Kitco News Kitco News

Thursday April 29, 2021

https://youtu.be/vWY855esnPA

(Kitco News) - A global shortage of physical gold and silver products has created a premium on coins and bars, and this premium is causing a disconnect between the spot price and the "true" price that retail investors need to pay, said Ed Moy, former director of the U.S. Mint.

Moy, who was the director of the U.S. Mint between 2006 and 2011, cites the inability of the mints around the world to keep up with physical coin and bar demand as a reason for this shortage.

"Not only the U.S. Mint, but other Mints around the world, Australia's Perth Mint, the Mexican Mint, have all run out of gold, they can't keep it in spot and there's so many shortages retailers are having problems accessing that gold," Moy told Michelle Makori, Kitco's editor-in-chief.

Premiums on these physical gold and silver products can run as high as 20% in some places, Moy said.

"If you go to any of the top retailers for gold bullion and take a look at what they're charging for an ounce American Eagle gold bullion coin, even though the spot price right now is $1,775 give or take, you're hard pressed to find a ounce gold coin for anything less than $2,000, and I've seen it as high as $2,100," he said.

One of the main reasons for why the spot prices have not caught up to gold and silver's premium-adjusted price is that the overall markets are flooded with bullion derivatives, Moy said, but it's only a matter of time before the short contracts keeping the price down expire.

"What's artificially depressing the price of gold now is that there's a lot of institutional investors that don't hold gold. What they hold is they buy gold derivatives, like futures...and a lot of them are betting that the economy's going to recover and that everything's going to be fine and gold's going to go down," he said. "As those short contracts come up, what you're seeing is a popping in price."

By Kitco News

https://investorshub.advfn.com/Monument-Mining-TSXV-MMY-13403/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=163511976

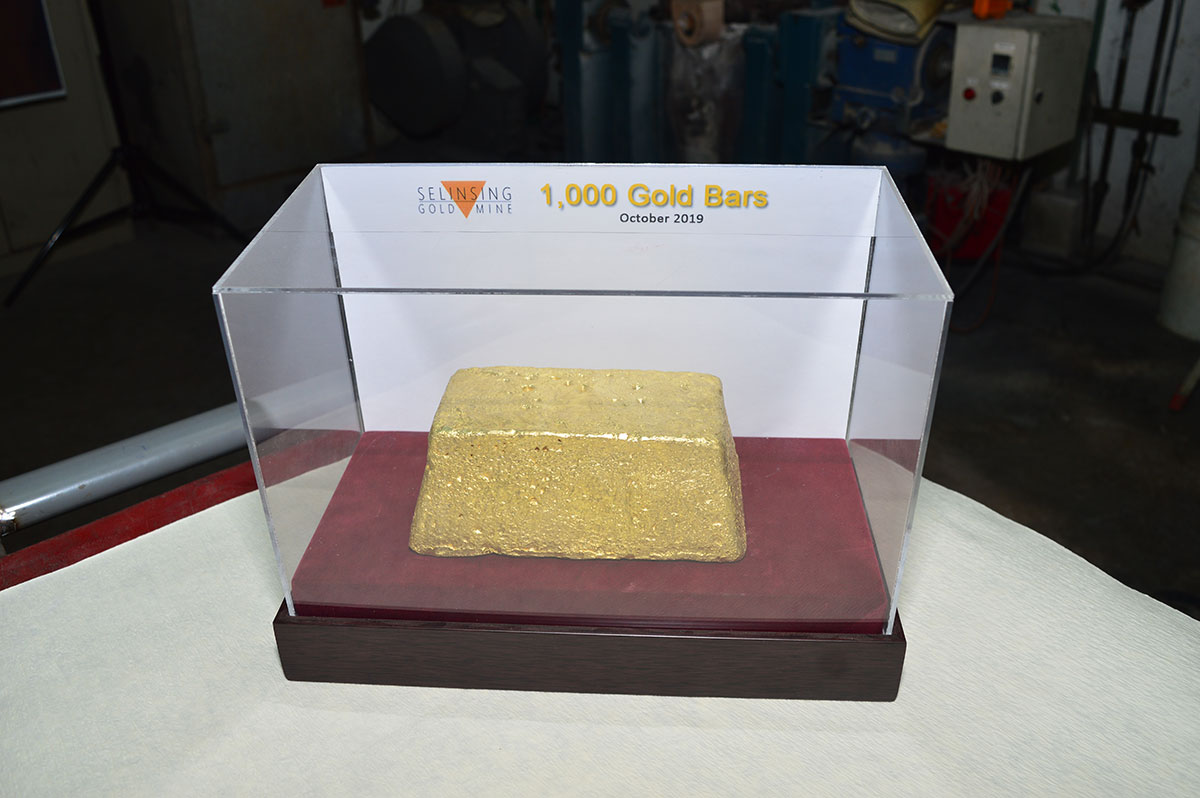

$Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new

great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future

years the weather is good no curtain needed -

$1,000th Gold Bar Pour Produced by MMY; Photo Gallery

https://www.monumentmining.com/news-media/photo-gallery/

$Market Cap $46 mil. - No Debt - someone has to be kidding

is it the fact ???

What a Great Gold Mines bargain

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered

Imo!

$Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit

Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA.

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM