| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Monday, June 21, 2021 2:52:14 PM

By: SentimenTrader | June 21, 2021

At the moment, given the non-stop rise in the price of crude oil in the last year and the pickup of inflation in recent months, there is a lot of concern regarding the future direction of gasoline prices. Human nature being what it is, this is understandable. Which make this an opportune time to invoke the following:

Jay's Kaeppel's Trading Maxim #16: Human nature can be detrimental to trading success and should be avoided as much as, um, humanly possible.

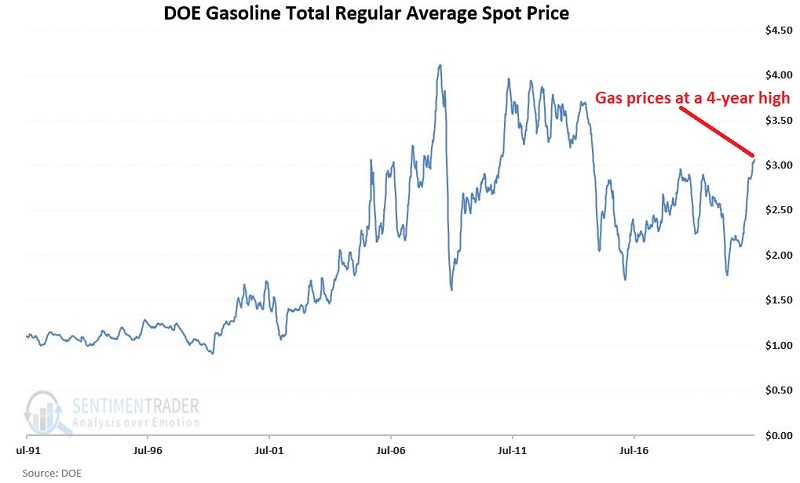

The chart below displays retail gas prices since 1991 as reported the U.S. Retail Automotive Gasoline Total Regular Average spot price, sourced from the U.S. Department of Energy. Again, with prices surging recently to a 4-year high, the heightened level of concern is understandable.

At first blush, there does not appear to be much rhyme or reason to the fluctuations in the price of gasoline. However, if we dig a little deeper, it turns out that there is a great deal of cyclicality to it.

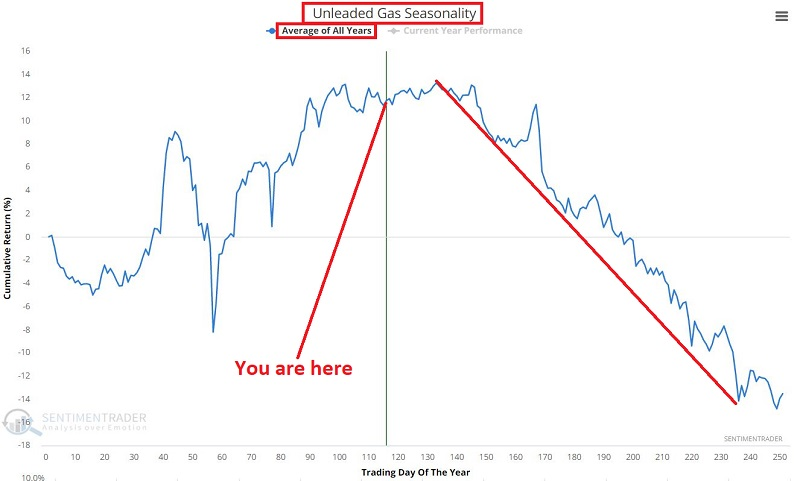

The chart below displays the annual seasonal trend for Unleaded Gas futures.

Does anything jump out at you in the chart above? If your vision is even remotely functional, you likely picked up on the significant weakness that tends to occur in the second half of the year.

This raises an interesting question: "Does this cyclicality in the futures market translate in any way to the price at the pump?" That answer to that question depends on how closely gas prices correlate to unleaded gas futures.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Lingerie Fighting Championships Signs Broadcast Deal With Maybacks Global Entertainment • BOTY • Sep 26, 2024 9:00 AM

Maybacks Global Entertainment and Lingerie Fighting Championships Enter Into Broadcast And Revenue Sharing Agreement • AHRO • Sep 26, 2024 8:30 AM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM