). This distinction is important, as a severe recession (decline of 2.5%+ in GDP) corresponds to an average equity market decline of ~34% while a mild/moderate recession corresponds to an average decline of ~24%—a difference of 10%! So even if we are in the midst of a mild/moderate recession, the equity market has already priced in ~84% of the decline from a historical basis.

Read Full Story »»»

DiscoverGold

DiscoverGold

By: Raymond James Financial | May 21, 2022

Key Takeaways

• Rate hikes cannot solely resolve pricing pressures

• Sentiment may become a self-fulfilling prophecy

• Retailer earnings calls conveyed cautionary trends

We remain in the camp that the US economy will not enter a recession over the next 12 months. For the most part, neither our long nor our short-term indicators suggest any sign of an impending recession. However, we do think there is a conundrum confronting the Federal Reserve (Fed): Can it aggressively raise interest rates to slow the pace of inflation in an environment in which anecdotal evidence suggests signs of strain? With inflation largely driven by factors out of the Fed’s control (e.g., war, weather), we believe the Fed should not raise rates as much as the market is expecting. This is especially true as the major retailers share insights on what is stressing their outlook. The Fed should take note, as these are real-time insights into the most important driver of the US economy – the consumer.

• The Fed’s Fight Against Inflation | Chair Powell hardened the hawkish stance this week, saying the Fed “won’t hesitate” to increase interest rates until prices start to normalize and financial conditions are in an appropriate place even if “that involves moving past broadly understood levels of neutral.” According to the market’s expectations, the fed funds rate will approach 3% by year end. This would equate to the largest annual increase in interest rates since 1994. The Fed has only hiked rates twice so far—increasing the fed funds rate by 0.75%—but it has already started to make investors nervous as it appears to be dampening some economic activity. And remember, historically, the impact of rate hikes acts with a lag of at least six months. Yes, inflation is still near the highest levels since the 1980s, but steadily increasing rates cannot solely resolve pricing pressures —especially when the catalysts for higher prices are out of the Fed’s control (e.g., energy prices driven by the war in Ukraine).

• How Many Hits Can The Consumer Absorb? | The consumer has been buoyed by wage gains and job creation—two primary reasons why a recession can be avoided. But there are limits to the resiliency as negative forces begin the mount. Gas prices are at a record high ($4.59/gallon) ahead of the summer driving season, food prices are rising at the fastest pace since 1981, and $8.4 trillion in wealth has been wiped out due to the declines in the equity and fixed income markets—just to name a few. The culmination of these pressure points has rightfully weakened confidence. Confidence can be fickle and change quickly, but it must be monitored. Why? The longer it stays weak, the more likely it could develop into a self-prophesizing recession.

• Retailers Reveal Struggles | This earnings season for retailers provides some early warning signs to the Fed to proceed cautiously when raising interest rates. Below are a few cautionary trends management teams conveyed during their calls:

• Overstaffing / Two of the biggest employers in the US – Amazon and Walmart – highlighted plans to slow hiring. While this may dampen job creation, it may also slow wage gains, which tend to be a long-term driver of inflation.

• Inventory / Target admitted it failed to anticipate the pace at which consumer spending would shift from categories such as TVs and appliances to luggage, toys for birthday parties, and attire for events. With inventory levels in many cases up 20% from the average, a reduction in inventory is likely to lead to more discounting—placing downward pressure on inflation.

• Substitutes / Both Target and Walmart noted a shift in spending from brand name labels to lower cost generic options. This bargain hunting behavior suggests that consumers, particularly at the lower end of the income spectrum, are struggling.

The Fed must take note of these messages, and next week should provide additional insights from leading retailers as we get earnings from Best Buy (consumer electronics) and other discounters (Dollar Tree, Dollar General, and Costco).

• Bottom Line – A Slowdown Is Not A Contraction | We caution the Fed against aggressively hiking into what seems to be a slowing (not contracting!) economy. If it hopes to achieve a soft landing as it did in 1994, it needs to pivot its rhetoric and not hike too aggressively. Our expectation is that the fed funds rate will ultimately increase to 2-2.5%, well below market expectations. After two 0.5% increases at the June and July Fed meetings, we hope to see a dovish shift at the Jackson Hole Symposium (August 25) as inflationary pressures should begin easing. If 1994 serves as the example of what may occur if a soft landing is accomplished, the S&P 500 was up more than 20% in each of the proceeding five years. While we don’t anticipate these gains being repeated, the equity market should at least recover its losses and move higher by year end. And even if a recession does occur (again, not our base case), it should be mild/moderate given the overall health of consumer and corporate balance sheets and the lack of an ‘excess’ (e.g., overleverage in the housing market leading to the 2008 recession). This distinction is important, as a severe recession (decline of 2.5%+ in GDP) corresponds to an average equity market decline of ~34% while a mild/moderate recession corresponds to an average decline of ~24%—a difference of 10%! So even if we are in the midst of a mild/moderate recession, the equity market has already priced in ~84% of the decline from a historical basis.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.