Thursday, May 27, 2021 3:12:50 AM

Targets 0.0084 / 0.0098 / $0.015 / $0.030

http://www.allotcbb.com/quote.php?symbol=AAPT

I'll Alert you of stocks to Buy,

before the Run happens !

________________________________________________________________

AAPT Security Details

Share Structure

Market Value1...............$19,074,666 a/o May 26, 2021

Authorized Shares.....3,000,000,000 a/o May 24, 2021

Outstanding Shares...2,980,416,590 a/o May 24, 2021

Restricted.....................749,702,088 a/o May 24, 2021

Unrestricted...............2,230,714,502 a/o May 24, 2021

Held at DTC...............1,864,353,848 a/o May 24, 2021

Float...............................360,000,000 a/o Jun 30, 2013

Par Value 0.001

https://www.ldmicro.com/profile/AAPT

https://www.otcmarkets.com/stock/AAPT/security

http://www.allotcbb.com/quote.php?symbol=AAPT

https://www.quotemedia.com/portal/history?qm_symbol=AAPT

Authorized Shares,

has No Bearing on the price.

The Shares Authorized,

is not used in any fundamental of financial calculation,

to determine company value.

________________________________________________________________

How Targets are Calculated

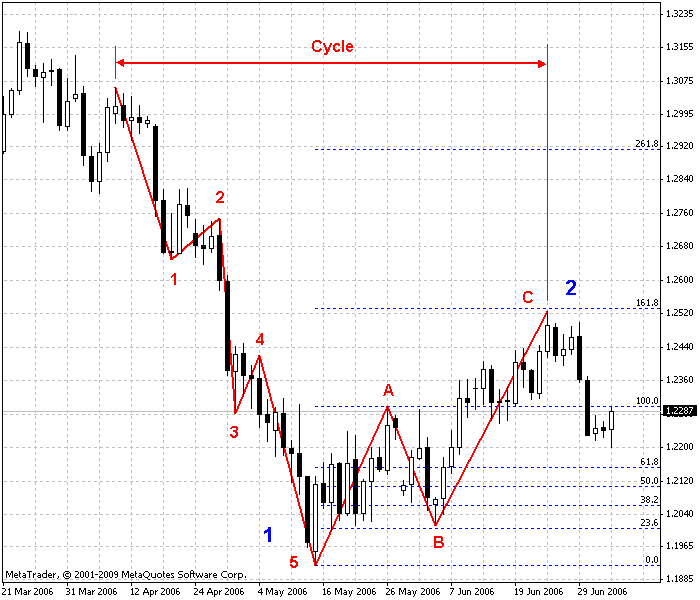

Fibonacci Numbers and Retrace Targets: Explained

________________________________________________________________

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

Fibonacci Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

_________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

________________________________________________________________

________________________________________________________________

Live! Charts

North Bay Resources Announces Assays up to 5 oz/ton Gold, 1.5 oz/ton Platinum, 0.5 oz/ton Palladium, and 0.5 oz/ton Rhodium at Mt. Vernon Gold Mine, Sierra County, California • NBRI • Oct 4, 2024 9:15 AM

Basanite, Inc. Appoints Ali Manav as Interim Chief Executive Officer • BASA • Oct 3, 2024 9:15 AM

Integrated Ventures Announces Launch of MedWell Facilities, LLC and Lease Agreement with Giant Fitness Clubs • INTV • Oct 3, 2024 8:45 AM

Beyond the Horizon: Innovative Drug Combinations Offer New Hope for Alzheimer's and More • NVS • Oct 3, 2024 8:45 AM

SMX and FinGo Enter Into Collaboration Mandate to Develop a Joint 'Physical to Digital' Platform Service To Enhance Natural Rubber Industry's Ability to Report on Sustainable and Ethical Supply Chains • SMX • Oct 3, 2024 7:00 AM

Transforming Alzheimer's Treatment: Innovative Combinations to Boost Cognition • PFE • Oct 2, 2024 9:00 AM