Monday, December 20, 2021 8:36:03 AM

Disturb featuring Miles Kennedy is on "Morning Markets"

.

.

.

.

Morning Markets

.

.

.

.

Stocks, Futures, Oil Tumble On Omicron Lockdowns, Manchin Shockwave

Monday, Dec 20, 2021 - 08:02 AM

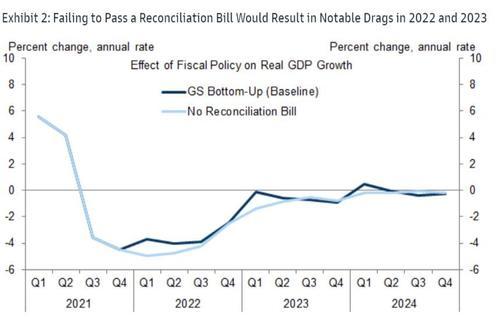

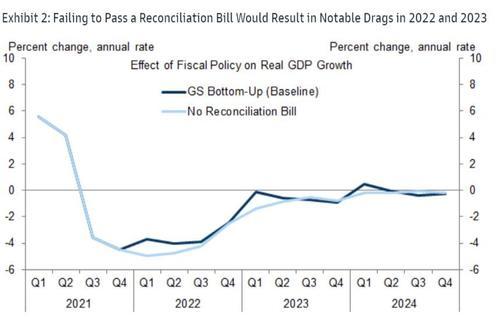

Global stocks and US equity futures are sharply lower to start the otherwise very quiet holiday week, dragged lower by Manchin's shock decision to kill Biden's economic agenda (which Goldman said would cut US Q1 GDP from 3% to 2%), accelerating government measures to counter the fast-spreading omicron variant and fears over the growth outlook amid a tightening Fed. US equity futures tumbled almost 100 points from their Friday close (and more than 200 points from Thursday's all time high before paring some losses buoyed by optimism from news that Moderna’s booster vaccine increases antibodies 37-fold against omicron. Treasury yields also pared a sharp drop as low as 1.35% and the dollar held a jump from Friday, while crude oil slid on worries that mobility curbs to tackle the strain will hurt demand. As of 730am S&P 500 futures were down down 1.1%, Nasdaq 100 -1.3%, and Dow -1.0%.

In the weekend's biggest news, senator Joe Manchin blindsided the White House on Sunday by rejecting Biden’s $1.75 trillion tax-and-spending package, prompting a sharply critical statement from the White House which called Manchin’s decision a “sudden and inexplicable reversal.” Biden and top Democrats must now regroup to see if a scaled-back version remains possible with little more than 10 months before midterm elections that will decide control of Congress. As noted late last night, Goldman Sachs Group Inc. cut its forecast for U.S. economic growth for next year after Manchin’s move (more below). On Monday, Chuck Schumer said the Senate will still vote “very early” in 2022 on Biden’s economic agenda, although it was unclear just what the new plan will look like now that Build Back Better is dead.

Not helping matters were the latest development in the Omicron front where the biggest European countries are introducing more curbs, with U.K. officials keeping open the possiblity of stronger measures before Christmas and the Netherlands returning to lockdown, even as Biden’s chief medical advisor said further U.S. lockdowns are unlikely. In some "good" news, said a third dose of its Covid-19 vaccine saw a 37-fold increase in neutralizing antibodies against omicron. Ironically. While investors remain on edge over the outlook for economic activity, there remains little evidence that the new variant causes illness as severe as the delta variant, especially among those already vaccinated.

“The main reason behind the market sell off today is the rejection of Biden’s $2 trillion tax-and-spending package, which will lead to a reduction in U.S. economic growth forecasts,” said Michel Keusch, a portfolio manager at Bellevue Asset Management. “With trading volumes getting thinner and thinner into the year end, this is the catalyst creating some short-term nervousness.”

Then there are tightening concerns: the Federal Reserve’s decision to increase the pace of tapering last week is also adding to investor nerves about the outlook for 2022. And now, without either fiscal or monetary support, economists see a policy-induced slowdown in the economy where Goldman on Sunday cut its real GDP forecast for 2022: 2% in Q1 (vs. 3% prior), 3% in Q2 (vs. 3.5% prior), and 2.75% in Q3 (vs. 3% prior).

One place which is convinced the Fed will not meet its targets it the bond market where traders of eurodollar futures price rates much lower than FOMC targets for the end of 2023 and 2024.

Finally, as Bloomberg notes, there is also the issue of divergent global monetary policy to contend with, as the People’s Bank of China stepped up easing overnight with the first rate cut in 20 months.

Looking at the premarket, travel stocks fell the most with United Airlines down 3.4% leading declines among major U.S. carriers, while a 4% slide in Royal Caribbean Cruises led the fall among cruise operators. Energy and industrial bellwethers also declined, with Chevron, 3M and Caterpillar falling over 2% each. Major U.S. tech and internet stocks slumped hitting shares in most highly valued names, as well as in cyclicals. Apple fell as much as 2.1% premarket while fellow large- cap tech names also drop, with Facebook-owner Meta Platforms down 1.9%, Alphabet -1.2%, Amazon.com -1.7%, Twitter -2.1%, Microsoft -1.6%. Here are some of the other big U.S. movers today:

Major U.S. tech and internet stocks drop in premarket trading as risk appetite sours globally amid worries over further pandemic- related restrictions, hitting shares in most highly valued names, as well as in cyclicals.

Shares in U.S. renewables firms drop in premarket after U.S. Senator Joe Manchin’s surprise rejection of President Joe Biden’s $2 trillion package.

Moderna (MRNA US) rises 6% in U.S. premarket after the company said that a booster dose of its Covid-19 vaccine increased antibody levels against the omicron variant.

Society Pass (SOPA US) surges 22% in premarket after the loyalty platform operator said in a statement it has been added to the Russell 2000 Index.

Boston Beer (SAM US) upgraded to hold at Jefferies following pullback of more than 60% in the shares related to “massive” reset in expectations for hard seltzers, removing the only negative rating on the stock. Shares up 0.3% on low volume in premarket.

"After battling endless headwinds in recent weeks, markets have finally been knocked over as the rapid spread of Omicron finally reaches panic mode," Russ Mould, investment director at AJ Bell, wrote in a client note.

Europe's Stoxx 600 also stumbled, now down about 1.4% after falling as much as 2.6%, weighed down the most by travel and insurance. All sectors are in red. FTSE 100 recovers slightly as energy gets a leg up, but is still off by 1.2%. Dax -2%.

Earlier in the session, Asian stocks were set for the biggest drop since March, as the spread of the omicron variant and a surprising setback to U.S. President Joe Biden’s economic agenda forced traders to take bets off the table. The MSCI Asia Pacific Index sank as much as 2%, headed for its lowest close since November 2020, with tech and consumer shares the biggest drags.

Relatively thin trading ahead of the year-end exacerbated declines in the region, as investors grapple with fresh outbreaks of Covid-19 and monetary policy tightening globally. The MSCI Asia Pacific Index is down about 15% from a peak in February, compared with an 18% gain in the S&P 500. “Omicron’s spread over the festive holidays and Manchin” are driving the risk-off mood, said Wai Ho Leong, strategist at Modular Asset Management (Singapore). “But most of all, it is the lack of liquidity in all markets.” India was the worst performer around the region, with its benchmark index poised to enter a correction amid the spread of the omicron variant. Chinese stocks also dropped despite a cut to bank borrowing costs for the first time in 20 months

In FX, the dollar reversed gains and was little changed. The pound fell in line with other risk- sensitive currencies as global market sentiment soured; gilts advanced. Hedging the major currencies over the next month comes at a similar cost, yet the pound turns expensive further out as it holds a higher beta on monetary policy divergence. The Australian and New Zealand dollars followed a broader move lower in commodity FX amid a slide in oil and stocks. The yen advanced with Japanese government bonds. The lira tumbled to another record low after Turkish President Recep Tayyip Erdogan pledged to continue cutting interest rates.

In rates, Treasury yields fell by ~3bp in 5-year sector, steepening 5s30s spread by 3bp on the day as long-end yields were little changed; 10-year yields 1bp lower around 1.39%, outperforming bunds and gilts. Treasuries drifted higher Monday as global stocks extended losses. Gains were led by front- and belly of the curve, while eurodollars advanced and the amount of Federal Reserve rate-hike premium for 2024 and 2024 eased. Long-end lagged the move ahead of a 20-year bond auction Tuesday. Bund and gilt curves are mixed. Italy lags in the peripheral complex, widening ~2bps to Germany.

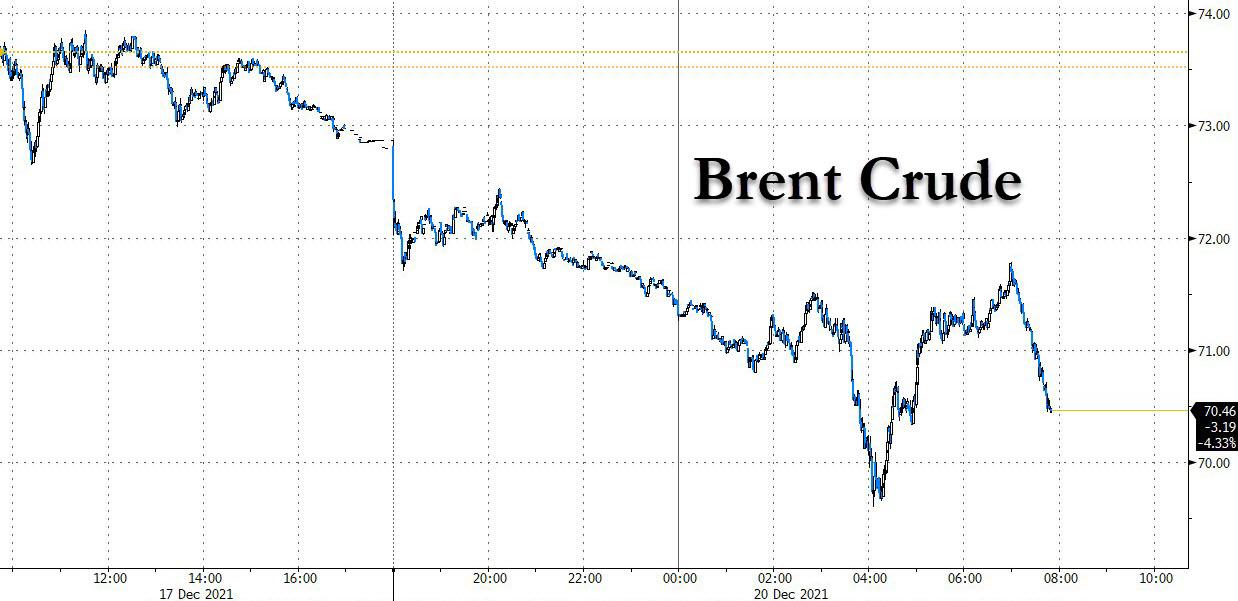

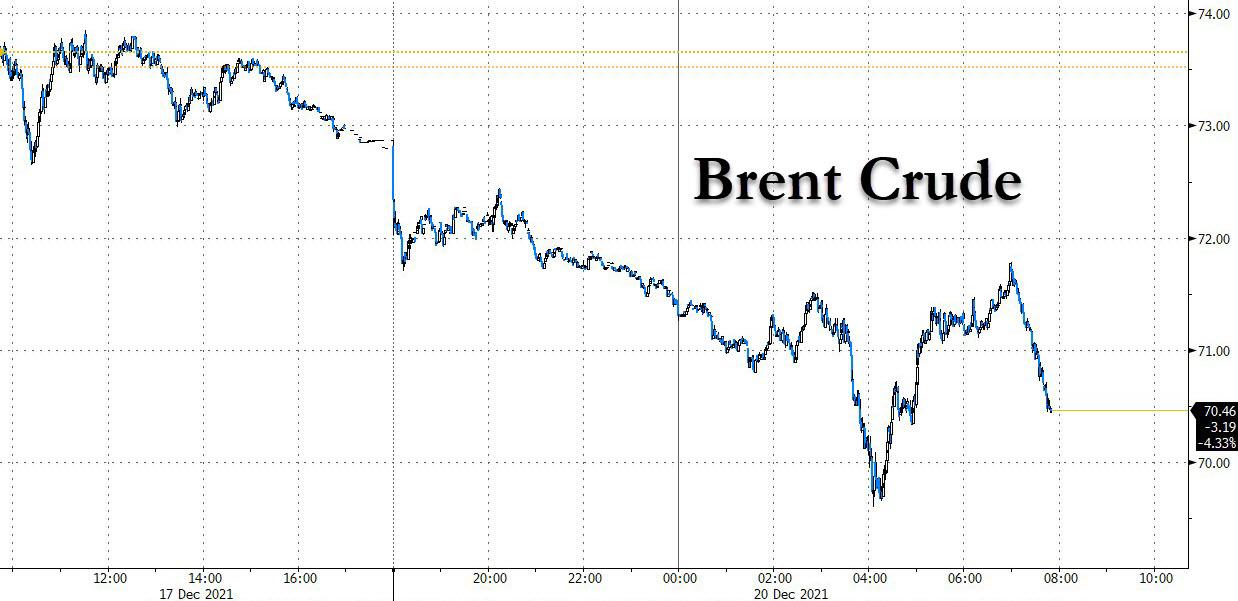

In commodities, Brent crude extends dropped to trade down as much as 5.3%, trading as low as $69.60/bbl before paring some losses, with Brent down 3% to $71 per barrel, and WTI -4% to around the $68-handle. Spot gold drifts below the $1,800-handle. Base metals complex under pressure; LME aluminum and nickel decline the most.

There is nothing on the economic calendar today except that Nov. Leading Index, which is estimated to print at 0.9%.

Market Snapshot

S&P 500 futures down 1.6% to 4,535.75

MXAP down 1.8% to 187.95

MXAPJ down 1.8% to 607.98

Nikkei down 2.1% to 27,937.81

Topix down 2.2% to 1,941.33

Hang Seng Index down 1.9% to 22,744.86

Shanghai Composite down 1.1% to 3,593.60

Sensex down 2.0% to 55,848.23

Australia S&P/ASX 200 down 0.2% to 7,292.16

Kospi down 1.8% to 2,963.00

STOXX Europe 600 down 2.2% to 463.29

German 10Y yield little changed at -0.40%

Euro up 0.2% to $1.1259

Brent Futures down 3.9% to $70.67/bbl

Gold spot up 0.1% to $1,800.19

U.S. Dollar Index little changed at 96.61

Top Overnight News from Bloomberg

President Joe Biden faces the unexpected task of quickly rewriting his policy agenda in a crucial election year after a key Senate Democrat abruptly rejected his signature $1.75 trillion economic plan

Germany’s new coalition government picked Joachim Nagel, a former Bundesbank senior official, as the central bank’s next chief, according to a person with knowledge of the matter

The ECB will not raise interest rates in 2022 if inflation behaves as expected, governing council member Pablo Hernandez de Cos told Expansion newspaper in an interview

Europe’s biggest countries are introducing more curbs to fight a surge in Covid-19 infections, from another lockdown in the Netherlands to stricter travel restrictions at the height of the holiday period

Chinese property stocks tumbled close to a fresh five-year low after a series of asset sales underscored concern that equity investors will bear the brunt of losses as developers offload projects to repay debt

Chinese banks lowered borrowing costs for the first time in 20 months, foreshadowing more monetary support to an economy showing strain from a property slump, weak private consumption and sporadic virus outbreaks

A more detail look at global markets courtesy of Newsquawk

Asia-Pac equities traded mostly lower following the volatile session on Wall Street on Friday, which saw the Dow Jones, S&P 500 and the Nasdaq all posting varying degrees of losses, whilst the Russell 2000 outperformed with decent gains. Overnight, US equity futures opened with a mild upside bias, albeit the optimism faded in early trade as risk aversion materialised, with the ES Mar 2022 contract falling below its 50 DMA (4,596) whilst the NQ and RTY saw losses of over 1% apiece. Sentiment was hit by the slew of concerning COVID headlines over the weekend, whilst Friday saw further hawkish rhetoric from Fed officials - with Fed’s Waller suggesting the whole point of accelerating the bond taper was to make the March Fed meeting a live meeting for the first hike, and under his base case March is very likely for lift-off, although it could be pushed back to May. The ASX 200 (-0.3%) was pressured by some large-cap miners and banks, whilst the Nikkei 225 (-2.1%) and KOSPI (-1.8%) conformed to the downbeat tone, with upside in the former also capped by recent JPY strength. The Hang Seng (-1.9%) and Shanghai Comp (-1.1%) initially saw shallower losses after the PBoC opted to cut the 1yr Loan Prime Rate by 5bps, whilst the 5yr rate was maintained, although the property sector faced more woes after S&P downgraded Evergrande to Selective Default, whilst Kaisa shares slumped after trade resumed following a two-week hiatus, with the Co. in discussions regarding a debt restructuring plan. The Hang Seng dipped below 23,000 for the first time since May 2020. Elsewhere, US 10yr futures continued edging higher as APAC risk aversion supported the haven, whilst Goldman Sachs also cut its US real GDP Growth forecasts on the Build Back Better blockade.

Top Asian News

Coal India Defends Quality Level of Shipments After Complaints

Hong Kong Eyes New Security Law After Electing Loyalist Council

Asian Stocks Drop to Lowest in 13 Months on Virus Woes, Manchin

Best Way for China to Lower Market Rates is to Sell Yuan: Nomura

European bourses commenced the week on the backfoot, continuing the broad pressure seen in APAC trade, as focus is firmly fixed on the Omicron variant. The downside in APAC hours was also a feature of the choppy trade in the US on Friday, and amid non-COVID catalysts such as US Senator Manchin presenting a stumbling block to BBB which effectively ends the chances it can be passed this year, while hawkish central banks is also a theme traders are cognizant of for next year. Euro Stoxx 50 -1.4%, benchmarks are lower across the board as further COVID-19 restrictions are imposed/touted; thus far, the most stringent has seen the Netherlands return to lockdowns, while the likes of the UK and Germany are mulling measures. Vaccine producer Moderna (+5.5% in premarket trade) released preliminary booster data vs Omicron, which saw a modest paring of the risk-off conditions; the vaccine boosts neutralising antibody levels by 37-fold vs pre-boost levels. All sectors remain in the red however, with underperformance in those most exposed to COVID restrictions, such as Travel & Leisure, Oil & Gas and Autos. Individual movers were predominantly dictated by the broader price action; however, THG (+12.5%) is the morning’s outperformer following reports that a notable short on the name has removed its position. Meanwhile, US futures are softer across the board (ES -1.3%) ahead of a very sparse docket where focus will, as it is in European hours, centre around the fiscal narrative and COVID. On the latter, President Biden is due to speak on the situation on Tuesday, calling for individuals to get vaccinated.

Top European News

Johnson Appoints Truss to Key Brexit Role After Torrid Week

Germany Picks Bundesbank Veteran Nagel as Central Bank Chief

Czech Billionaire Family Faces Final Showdown Over Bank Merger

Flashpoints That May Heal or Deepen the Lira’s Pain in 2022

In FX, the Dollar is mixed across the board, but retaining an upward bias overall amidst greater gains vs high beta, activity and cyclical currencies compared to losses against safer havens as broad risk sentiment sours on a number of factors, but mainly COVID-19. Hence, the index is holding quite firmly above 96.500 within a 96.504-680 range even though US Treasury yields are soft and the curve is marginally flatter, with traction or the Greenback coming via hawkish comments in wake of last week’s FOMC from Fed’s Waller who would not object to lifting rates as soon as tapering is done next March. Ahead, a very sparse Monday agenda only comprises November’s leading index.

JPY/EUR/CHF/XAU - As noted above, risk-off positioning due to the ongoing spread of Omicron has prompted demand for the Yen, the Euro, with added momentum from bullish Eur/Gbp cross flows, plus the Franc and Gold to lesser extents. Usd/Jpy is tethered around 113.50 in response, though unhindered by imposing option expiries in contrast to last Friday and the headline pair capped by technical resistance in the form of 21 and 50 DMAs that come in at 113.77 and 113.83 respectively today. Meanwhile, Eur/Usd is back above 1.1250 amidst mixed ECB vibes as de Cos underscores guidance for no hikes in 2022, but sources say that GC hawks wanted explicit recognition of upside inflation risks and were shouted down by chief economist Lane. However, Eur/Gbp has bounced even more firmly from sub-0.8500 lows on what looks like a combination of early year end demand or RHS orders and Pound underperformance on pandemic, political and Brexit-related factors. Elsewhere, Usd/Chf is hovering mostly sub-0.9250 and Eur/Chf is pivoting 1.0400 with latest weekly Swiss sight deposits showing no sign of intervention and Gold is rotating around Usd 1800/oz after a false upside breach of Usd 1810, but not quite enough follow-through buying to scale another upside target circa Usd 1815.

GBP/AUD/NZD/CAD - The major fall guys, as Sterling loses 1.3200+ status yet again on all the aforementioned negatives, and also feels some contagion from weakness in Brent, while the Aussie is straddling 0.7100, the Kiwi is trying to keep its head above 0.6700 and the Loonie contain declines through 1.2900 alongside the latest retracement in WTI.

In commodities, WTI and Brent are also risk-off, moving in tandem with the equity action, on the COVID-19 narrative and implementation/prospect of further restrictions hitting the demand-side of the equation. WTI relinquishes USD 67.00/bbl and Brent gave up the USD 70.00/bbl level. In fitting the broader market move, some easing of the initial downside was seen post-Moderna’s update. Elsewhere, in crude specifics, Libya’s NOC confirmed reports that the Petroleum Facilities Guard was blocking several fields in the region; some suggest production of oil has dropped to 950k BPD due to losses of production at El Sharara field (estimated at 280k BPD). Elsewhere, OPEC+ compliance has reportedly increased marginally in November, in-fitting with the assessments in earlier sourced reports. In metals, spot gold and silver are contained on the session with little evidence of risk-off making its self-known at this point in time, with the yellow metal pivoting USD 1800/oz. Elsewhere, copper is impacted on the risk tone but offset somewhat by Chile’s President-elect Boric saying he will oppose the Dominga copper-iron mine project.

US Event Calendar

10am: Nov. Leading Index, est. 0.9%, prior 0.9%

DB's Jim Reid concludes the overnight wrap

As we arrive at the final week before Christmas, there’s plenty of newsflow from the weekend for markets to digest this morning. In particular, there was the announcement from the US that Senator Joe Manchin of West Virginia wouldn’t be able to support the Build Back Better Bill, which has been the subject of intense negotiations over recent weeks and marks a significant blow for President Biden’s economic agenda. Meanwhile on the Covid front, there was a further ratcheting up of concerns about the Omicron variant, with the Netherlands becoming the latest European country to go back into lockdown as of yesterday, as cases continue to spread elsewhere. But otherwise, the events calendar is looking fairly quiet for now in this holiday-shortened week, with just a few lower-tier data releases and the occasional central bank speaker.

We’ll start with Omicron, since that remains one of the biggest issues for markets right now and has significantly clouded the outlook moving into year-end. In a nutshell, the news over the weekend from Europe has only pointed in the direction of further restrictions across multiple countries, with the Netherlands being the most severe as a full lockdown was announced by the Prime Minister on Saturday that leaves just supermarkets and essential shops open, with even schools shut. When it comes to socialising, people will not be allowed to receive more than 2 visitors aged 13 and over per day, although over 24-26 December, New Year’s Eve and New Year’s Day, this will be raised to 4 people.

Elsewhere in Europe there was a similar pattern towards tougher measures, with the Irish PM announcing on Friday evening that there would be an 8pm closing time for bars, restaurants and theatres, among others, which would last from today until January 30. Over in Spain, Prime Minister Sánchez said in a televised address yesterday that he’d be meeting with regional leaders virtually on Wednesday to look at measures for the weeks ahead. In Italy, it’s been widely reported that the government is looking at further measures to contain the spread as well, and they’re set to meet on Thursday to discuss these, whilst here in the UK, Health Secretary Javid was not ruling out further restrictions this side of Christmas. Separately in the US, President Biden is set to deliver a speech tomorrow about Covid and the steps that the administration will be taking, with Press Secretary Jen Psaki tweeting that Biden would also be “issuing a stark warning of what the winter will look like for Americans that choose to remain unvaccinated.”

For those after a bit more optimism ahead of Christmas, then a couple of DB research notes out on Friday about the new variant will definitely be of interest. The first by FX Strategist Shreyas Gopal (link here) looks at London, which is the epicentre of Omicron infections in the UK, and tracks cases there against those in the South African province of Gauteng a couple of weeks back. The good news is that if the relationship is similar, then that does suggest a peak in cases soon. The other note comes from our head of rates research Francis Yared (link here) who shows that although deaths are starting to increase in South Africa, they’re currently on a much lower trajectory relative to cases compared to previous waves. An important question for markets is whether these patterns from South Africa can be extrapolated over to the advanced economies, which have much higher vaccination rates on the one hand, but also much older populations on the other, so there are factors that could push in either direction. Keep an eye out on these leading indicators from South Africa, as well as London, since they’ll have implications for what could occur in the coming weeks elsewhere.

Away from Covid, the other main piece of news over the weekend came from the US, where the moderate Democratic senator Joe Manchin said that he couldn’t support the Build Back Better package that forms a key part of President Biden’s economic agenda, with much of his proposals on social programs and climate change. The news broke in an interview from Manchin on Fox News Sunday, when Manchin said “I can’t get there” when it comes to supporting the package, and follows direct negotiations that he’d been having with the president. Manchin’s support is crucial for the bill’s passage, since the Senate is split 50-50 between the Democrats and Republicans, with the Democrats having control only by virtue of Vice President Harris’ casting vote. So with zero Republican support for the package, that required every single Democratic senator on board with the proposals, giving Manchin enormous influence.

A statement from White House Press Secretary Jen Psaki in response to Manchin did not sound impressed, saying that his comments “are at odds with his discussions this week with the President, with White House staff, and with his own public utterances.” It went on to say that “we will continue to press him to see if he will reverse his position yet again, to honor his prior commitments and be true to his word.” Nevertheless, Manchin’s own written statement wasn’t using the language of compromise, saying that his “Democratic colleagues in Washington are determined to dramatically reshape our society in a way that leaves our country even more vulnerable to the threats we face.” So the implication from Manchin is that Build Back Better won’t be happening this side of the mid-terms in its current form, and would require a fundamental rethink and meaningful slimming down were it to have any chance of passing.

Those twin factors of further Omicron restrictions and Manchin’s announcement have weighed heavily on Asian equities overnight, with the Nikkei (-2.17%), KOSPI (-1.66%), Hang Seng (-1.44%), CSI (-0.98%) and Shanghai Composite (-0.75%) all moving lower. In India, the benchmark NIFTY is also down 10% from its peak in October, putting the index in correction territory. However, we did get a policy easing in China, with banks lowering the 1yr prime rate by -5bps to 3.8%. That move came alongside separate remarks from Bank of Japan Governor Kuroda, who said it was too early to think about policy normalisation, and that discussion should take place once inflation is closer to the 2% target. European and US equities are set to follow Asia lower later on, with futures on both the S&P 500 (-0.97%) and the DAX (-1.63%) both pointing lower this morning. And oil prices been struggling overnight as well in light of the recent virus news, with Brent Crude down -3.02% to $71.30/bbl at time of writing.

Recapping last week now, and the main events were the array of central bank meetings ahead of the holidays. In the US, the Fed doubled the pace of their tapering as expected, which would bring net asset purchases to an end in mid-March, and the median dot now expects three rate hikes in 2022. By the close on Friday, Fed funds futures were pricing in a 55% chance of an initial hike by the March meeting, and an 87% chance of one by the May meeting. The ECB was then up next, and started a wind down of net PEPP purchases that are also set to finish in March next year. The ECB is cushioning the landing though, having moved to increase APP purchases until October next year after PEPP ends, following which they’ll maintain a pace of €20bn a month until shortly before liftoff. The ECB maintained some policy optionality through flexibility on PEPP reinvestments, which our Europe economists read as a commitment to smoothing the transmission of monetary policy.

In the UK, the BoE hiked Bank Rate by +15bps to 0.25%. The MPC noted the decision was finely balanced due to Covid uncertainty, but the vote was still 8-1 in favour of a hike. Over in Japan, the BoJ rounded out the major DM central bank meetings, keeping rates unchanged and announcing a slow reduction in corporate debt holdings. At the same time, they extended a special covid loans program targeted at small and medium-sized firms to September 2022.

When all was said and done, many sovereign bond yields actually ended the week lower, even with the hawkish pivot from the various central banks. 10yr yields on Treasuries (-8.2bps) and bunds (-3.1bps) both declined, although those on gilts did post a small +1.7bps gain over the week. Meanwhile growing Covid pessimism served to dampen risk appetite and send global equity indices lower last week. By Friday the S&P 500 (-1.94%) had fallen for the 3rd week out of the last 4, hampered by an underperformance from tech stocks that saw the NASDAQ (-2.95%) and the FANG+ index (-4.53%) both lose significant ground. Over in Europe the moves were smaller, albeit still lower, and the STOXX 600 ended the week -0.35%.

Have a Great Day

and Thanks

J:D

.

.

.

.

.

.

.

. . . .

.

.

.

.

Morning Markets

.

.

.

.

Stocks, Futures, Oil Tumble On Omicron Lockdowns, Manchin Shockwave

Monday, Dec 20, 2021 - 08:02 AM

Global stocks and US equity futures are sharply lower to start the otherwise very quiet holiday week, dragged lower by Manchin's shock decision to kill Biden's economic agenda (which Goldman said would cut US Q1 GDP from 3% to 2%), accelerating government measures to counter the fast-spreading omicron variant and fears over the growth outlook amid a tightening Fed. US equity futures tumbled almost 100 points from their Friday close (and more than 200 points from Thursday's all time high before paring some losses buoyed by optimism from news that Moderna’s booster vaccine increases antibodies 37-fold against omicron. Treasury yields also pared a sharp drop as low as 1.35% and the dollar held a jump from Friday, while crude oil slid on worries that mobility curbs to tackle the strain will hurt demand. As of 730am S&P 500 futures were down down 1.1%, Nasdaq 100 -1.3%, and Dow -1.0%.

In the weekend's biggest news, senator Joe Manchin blindsided the White House on Sunday by rejecting Biden’s $1.75 trillion tax-and-spending package, prompting a sharply critical statement from the White House which called Manchin’s decision a “sudden and inexplicable reversal.” Biden and top Democrats must now regroup to see if a scaled-back version remains possible with little more than 10 months before midterm elections that will decide control of Congress. As noted late last night, Goldman Sachs Group Inc. cut its forecast for U.S. economic growth for next year after Manchin’s move (more below). On Monday, Chuck Schumer said the Senate will still vote “very early” in 2022 on Biden’s economic agenda, although it was unclear just what the new plan will look like now that Build Back Better is dead.

Not helping matters were the latest development in the Omicron front where the biggest European countries are introducing more curbs, with U.K. officials keeping open the possiblity of stronger measures before Christmas and the Netherlands returning to lockdown, even as Biden’s chief medical advisor said further U.S. lockdowns are unlikely. In some "good" news, said a third dose of its Covid-19 vaccine saw a 37-fold increase in neutralizing antibodies against omicron. Ironically. While investors remain on edge over the outlook for economic activity, there remains little evidence that the new variant causes illness as severe as the delta variant, especially among those already vaccinated.

“The main reason behind the market sell off today is the rejection of Biden’s $2 trillion tax-and-spending package, which will lead to a reduction in U.S. economic growth forecasts,” said Michel Keusch, a portfolio manager at Bellevue Asset Management. “With trading volumes getting thinner and thinner into the year end, this is the catalyst creating some short-term nervousness.”

Then there are tightening concerns: the Federal Reserve’s decision to increase the pace of tapering last week is also adding to investor nerves about the outlook for 2022. And now, without either fiscal or monetary support, economists see a policy-induced slowdown in the economy where Goldman on Sunday cut its real GDP forecast for 2022: 2% in Q1 (vs. 3% prior), 3% in Q2 (vs. 3.5% prior), and 2.75% in Q3 (vs. 3% prior).

One place which is convinced the Fed will not meet its targets it the bond market where traders of eurodollar futures price rates much lower than FOMC targets for the end of 2023 and 2024.

Finally, as Bloomberg notes, there is also the issue of divergent global monetary policy to contend with, as the People’s Bank of China stepped up easing overnight with the first rate cut in 20 months.

Looking at the premarket, travel stocks fell the most with United Airlines down 3.4% leading declines among major U.S. carriers, while a 4% slide in Royal Caribbean Cruises led the fall among cruise operators. Energy and industrial bellwethers also declined, with Chevron, 3M and Caterpillar falling over 2% each. Major U.S. tech and internet stocks slumped hitting shares in most highly valued names, as well as in cyclicals. Apple fell as much as 2.1% premarket while fellow large- cap tech names also drop, with Facebook-owner Meta Platforms down 1.9%, Alphabet -1.2%, Amazon.com -1.7%, Twitter -2.1%, Microsoft -1.6%. Here are some of the other big U.S. movers today:

Major U.S. tech and internet stocks drop in premarket trading as risk appetite sours globally amid worries over further pandemic- related restrictions, hitting shares in most highly valued names, as well as in cyclicals.

Shares in U.S. renewables firms drop in premarket after U.S. Senator Joe Manchin’s surprise rejection of President Joe Biden’s $2 trillion package.

Moderna (MRNA US) rises 6% in U.S. premarket after the company said that a booster dose of its Covid-19 vaccine increased antibody levels against the omicron variant.

Society Pass (SOPA US) surges 22% in premarket after the loyalty platform operator said in a statement it has been added to the Russell 2000 Index.

Boston Beer (SAM US) upgraded to hold at Jefferies following pullback of more than 60% in the shares related to “massive” reset in expectations for hard seltzers, removing the only negative rating on the stock. Shares up 0.3% on low volume in premarket.

"After battling endless headwinds in recent weeks, markets have finally been knocked over as the rapid spread of Omicron finally reaches panic mode," Russ Mould, investment director at AJ Bell, wrote in a client note.

Europe's Stoxx 600 also stumbled, now down about 1.4% after falling as much as 2.6%, weighed down the most by travel and insurance. All sectors are in red. FTSE 100 recovers slightly as energy gets a leg up, but is still off by 1.2%. Dax -2%.

Earlier in the session, Asian stocks were set for the biggest drop since March, as the spread of the omicron variant and a surprising setback to U.S. President Joe Biden’s economic agenda forced traders to take bets off the table. The MSCI Asia Pacific Index sank as much as 2%, headed for its lowest close since November 2020, with tech and consumer shares the biggest drags.

Relatively thin trading ahead of the year-end exacerbated declines in the region, as investors grapple with fresh outbreaks of Covid-19 and monetary policy tightening globally. The MSCI Asia Pacific Index is down about 15% from a peak in February, compared with an 18% gain in the S&P 500. “Omicron’s spread over the festive holidays and Manchin” are driving the risk-off mood, said Wai Ho Leong, strategist at Modular Asset Management (Singapore). “But most of all, it is the lack of liquidity in all markets.” India was the worst performer around the region, with its benchmark index poised to enter a correction amid the spread of the omicron variant. Chinese stocks also dropped despite a cut to bank borrowing costs for the first time in 20 months

In FX, the dollar reversed gains and was little changed. The pound fell in line with other risk- sensitive currencies as global market sentiment soured; gilts advanced. Hedging the major currencies over the next month comes at a similar cost, yet the pound turns expensive further out as it holds a higher beta on monetary policy divergence. The Australian and New Zealand dollars followed a broader move lower in commodity FX amid a slide in oil and stocks. The yen advanced with Japanese government bonds. The lira tumbled to another record low after Turkish President Recep Tayyip Erdogan pledged to continue cutting interest rates.

In rates, Treasury yields fell by ~3bp in 5-year sector, steepening 5s30s spread by 3bp on the day as long-end yields were little changed; 10-year yields 1bp lower around 1.39%, outperforming bunds and gilts. Treasuries drifted higher Monday as global stocks extended losses. Gains were led by front- and belly of the curve, while eurodollars advanced and the amount of Federal Reserve rate-hike premium for 2024 and 2024 eased. Long-end lagged the move ahead of a 20-year bond auction Tuesday. Bund and gilt curves are mixed. Italy lags in the peripheral complex, widening ~2bps to Germany.

In commodities, Brent crude extends dropped to trade down as much as 5.3%, trading as low as $69.60/bbl before paring some losses, with Brent down 3% to $71 per barrel, and WTI -4% to around the $68-handle. Spot gold drifts below the $1,800-handle. Base metals complex under pressure; LME aluminum and nickel decline the most.

There is nothing on the economic calendar today except that Nov. Leading Index, which is estimated to print at 0.9%.

Market Snapshot

S&P 500 futures down 1.6% to 4,535.75

MXAP down 1.8% to 187.95

MXAPJ down 1.8% to 607.98

Nikkei down 2.1% to 27,937.81

Topix down 2.2% to 1,941.33

Hang Seng Index down 1.9% to 22,744.86

Shanghai Composite down 1.1% to 3,593.60

Sensex down 2.0% to 55,848.23

Australia S&P/ASX 200 down 0.2% to 7,292.16

Kospi down 1.8% to 2,963.00

STOXX Europe 600 down 2.2% to 463.29

German 10Y yield little changed at -0.40%

Euro up 0.2% to $1.1259

Brent Futures down 3.9% to $70.67/bbl

Gold spot up 0.1% to $1,800.19

U.S. Dollar Index little changed at 96.61

Top Overnight News from Bloomberg

President Joe Biden faces the unexpected task of quickly rewriting his policy agenda in a crucial election year after a key Senate Democrat abruptly rejected his signature $1.75 trillion economic plan

Germany’s new coalition government picked Joachim Nagel, a former Bundesbank senior official, as the central bank’s next chief, according to a person with knowledge of the matter

The ECB will not raise interest rates in 2022 if inflation behaves as expected, governing council member Pablo Hernandez de Cos told Expansion newspaper in an interview

Europe’s biggest countries are introducing more curbs to fight a surge in Covid-19 infections, from another lockdown in the Netherlands to stricter travel restrictions at the height of the holiday period

Chinese property stocks tumbled close to a fresh five-year low after a series of asset sales underscored concern that equity investors will bear the brunt of losses as developers offload projects to repay debt

Chinese banks lowered borrowing costs for the first time in 20 months, foreshadowing more monetary support to an economy showing strain from a property slump, weak private consumption and sporadic virus outbreaks

A more detail look at global markets courtesy of Newsquawk

Asia-Pac equities traded mostly lower following the volatile session on Wall Street on Friday, which saw the Dow Jones, S&P 500 and the Nasdaq all posting varying degrees of losses, whilst the Russell 2000 outperformed with decent gains. Overnight, US equity futures opened with a mild upside bias, albeit the optimism faded in early trade as risk aversion materialised, with the ES Mar 2022 contract falling below its 50 DMA (4,596) whilst the NQ and RTY saw losses of over 1% apiece. Sentiment was hit by the slew of concerning COVID headlines over the weekend, whilst Friday saw further hawkish rhetoric from Fed officials - with Fed’s Waller suggesting the whole point of accelerating the bond taper was to make the March Fed meeting a live meeting for the first hike, and under his base case March is very likely for lift-off, although it could be pushed back to May. The ASX 200 (-0.3%) was pressured by some large-cap miners and banks, whilst the Nikkei 225 (-2.1%) and KOSPI (-1.8%) conformed to the downbeat tone, with upside in the former also capped by recent JPY strength. The Hang Seng (-1.9%) and Shanghai Comp (-1.1%) initially saw shallower losses after the PBoC opted to cut the 1yr Loan Prime Rate by 5bps, whilst the 5yr rate was maintained, although the property sector faced more woes after S&P downgraded Evergrande to Selective Default, whilst Kaisa shares slumped after trade resumed following a two-week hiatus, with the Co. in discussions regarding a debt restructuring plan. The Hang Seng dipped below 23,000 for the first time since May 2020. Elsewhere, US 10yr futures continued edging higher as APAC risk aversion supported the haven, whilst Goldman Sachs also cut its US real GDP Growth forecasts on the Build Back Better blockade.

Top Asian News

Coal India Defends Quality Level of Shipments After Complaints

Hong Kong Eyes New Security Law After Electing Loyalist Council

Asian Stocks Drop to Lowest in 13 Months on Virus Woes, Manchin

Best Way for China to Lower Market Rates is to Sell Yuan: Nomura

European bourses commenced the week on the backfoot, continuing the broad pressure seen in APAC trade, as focus is firmly fixed on the Omicron variant. The downside in APAC hours was also a feature of the choppy trade in the US on Friday, and amid non-COVID catalysts such as US Senator Manchin presenting a stumbling block to BBB which effectively ends the chances it can be passed this year, while hawkish central banks is also a theme traders are cognizant of for next year. Euro Stoxx 50 -1.4%, benchmarks are lower across the board as further COVID-19 restrictions are imposed/touted; thus far, the most stringent has seen the Netherlands return to lockdowns, while the likes of the UK and Germany are mulling measures. Vaccine producer Moderna (+5.5% in premarket trade) released preliminary booster data vs Omicron, which saw a modest paring of the risk-off conditions; the vaccine boosts neutralising antibody levels by 37-fold vs pre-boost levels. All sectors remain in the red however, with underperformance in those most exposed to COVID restrictions, such as Travel & Leisure, Oil & Gas and Autos. Individual movers were predominantly dictated by the broader price action; however, THG (+12.5%) is the morning’s outperformer following reports that a notable short on the name has removed its position. Meanwhile, US futures are softer across the board (ES -1.3%) ahead of a very sparse docket where focus will, as it is in European hours, centre around the fiscal narrative and COVID. On the latter, President Biden is due to speak on the situation on Tuesday, calling for individuals to get vaccinated.

Top European News

Johnson Appoints Truss to Key Brexit Role After Torrid Week

Germany Picks Bundesbank Veteran Nagel as Central Bank Chief

Czech Billionaire Family Faces Final Showdown Over Bank Merger

Flashpoints That May Heal or Deepen the Lira’s Pain in 2022

In FX, the Dollar is mixed across the board, but retaining an upward bias overall amidst greater gains vs high beta, activity and cyclical currencies compared to losses against safer havens as broad risk sentiment sours on a number of factors, but mainly COVID-19. Hence, the index is holding quite firmly above 96.500 within a 96.504-680 range even though US Treasury yields are soft and the curve is marginally flatter, with traction or the Greenback coming via hawkish comments in wake of last week’s FOMC from Fed’s Waller who would not object to lifting rates as soon as tapering is done next March. Ahead, a very sparse Monday agenda only comprises November’s leading index.

JPY/EUR/CHF/XAU - As noted above, risk-off positioning due to the ongoing spread of Omicron has prompted demand for the Yen, the Euro, with added momentum from bullish Eur/Gbp cross flows, plus the Franc and Gold to lesser extents. Usd/Jpy is tethered around 113.50 in response, though unhindered by imposing option expiries in contrast to last Friday and the headline pair capped by technical resistance in the form of 21 and 50 DMAs that come in at 113.77 and 113.83 respectively today. Meanwhile, Eur/Usd is back above 1.1250 amidst mixed ECB vibes as de Cos underscores guidance for no hikes in 2022, but sources say that GC hawks wanted explicit recognition of upside inflation risks and were shouted down by chief economist Lane. However, Eur/Gbp has bounced even more firmly from sub-0.8500 lows on what looks like a combination of early year end demand or RHS orders and Pound underperformance on pandemic, political and Brexit-related factors. Elsewhere, Usd/Chf is hovering mostly sub-0.9250 and Eur/Chf is pivoting 1.0400 with latest weekly Swiss sight deposits showing no sign of intervention and Gold is rotating around Usd 1800/oz after a false upside breach of Usd 1810, but not quite enough follow-through buying to scale another upside target circa Usd 1815.

GBP/AUD/NZD/CAD - The major fall guys, as Sterling loses 1.3200+ status yet again on all the aforementioned negatives, and also feels some contagion from weakness in Brent, while the Aussie is straddling 0.7100, the Kiwi is trying to keep its head above 0.6700 and the Loonie contain declines through 1.2900 alongside the latest retracement in WTI.

In commodities, WTI and Brent are also risk-off, moving in tandem with the equity action, on the COVID-19 narrative and implementation/prospect of further restrictions hitting the demand-side of the equation. WTI relinquishes USD 67.00/bbl and Brent gave up the USD 70.00/bbl level. In fitting the broader market move, some easing of the initial downside was seen post-Moderna’s update. Elsewhere, in crude specifics, Libya’s NOC confirmed reports that the Petroleum Facilities Guard was blocking several fields in the region; some suggest production of oil has dropped to 950k BPD due to losses of production at El Sharara field (estimated at 280k BPD). Elsewhere, OPEC+ compliance has reportedly increased marginally in November, in-fitting with the assessments in earlier sourced reports. In metals, spot gold and silver are contained on the session with little evidence of risk-off making its self-known at this point in time, with the yellow metal pivoting USD 1800/oz. Elsewhere, copper is impacted on the risk tone but offset somewhat by Chile’s President-elect Boric saying he will oppose the Dominga copper-iron mine project.

US Event Calendar

10am: Nov. Leading Index, est. 0.9%, prior 0.9%

DB's Jim Reid concludes the overnight wrap

As we arrive at the final week before Christmas, there’s plenty of newsflow from the weekend for markets to digest this morning. In particular, there was the announcement from the US that Senator Joe Manchin of West Virginia wouldn’t be able to support the Build Back Better Bill, which has been the subject of intense negotiations over recent weeks and marks a significant blow for President Biden’s economic agenda. Meanwhile on the Covid front, there was a further ratcheting up of concerns about the Omicron variant, with the Netherlands becoming the latest European country to go back into lockdown as of yesterday, as cases continue to spread elsewhere. But otherwise, the events calendar is looking fairly quiet for now in this holiday-shortened week, with just a few lower-tier data releases and the occasional central bank speaker.

We’ll start with Omicron, since that remains one of the biggest issues for markets right now and has significantly clouded the outlook moving into year-end. In a nutshell, the news over the weekend from Europe has only pointed in the direction of further restrictions across multiple countries, with the Netherlands being the most severe as a full lockdown was announced by the Prime Minister on Saturday that leaves just supermarkets and essential shops open, with even schools shut. When it comes to socialising, people will not be allowed to receive more than 2 visitors aged 13 and over per day, although over 24-26 December, New Year’s Eve and New Year’s Day, this will be raised to 4 people.

Elsewhere in Europe there was a similar pattern towards tougher measures, with the Irish PM announcing on Friday evening that there would be an 8pm closing time for bars, restaurants and theatres, among others, which would last from today until January 30. Over in Spain, Prime Minister Sánchez said in a televised address yesterday that he’d be meeting with regional leaders virtually on Wednesday to look at measures for the weeks ahead. In Italy, it’s been widely reported that the government is looking at further measures to contain the spread as well, and they’re set to meet on Thursday to discuss these, whilst here in the UK, Health Secretary Javid was not ruling out further restrictions this side of Christmas. Separately in the US, President Biden is set to deliver a speech tomorrow about Covid and the steps that the administration will be taking, with Press Secretary Jen Psaki tweeting that Biden would also be “issuing a stark warning of what the winter will look like for Americans that choose to remain unvaccinated.”

For those after a bit more optimism ahead of Christmas, then a couple of DB research notes out on Friday about the new variant will definitely be of interest. The first by FX Strategist Shreyas Gopal (link here) looks at London, which is the epicentre of Omicron infections in the UK, and tracks cases there against those in the South African province of Gauteng a couple of weeks back. The good news is that if the relationship is similar, then that does suggest a peak in cases soon. The other note comes from our head of rates research Francis Yared (link here) who shows that although deaths are starting to increase in South Africa, they’re currently on a much lower trajectory relative to cases compared to previous waves. An important question for markets is whether these patterns from South Africa can be extrapolated over to the advanced economies, which have much higher vaccination rates on the one hand, but also much older populations on the other, so there are factors that could push in either direction. Keep an eye out on these leading indicators from South Africa, as well as London, since they’ll have implications for what could occur in the coming weeks elsewhere.

Away from Covid, the other main piece of news over the weekend came from the US, where the moderate Democratic senator Joe Manchin said that he couldn’t support the Build Back Better package that forms a key part of President Biden’s economic agenda, with much of his proposals on social programs and climate change. The news broke in an interview from Manchin on Fox News Sunday, when Manchin said “I can’t get there” when it comes to supporting the package, and follows direct negotiations that he’d been having with the president. Manchin’s support is crucial for the bill’s passage, since the Senate is split 50-50 between the Democrats and Republicans, with the Democrats having control only by virtue of Vice President Harris’ casting vote. So with zero Republican support for the package, that required every single Democratic senator on board with the proposals, giving Manchin enormous influence.

A statement from White House Press Secretary Jen Psaki in response to Manchin did not sound impressed, saying that his comments “are at odds with his discussions this week with the President, with White House staff, and with his own public utterances.” It went on to say that “we will continue to press him to see if he will reverse his position yet again, to honor his prior commitments and be true to his word.” Nevertheless, Manchin’s own written statement wasn’t using the language of compromise, saying that his “Democratic colleagues in Washington are determined to dramatically reshape our society in a way that leaves our country even more vulnerable to the threats we face.” So the implication from Manchin is that Build Back Better won’t be happening this side of the mid-terms in its current form, and would require a fundamental rethink and meaningful slimming down were it to have any chance of passing.

Those twin factors of further Omicron restrictions and Manchin’s announcement have weighed heavily on Asian equities overnight, with the Nikkei (-2.17%), KOSPI (-1.66%), Hang Seng (-1.44%), CSI (-0.98%) and Shanghai Composite (-0.75%) all moving lower. In India, the benchmark NIFTY is also down 10% from its peak in October, putting the index in correction territory. However, we did get a policy easing in China, with banks lowering the 1yr prime rate by -5bps to 3.8%. That move came alongside separate remarks from Bank of Japan Governor Kuroda, who said it was too early to think about policy normalisation, and that discussion should take place once inflation is closer to the 2% target. European and US equities are set to follow Asia lower later on, with futures on both the S&P 500 (-0.97%) and the DAX (-1.63%) both pointing lower this morning. And oil prices been struggling overnight as well in light of the recent virus news, with Brent Crude down -3.02% to $71.30/bbl at time of writing.

Recapping last week now, and the main events were the array of central bank meetings ahead of the holidays. In the US, the Fed doubled the pace of their tapering as expected, which would bring net asset purchases to an end in mid-March, and the median dot now expects three rate hikes in 2022. By the close on Friday, Fed funds futures were pricing in a 55% chance of an initial hike by the March meeting, and an 87% chance of one by the May meeting. The ECB was then up next, and started a wind down of net PEPP purchases that are also set to finish in March next year. The ECB is cushioning the landing though, having moved to increase APP purchases until October next year after PEPP ends, following which they’ll maintain a pace of €20bn a month until shortly before liftoff. The ECB maintained some policy optionality through flexibility on PEPP reinvestments, which our Europe economists read as a commitment to smoothing the transmission of monetary policy.

In the UK, the BoE hiked Bank Rate by +15bps to 0.25%. The MPC noted the decision was finely balanced due to Covid uncertainty, but the vote was still 8-1 in favour of a hike. Over in Japan, the BoJ rounded out the major DM central bank meetings, keeping rates unchanged and announcing a slow reduction in corporate debt holdings. At the same time, they extended a special covid loans program targeted at small and medium-sized firms to September 2022.

When all was said and done, many sovereign bond yields actually ended the week lower, even with the hawkish pivot from the various central banks. 10yr yields on Treasuries (-8.2bps) and bunds (-3.1bps) both declined, although those on gilts did post a small +1.7bps gain over the week. Meanwhile growing Covid pessimism served to dampen risk appetite and send global equity indices lower last week. By Friday the S&P 500 (-1.94%) had fallen for the 3rd week out of the last 4, hampered by an underperformance from tech stocks that saw the NASDAQ (-2.95%) and the FANG+ index (-4.53%) both lose significant ground. Over in Europe the moves were smaller, albeit still lower, and the STOXX 600 ended the week -0.35%.

Have a Great Day

and Thanks

J:D

.

.

.

.

.

.

.

. . . .

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.