Sunday, May 23, 2021 1:04:37 AM

****Sunday Morning Line Tip Sheet****

.

.

.

.

.

Racetrack program: $3 with $8 premium

Sunday Fun Day

OK '''Lets Fire This Train UP'''' and

Welcome to Turf Paradise at JD Downs

Track Side Stage

Little Big Town (LIVE)

.

.

Race Time

Sunday 5/23/2021 Post Time 6PM EST Metals Futures Open Live

.

.

.

Sunday Forum Features

This week, Andrew Maguire targets the crucial stairsteps for gold and silver amidst the current volatile mix of a strong dollar and rising bond yields, and offers a marketwide update heading into a fast-closing Basel III window.

The precious metals expert breaks down the CME’s seemingly counterintuitive decision to reduce margins into a rising gold price, and shares price expectations for gold and silver ahead of next week’s BIS options expiry.

Turning to the silver squeeze, the long-time wholesaler runs through the knock-on effect of Reddit-driven physical silver demand forcing discipline on the 500-1 leveraged paper markets.

.

.

.

What's next for gold price after 'game-changing' week?

Friday May 21, 2021 13:24

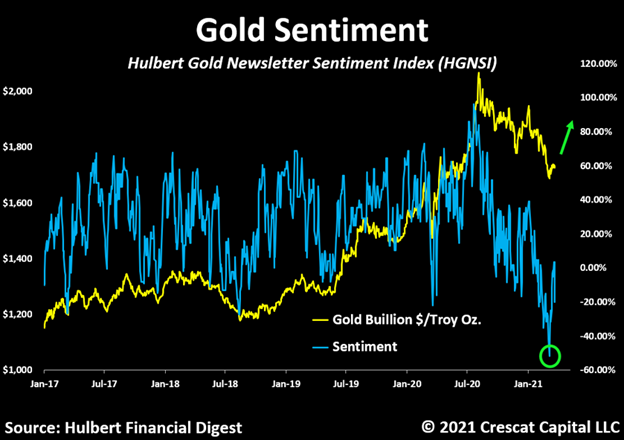

(Kitco News) This week was a "game-changer" for gold as prices climbed towards the $1,900 an ounce level while the rest of the markets saw chaotic trading, according to analysts.

After a massive selloff in the crypto space, gold's appeal is back on the radar for many investors, including new institutional money, OANDA senior market analyst Edward Moya told Kitco News.

"This was one of those weeks that was a game-changer for many traders. The crypto bubble popped. And even though cryptos are not going away anytime soon, the argument that bitcoin is a good inflation hedge, which has been attracting a lot of institutional money, has been questioned," Moya said. "Going forward, people will be much more aware and concerned about bitcoin volatility. This is leading to waves of money coming back into gold. The gold-backed ETF selling has now stopped as well. I'm bullish on gold."

After a very decent April and May, gold is on a cusp of trading significantly higher, said TD Securities head of global strategy Bart Melek.

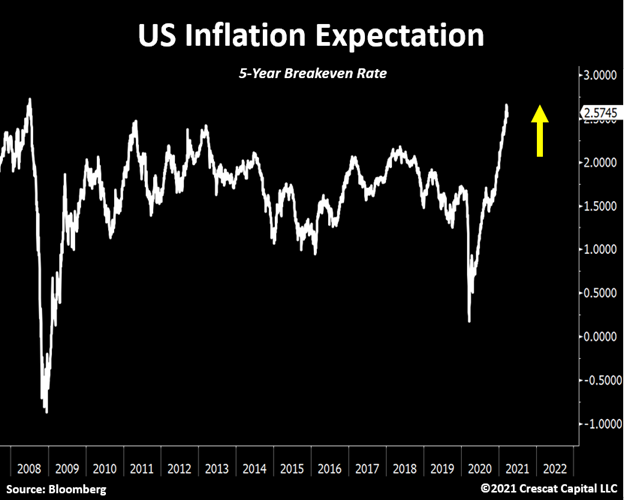

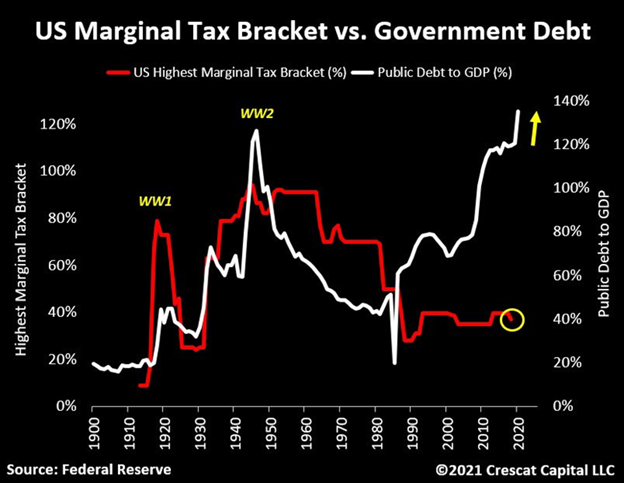

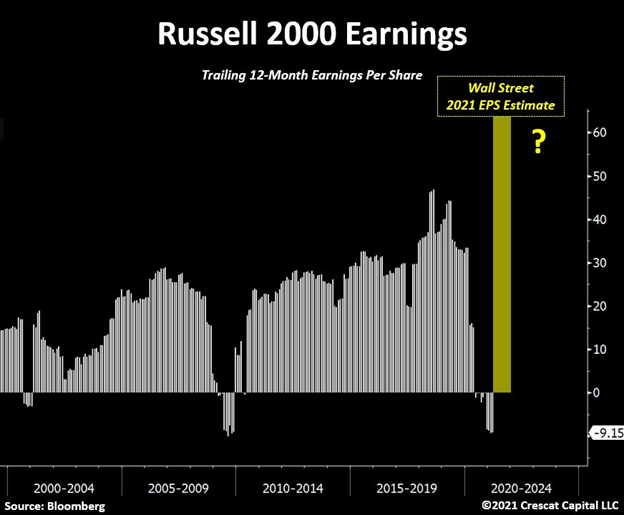

"The $,1900+ gold levels are in the cards in the not too distant future. We will see how aggressive the Fed is on tightening. I don't think it will be. Inflationary expectations will move higher as we conclude that the Fed is quite happy and ready to allow inflation to move above target," he said.

Is Fed's tapering a risk for gold?

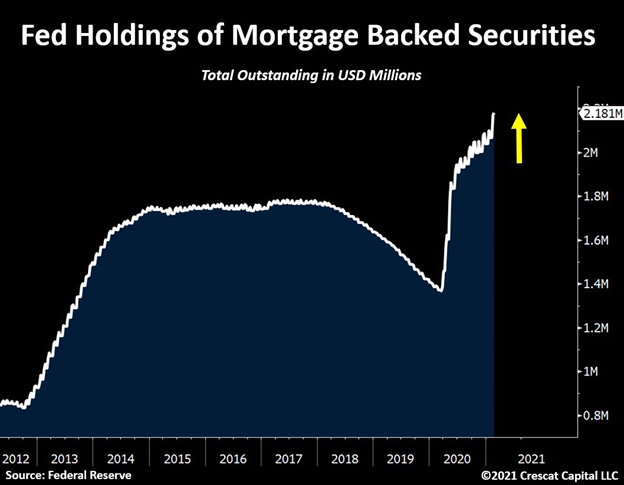

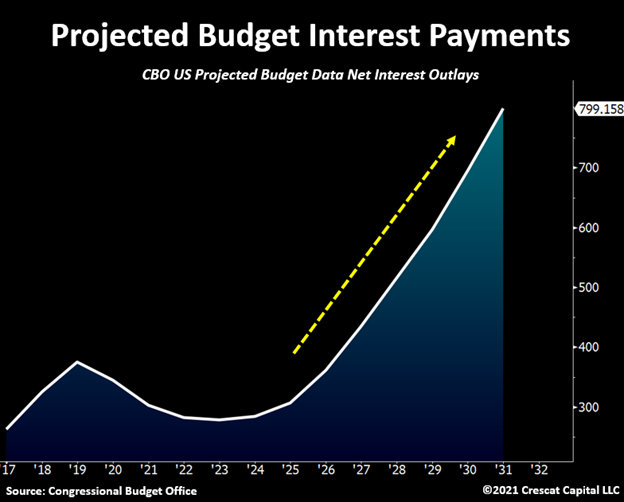

One risk that remains is tapering by the Federal Reserve, which could trigger another surge in the U.S. 10-year Treasury yields, Moya said.

"The movement in the bond market is likely to provide the primary risk for gold. The surging Treasury yields story is kryptonite for gold. But the Fed is locked in, and it can't just flip and start to normalize policy. That will trigger too much chaos," Moya said.

And despite the comments in the Fed's April meeting minutes that some officials would be ready to start talking about tapering at "upcoming meetings" depending on economic progress, the Fed is still likely to be one of the last central banks to tighten. And this is an excellent environment for gold.

"Due to the risks that are brewing, gold will benefit as an inflation hedge and a safe-haven asset. Other central banks will be in the tightening mode a lot sooner than the Fed. And that means weaker dollar," Moya added.

When the minutes were released on Wednesday, gold managed to hold and look past the tapering comments, said Melek. That was partly due to markets shifting their expectations from a robust recovery to a slightly slower one.

"The expectation is that the data cycle is going to disappoint with the markets adjusting downwards. Even though we will get tapering at some point, I don't envision an environment where real interest rates advance very much. This is a supportive environment for gold," he told Kitco News.

Levels to watch

With the $1,900 an ounce on the horizon, markets might not have to wait too long to see that breached.

"We are likely to see gold still move past the $1,900 mark. When you look at the gold flow from last week, we were firmly around $1,820-30. Now we are at $1,870, and we passed the 200-day moving average," Melek said. "Short positions in gold are also unwinding. There's plenty of room to go higher."

Gold's outlook is bullish in the short and medium-term, Moya stated. "We are going to see a couple of more attempts at $1,900 next week. I will not be surprised if we take that level out soon."

Gold is definitely in an uptrend, but the precious metal needs to make sure it holds the $1,846 as a support level, Phoenix Futures and Options LLC president Kevin Grady told Kitco News.

"I remain neutral on gold. We could get a pullback. For me, a big number is $1,846. It is a really big support level. If we re-test it next week, it needs to hold. If we don't, the next level of support for gold is $1,808."

Key data next week

There are a few important data releases to watch next week, especially Tuesday's CB consumer confidence, Thursday's U.S. Q1 GDP and durable goods orders numbers, as well as Friday's personal income and the PCE price index.

"Consumer confidence is quite important here even though it is a lagging indicator. Also, the releases to watch are the durable goods orders and personal income," said Melek. "Weaker-than-expected data will end up being positive for gold. The market will conclude that despite what we saw in the minutes, there is no particular urgency to start tightening in any way."

Other data to keep an eye on include house price index and new home sales on Tuesday and jobless claims with pending home sales on Thursday.

By Anna Golubova

.

.

.

Clubhouse Stage

Dwight Yoakam, Clint Black, Ricky Skaggs, Alan Jackson, Brad Paisley, Carrie Underwood LIVE

.

.

.

.

.

.

.

.

.

.

.

.

.

Jockey Weekly Tip Sheets (free with admission)

The dollar – ended the week marginally lower amid lots of vol…

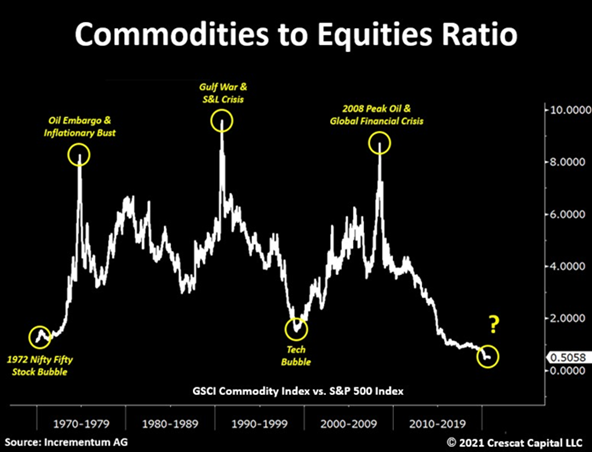

Commodities fell for the 2nd straight week…

Copper was down for the 2nd straight week – its biggest weekly loss since September…

And the short-end term structure for copper has plunged negative (3m forward prices below spot) for the first time in a year suggesting buyers are finally taking a break…

Thanks to three limit-up moves from Wednesday’s limit-down lows, Lumber managed gains on the week after last week’s plunge…

Amid all this turmoil, Treasuries ended the week practically unchanged (long-end modestly outperforming -1bps vs the belly +1bps

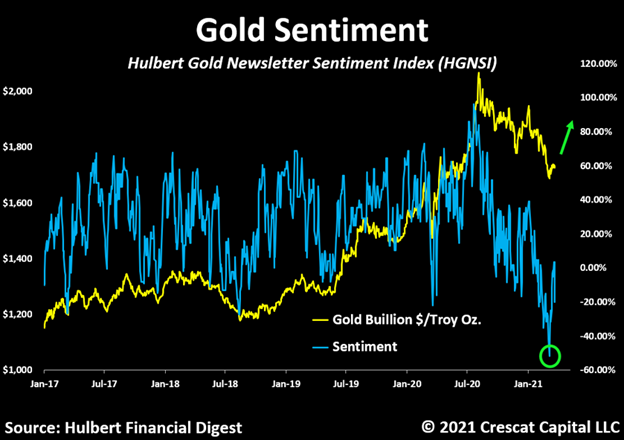

Gold rallied for the 3rd week in a row (up 6 of the last 7 weeks) to its highest weekly close since January 1st (decoupling a little from real yields this week)…

Gold is also now up 7 days in a row (and up 12 of the last 13 days), closing above its 50DMA for the first time since January…

Oil suffered it first losing week in the last month…

US Macro Surprise Index went red for the first time since June 2020…

.

.

.

Hot Paper Handbill Certs 2 for .25cents

..

.

.

Race Pen viewing area

1. "Silver Shot" 5/1

2."Show Me The Money Copper" 7/2

3."Bursting Platinum" 5/4

4. Scratched

5."Wheres My Legs Gold" 4/1

6."Too Much Coffee Palladium" 5/2

Scratched

"Drink Me Oil"

.

.

Public Handicapper Selections: Wheres My Legs Gold, Silver Shot, Too Much Coffee Palladium, Bursting Platinum,

Trainers Morning Line Most Active (Top Purse)

New Found Gold

Pacific Booker Minerals

Nouveau Monde Graphite

Gatos Silver

Filo Mining

Arizona Metals

Solaris Resources

Centerra Gold

Great Bear Resources

Maverix Metals

Artemis Gold

Chesapeake Gold

Aura Minerals

Eskay Mining

Orla Mining

Trainers High Cotton Contenders (In the money)

Altair Resources

Capstone Mining

Trevali Mining

Andean Precious Metals

NuLegacy Gold

Uranium Energy

Kinross Gold

Nevada Copper

Fremont Gold

Labrador Gold

Ivanhoe Mines

Emerita Resources

B2Gold

Denison Mines

Lundin Mining

.

.

.

and don't forget we offer fine dining at the

Hungry Miner Buffet

Hungry Miner Stage

Kelsea Ballerini shows up at the Hungry Miner buffet and surprises Landon Wall!!! LIVE

.

.

.

..

.

.

.

.

Disclaimer

.

.

J:Ds

.

.

.

.

.

.

.

.

.

.

............O........V..........E...........Network.........

.

.

.

.

.

Racetrack program: $3 with $8 premium

Sunday Fun Day

OK '''Lets Fire This Train UP'''' and

Welcome to Turf Paradise at JD Downs

EnJoy you're day and see you tonight for the Metals Futures Open

Track Side Stage

Little Big Town (LIVE)

.

.

Race Time

Sunday 5/23/2021 Post Time 6PM EST Metals Futures Open Live

.

.

.

Sunday Forum Features

This week, Andrew Maguire targets the crucial stairsteps for gold and silver amidst the current volatile mix of a strong dollar and rising bond yields, and offers a marketwide update heading into a fast-closing Basel III window.

The precious metals expert breaks down the CME’s seemingly counterintuitive decision to reduce margins into a rising gold price, and shares price expectations for gold and silver ahead of next week’s BIS options expiry.

Turning to the silver squeeze, the long-time wholesaler runs through the knock-on effect of Reddit-driven physical silver demand forcing discipline on the 500-1 leveraged paper markets.

.

.

.

What's next for gold price after 'game-changing' week?

Friday May 21, 2021 13:24

(Kitco News) This week was a "game-changer" for gold as prices climbed towards the $1,900 an ounce level while the rest of the markets saw chaotic trading, according to analysts.

After a massive selloff in the crypto space, gold's appeal is back on the radar for many investors, including new institutional money, OANDA senior market analyst Edward Moya told Kitco News.

"This was one of those weeks that was a game-changer for many traders. The crypto bubble popped. And even though cryptos are not going away anytime soon, the argument that bitcoin is a good inflation hedge, which has been attracting a lot of institutional money, has been questioned," Moya said. "Going forward, people will be much more aware and concerned about bitcoin volatility. This is leading to waves of money coming back into gold. The gold-backed ETF selling has now stopped as well. I'm bullish on gold."

After a very decent April and May, gold is on a cusp of trading significantly higher, said TD Securities head of global strategy Bart Melek.

"The $,1900+ gold levels are in the cards in the not too distant future. We will see how aggressive the Fed is on tightening. I don't think it will be. Inflationary expectations will move higher as we conclude that the Fed is quite happy and ready to allow inflation to move above target," he said.

Is Fed's tapering a risk for gold?

One risk that remains is tapering by the Federal Reserve, which could trigger another surge in the U.S. 10-year Treasury yields, Moya said.

"The movement in the bond market is likely to provide the primary risk for gold. The surging Treasury yields story is kryptonite for gold. But the Fed is locked in, and it can't just flip and start to normalize policy. That will trigger too much chaos," Moya said.

And despite the comments in the Fed's April meeting minutes that some officials would be ready to start talking about tapering at "upcoming meetings" depending on economic progress, the Fed is still likely to be one of the last central banks to tighten. And this is an excellent environment for gold.

"Due to the risks that are brewing, gold will benefit as an inflation hedge and a safe-haven asset. Other central banks will be in the tightening mode a lot sooner than the Fed. And that means weaker dollar," Moya added.

When the minutes were released on Wednesday, gold managed to hold and look past the tapering comments, said Melek. That was partly due to markets shifting their expectations from a robust recovery to a slightly slower one.

"The expectation is that the data cycle is going to disappoint with the markets adjusting downwards. Even though we will get tapering at some point, I don't envision an environment where real interest rates advance very much. This is a supportive environment for gold," he told Kitco News.

Levels to watch

With the $1,900 an ounce on the horizon, markets might not have to wait too long to see that breached.

"We are likely to see gold still move past the $1,900 mark. When you look at the gold flow from last week, we were firmly around $1,820-30. Now we are at $1,870, and we passed the 200-day moving average," Melek said. "Short positions in gold are also unwinding. There's plenty of room to go higher."

Gold's outlook is bullish in the short and medium-term, Moya stated. "We are going to see a couple of more attempts at $1,900 next week. I will not be surprised if we take that level out soon."

Gold is definitely in an uptrend, but the precious metal needs to make sure it holds the $1,846 as a support level, Phoenix Futures and Options LLC president Kevin Grady told Kitco News.

"I remain neutral on gold. We could get a pullback. For me, a big number is $1,846. It is a really big support level. If we re-test it next week, it needs to hold. If we don't, the next level of support for gold is $1,808."

Key data next week

There are a few important data releases to watch next week, especially Tuesday's CB consumer confidence, Thursday's U.S. Q1 GDP and durable goods orders numbers, as well as Friday's personal income and the PCE price index.

"Consumer confidence is quite important here even though it is a lagging indicator. Also, the releases to watch are the durable goods orders and personal income," said Melek. "Weaker-than-expected data will end up being positive for gold. The market will conclude that despite what we saw in the minutes, there is no particular urgency to start tightening in any way."

Other data to keep an eye on include house price index and new home sales on Tuesday and jobless claims with pending home sales on Thursday.

By Anna Golubova

.

.

.

Clubhouse Stage

Dwight Yoakam, Clint Black, Ricky Skaggs, Alan Jackson, Brad Paisley, Carrie Underwood LIVE

.

.

.

.

.

.

.

.

.

.

.

.

.

Jockey Weekly Tip Sheets (free with admission)

The dollar – ended the week marginally lower amid lots of vol…

Commodities fell for the 2nd straight week…

Copper was down for the 2nd straight week – its biggest weekly loss since September…

And the short-end term structure for copper has plunged negative (3m forward prices below spot) for the first time in a year suggesting buyers are finally taking a break…

Thanks to three limit-up moves from Wednesday’s limit-down lows, Lumber managed gains on the week after last week’s plunge…

Amid all this turmoil, Treasuries ended the week practically unchanged (long-end modestly outperforming -1bps vs the belly +1bps

Gold rallied for the 3rd week in a row (up 6 of the last 7 weeks) to its highest weekly close since January 1st (decoupling a little from real yields this week)…

Gold is also now up 7 days in a row (and up 12 of the last 13 days), closing above its 50DMA for the first time since January…

Oil suffered it first losing week in the last month…

US Macro Surprise Index went red for the first time since June 2020…

.

.

.

Hot Paper Handbill Certs 2 for .25cents

..

.

.

Race Pen viewing area

1. "Silver Shot" 5/1

2."Show Me The Money Copper" 7/2

3."Bursting Platinum" 5/4

4. Scratched

5."Wheres My Legs Gold" 4/1

6."Too Much Coffee Palladium" 5/2

Scratched

"Drink Me Oil"

.

.

Public Handicapper Selections: Wheres My Legs Gold, Silver Shot, Too Much Coffee Palladium, Bursting Platinum,

Trainers Morning Line Most Active (Top Purse)

New Found Gold

Pacific Booker Minerals

Nouveau Monde Graphite

Gatos Silver

Filo Mining

Arizona Metals

Solaris Resources

Centerra Gold

Great Bear Resources

Maverix Metals

Artemis Gold

Chesapeake Gold

Aura Minerals

Eskay Mining

Orla Mining

Trainers High Cotton Contenders (In the money)

Altair Resources

Capstone Mining

Trevali Mining

Andean Precious Metals

NuLegacy Gold

Uranium Energy

Kinross Gold

Nevada Copper

Fremont Gold

Labrador Gold

Ivanhoe Mines

Emerita Resources

B2Gold

Denison Mines

Lundin Mining

.

.

.

and don't forget we offer fine dining at the

Hungry Miner Buffet

Hungry Miner Stage

Kelsea Ballerini shows up at the Hungry Miner buffet and surprises Landon Wall!!! LIVE

.

.

.

..

.

.

.

.

Disclaimer

.

.

J:Ds

.

.

.

.

.

.

.

.

.

.

............O........V..........E...........Network.........

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.