6,662 viewsOct 21, 2021

https://www.youtube.com/watch?v=dDzXx3TabbY

$Monument Progresses Flotation Plant Construction at the Selinsing Gold Mine in Malaysia

V.MMY | 4 hours ago

VANCOUVER, British Columbia, Oct. 14, 2021 (GLOBE NEWSWIRE) --

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com/news-media/news/2021/monument-progresses-flotation-plant-construction-at-the-selinsing-gold-mine-in-malaysia/

https://www.monumentmining.com/news-media/news/2021/monument-reports-fourth-quarter-and-fiscal-2021-results/

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) ("Monument" or the "Company") is pleased to announce the progress on flotation plant construction at the Selinsing Gold Mine in Malaysia to produce saleable sulphide gold concentrates. The flotation plant construction includes: project management, project validation, flotation design and engineering, procurement, construction and commissioning.

Charlie Northfield, General Manager and the Project Sponsor at the Selinsing Gold Mine, commented: “I am thrilled to report that we are on schedule for construction completion in June 2022. To mitigate the risk of delays that might be caused by the Covid 19 pandemic from time to time, we are making our best efforts to advance deliverables ahead of the schedule. Our ability to move quickly is a testament to the capacity and experience of the on-site team. We will provide further updates on the flotation plant construction process in the weeks to come.”

Project Management

The project management team is led by the oversight board chaired by Cathy Zhai, President and CEO, comprising Project Sponsor, Project Manager, Project Controller and the Plant Manager as the end user. The procurement and engineering team on site are Selinsing employees. The majority of key project personnel participated in the existing Selinsing gold plant construction work back in 2008 to 2010. Six new employees will be recruited at different times in the construction and four personnel seconded from the existing Selinsing workforce.

Detailed Engineering Design

Following completion of independent flotation testwork and amendment of conceptual design of the flotation plant by Orway Mineral Consultants (“OMC”) (refer to July 6th 2021 news release), the contract for detailed engineering design was awarded to Mincore Pty Ltd. (“Mincore”), an Australia based engineering company.

The scope of work undertaken by Mincore included: the development of the 3D model of the flotation processing plant, preparation of equipment specifications and data sheets, and development of the control system for the new process equipment. Plant design aims to maximize gravity flow and to provide plant access for maintenance while allowing the current gravity / CIL plant operation to continue without interruption. The plant layout design allows for the future addition of the proposed BIOX® circuit and ancillary works.

Up to September 30th 2021 Mincore has achieved 80% completion of the design work. HAZOP design reviews have been carried out for the new process facilities to identify and mitigate any operational safety issues. Civil and structural drawings are scheduled for completion on October 31st 2021; mechanical and piping drawings will be issued for construction by November 30th 2021.

Lim Teck Chong, Flotation Plant Project Manager, commented: “The successful flotation testwork gave us the green light to proceed with all aspects of the development of the project. The detailed engineering design is approaching completion and the pilot plant is expected to be completed this month. Procurement, earthworks, and recruitment have all progressed as we ramp up and prepare for civil foundation work to begin.”

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b66d6a8e-baeb-42e5-ac8a-2ad921b4c613

Procurement

Procurement of long lead equipment items has been completed and contracts have been awarded for the supply of flotation cells, concentrate and water recovery thickeners, and the concentrate filter press. Technical and financial appraisals have been completed and contracts are being prepared for the air blowers, compressor, slurry pumps and 11kV/415V transformer. Procurement is continuing for the motor control centre, agitators, reagent pumps and plate work for conditioning and reagent tanks.

The flotation pilot plant has been delivered to site and is currently being set up at the research and development laboratory. The pilot plant features a ball mill and classifier, rougher/scavenger flotation cells and three stages of cleaner flotation to replicate the flowsheet of the full scale flotation plant. The pilot plant will be used for operator training, reagent trials, and for the preparation of concentrate samples for potential customers. The pilot plant is expected to be fully operational before the end of October 2021.

Risk control over the long lead items is focused on periodical inspection and shipping scheduling, which faces global challenges during the pandemic period.

Construction

Flotation construction includes: earthworks, civil engineering, structural engineering, mechanical and electrical installation and other associated plant upgrades.

Contractor Engagement: Suitably experienced Malaysian contractors have been shortlisted for the construction work according to discipline comprising: civil and structural, mechanical and piping, and electrical and instrumentation. Most of these contractors have worked on previous construction phases of the Selinsing operation. The contract has been awarded to reroute the power cables to the primary and secondary ball mills outside of the new flotation plant footprint to avoid any interference during construction work.

Civil Foundation Work: 75% of the earthworks have been completed for the plant foundations, and final excavations will be conducted once civil drawings have been issued for construction. Civil foundation work is expected to commence in early November, starting with the construction of the retaining wall extension, and followed by civil works in the flotation area, concentrate and water recovery thickeners and the filter press building. At the same time the foundations will be constructed for the new warehouse, reagents mixing and air services buildings.

Transition to Flotation

The production of flotation concentrate is expected to commence in July 2022 as soon as all of the flotation cells, concentrate thickener and filter press have been commissioned. In the current production schedule the CIL plant will continue operation until commissioning of the flotation plant commences. We will keep the production going as long as possible to generate cash flow primarily from Selinsing, Buffalo Reef pits and the Peranggih Prospect, provided that readers shall understand that there might be an interruption to production due to the Covid pandemic, and there might be volatility of production in transition to the new life of mine from the existing remaining life of mine.

During the period from late August to the beginning of October, while the CIL plant has continued operation throughout the time, the elution heat exchanger however has been offline after 10 years’ of service, and the spare was unexpectedly found to have failed. Gold pours were put on hold until October when the unit was re-built and back in service. A suitable replacement heat exchanger has been located in Kuala Lumpur and an order has been placed to secure this unit and delivery is awaited. The Company keeps its repair and maintenance program going to ensure sustained production as planned.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE:D7Q1) is an established Canadian gold producer that owns and operates the Selinsing Gold Mine in Malaysia. Its experienced management team is committed to growth and is also advancing the Murchison Gold Projects comprising Burnakura, Gabanintha and Tuckanarra (20% interest) in the Murchison area of Western Australia. The Company employs approximately 200 people in both regions and is committed to the highest standards of environmental management, social responsibility, and health and safety for its employees and neighboring communities.

Cathy Zhai, President and CEO

Monument Mining Limited

Suite 1580 -1100 Melville Street

Vancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web site at www.monumentmining.com or contact:

Richard Cushing, MMY Vancouver T: +1-604-638-1661 x102 rcushing@monumentmining.com

"Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

Forward-Looking Statement

https://www.monumentmining.com/news-media/news/2021/monument-reports-fourth-quarter-and-fiscal-2021-results/

https://www.monumentmining.com/news-media/news/

Darkness Coming Dollar Falls – Bo Polny

By Greg Hunter On October 9, 2021 In Political Analysis 14 Comments

By Greg Hunter‘s USAWatchdog.com (Saturday Night Post)

https://usawatchdog.com/darkness-coming-dollar-falls-bo-polny/

Geo-political and financial analyst Bo Polny has long said “. . .

Nothing can stop these people aside from a Biblical intervention from

God.”

According to Polny’s Biblical cycle and timing charts, that’s exactly

what is likely going to happen by the end of the year.

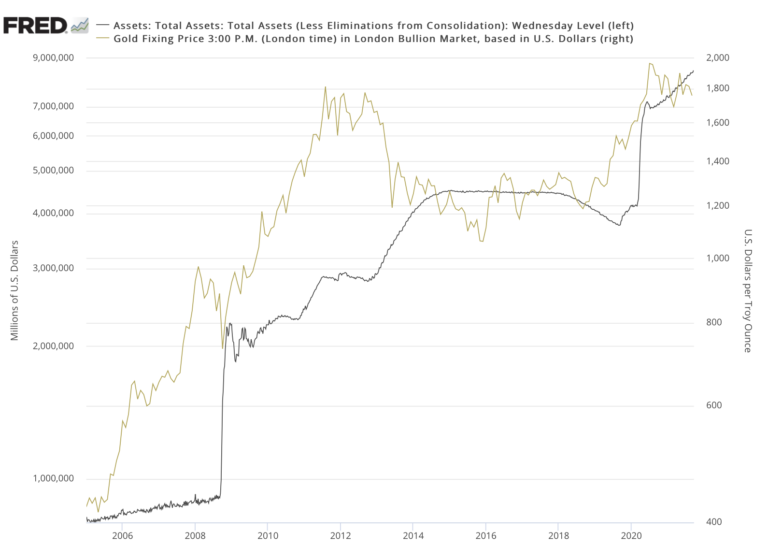

It all centers around the value of the U.S. dollar.

Polny explains, “Bitcoin, years ago, was under a dollar.

Then it was a dollar.

Then it was ten bucks.

Then it was a hundred, and then it was a $1,000.

All they can do is keep bashing it with news and say how horrible it is.

Ultimately, the most horrible currency in the world is the U.S. dollar.

The U.S. dollar is the root of all evil.

Polny says America’s story is about to run parallel to the Bible story of Lazarus, who was brought back to life by Christ after four days buried in a dark tomb. Polny says, “In the United States right now, we have gone in the wrong direction. We have been controlled by evil, and so the United States must fall. This is going to be like the Baptism moment. You die to be reborn. So, the United States is about to fall, and it’s going to look horrible. It’s going to look like God has abandoned us. How do you think it looked for Lazarus when he was in the tomb? He was dead. Lazarus and the United States are playing similar rolls. These are cycles, and that which has been will be again. . . . I am going to continue with the story, and it all ties in with the dollar and the United States. Jesus said, ‘This illness (for Lazarus) does not lead to death.’ . . . The fall of the United States is for the glory of God so that the Son of man can be glorified through it. . . .When the United States falls, people are ultimately going to wake up. This is about waking up the church.”

When could this take place? Bo says, “I think sometime in November the United States goes dark. . . . The land will rumble. Power will stumble and evil will crumble. This is what’s coming, and these are the events that we are super close to seeing. This will lead into what is called ‘Hypnotic November’ and death to life. . . . The United States will be reborn to shine once again for all the world to see. . . . We have the great awakening coming, and this will cause gold and silver to lift. . . .The dollar is an instrument that is about to go down. Because it no longer has a contract with Saudi Arabia because Russia got one, it’s about to lose its world reserve status. It’s about to go down, and the question is have you positioned yourself for what’s about to happen?”

Polny goes on to say, “You want to talk about bondage? Look what happened with the election. All it was were bribes and payoffs and nothing more than that. They are trying to control the military . . . they control social media. You know they control FOX News and all the major news stations and everything. . . . This whole money system is disgusting. Each one of these categories is a gate to hell. They control everything to the gates to hell through their money system. The gates of hell shall not prevail.”

In closing, Polny says, “The money system we have today is not attached to gold, and it’s no longer attached to oil. It’s free floating, and the only thing that is holding it up is faith and confidence. How confident do you feel right now with what is going on in the United States? . . . A massive event is coming, and unless the dollar falls, nothing changes. Hollywood won’t change. The banking system won’t change. The media won’t change. Nothing will change. . . .Everything that was held up by the dollar is about to go down.”

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with financial analyst and Biblical cycle expert Bo Polny, founder of Gold2020Forecast.com. (10.09.21)

(This write-up is only a small sample. There is more in the 52 min. interview.)

(To Donate to USAWatchdog.com Click Here)

$Monument Mining (TSXV:MMY) PM Note; The sluggish jobs market

could pressure the Fed to forestall any radical departure from current

stimulus policies and add to market concerns over inflation.

Charlie Morris, the London-based publisher of the Atlas Pulse Gold Report,

says that inflation is proving to be “not so transitory…

and this is where silver comes in.”

“Many say silver is gold on crack,” he explains, “but that’s not

the whole story.

Gold responds to lower interest rates like the long bond, whereas

silver lags gold in that scenario.

Silver only responds when inflation expectations are rising, and

that’s when it really outperforms gold.”

He goes on to say that “silver loves inflation even more than gold …

If the spike move in inflation expectations continues, I would

reasonably expect silver to outperform gold from here.

But remember, silver is riskier and more volatile but does

the same job as gold over the long-term.”

bigone thanks; Default Hysteria: No Time To Panic; Time To Plan

12,206 viewsStreamed live on Oct 1, 2021

RonPaulLibertyReport

291K subscribers

https://www.youtube.com/watch?v=j7dKL52MJNE

Analyst Brien Lundin offered a short overview of the technical factors

at play in the gold and silver markets and came away with a

cautiously positive outlook.

“For its part,” he writes, “silver never delivered the buy signal

that gold did, but seemed about to.

It remains in that state, still with a sell signal, but in the area

where we would expect a rebound.

That’s because, when monetary issues are driving the metals and

supportive of higher prices, gold and silver have tended to hit

these bottoms in the 14-week stochastic and quickly reverse higher.

So a rebound seems not only inevitable for fundamental reasons,

but perhaps imminent on the technical evidence. In fact, as we’re

putting this issue to bed, gold has bounced as much as $40.

Most of that gain came after Powell, in testimony before the House,

noted that the U.S. economy is ‘far away from full employment.’

Let’s grant that he’s also angling for re-appointment, but also

recognize that gold is at extremely oversold levels and therefore

primed for some sort of rally.”

These ‘sound money’ assets will ‘come back with a vengeance’ – Lawrence Lepard

97,876 viewsSep 21, 2021

Kitco NEWS

392K subscribers

https://www.youtube.com/watch?v=8VBrfn6l9Co

$bigone Note; Let's see gold not just as real money but as

the “original” money.

Thus, gold is the measure of value for everything else – including

the US dollar.

“The US dollar, has lost somewhere between 98-99% of its

purchasing power over the past one hundred years.

When the gold price hit $2060 oz. last August, it was a

one hundred-fold increase over the past century and represented

a ninety-nine percent loss in US dollar purchasing power.

In inflation-adjusted terms, $2060 oz. in August 2020 is nearly

identical to $1895 oz. in August 2011.

Both peaks equate similarly to a ninety-nine percent loss

in US dollar purchasing power.

$Monument Reports Fourth Quarter and Fiscal 2021 Results

September 24, 2021

https://www.monumentmining.com/news-media/news/2021/monument-reports-fourth-quarter-and-fiscal-2021-results/

$Gross Revenue of $23.24 Million and Cash Cost of US$1,178/Oz

Vancouver, B.C., September 24, 2021,

$Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or the

“Company” today announced its annual financial results for the year

ended June 30, 2021.

All amounts are in United States dollars unless otherwise indicated (refer to www.sedar.com for full financial results).

President and CEO Cathy Zhai commented: “During this fiscal year,

Monument has focused on consolidating the asset portfolio by spinning

off the Mengapur base metal project and placing the Tuckanarra Gold

Project into a joint venture.

The restructured gold focused portfolio provides potential catalysts for

re-rating the share price going forward into fiscal 2022 and beyond for

our shareholders.

“For the same reason, as of June 30, 2021, we established a solid

financial position with $38.62 million in cash and cash equivalents on

hand.

The strengthened cash reserves allow us to support and implement the

corporate value creation strategies, especially to fund

the Selinsing gold treatment plant expansion and

exploration of Murchison.

Monument is open to all corporate development opportunities to optimize

our future growth and shareholders value moving forward”.

Ms. Zhai further commented: “With the continued challenges from the

global Covid-19 pandemic that caused more than six weeks mine shut down

during the year, Selinsing Gold Mine produced positive cash flow in

2021 from mining super-low grade ore, leachable sulphide ore and

Peranggih materials, which has brought our aggregated

Selinsing Gold Mine production to 325,509 ounces at an average cost of

$535 per ounce with gross revenue of $452.1 million, gross margin of

$279.3 million and net cash from production of $275 million.

Looking forward, our management team will continue to work hard with

the “Can Do” attitude and the philosophy of “being a doer” in

delivering our commitment to our shareholders.”

Fiscal 2021 Highlights:

Restructured assets to a gold focused portfolio by spinning out

Mengapur copper and iron project;

Two staged Selinsing gold plant conversion with the flotation plant

construction commenced and fully funded;

Murchison Project exploration strategized to test potential gold

discovery and upside;

Tuckanarra Joint ventured with Odyssey fast tracking

exploration and development;

Selinsing Gold Mine continued with leachable sulphide ore production transitioning to new life of mine

Fourth Quarter and Fiscal 2021 Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2021/monument-reports-fourth-quarter-and-fiscal-2021-results/

Though the prospect of tapering has acted as a drag on the gold price

over the past several weeks, Gold Newsletter’s Brien Lundin believes

its reality will come as a relief.

“As you know,” he says in a recently issued advisory, “my view is

that the actual initiation of QE tapering could be a launching pad

for gold, much as the Fed’s initial rate hike in December 2015 ended

gold’s long bear market.

The actual removal of accommodation seems to also remove selling pressure

on gold from speculators betting on that event.

If so, then the expected catalyst isn’t long in coming.…

How they’re going to buy less Treasurys as Congress and the Biden

administration add trillions upon trillions in deficit spending is

beyond me, but my expectations have always been that the markets

won’t allow Powell & Co. to get very far down the road of policy

normalization anyway.

That underpins my long-term view that much higher gold and silver

prices are ahead.”

$News Releases - Monument Announces Completion of Upscaled Phase 1

Drilling in the Field at the Murchison Gold Project

September 20, 2021

Vancouver, B.C., September 20, 2021,

$Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or the

“Company” is pleased to announce the successful completion of an

upscaled Phase 1 18,000 metre air core (“AC”) and reverse circulation

(“RC”) drill program at its Murchison Gold Project in Western

Australia.

Highlights

Completion of 46 RC holes for 3,465 metres targeting the Munro Bore

Extension target as well as the FLC2 and FLC3 prospects, within the

Burnakura Project Area. Hole depths ranged from 40 to 160 metres and

were located outside of the current resource areas.

A total of 349 AC holes were completed for 10,484 metres focusing on

high quality structural targets defined from geophysical surveys in

areas of shallow cover.

The Munro Bore mineralized structure has an extension into Monument’s

tenement (“Munro Bore Extension”).

Geological mapping and interpretation of the completed drilling is in

progress, and subject to results obtained, follow up drill programs

will be planned.

All of the samples generated from the drilling have been delivered to

ALS Geochemistry, Perth, and results are expected to be received

between October and November 2021.

A drill program consisting of over 5,500 metres of combined RC and

diamond drilling (“DD”) targeting beneath open pits along the high-

grade North of Alliance (“NOA”) structure is at an advanced planning

stage and selection of a drill contractor is in progress.

Monument commenced its Phase 1 AC and RC drill program on July 3rd 2021

(as announced on July 20th 2021) and completed it by August 21st 2021

(Figure 1).

This first phase of drilling was designed to test new high quality

structural targets beneath cover for potential mineralization that may

lead to the identification of shallow stand alone or satellite gold

deposits to supplement the current resource base.

In addition, the drilling tested the strike continuation at Munro Bore

Extension that is adjacent to Munro Bore (not owned by Monument).

Munro Bore has estimated historical resources of 266,000t at 1.6g/t Au

(reported in “Technical Project Review and Independent Valuation Report

(Short Form)” prepared by Giralia Resources NL and reviewed by

Ravensgate Mining Industry Consultants in January 2011).

A total of 46 RC holes for 3,465m were completed against a plan of 12

holes for 1,260m, comprised of 1,301m for the planned Munro Bore

Extension and additional 2,164m for the FLC2 and FLC3 prospects that

was originally planned in the phase two.

It was brought forward to take advantage of increased drill rig

availability.

A total of 349 AC holes were completed for 10,484m at the Authaal East,

Burnakura South and Junction targets against a plan of 430 AC holes for

16,680m at Munro Bore Extension, Banderol South and Junction.

The targets were tested as planned except the eastern line of the

Junction target was not drilled due to steep terrain.

The depth to blade refusal was generally less than anticipated resulting

in fewer metres drilled than originally planned.

Drill holes were angled at 60 degrees and generally spaced at 25m with

lines spaced at between 400m to 950m.

https://www.monumentmining.com/news-media/news/2021/monument-announces-completion-of-upscaled-phase-1-drilling-in-the-field-at-the-murchison-gold-project/

$China Will Back Their Country's Digital Yuan With Gold

https://www.zerohedge.com/news/2021-08-25/china-will-back-their-countrys-digital-yuan-gold

When it happen all countries have to follow -

POG $10,000.-/oz + + +

IMO!

With Monuments sufficient cash to cover all near term project

expenditures

and still have significant surplus for contingencies -

MMY are very well situated to begin adding cash from current and

near term project cash flows.

MMY's ex. balance sheet wise, is much better situated

than most junior gold producers -

Additions to Investors Link on Website

plans for second source of cash flows from second safe mining

Jurisdiction -

$Each Jurisdiction has exploration upside above 1 million ounces..

https://www.monumentmining.com/investors/

Additions to Murchison Gold Mines Project..3D Model -

is interesting of ex. those two very large early exploration high

grade targets at the northern margin of -

Burnakura gold mines properties and at its southern margins -

also the two in between ones are large gold properties

based on the 25 km scale.

The new 3D geology model demonstrates that;

Burnakura Gold mines exploration upside

are very large, even from new open pits mines -

and what MMY know from

its underground drilling explorations -

https://www.monumentmining.com/site/assets/files/4188/mmy_corporate_presentation-2021_04_08.pdf

$bigone thanks; $Monthly BIG picture L@@K at $GOLD

proper TA schooled all the EXPERTS = REALITY

https://tinyurl.com/2vx5mz95

https://fisherpreciousmetals.com/83-analysts-believe-gold-will-go-parabolic-to-between-2500-and-15000/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=163835890

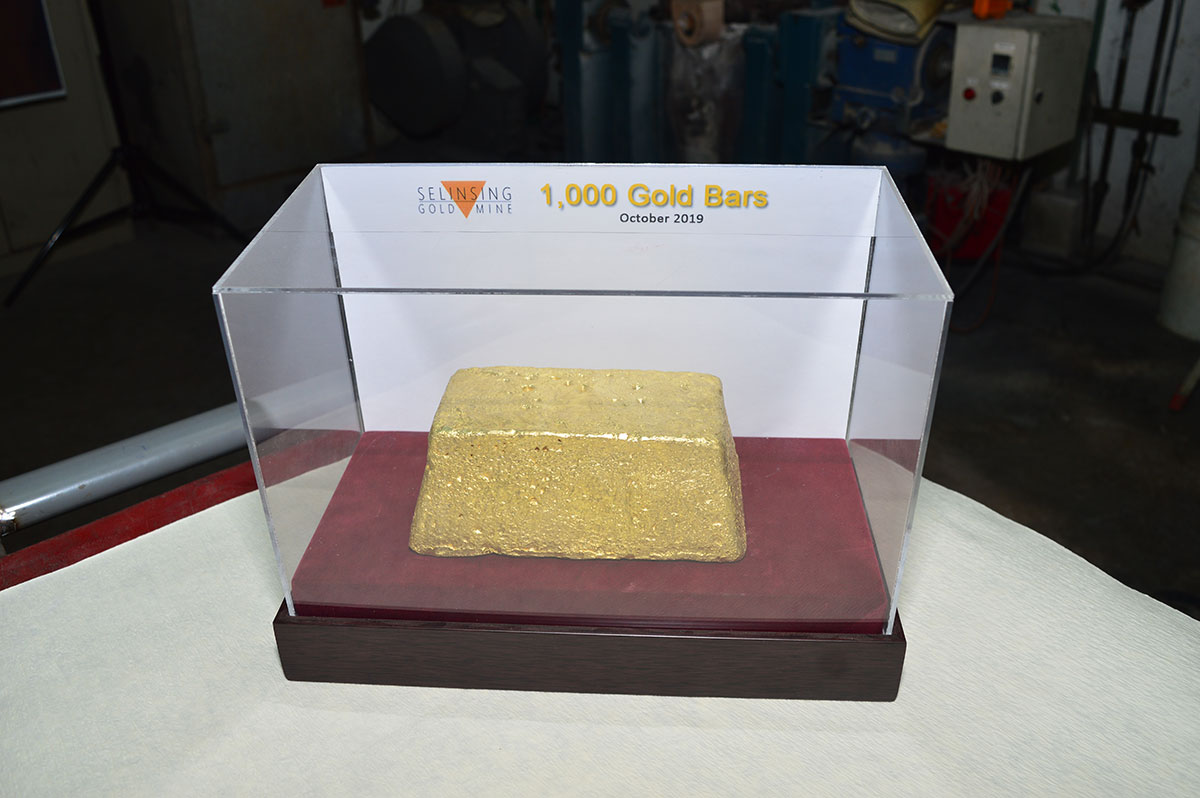

$Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new

great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future

years the weather is good no curtain needed -

$1,000th Gold Bar Pour Produced by MMY; Photo Gallery

https://www.monumentmining.com/news-media/photo-gallery/

$Market Cap $46 mil. - No Debt - someone has to be kidding

is it the fact ???

What a Great Gold Mines bargain

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered

Imo!

$Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit

Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA.

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM