ex.

Germany market Tradegate 0.144 is about $0.215 cad

by deiwel

https://www.tradegate.de/orderbuch.php?lang=en&isin=CA61531Y1051

$GOLD BULL: Rome Is Burning And The Fed Is Trapped

https://kingworldnews.com/gold-bull-rome-is-burning-and-the-fed-is-trapped/

$bigone thanks; Money once again flowing into gold mining producers -

The IT and Crypto sectors have now topped and that cash is now looking

for the next hot sector.

That sector is now gold.

On Friday, reviewing analyst rating changes on my Investment House

daily report, I found that almost all of the covered gold stocks were

rated Outperform.

I have never seen such a rapid and universal alteration in gold ratings

in my investment career which goes back decades.

So, we are looking at a revival of investment dollars into gold and gold

mines stocks.

We have a huge amount of material and development news pending release

in the near future.

$Considering this along with increased investment flows into Gold, its a

fair bet that we will exit June above $0.30 + + + +

Throughout the summer, we will see sequential releases of Murchison

drilling results along with development news at Peranghi, processing of

Colombian concentrate, construction progress of the Floatation plant

and other new developments currently under consideration.

If all goes according to form, we have an excellent chance of exiting

summer above $0.60 + + + +

Even at that price, we will still be very undervalued bargain....

IMO! nozzpack

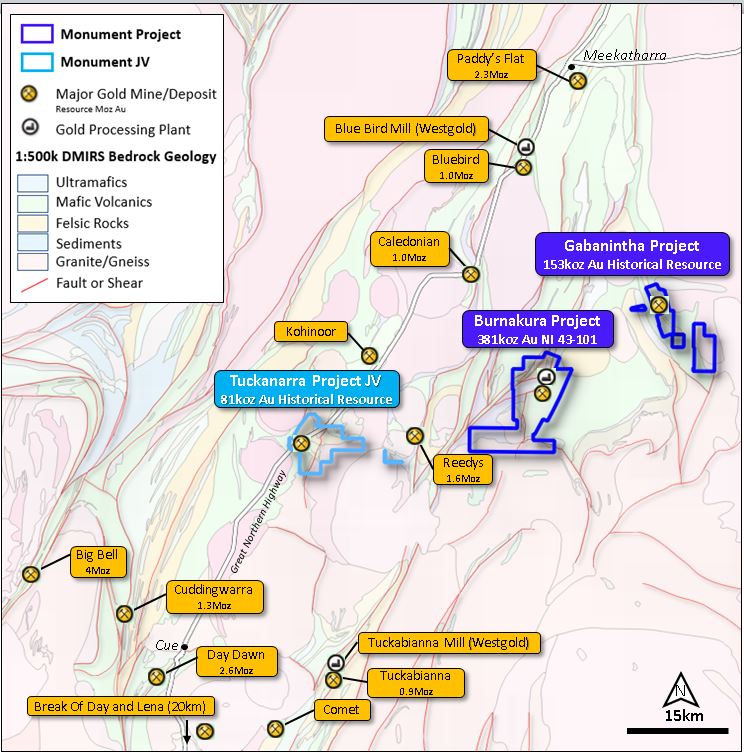

$bigone thanks; In December 2020, Monument Mining Ltd. made an Joint

Venture agreement with Odyssey Gold Ltd.

MMY got a 20% free carried interest (not need to pay any cost of

exploration drilling etc. up to

the project are ready for gold milling, processing etc.)

MMY also got a 1% NSR royalty over Odyssey’s 80% interest in the

property.

Ody got 80% interest in MMY's Tuckanarra Gold project to carry out

all needed exploration, drilling, feasibility study etc.

Odyssey Gold Ltd., leaving Monument with a 20% free carried interest

and a 1% NSR royalty over Odyssey’s 80% interest in the property.

An unincorporated joint venture was formed with Odyssey to advance

the exploration over Tuckanarra.

Odyssey will be solely responsible for funding the exploration and

evaluation activities at Tuckanarra until a decision to mine is

reached.

The future processing of ore from tenements held by Odyssey

through the Monuments Mining Ltd's Burnakura plant remains

an option should maybe if commercial

terms be reached!?

$Visible Gold at Odyssey/Monument Tuckanarra JointVenture Project

Reinforce Exploration Targeting at Murchison Gold Project

MMY | May 5, 2021

VANCOUVER, British Columbia, May 05, 2021 (GLOBE NEWSWIRE) --

$Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or

the “Company” is pleased to receive the news announced

by its Joint Venture Partner Odyssey Gold Ltd (“ODY”)

that significant visible gold has been intersected in its

maiden diamond hole

Figure 1), a 70m step-out in the eastern extension of the developing

Bottle Dump deposit at the Tuckanarra JV Project (“Tuckanarra”)

located in the Murchison Goldfield.

Together with other results, the new finding confirms the strong

potential of the Bottle Dump trend to host high-grade gold

mineralization (For details refer to:

www.investi.com.au/api/announcements/ody/420449c6-9f8.pdf ).

Figure 1: Significant visible gold ? is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f33fad6e-54b6-4e35-8110-27a52264226f

https://stockhouse.com/news/press-releases/2021/05/05/visible-gold-at-odyssey-monument-tuckanarra-jv-project-reinforce-exploration

Odyssey Gold (ASX: ODY) - Is it the next big micro cap mover?

1,110 views•May 4, 2021

https://www.youtube.com/watch?v=QbuxeLUQ-cw

The Stocks in Action || Which ASX Listed Stocks Are Trending Today?

17 views•May 4, 2021

https://www.youtube.com/watch?v=_ek5QhYsaRc

Odyssey Gold (ASX:ODY) exploration update on its high-grade gold

projects in the Murchison Goldfields

https://www.youtube.com/watch?v=y0FJY_6Zmec

When I first began writing about such projections, I was satisfied with

identifying 10 individuals who were of the opinion that gold would

attain a peak greater than $2,500.

That list has grown to 83 of which 47 believe that $5,000 or more for

gold is likely.

I encourage you to check out their articles and their rationale for

such high gold prices in the years (and in some cases just months) to

come:

$Higher than $10,000

https://fisherpreciousmetals.com/83-analysts-believe-gold-will-go-parabolic-to-between-2500-and-15000/

$bigone Yes, Unbelievable!!! Amazing!! The end of the age of speculation-

Buckle up. We might be in for a rough ride if we have truly come to the

end of the age of speculation. More than one investor has stumbled upon

diversification on the road to portfolio wisdom.

$BUY MMY GOLD -

Estimated Value of ODY Visible Gold..$2 million

$They announced today that the grade was above the 12,000 gns/ton

detection limit of the grade technology used.

$They will assay it again with an upper grade detection limit of 35,000

gms/ton.

Using the approximate average of the lower and upper limit....25,000

gms/ton......at current CAD prices that is worth about $2 million.

What a core !

https://stockhouse.com/companies/bullboard?symbol=v.mmy&postid=33231121

$Monument Mining (TSXV:MMY) MMY's Murchison Gold Mines...Great Gold

Country and new update drilling to

target the high grade old gold mines by Monument Gold Mining -

https://www.monumentmining.com/projects/murchison-gold-portfolio/

The Pass Scout drilling by Monument has already identified three high

grade shallow oxides outside the Lewis and reward pits -

This is the same area where ATW hit 16 ounces per ton over 1 meter in

2008 -

These could be three new oxide mines ex...may delivering 25,000 to

50,000 ounces per pit to the Burnakura Gold mill -

The new 3D geologic model has identified 30 of these shallow gold

projects at Burnakura and another 30 at Monuments

Gabanintha Old Gold Mines -

Beyond any doubt, some of those will be new oxide gold open pits

mining that can be very profitably mined -

AISC at or below $1000 per gold ounce -

We are going to have an excellent summer at Murchison Gold Mines -

with more high grade modern drilling of the old gold mines area -

It should be no problem breaking thru the $0.50 level -

can't wait to the drill results begin to pour in to expose

the rich old gold mines country

With Monuments sufficient cash to cover all near term project

expenditures

and still have significant surplus for contingencies -

MMY are very well situated to begin adding cash from current and

near term project cash flows.

MMY's ex. balance sheet wise, is much better situated

than most junior gold producers -

Additions to Investors Link on Website

plans for second source of cash flows from second safe mining

Jurisdiction -

$Each Jurisdiction has exploration upside above 1 million ounces..

https://www.monumentmining.com/investors/

Additions to Murchison Gold Mines Project..3D Model -

is interesting of ex. those two very large early exploration high

grade targets at the northern margin of -

Burnakura gold mines properties and at its southern margins -

also the two in between ones are large gold properties

based on the 25 km scale.

The new 3D geology model demonstrates that;

Burnakura Gold mines exploration upside

are very large, even from new open pits mines -

and what MMY know from

its underground drilling explorations -

https://www.monumentmining.com/site/assets/files/4188/mmy_corporate_presentation-2021_04_08.pdf

$bigone thanks; $Monthly BIG picture L@@K at $GOLD

proper TA schooled all the EXPERTS = REALITY

https://tinyurl.com/2vx5mz95

https://fisherpreciousmetals.com/83-analysts-believe-gold-will-go-parabolic-to-between-2500-and-15000/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=163835890

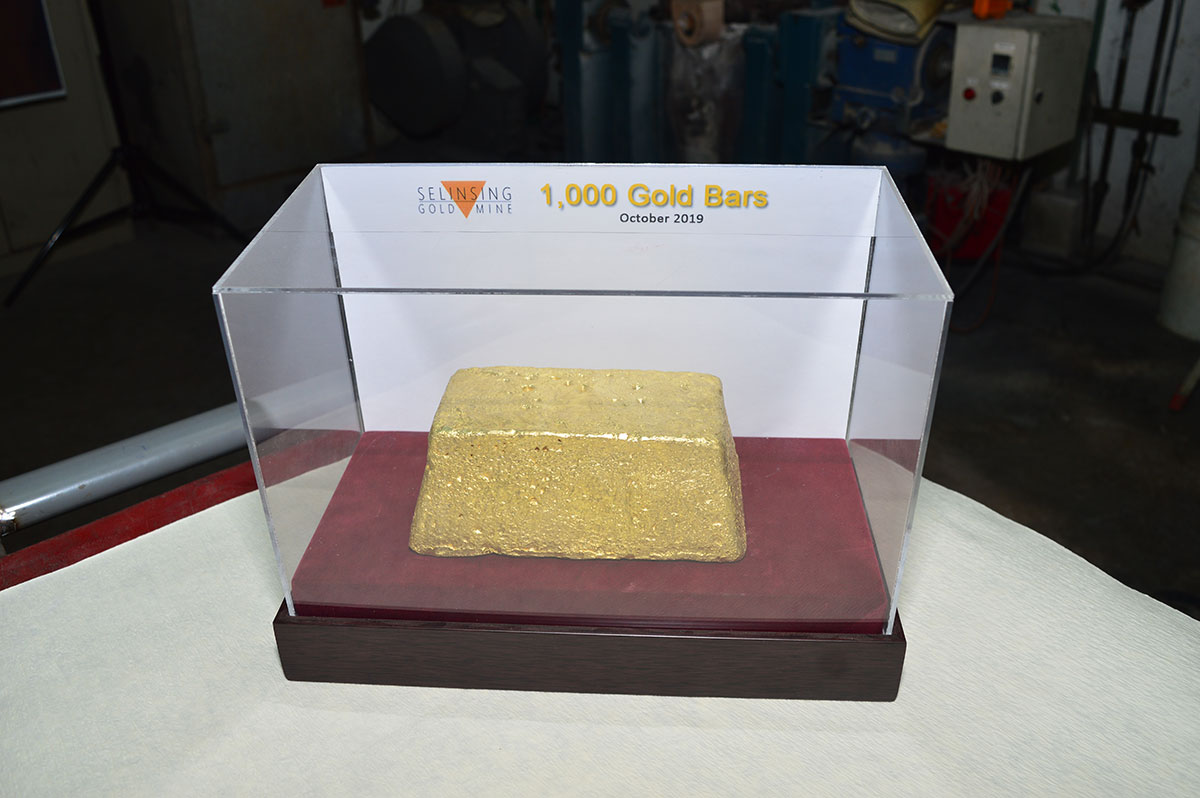

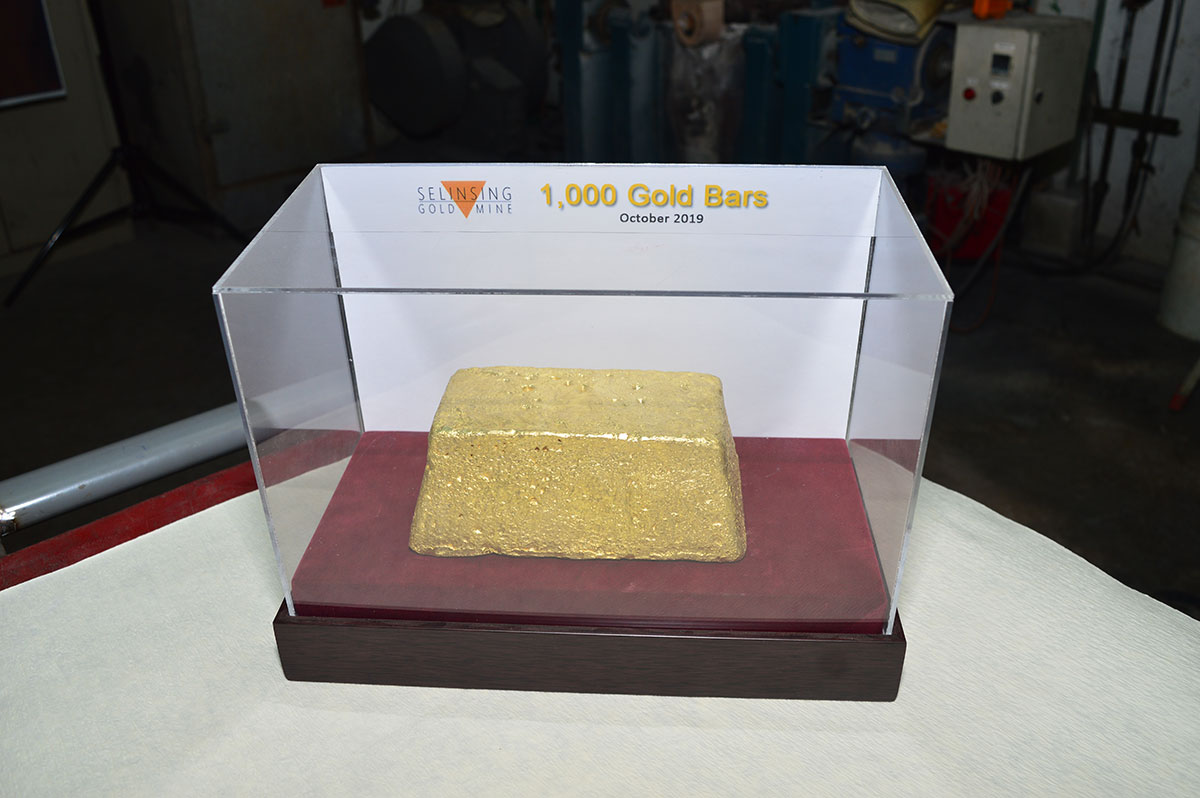

$Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new

great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future

years the weather is good no curtain needed -

$1,000th Gold Bar Pour Produced by MMY; Photo Gallery

https://www.monumentmining.com/news-media/photo-gallery/

$Market Cap $46 mil. - No Debt - someone has to be kidding

is it the fact ???

What a Great Gold Mines bargain

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered

Imo!

$Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit

Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA.

SANUWAVE Announces Record Quarterly Revenues: Q3 FY2024 Financial Results • SNWV • Nov 8, 2024 7:07 AM

DBG Pays Off $1.3 Million in Convertible Notes, which Retires All of the Company's Convertible Notes • DBGI • Nov 7, 2024 2:16 PM

SMX and FinGo Enter Into Collaboration Mandate to Develop a Joint 'Physical to Digital' Platform Service • SMX • Nov 7, 2024 8:48 AM

Rainmaker Worldwide Inc. (OTC: RAKR) Announces Successful Implementation of 1.6 Million Liter Per Day Wastewater Treatment Project in Iraq • RAKR • Nov 7, 2024 8:30 AM

SBC Medical Group Holdings and MEDIROM Healthcare Technologies Announce Business Alliance • SBC • Nov 7, 2024 7:00 AM

VAYK Confirms Insider Buying at Open Market • VAYK • Nov 5, 2024 10:40 AM