| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Friday, May 07, 2021 4:20:38 PM

Weekly Investment Strategy | Markets and Investing

By: Raymond James Financial | May 7, 2021

Key Takeaways

• The disconnect between price & earnings recoveries

• Pricing pressures accompanying the recovery

• An ever growing dependence on technology

With more than 300 billion emails sent per day**, it is hard to believe that email has only been in existence for 50 years. While there have been countless improvements and innovations made to the system since its origination, the communication method itself has become an integral part of our daily lives, especially as many of us still work from home! As for the financial markets, the primary way corporations communicate their results, outlook, and analysis of critical trends and risks with shareholders is through earnings conference calls, and with more than 90% of the S&P 500’s market capitalization now reported, it is prudent to evaluate some of the messages firms have sent. At this juncture last year, these calls were not nearly as valuable due to the heightened uncertainty caused by the COVID-19 pandemic, but this year, the transcripts are critical in calibrating our equity market outlook.

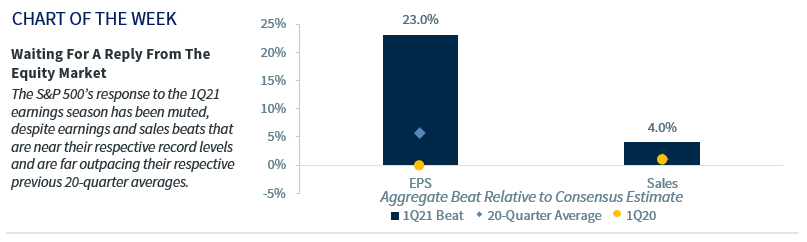

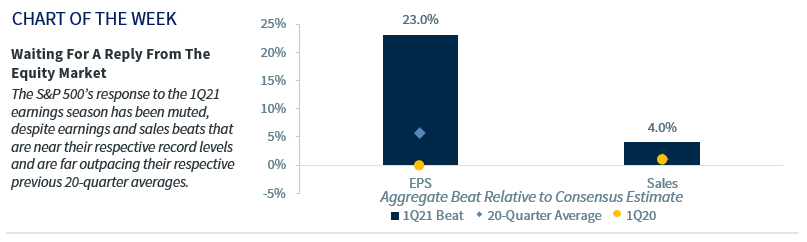

• Waiting For A Reply From The Market | Our expectation for an above-average earnings season has come to fruition with the strongest quarterly year-over-year earnings growth since 1Q10, sales and earnings beats near record levels, and consensus earnings estimates for 2021 and 2022 being revised 5.6% and 3.1% higher respectively. Despite these improving trends, the S&P 500 has rallied only 1.5% since the unofficial start of earning season. This lack of market response suggests that these results were already priced in, and that near-term risks (e.g., tax hikes, political tensions) are weighing on investors’ minds.

• Catalysts For Earnings Rebound Could Be Copied | In reviewing the transcripts for numerous companies across various industries, the catalysts supporting the earnings rebound were similar. The key drivers mentioned are the same fundamental reasons we’ve maintained for our long-term positive view: (1) the US economy moving toward a sustainable reopening, (2) the robust pace of vaccinations and (3) record breaking fiscal stimulus. In addition, other messages that regularly appeared include:

1. Pandemic Deepened The Attachment To Technology | With heightened levels of cash on balance sheets, many companies outlined either planned or already completed tech-oriented capital expenditures. Whether it be improving the online customer experience, providing more exact delivery times for packages, or expanding payment options, it is clear that “technology will be a powerful engine” for the recovery and future growth as “technology needs continue to evolve at a rapid pace.”

2. Consumer Dependence On Deliveries | While e-commerce was a growing trend prior to the pandemic, the lockdowns led to an increase in online orders as consumers sought items unavailable at their local stores or simply desired to avoid brick and mortar retail locations for health reasons. Earnings calls across various industries showed that “digital is a significant growth opportunity,” with some firms hoping to maintain their sizable gains in digital households. Package carriers reinstating “next-day service guarantees” due to customers placing a “high value on the reliability” only accentuates on-line importance.

3. Companies Subscribing To The ESG Movement | There has been no shortage of companies making headlines for initiatives related to ESG principles, and the 1Q21 earnings calls only added to the list as pharmaceutical companies expressed concerns over patient access and pricing in all communities, retailers adding transparency about board composition, hotel chains highlighting shifts towards renewable energy sources, and tech companies stressing the lowering of their carbon footprint.

4. COVID-19 Impact Still In The Subject Line For Some Companies | With the hope for a sustainable reopening becoming a reality, investors turned to ‘reopening’ companies with expectations that the rebound would most benefit these stocks. Our concern: a price-to-earnings disconnect as many of these stocks have recovered much of their price declines without the accompanying bounce back in revenues and earnings. For example, hotel chains are facing a lack of visibility in bookings with some 30% or more below pre-COVID revenues, airlines are missing business travelers with some commenting that margins may not be recovered until 2023, and cruise lines are yet to resume operations in the US.

5. May Not Be Able To Transmit Price Increases To Consumers | We’ve anticipated the base effects of the recovery resulting in a transitory rise in inflation, and many of the largest companies within the S&P 500 identified issues related to backlogs, supply chain disruptions, and rising commodity costs. While some industries may have more leverage than others, the Consumer Staples sector may have difficulty passing on their input price increases to consumers as necessary “temporary COVID-19 spending” on items such as cleaning supplies, sanitizer, paper towels and toilet paper wanes.

Read Full Story »»»

DiscoverGold

DiscoverGold

By: Raymond James Financial | May 7, 2021

Key Takeaways

• The disconnect between price & earnings recoveries

• Pricing pressures accompanying the recovery

• An ever growing dependence on technology

With more than 300 billion emails sent per day**, it is hard to believe that email has only been in existence for 50 years. While there have been countless improvements and innovations made to the system since its origination, the communication method itself has become an integral part of our daily lives, especially as many of us still work from home! As for the financial markets, the primary way corporations communicate their results, outlook, and analysis of critical trends and risks with shareholders is through earnings conference calls, and with more than 90% of the S&P 500’s market capitalization now reported, it is prudent to evaluate some of the messages firms have sent. At this juncture last year, these calls were not nearly as valuable due to the heightened uncertainty caused by the COVID-19 pandemic, but this year, the transcripts are critical in calibrating our equity market outlook.

• Waiting For A Reply From The Market | Our expectation for an above-average earnings season has come to fruition with the strongest quarterly year-over-year earnings growth since 1Q10, sales and earnings beats near record levels, and consensus earnings estimates for 2021 and 2022 being revised 5.6% and 3.1% higher respectively. Despite these improving trends, the S&P 500 has rallied only 1.5% since the unofficial start of earning season. This lack of market response suggests that these results were already priced in, and that near-term risks (e.g., tax hikes, political tensions) are weighing on investors’ minds.

• Catalysts For Earnings Rebound Could Be Copied | In reviewing the transcripts for numerous companies across various industries, the catalysts supporting the earnings rebound were similar. The key drivers mentioned are the same fundamental reasons we’ve maintained for our long-term positive view: (1) the US economy moving toward a sustainable reopening, (2) the robust pace of vaccinations and (3) record breaking fiscal stimulus. In addition, other messages that regularly appeared include:

1. Pandemic Deepened The Attachment To Technology | With heightened levels of cash on balance sheets, many companies outlined either planned or already completed tech-oriented capital expenditures. Whether it be improving the online customer experience, providing more exact delivery times for packages, or expanding payment options, it is clear that “technology will be a powerful engine” for the recovery and future growth as “technology needs continue to evolve at a rapid pace.”

2. Consumer Dependence On Deliveries | While e-commerce was a growing trend prior to the pandemic, the lockdowns led to an increase in online orders as consumers sought items unavailable at their local stores or simply desired to avoid brick and mortar retail locations for health reasons. Earnings calls across various industries showed that “digital is a significant growth opportunity,” with some firms hoping to maintain their sizable gains in digital households. Package carriers reinstating “next-day service guarantees” due to customers placing a “high value on the reliability” only accentuates on-line importance.

3. Companies Subscribing To The ESG Movement | There has been no shortage of companies making headlines for initiatives related to ESG principles, and the 1Q21 earnings calls only added to the list as pharmaceutical companies expressed concerns over patient access and pricing in all communities, retailers adding transparency about board composition, hotel chains highlighting shifts towards renewable energy sources, and tech companies stressing the lowering of their carbon footprint.

4. COVID-19 Impact Still In The Subject Line For Some Companies | With the hope for a sustainable reopening becoming a reality, investors turned to ‘reopening’ companies with expectations that the rebound would most benefit these stocks. Our concern: a price-to-earnings disconnect as many of these stocks have recovered much of their price declines without the accompanying bounce back in revenues and earnings. For example, hotel chains are facing a lack of visibility in bookings with some 30% or more below pre-COVID revenues, airlines are missing business travelers with some commenting that margins may not be recovered until 2023, and cruise lines are yet to resume operations in the US.

5. May Not Be Able To Transmit Price Increases To Consumers | We’ve anticipated the base effects of the recovery resulting in a transitory rise in inflation, and many of the largest companies within the S&P 500 identified issues related to backlogs, supply chain disruptions, and rising commodity costs. While some industries may have more leverage than others, the Consumer Staples sector may have difficulty passing on their input price increases to consumers as necessary “temporary COVID-19 spending” on items such as cleaning supplies, sanitizer, paper towels and toilet paper wanes.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.