| Followers | 679 |

| Posts | 140863 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Monday, May 24, 2021 8:37:47 AM

Best ETFs For June 2021

By: Jason Bodner | May 24, 2021

• I spend all my time trying to find the outlier stocks of tomorrow. Outliers are the 4% of stocks that account for 100% of the gains of the stock market above treasuries for nearly 100 years.

A portfolio of outlier stocks can become chock full of monster gains for years to come, if chosen wisely.

But wouldn’t it be great if there was already a collection of outliers we could buy without even having to think about it?

Well maybe there is a way to do just that… through outlier ETFs.

So, here I’m going to give you the best ETFs that big money is getting involved in this month.

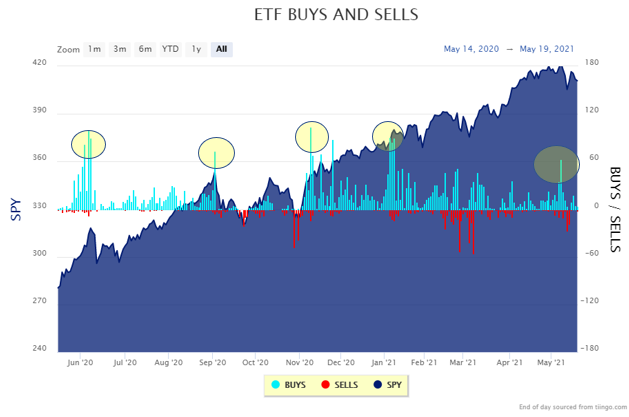

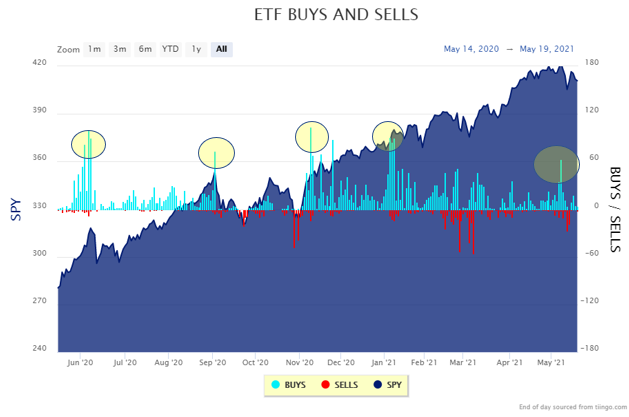

First thing’s first: to find them, I looked at all the ETFs making Big Money signals. I did that by heading over to MAPsignals.com and then looked at the Big Money ETF Buys and Sells chart. I looked at days with the biggest buying, circled here:

Once I had all the ETFs, I wanted to know which were the best potential opportunities. ETFs are baskets of stocks. And because MAPsignals scores over 6,000 stocks every day, as long as I know which stocks make up the ETFs, I can rank them all.

Here are the 5 best ETFs with scores: The Composite score, Technical score, and Fundamental score. These were computed by accounting for each components stock’s score and its associated weighting in the ETF. (keep in mind that weightings will change from time to time)

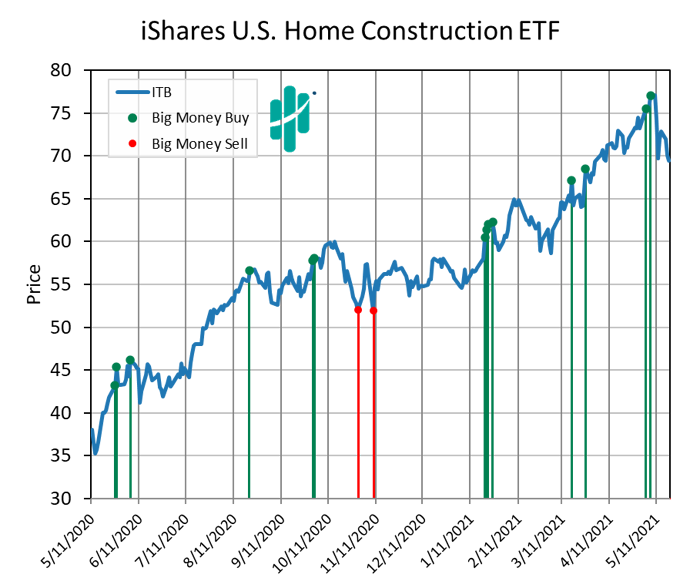

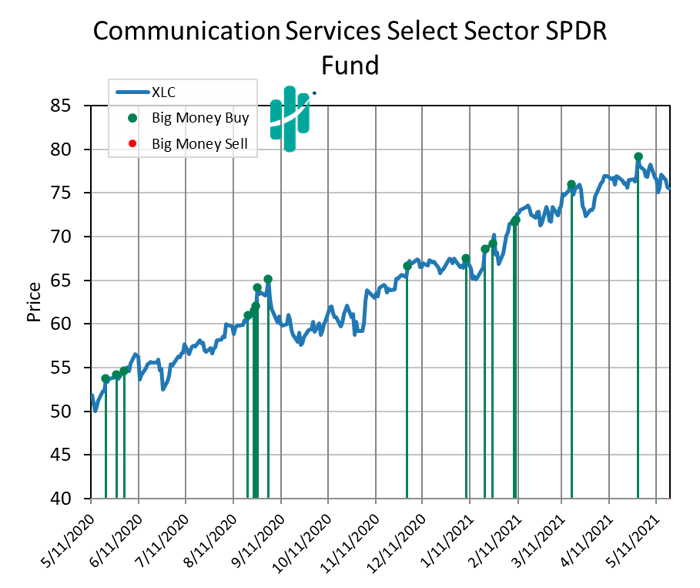

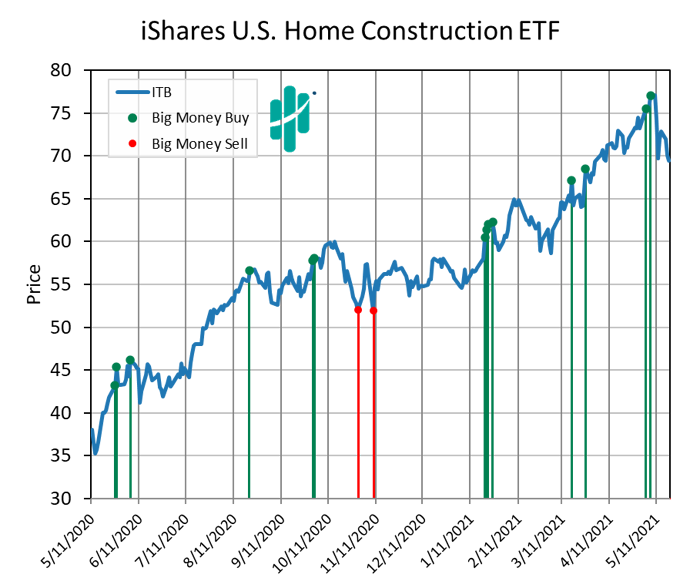

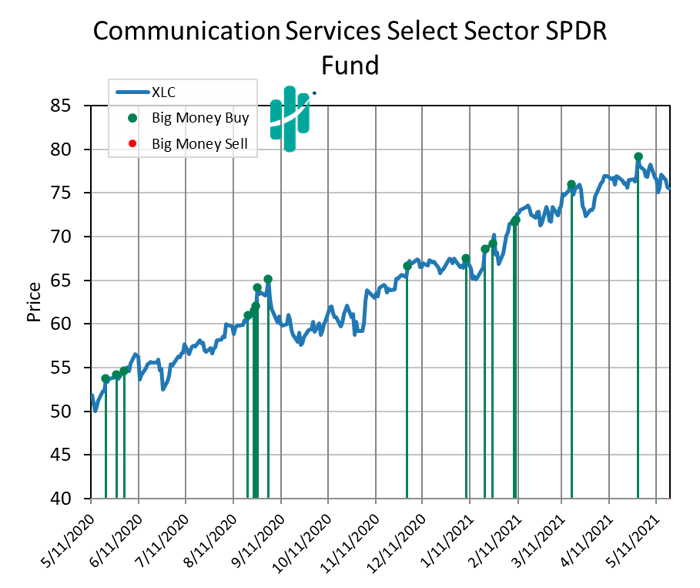

Below we see each ETF, their recent Big Money activity, and their scores. XLF, ITB, and XLC are top ranked ETFs. That makes sense because financials, home builders, and communications stocks have been leading the market much of this year so far.

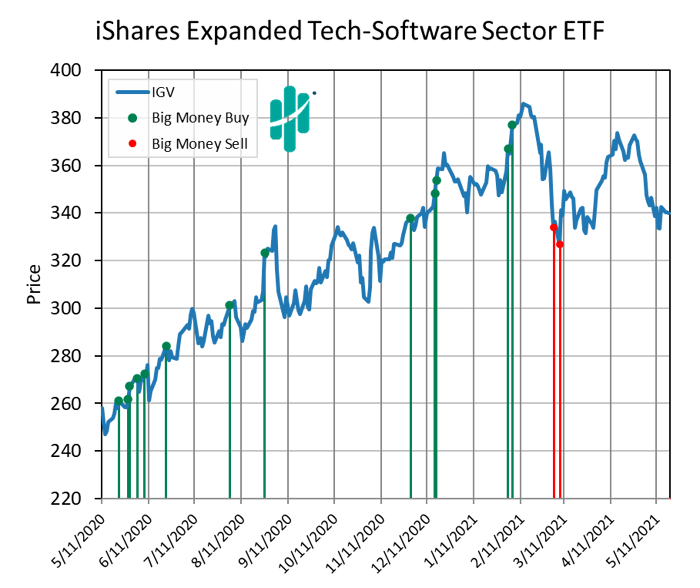

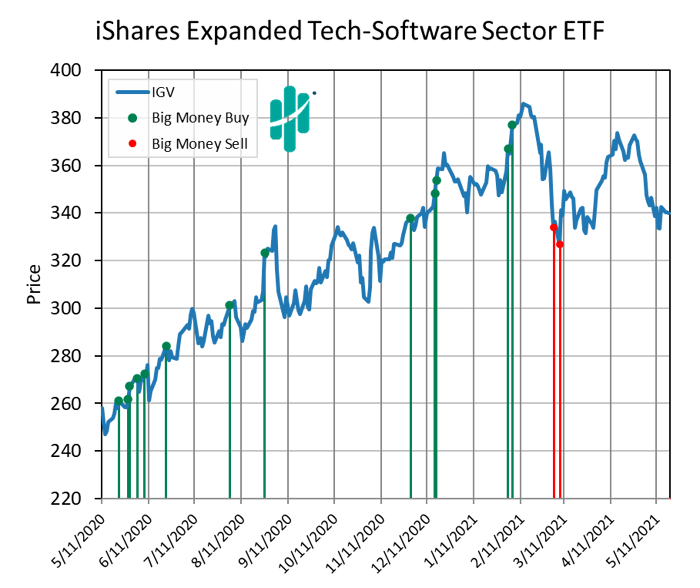

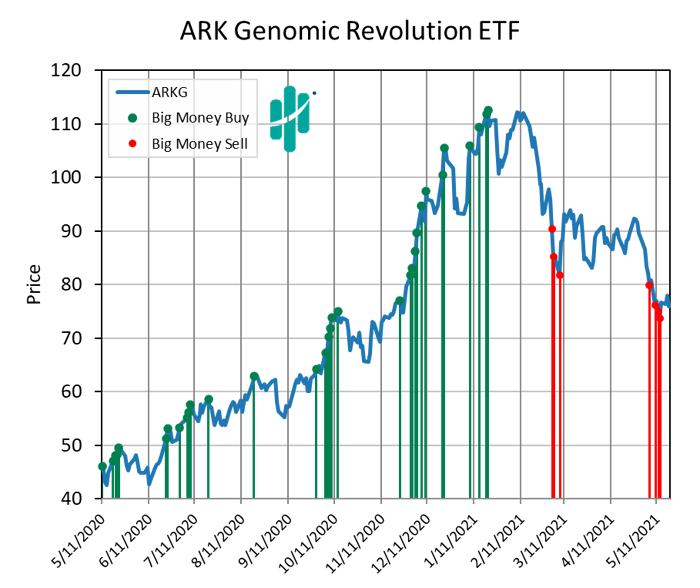

IGV and ARKG, however, rank low on our list of ETFs. But there is opportunity here because the low scores are due to weak technicals. Big Money has been selling these ETFs, largely because they are heavily concentrated in growth stocks. But these stocks have excellent fundamentals: growing sales and earnings and big profits. These weak ETFs represent great potential bargains.

Let’s quickly look at the year-to-date performance of these 5 ETFs:

• XLF +29.3%

• ITB +29.2%

• XLC +13.5%

• IGV -4.0%

• ARKG -18.1%

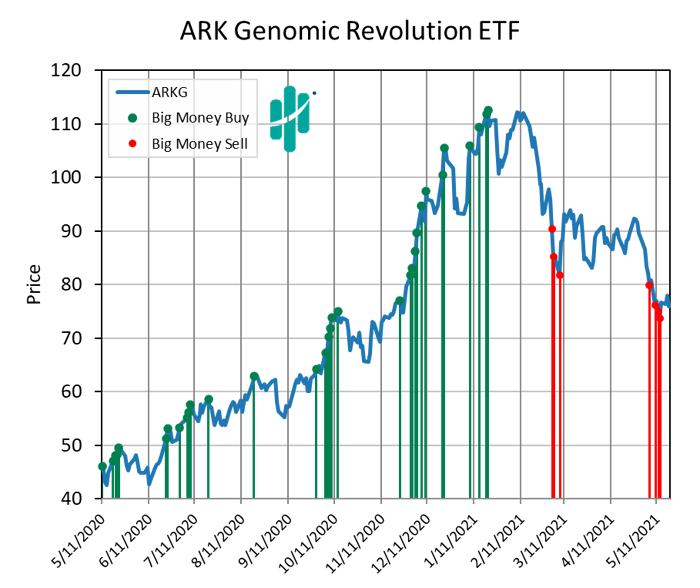

Now let’s quickly look at Big Money buying in the ETFs. Each chart below has many green bars which represents unusually large buying. The few red bars represent unusually large selling. What jumps out is the huge buying in all the ETFs.

Only with IGV and ARKG, there was recent selling too. But again, selling on ETFs and stocks with great fundamentals represents a value opportunity.

Source: www.mapsignals.com, End of day data sourced from Tiingo.com

Here’s why I like these ETFs: they are highly concentrated with fundamentally superior stocks. Below we see a table of three stocks in each ETF. They are some of the highest weightings in each.

Notice their fundamental scores are very strong on a scale from 0-100. This means strong growing sales, earnings, and profits over one and three years. This is how MAPsignals boils down all its fundamental research into one elegant score.

Now with XLF, ITB, and XLC – we see the stocks also have strong technical scores. That means Big Money has been pouring into them, lifting them to new highs. They are buoyant with Big Money support. But in IGV and AKG, we see weak technical scores. This means Big Money has been exiting the stocks.

But before you get spooked, let’s keep the recent environment in mind: Growth has fallen out of favor while value and reopen stocks have become all the rage. But it’s essential to remember these growth companies create phenomenal products and services enhancing our lives. I don’t foresee that stopping in the future. The recent selling is temporary and thematic.

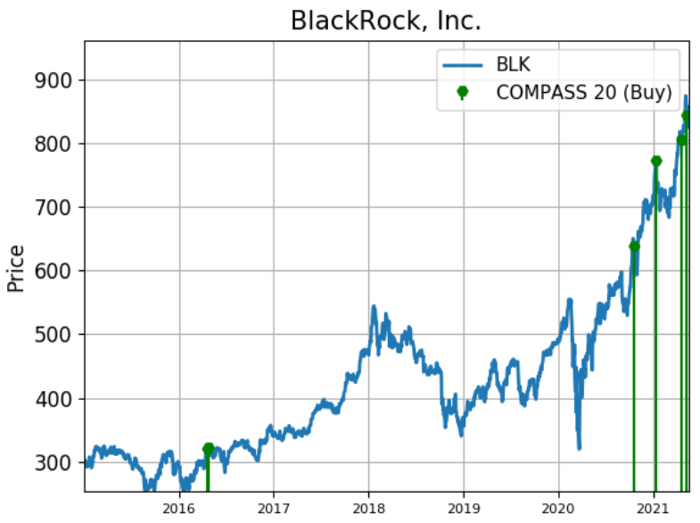

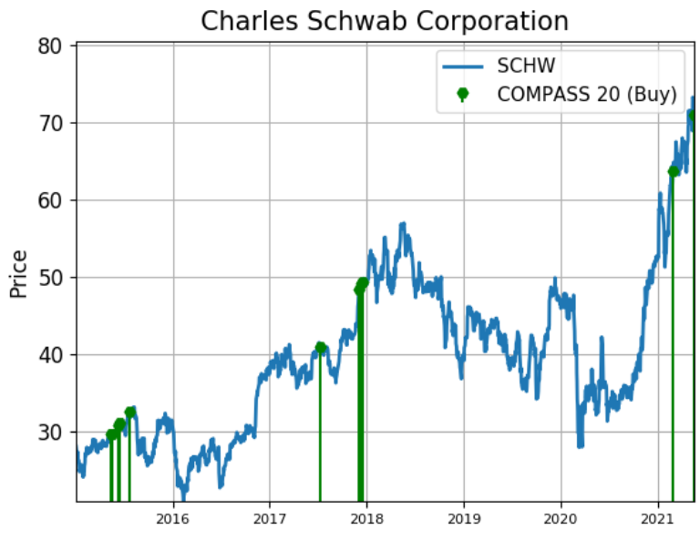

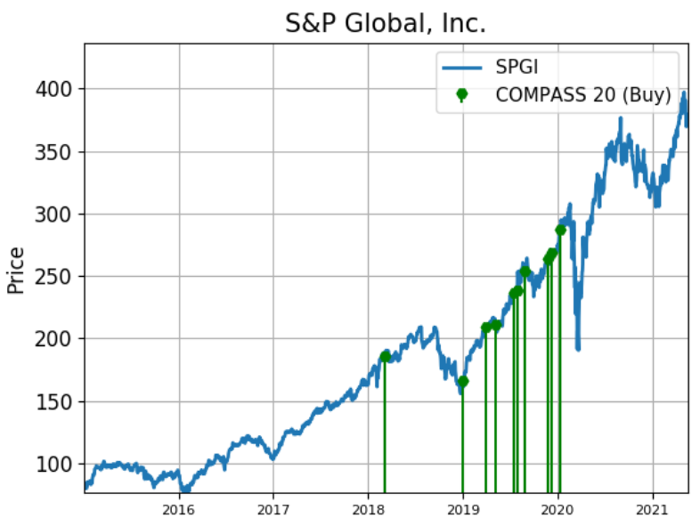

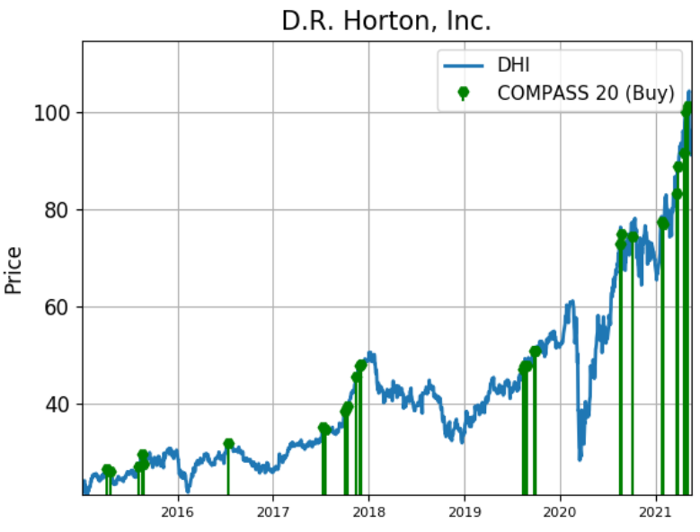

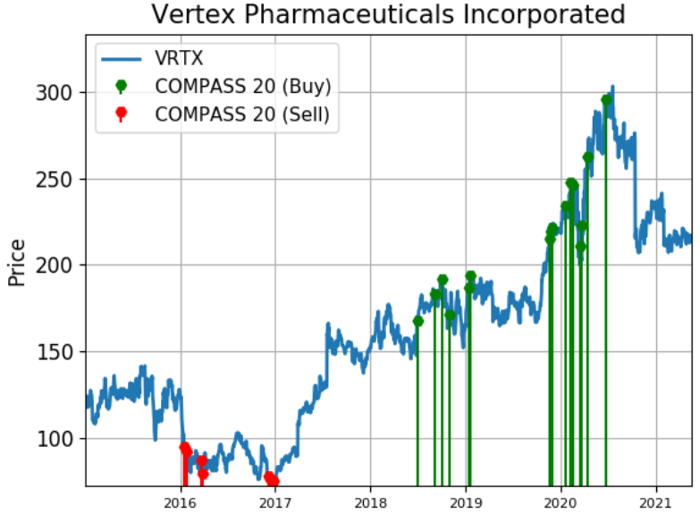

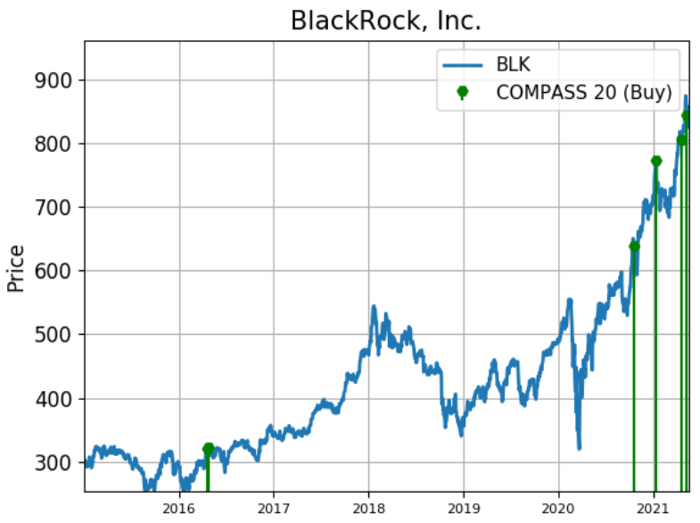

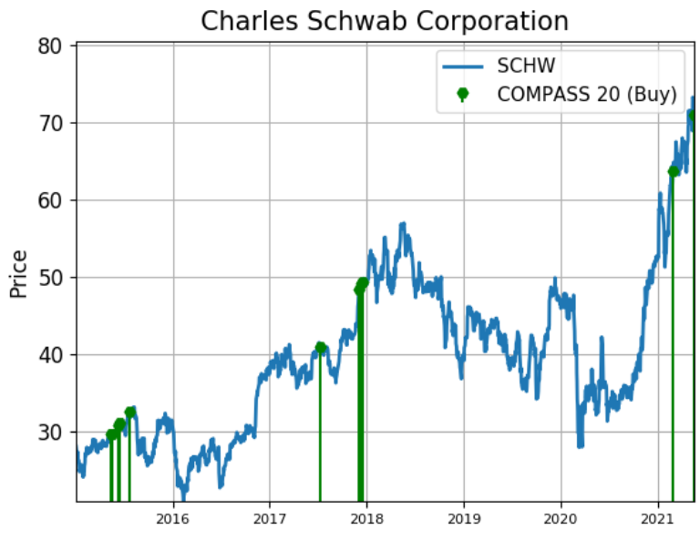

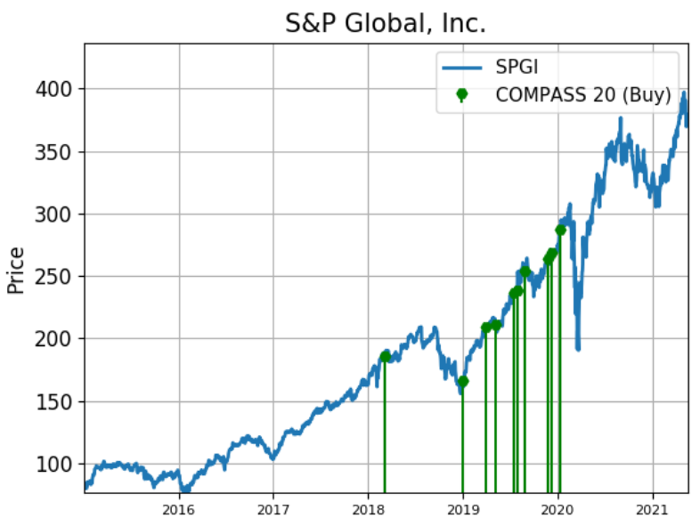

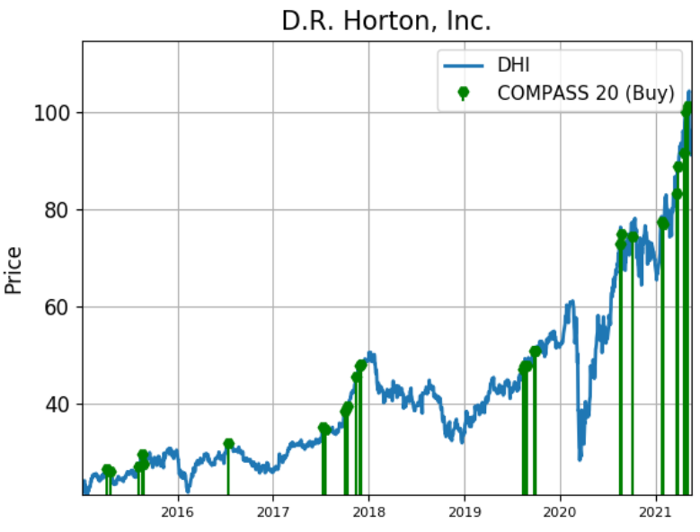

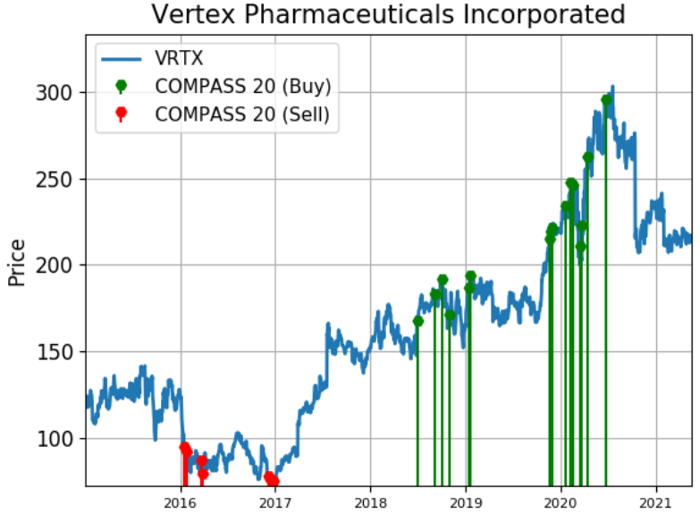

What really drives this home is looking at how long-term Big Money buying can lead to monstrous gains. Below are charts showing all the instances these stocks were Top stocks in our research since 2015: our weekly report of outliers. We don’t need to go into details on each chart.

I’d like you to notice a few things:

• When Big Money buying pours in, stocks go up

• Repeated outliers, especially for years often means outsized gains

Owning outlier stocks is the way I try to beat markets. Easy exposure to many stocks can be achieved by buying ETFs. But just like anything, you must be in the 1% if you want to be in the 1%.

We can find outlier ETFs by tracking the Big Money. But that alone isn’t enough: when we catalog the components and find outlier stocks underneath… that’s the winning recipe.

So, there you have it: the 5 best ETFs that Big Money has been trafficking in recently. Outlier ETFs hold outlier stocks. Finding them is the key to finding potentially outlier gains.

Now let’s look at what those look like:

Source: www.mapsignals.com, End of day data sourced from Tiingo.com

The Bottom Line

XLF, ITB, XLC, IGV, & ARKG represent top ETFs for June 2021. Financials, homebuilders, & Communications stocks have performed well lately, which should continue. Software and Genomics companies have reached interesting levels, too. Paying attention to the fundamental quality of ETF constituents is paramount.

Read Full Story »»»

DiscoverGold

DiscoverGold

By: Jason Bodner | May 24, 2021

• I spend all my time trying to find the outlier stocks of tomorrow. Outliers are the 4% of stocks that account for 100% of the gains of the stock market above treasuries for nearly 100 years.

A portfolio of outlier stocks can become chock full of monster gains for years to come, if chosen wisely.

But wouldn’t it be great if there was already a collection of outliers we could buy without even having to think about it?

Well maybe there is a way to do just that… through outlier ETFs.

So, here I’m going to give you the best ETFs that big money is getting involved in this month.

First thing’s first: to find them, I looked at all the ETFs making Big Money signals. I did that by heading over to MAPsignals.com and then looked at the Big Money ETF Buys and Sells chart. I looked at days with the biggest buying, circled here:

Once I had all the ETFs, I wanted to know which were the best potential opportunities. ETFs are baskets of stocks. And because MAPsignals scores over 6,000 stocks every day, as long as I know which stocks make up the ETFs, I can rank them all.

Here are the 5 best ETFs with scores: The Composite score, Technical score, and Fundamental score. These were computed by accounting for each components stock’s score and its associated weighting in the ETF. (keep in mind that weightings will change from time to time)

Below we see each ETF, their recent Big Money activity, and their scores. XLF, ITB, and XLC are top ranked ETFs. That makes sense because financials, home builders, and communications stocks have been leading the market much of this year so far.

IGV and ARKG, however, rank low on our list of ETFs. But there is opportunity here because the low scores are due to weak technicals. Big Money has been selling these ETFs, largely because they are heavily concentrated in growth stocks. But these stocks have excellent fundamentals: growing sales and earnings and big profits. These weak ETFs represent great potential bargains.

Let’s quickly look at the year-to-date performance of these 5 ETFs:

• XLF +29.3%

• ITB +29.2%

• XLC +13.5%

• IGV -4.0%

• ARKG -18.1%

Now let’s quickly look at Big Money buying in the ETFs. Each chart below has many green bars which represents unusually large buying. The few red bars represent unusually large selling. What jumps out is the huge buying in all the ETFs.

Only with IGV and ARKG, there was recent selling too. But again, selling on ETFs and stocks with great fundamentals represents a value opportunity.

Source: www.mapsignals.com, End of day data sourced from Tiingo.com

Here’s why I like these ETFs: they are highly concentrated with fundamentally superior stocks. Below we see a table of three stocks in each ETF. They are some of the highest weightings in each.

Notice their fundamental scores are very strong on a scale from 0-100. This means strong growing sales, earnings, and profits over one and three years. This is how MAPsignals boils down all its fundamental research into one elegant score.

Now with XLF, ITB, and XLC – we see the stocks also have strong technical scores. That means Big Money has been pouring into them, lifting them to new highs. They are buoyant with Big Money support. But in IGV and AKG, we see weak technical scores. This means Big Money has been exiting the stocks.

But before you get spooked, let’s keep the recent environment in mind: Growth has fallen out of favor while value and reopen stocks have become all the rage. But it’s essential to remember these growth companies create phenomenal products and services enhancing our lives. I don’t foresee that stopping in the future. The recent selling is temporary and thematic.

What really drives this home is looking at how long-term Big Money buying can lead to monstrous gains. Below are charts showing all the instances these stocks were Top stocks in our research since 2015: our weekly report of outliers. We don’t need to go into details on each chart.

I’d like you to notice a few things:

• When Big Money buying pours in, stocks go up

• Repeated outliers, especially for years often means outsized gains

Owning outlier stocks is the way I try to beat markets. Easy exposure to many stocks can be achieved by buying ETFs. But just like anything, you must be in the 1% if you want to be in the 1%.

We can find outlier ETFs by tracking the Big Money. But that alone isn’t enough: when we catalog the components and find outlier stocks underneath… that’s the winning recipe.

So, there you have it: the 5 best ETFs that Big Money has been trafficking in recently. Outlier ETFs hold outlier stocks. Finding them is the key to finding potentially outlier gains.

Now let’s look at what those look like:

Source: www.mapsignals.com, End of day data sourced from Tiingo.com

The Bottom Line

XLF, ITB, XLC, IGV, & ARKG represent top ETFs for June 2021. Financials, homebuilders, & Communications stocks have performed well lately, which should continue. Software and Genomics companies have reached interesting levels, too. Paying attention to the fundamental quality of ETF constituents is paramount.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.