| Followers | 923 |

| Posts | 48285 |

| Boards Moderated | 0 |

| Alias Born | 07/22/2008 |

Wednesday, May 05, 2021 9:46:59 AM

In April 2010, the Company’s Board of Directors authorized and approved the implementation of a reverse common stock split at a ratio of one-for-one hundred shares and authorized and directed the Company to file an amendment to its Certificate of incorporation, as amended to date, with the Delaware Secretary of State to effect that reverse stock split. As of May 13, 2010, the effective date of the reverse stock split, every hundred (100) shares of the Company’s common stock outstanding prior to the reverse split was converted into one (1) “new” share of the Company’s common stock outstanding after the reverse stock split. The reverse split reduced the number of outstanding shares of the Company’s common stock from approximately 23.5 million shares to 235,088 shares. Any stockholder who would have received a fraction of a share of common stock after the reverse stock split instead received a cash payment in lieu of that fractional share based on the recent OTCQX trading price of Proxim’s common stock. The exercise price and number of shares of common stock issuable under the Company’s outstanding warrants and options and under its equity incentive plans were proportionately adjusted to reflect the reverse common stock split. The number of common shares issuable upon conversion of the Company’s Series A preferred stock and the number of votes associated with the Company’s Series A preferred stock were proportionately reduced to reflect the reverse common stock split.

---o---

FLOAT in 2015: 235,088

I think they forgot that they owned this, lol...

Current price: $3.44

Market Cap: $820,625

AS 5,000,000

OS 238,554

FLOAT (2015) $235,088

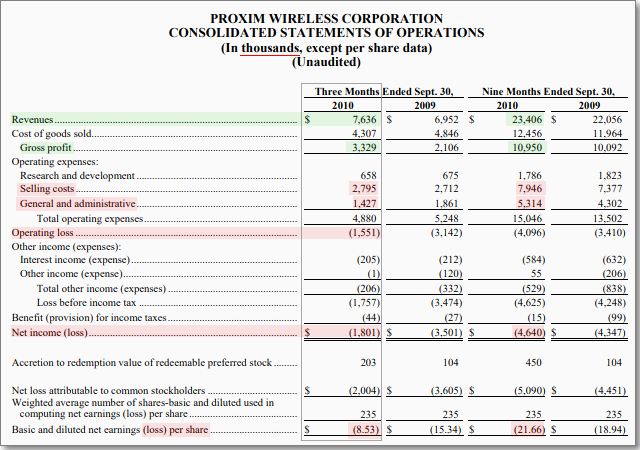

They were doing approximately $30,000,000 in revenues...

Lost ~$2 million in the quarter...

Lost $8.53 per share (OS 235k)...

--- new owner SRA Holdings, Japanese ---

Lose the Selling costs & Gen/Admin +$4 million...

Turns $2 million loss into $2 million gain...

Earns $8.53 per share...

$8.50 x 4 quarters = $34 EPS (trailing twelve months)

P/E ratio 20 = pps $68

P/E ratio 30 = pps $103

Current pps: $3.44

Of course, turning that $2 million loss per Q into $2 million gain per Q is/was the tricky part.

Did the SRA OSS, SRA Inc, SRA Holding Inc, Japanese, get this turned around?

Chart is Monthly. NO DILUTION and NO VOLUME in 11 years!

PRXM Buy

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM