Friday, July 09, 2021 10:51:44 AM

My take (and it is MINE only), the filters being shipped by RESN's customers using WaveX technology are not generating much of an initial income impact- most likely due to the type (cheapness) of the filters being used. I have found that cell phones, for instance, contain as many as 60 different filters and they range in price (cost) from a nickle (0.05) on up. If RESN's customers are using RESN's WaveX technology on low-end filters, there won't be much up-front revenue and I think the numbers bear that out. That said, trying out new tech IS a gamble and companies looking for cutting edge advantages are not going to go out on a limb and experiment with their high-end products initially. Is this what has happened here? Don't know as I stated before- this is MY take.

My guess is RESN is relying on their XBAR technology to be the linchpin of their money generating portfolio for the future. Until then, their current revenue stream will not be recognized for some time as they are relying on royalty payments for the past two quarter sales and have not disclosed (that I can find) when or how often those payments are/will be made. *****Hence their disclosure statement on the News Release the other day: "...a majority of Resonant’s revenues are based on prepaid royalty contracts, which generate immediate cash but may have delayed revenue recognition. As a result, we continue to expect non-linear revenue amounts in subsequent quarters.

Hell, it could a year before we see recognized revenue in the quarterly statements from these initial runs of filters imo.

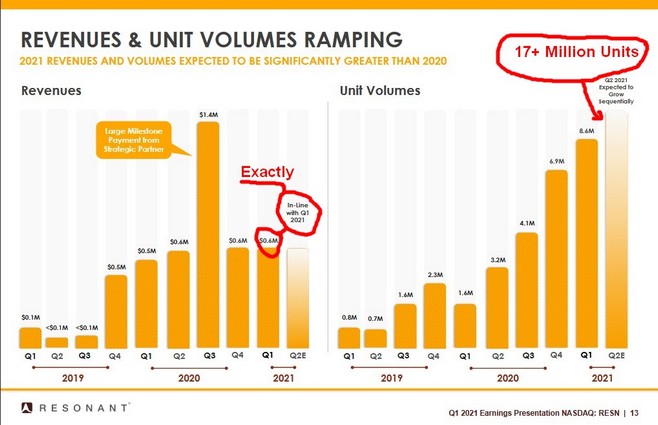

All that said, my opinion of the PR is that it only confirmed ONE thing- they ARE accurate in their time-line predictions. The pic below is from a webcast back in Q1 (?May). You can see their predictions for Q2 were spot on:

In conclusion, my take (again ONLY mine) is that there is nothing to "look" at here at the moment... we are still waiting for the big catalyst that pushes RESN over the top and this is still a development-stage company looking to break out. For the moment, I'm still satisfied with my position (avg'd @ $3.15) but more importantly, I still like the risk/reward potential. Make no mistake, the risks are significant imo. Another raise is all but guaranteed later this year based on their cash-burn imo, but could be mitigated with a strong confirmation of continued ongoing progress/success. We'll see.

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM