| Followers | 680 |

| Posts | 141214 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Friday, September 24, 2021 3:47:29 PM

By: Greg Schnell | September 24, 2021

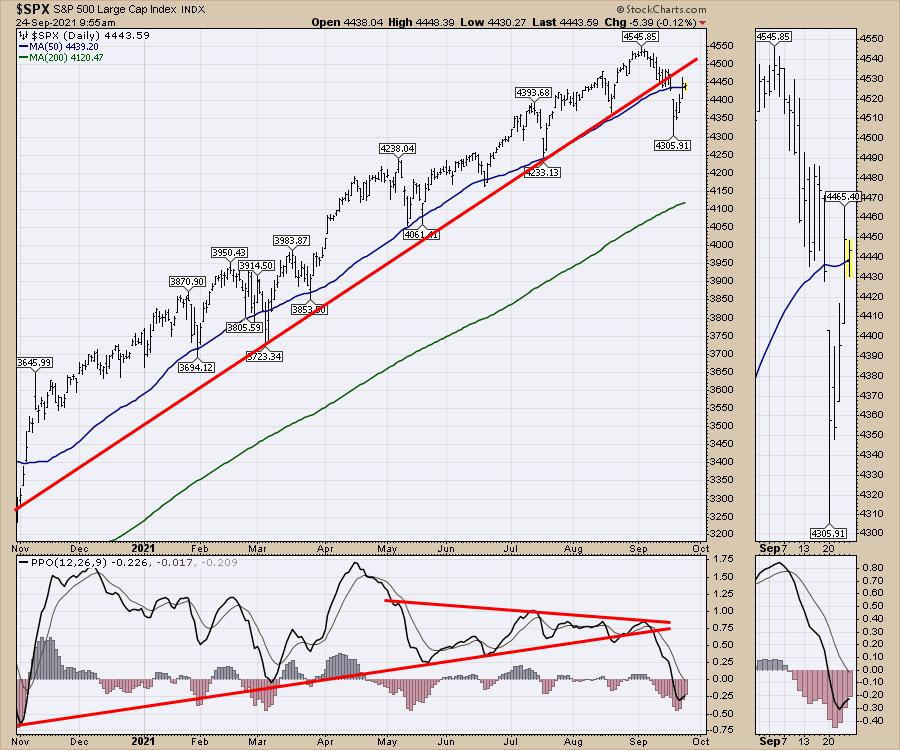

The market has tried to rally since the Monday lows, and we all know the difficulty of trying to figure out which rally is the right one to jump on. Every touch of the 50-day has created a market low. This time, the market is wobbling down around the 50-DMA.

Looking across the sectors, one sector stands out in relative performance compared to the $SPX as the average. There is also one sector that stands out as the biggest loser.

Energy has been rocking it for the last month. Meanwhile, Utilities have been sold off way more than any other sector. What is causing the paradoxical price action? My suggestion is, as utility input costs soar and interest rates turn up, the utility faces pressure on the financial statement. The United Kingdom has seen multiple utility companies fail, with more on the brink.

For investors planning for the green wave, of which I am one, we keep waiting for these green energy stocks to turn up. I have been writing a clean tech newsletter for a year, and it has been disappointing since February. They are not turning up meaningfully.

However, the XOP, the oil and gas production ETF, is surging on the back of tight inventories for both natural gas and oil. Expect a lot of government chin-wagging about the oil companies increasing pricing, but the problem lies in the government inaction to allow the metals used in green energy to be mined.

It looks like we are heading to a precipice for energy this winter. Germany and the UK look in serious shortfall. The US oil and gas inventories are staying particularly tight and the shut-ins from Hurricane Ida are also limiting current production flows out of the Gulf of Mexico.

One of the top areas for investing upside appears to be the oil and gas sector, as states move to open natural gas production facilities.

Another area that keeps soaring is Coal. How much are coal prices rising? This much.

Coal Price Chart: Business Insider

Coal exports continue to expand as prices rise due to increased coal demand. On a rainy day in the southwest corner of Canada, a coal terminal loads a barge for export.

Photo by Greg Schnell

As we look at governments around the world, coal is still in demand. This overhead shot of the coal terminal in Guatemala is one example of countries that still rely on coal. Surrounded by water, with large annual rainfall, the country is unable to create substantial power from renewables. Wind, solar and hydro isn't working as a model for this country. They have some renewable energy, but the size of the coal terminal demonstrates their demand.

Photo by Greg Schnell

However, it is still the large demand of coal from China and India that are generating higher prices for coal. Prices are soaring for coal as industrial manufacturers bid up the prices. This also competes with power generation.

We all want a cleaner world, but the reality is, unless we can get renewable materials at low prices with high volume, these countries will continue to use coal. Energy consumption continues to rise, but we don't have a solution moving fast enough to outpace the demand.

Here are some coal names and the price moves year to date.

I don't see any reason to give up on the returns in coal. The Oil and Gas sector looks to be having a solid 4th quarter. If this continues, one of the things that slows down a bull market are expensive commodities. At this point, there seems to be enough momentum to carry these stock prices higher.

Good trading,

Greg Schnell, CMT, MFTA

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM