| Followers | 679 |

| Posts | 140848 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Wednesday, May 18, 2022 3:46:10 PM

By: Lyn Alden Schwartzer | May 17, 2022

Citigroup

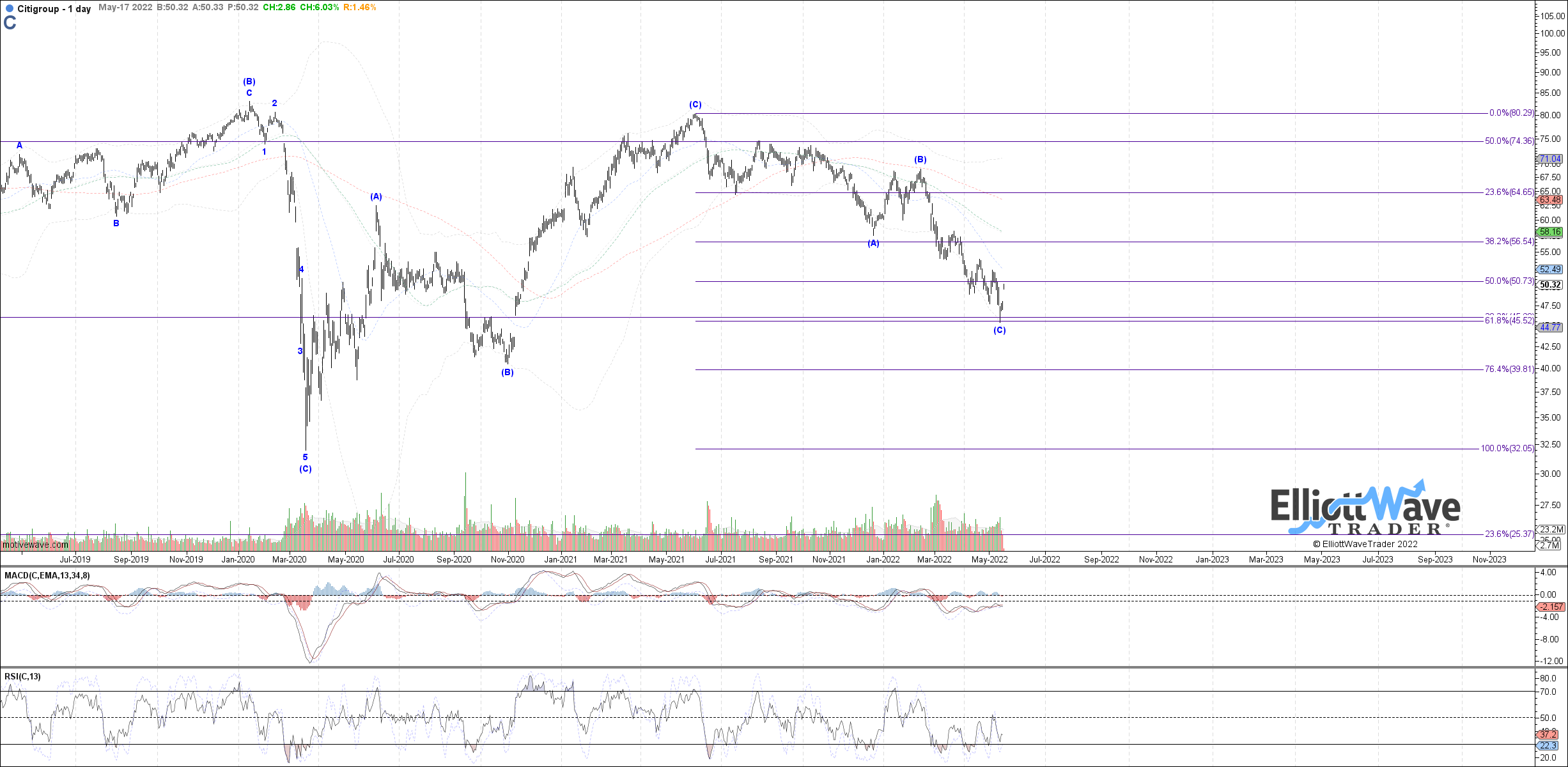

Garrett sees a potential bottom in place for Citigroup (C) but likes other bank charts better:

Turning up from the .618 retrace, but other big bank charts look much better in comparison

I personally like Bank of America (BAC) more than Citi from a risk-adjusted return perspective. However, I want to focus on Citi for a moment, because Berkshire Hathaway (BRK.A) just bought $3 billion of it.

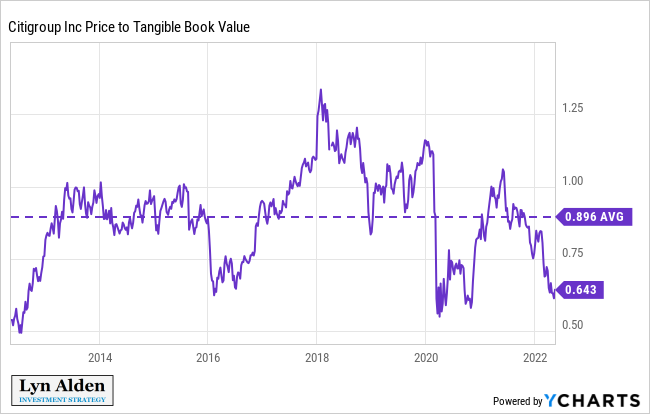

Basically, it’s the cheapest major US bank and pays a high dividend yield. Unlike other banks it is trading well below tangible book value, and well below its normal valuation range.

It has a single-digit price/earnings ratio:

Chart Source: F.A.S.T. Graphs

Does Citigroup deserve a lower valuation than the other big US banks? Yes. Does it deserve a valuation this low? I’d argue no.

With fear in the markets, buying Citigroup well below tangible book value does not seem like a bad 18-36 month trade to me.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent C News

- Citigroup Announces C$56.782 Million Redemption of 5.160% Fixed Rate / Floating Rate Subordinated Notes due 2027 • Business Wire • 04/24/2024 01:00:00 PM

- Apple Loses Market Share in China, GM Surges in Pre-Market Following Upward Revisions for 2024 Projections, and More News • IH Market News • 04/23/2024 11:25:34 AM

- United Shares Surge 5.3% in Q1 2024 Earnings Beat; Take-Two Cuts 5% of Workforce, and More News • IH Market News • 04/17/2024 10:57:39 AM

- CitiGroup Announces Full Redemption of Series D Preferred Stock • Business Wire • 04/15/2024 08:15:00 PM

- Upbeat Earnings, Retail Sales Data May Generate Buying Interest • IH Market News • 04/15/2024 01:10:16 PM

- U.S. Index Futures Surge after Dow Jones’ Worst Week, Oil Prices Dip • IH Market News • 04/15/2024 11:08:21 AM

- U.S. Stocks Pulling Back Sharply As JPMorgan Chase Disappoints • IH Market News • 04/12/2024 08:21:52 PM

- U.S. Stocks May Move Back To The Downside In Early Trading • IH Market News • 04/12/2024 01:10:09 PM

- Citigroup Reports First Quarter 2024 Results • Business Wire • 04/12/2024 12:00:00 PM

- U.S. Index Futures Indecisive Ahead of Banking Earnings, Oil Prices Surge • IH Market News • 04/12/2024 11:07:01 AM

- Nasdaq Surges To New Record Closing High But Dow Closes Little Changed • IH Market News • 04/11/2024 08:25:37 PM

- Citigroup Announces $2.75 Billion Redemption of 3.352% Fixed Rate / Floating Rate Notes due 2025 • Business Wire • 04/09/2024 08:15:00 PM

- U.S. Futures Dip Ahead of Key Inflation Data and Q1 Earnings Season Kickoff, Oil Prices Decline • IH Market News • 04/08/2024 11:19:03 AM

- Apple Terminates 614 Employees, Disney Unveils June Crackdown on Password Sharing, and More Updates • IH Market News • 04/05/2024 11:38:57 AM

- Citigroup Declares Common Stock Dividend; Citigroup Declares Preferred Dividends • Business Wire • 04/03/2024 08:28:00 PM

- Cal-Maine Surges on Strong Quarterly Performance, Taiwan Earthquake Disrupts Tech Supply Chain, and More • IH Market News • 04/03/2024 11:12:20 AM

- GameStop Shares Tumble 20% in Pre-Market Trading Amid Revenue Decline, Direct Digital Plummets 42%, and More News • IH Market News • 03/27/2024 10:54:47 AM

- Citigroup Global Markets Holdings Inc. – Issue of EUR 375,000,000 Cash Settled Exchangeable Bonds due April 2029 Referable to the Shares of LVMH Moet Hennessy Louis Vuitton • Business Wire • 03/27/2024 07:45:00 AM

- Super Micro Computer and Seagate Shares Surge on Analyst Optimism in Pre-Market Trading, and Latest News • IH Market News • 03/26/2024 11:20:49 AM

- Apple Pre-Market Drop Due to Antitrust Threats, Surprising Profit Boosts Micron Shares, and Latest Market Updates • IH Market News • 03/21/2024 11:17:26 AM

- Crypto: Bitcoin Plummets, Grayscale Promises Lower Fees, and Latest News • IH Market News • 03/19/2024 05:16:16 PM

- Adobe Stock Drops Following Below-Estimate Projections, Cardlytics Surges with Unexpected Profit, and More News • IH Market News • 03/15/2024 11:30:55 AM

- Intel Loses Pentagon Funding, Shell Plans 20% Business Team Reduction, and Latest News • IH Market News • 03/13/2024 11:02:03 AM

- Oracle Soars 13% With Exceptional Growth and Boosts Nvidia Shares With Collaboration Announcement, and More • IH Market News • 03/12/2024 11:21:35 AM

- Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses • Edgar (US Regulatory) • 03/11/2024 09:28:41 PM

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM