| Followers | 325 |

| Posts | 20159 |

| Boards Moderated | 5 |

| Alias Born | 12/15/2012 |

Friday, April 02, 2021 7:31:16 AM

#CRAZY_KARL: #SILJ: Silver Is A Sleeping Giant - Time To Load Up On SILJ

https://seekingalpha.com/article/4415513-silver-is-a-sleeping-giant-time-to-load-up-on-silj

Giant - Time To Load Up On SILJ

Mar. 23, 2021 4:50 AM ETETFMG Prime Junior Silver Miners ETF (SILJ)AGQ, DBS, DSLV...115 Comments63 Likes

Summary

Silver has not challenged its breakout level.

A higher high in 2021.

Consolidation continues - it’s just a matter of time - some inputs point to inflation.

The silver-gold ratio is a bullish sign for the silver market.

SILJ is likely to outperform the metal on the next leg higher.

Looking for a portfolio of ideas like this one? Members of Hecht Commodity Report get exclusive access to our model portfolio. Learn More »

We have just passed the first anniversary of silver's elevator shaft ride to the lowest level since 2009. The volatile precious metal became a falling knife during last year's COVID-19-inspired risk-off period. The price fell through technical support at the December 2015 $13.635 low on its way to $11.74 per ounce.

The spike low did not last for long. Silver was back over the $12 level in March 2020. In April, the price rose above $16 per ounce. May took silver to a high of over $18.50, and in July, the price eclipsed the level of critical technical resistance at the July 2016 $21.095 high. In 2020, silver reached a high of $29.915 per ounce, the highest price since early 2013. Last year's $18.175 range was the widest since 2011 when silver reached a high of $49.82 per ounce.

As we head towards the end of 2021's first quarter, silver has been sleeping. Since the start of this year, the range has been $6.31 on the continuous futures contract, but the precious metal put in a marginally higher high when it traded to $30.35 on February 1. Silver was sitting below the midpoint of its 2021 trading range on Monday, March 22, as the precious metal is consolidating and digesting its gains over the past year.

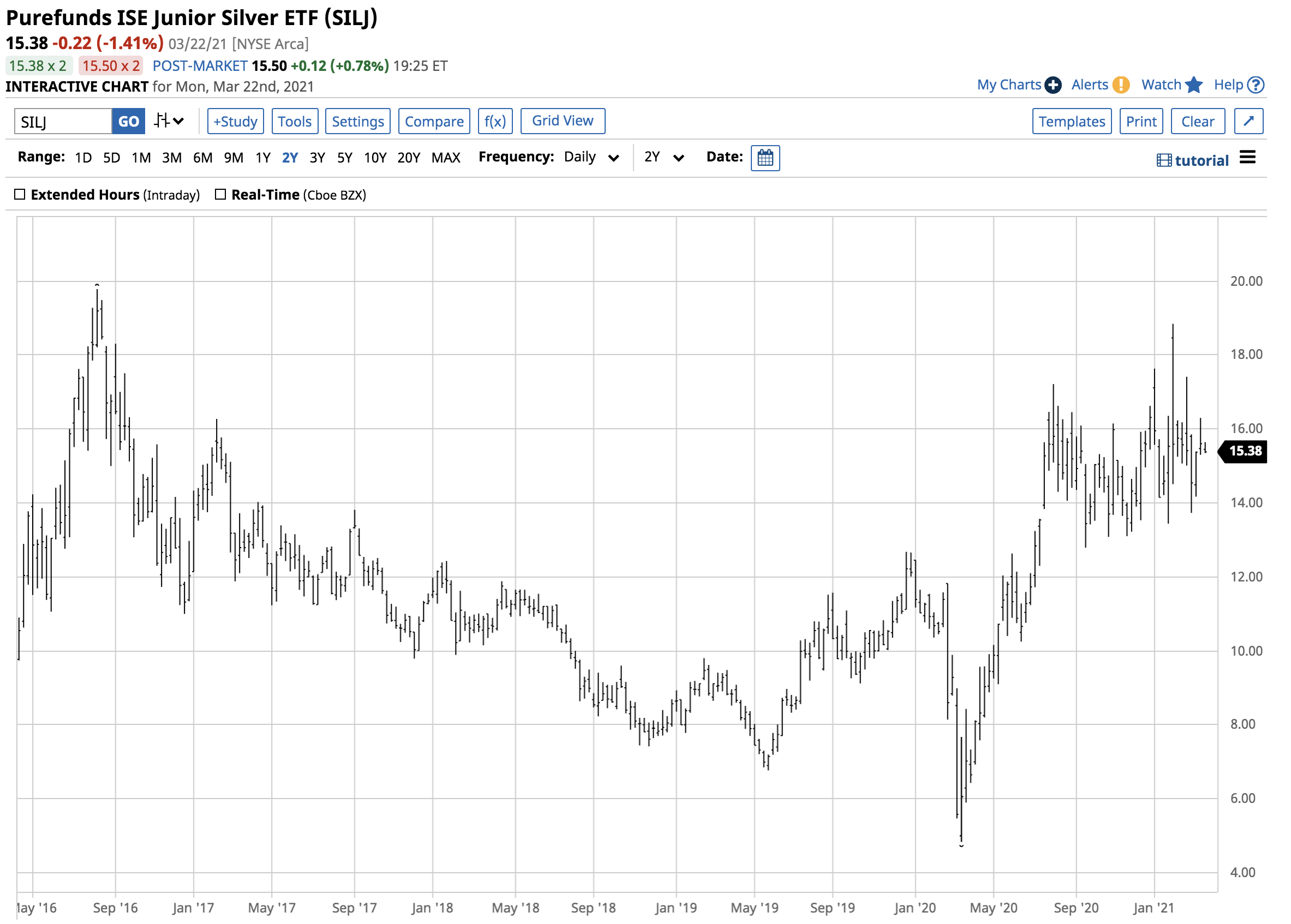

This could be the perfect time to add the ETFMG Prime Junior Silver Miners ETF product (SILJ) to your portfolio. As we learned last year, when silver decides to take off on the upside, the volatile metal takes no prisoners.

Silver has not challenged its breakout level

Last July, silver broke above its critical long-term resistance level at the July 2016 $21.095 peak. The resistance often becomes support, but silver has not returned near that level in 2021.

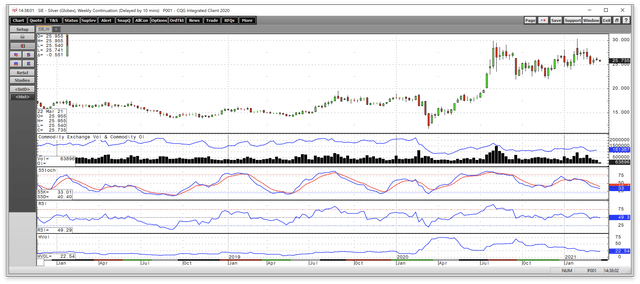

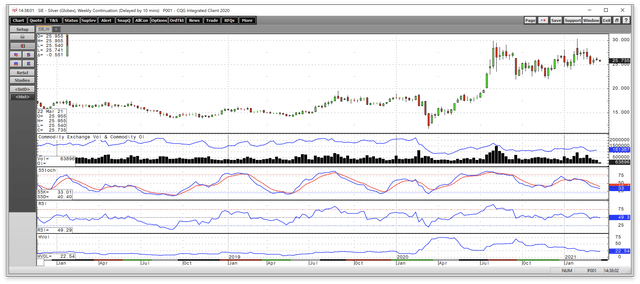

The weekly chart of the nearby COMEX silver futures contract highlights that the low in 2021 was at $24.04 per ounce in mid-January, which was $2.945 above the $21.095 breakout level. Silver has been digesting the price rise from 2020 and has made a series of higher lows.

The total number of open long and short positions in the silver futures arena stood at the 161,387-contract level as of March 19. The high in 2021 was at 184,832 contracts on February 1 when GameStop (NYSE:GME) inspired buying caused speculators to flock to the silver market. The open interest metric rose to 207,490 contracts in early August 2020 as silver reached its 2020 peak. The decline in open interest reflects an overall lack of investor and speculative interest in the silver market as the price moves sideways in its consolidation range.

The slow stochastic, a momentum indicator, was declining below a neutral reading. Even though silver has made higher lows throughout 2021, price momentum is falling. Relative strength is sitting at a neutral reading. Meanwhile, at 22.54%, weekly historical volatility is near the lowest level of 2021. The weekly price variance metric rose to a high of over 74% last March when silver plunged and moved to a lower high at over 68% in September 2020 when silver corrected to $21.96, its lowest level since it broke above the 2016 high. Silver volatility tends to spike higher during market corrections.

The bottom line is that while the bullish sentiment has evaporated from the silver market, the price has not violated any technical levels that would jeopardize the overall bullish price trend.

A higher high in 2021

The move to a higher high at $30.35 on February 1 was inspired by the wild speculative action inspired by GameStop and other stocks with high short interest levels.

On February 1, I wrote an article on Seeking Alpha titled Game On In Silver: This Could Be For Real. In that price and one that followed on March 1, I expressed the view that silver is digesting its rally, and it is just a matter of time before the price resumes its upward trajectory.

Silver rose to a higher high on February 1 and then corrected to a higher low of $24.905 on the continuous contract during the first week of March. I see no reason to alter my opinion of the silver market as the price trades sideways below the midpoint of its consolidation range.

Consolidation continues - It's just a matter of time - Some Inputs Point To Inflation

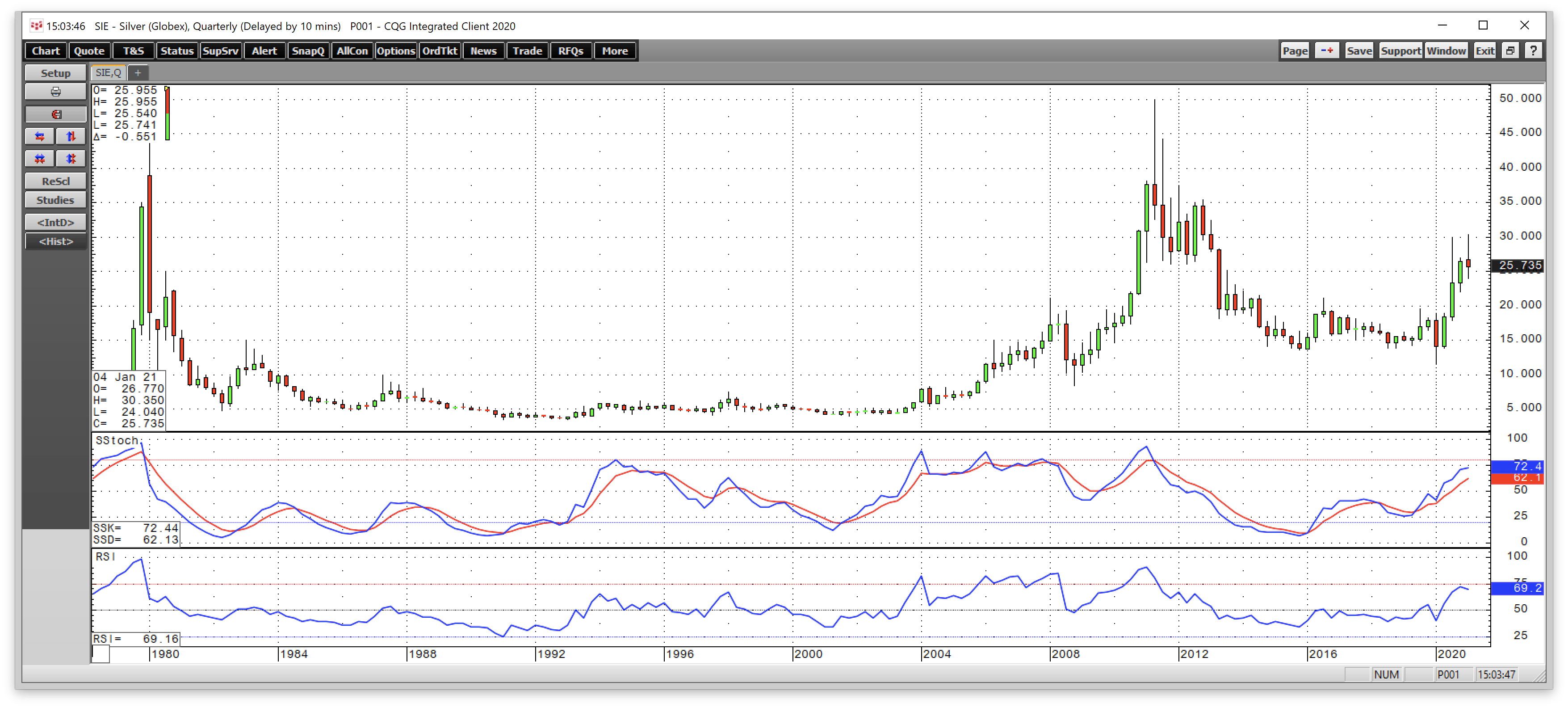

The long-term trend in the silver market remains bullish at just above the $25.75 level on March 22.

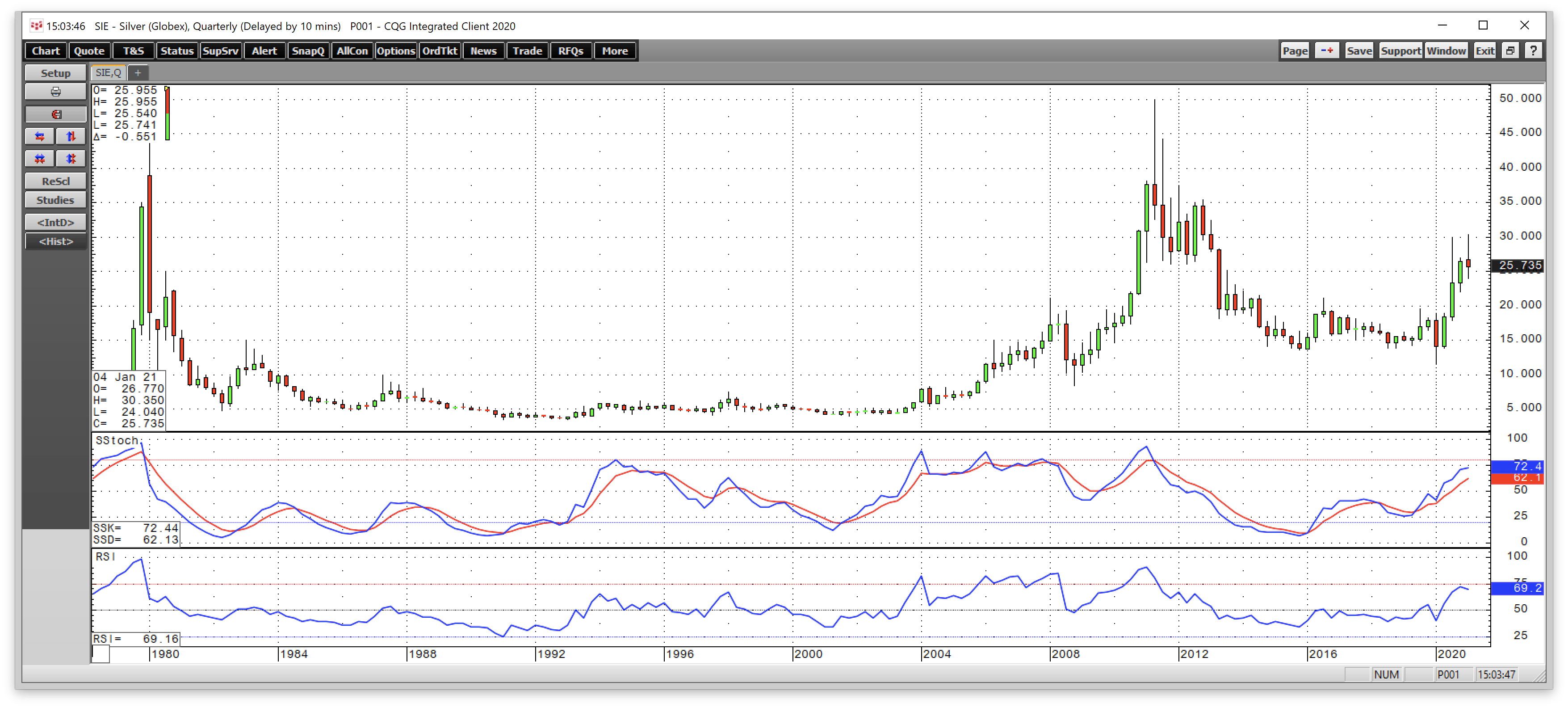

As the quarterly chart illustrates, long-term price momentum and relative strength indicators continue to point to a bullish trend in the silver market. A closing price above the $26.525 level on the nearby COMEX silver futures contract would establish the fourth consecutive quarterly gain in the silver futures market.

While silver consolidates, the US bond market has become a falling knife.

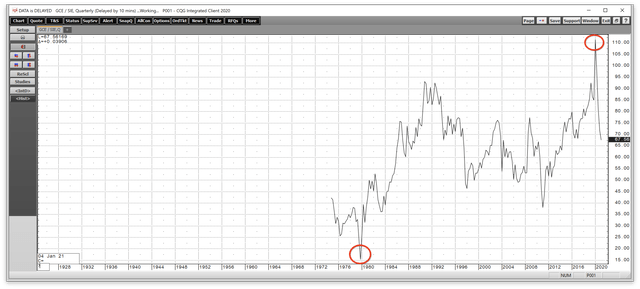

The chart of the US 30-Year Treasury bond futures contract shows the downward trajectory of the long bond and the upward pressure on interest rates on the yield curve. While the Fed keeps the short-term Fed Funds rate at zero percent and continues to purchase $120 billion in debt securities each month, bonds are ignoring the central bank. Simultaneously, the Fed continues to ignore the signal from the bond market that inflationary pressures are rising.

Inflation is historically bullish for silver and all commodity prices. Copper remains above $4 per pound, the highest level in a decade. Despite the recent correction, crude oil is sitting at over $61.50 per barrel. Grains are at over six-year highs, and many other raw material prices are validating the price action in the bond market. When real interest rates rise, it increases the cost of carrying commodities and weighs on their prices. However, when rates move to the upside because of inflation, commodities tend to appreciate.

Another bullish sign for the silver market is its historical price relationship with gold, the yellow metal that plays an integral role in the global financial system.

The silver-gold ratio is a bullish sign for the silver market

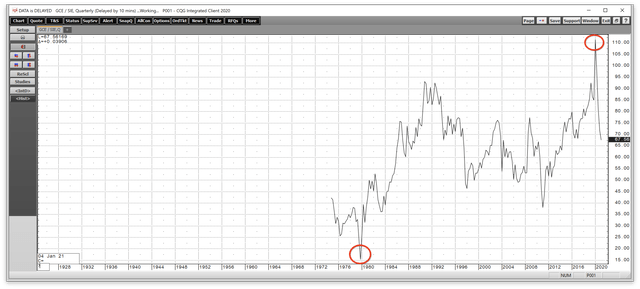

The silver-gold ratio had a volatile year in 2020. Before reverting towards the long-term median level, it exploded to a new record high when silver took the elevator shaft lower last March.

The long-term quarterly chart of the price of gold divided by silver's price shows that the ratio traded at a low of 15.47:1 in 1979 and rose to an all-time peak of 111.42:1 in 2020. The midpoint for the forty-one-year range is at 63.45:1. On Monday, March 22, April gold settled at $1738.10, with May silver at $25.769. The ratio was 67.45:1 as it moved towards the long-term median level.

The ratio tends to drop during bullish trends in the precious metals markets and rise when they are in bear markets. When gold and silver hit highs in 1980 and 2011, the ratio was well below the median level.

I view the current downward trend in the ratio as a bullish factor for gold and silver prices over the coming months.

SILJ is likely to outperform the metal on the next leg higher

As silver consolidates and digests the latest new high at $30.35 on February 1, the price is now over $4.50 below the most recent peak. Now could be the perfect time to purchase silver mining shares on a scale-down basis before the next leg to the upside.

Silver mining shares tend to outperform the price of silver on the upside and underperform during price corrections. Therefore, they act as leveraged tools for the silver market. Most leveraged products involve time decay as they use put and call options to create the gearing. However, silver mining shares have no expiration dates. The leverage comes from the ability to extract more silver at higher production costs from the earth's crust as the price of the metal appreciates.

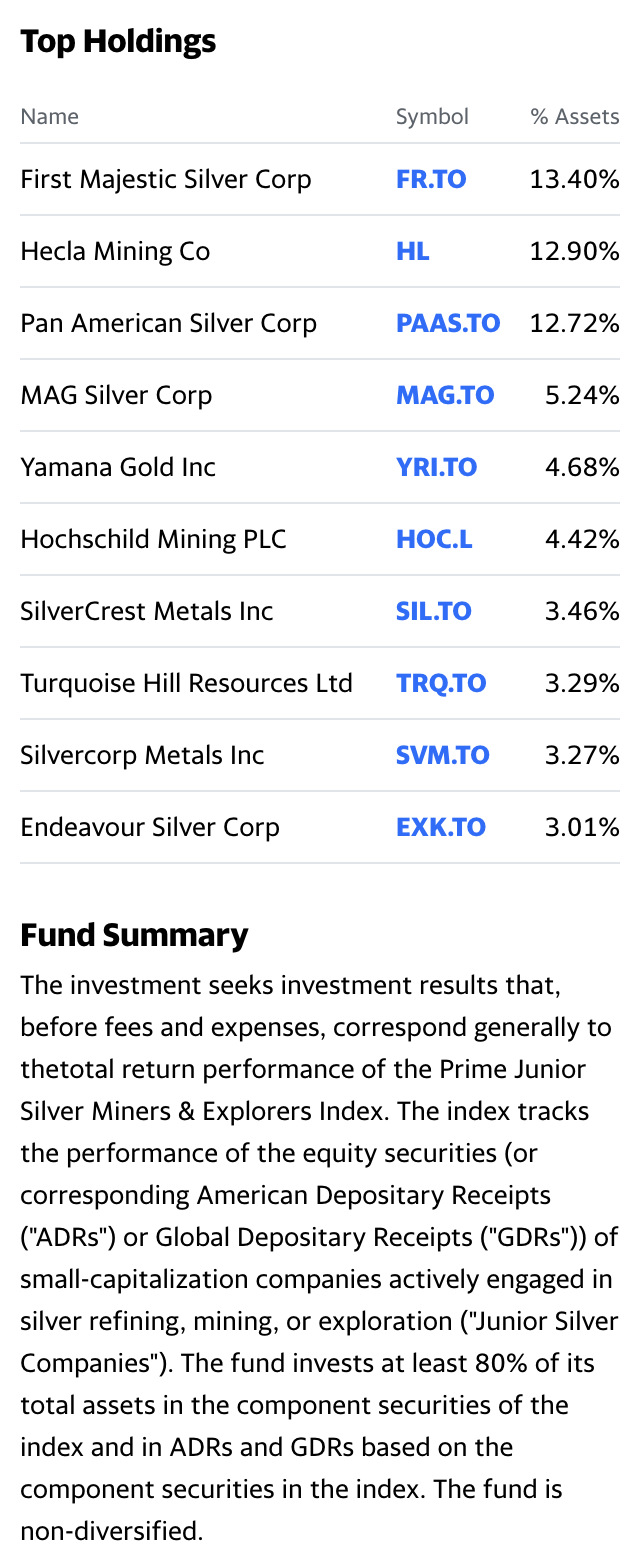

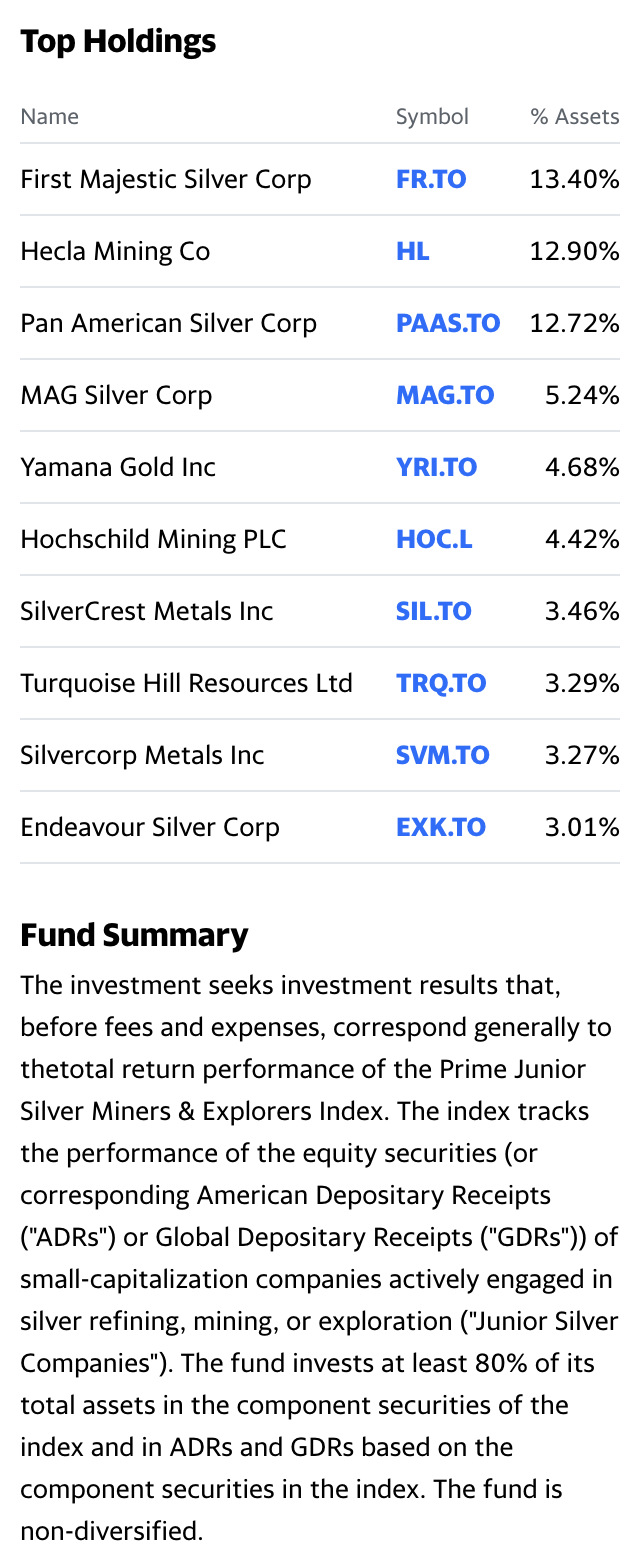

The top holdings and fund summary for the ETFMG Prime Junior Silver Miners ETF product (SILJ) include:

Source: Yahoo Finance

SILJ has $808.861 million in assets under management. The ETF product trades an average of over 1.83 million shares each day and charges a 0.69% management fee.

Nearby silver futures rose from $11.74 in March 2020 to a high of $30.35 on February 1, 2021, or 158.5%. Since then, silver fell to a low of $24.905 in early March or 17.94%.

Over the same period, the SILJ ETF rose from $4.84 to $18.84 per share or 289.3%. SILJ then fell to $13.73 per share or 27.1% lower than the February 1 high. The ETF offers market participants a leveraged risk position compared to the nominal price action in the silver futures market.

As silver consolidates, the precious metal could be a sleeping giant with incredible returns on the horizon in the coming months and years. I am a buyer of SILJ on a scale-down basis on price weakness as I expect higher highs in silver that will take the price to levels above the all-time 1980 peak at $50.36 per ounce. SILJ could turbocharge the percentage move in the silver market on the upside.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, foreign exchange, and precious metals. My weekly report covers the market movements of over 20 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders.

https://seekingalpha.com/checkout?service_id=mp_1066

https://seekingalpha.com/article/4415513-silver-is-a-sleeping-giant-time-to-load-up-on-silj

Giant - Time To Load Up On SILJ

Mar. 23, 2021 4:50 AM ETETFMG Prime Junior Silver Miners ETF (SILJ)AGQ, DBS, DSLV...115 Comments63 Likes

Summary

Silver has not challenged its breakout level.

A higher high in 2021.

Consolidation continues - it’s just a matter of time - some inputs point to inflation.

The silver-gold ratio is a bullish sign for the silver market.

SILJ is likely to outperform the metal on the next leg higher.

Looking for a portfolio of ideas like this one? Members of Hecht Commodity Report get exclusive access to our model portfolio. Learn More »

We have just passed the first anniversary of silver's elevator shaft ride to the lowest level since 2009. The volatile precious metal became a falling knife during last year's COVID-19-inspired risk-off period. The price fell through technical support at the December 2015 $13.635 low on its way to $11.74 per ounce.

The spike low did not last for long. Silver was back over the $12 level in March 2020. In April, the price rose above $16 per ounce. May took silver to a high of over $18.50, and in July, the price eclipsed the level of critical technical resistance at the July 2016 $21.095 high. In 2020, silver reached a high of $29.915 per ounce, the highest price since early 2013. Last year's $18.175 range was the widest since 2011 when silver reached a high of $49.82 per ounce.

As we head towards the end of 2021's first quarter, silver has been sleeping. Since the start of this year, the range has been $6.31 on the continuous futures contract, but the precious metal put in a marginally higher high when it traded to $30.35 on February 1. Silver was sitting below the midpoint of its 2021 trading range on Monday, March 22, as the precious metal is consolidating and digesting its gains over the past year.

This could be the perfect time to add the ETFMG Prime Junior Silver Miners ETF product (SILJ) to your portfolio. As we learned last year, when silver decides to take off on the upside, the volatile metal takes no prisoners.

Silver has not challenged its breakout level

Last July, silver broke above its critical long-term resistance level at the July 2016 $21.095 peak. The resistance often becomes support, but silver has not returned near that level in 2021.

The weekly chart of the nearby COMEX silver futures contract highlights that the low in 2021 was at $24.04 per ounce in mid-January, which was $2.945 above the $21.095 breakout level. Silver has been digesting the price rise from 2020 and has made a series of higher lows.

The total number of open long and short positions in the silver futures arena stood at the 161,387-contract level as of March 19. The high in 2021 was at 184,832 contracts on February 1 when GameStop (NYSE:GME) inspired buying caused speculators to flock to the silver market. The open interest metric rose to 207,490 contracts in early August 2020 as silver reached its 2020 peak. The decline in open interest reflects an overall lack of investor and speculative interest in the silver market as the price moves sideways in its consolidation range.

The slow stochastic, a momentum indicator, was declining below a neutral reading. Even though silver has made higher lows throughout 2021, price momentum is falling. Relative strength is sitting at a neutral reading. Meanwhile, at 22.54%, weekly historical volatility is near the lowest level of 2021. The weekly price variance metric rose to a high of over 74% last March when silver plunged and moved to a lower high at over 68% in September 2020 when silver corrected to $21.96, its lowest level since it broke above the 2016 high. Silver volatility tends to spike higher during market corrections.

The bottom line is that while the bullish sentiment has evaporated from the silver market, the price has not violated any technical levels that would jeopardize the overall bullish price trend.

A higher high in 2021

The move to a higher high at $30.35 on February 1 was inspired by the wild speculative action inspired by GameStop and other stocks with high short interest levels.

On February 1, I wrote an article on Seeking Alpha titled Game On In Silver: This Could Be For Real. In that price and one that followed on March 1, I expressed the view that silver is digesting its rally, and it is just a matter of time before the price resumes its upward trajectory.

Silver rose to a higher high on February 1 and then corrected to a higher low of $24.905 on the continuous contract during the first week of March. I see no reason to alter my opinion of the silver market as the price trades sideways below the midpoint of its consolidation range.

Consolidation continues - It's just a matter of time - Some Inputs Point To Inflation

The long-term trend in the silver market remains bullish at just above the $25.75 level on March 22.

As the quarterly chart illustrates, long-term price momentum and relative strength indicators continue to point to a bullish trend in the silver market. A closing price above the $26.525 level on the nearby COMEX silver futures contract would establish the fourth consecutive quarterly gain in the silver futures market.

While silver consolidates, the US bond market has become a falling knife.

The chart of the US 30-Year Treasury bond futures contract shows the downward trajectory of the long bond and the upward pressure on interest rates on the yield curve. While the Fed keeps the short-term Fed Funds rate at zero percent and continues to purchase $120 billion in debt securities each month, bonds are ignoring the central bank. Simultaneously, the Fed continues to ignore the signal from the bond market that inflationary pressures are rising.

Inflation is historically bullish for silver and all commodity prices. Copper remains above $4 per pound, the highest level in a decade. Despite the recent correction, crude oil is sitting at over $61.50 per barrel. Grains are at over six-year highs, and many other raw material prices are validating the price action in the bond market. When real interest rates rise, it increases the cost of carrying commodities and weighs on their prices. However, when rates move to the upside because of inflation, commodities tend to appreciate.

Another bullish sign for the silver market is its historical price relationship with gold, the yellow metal that plays an integral role in the global financial system.

The silver-gold ratio is a bullish sign for the silver market

The silver-gold ratio had a volatile year in 2020. Before reverting towards the long-term median level, it exploded to a new record high when silver took the elevator shaft lower last March.

The long-term quarterly chart of the price of gold divided by silver's price shows that the ratio traded at a low of 15.47:1 in 1979 and rose to an all-time peak of 111.42:1 in 2020. The midpoint for the forty-one-year range is at 63.45:1. On Monday, March 22, April gold settled at $1738.10, with May silver at $25.769. The ratio was 67.45:1 as it moved towards the long-term median level.

The ratio tends to drop during bullish trends in the precious metals markets and rise when they are in bear markets. When gold and silver hit highs in 1980 and 2011, the ratio was well below the median level.

I view the current downward trend in the ratio as a bullish factor for gold and silver prices over the coming months.

SILJ is likely to outperform the metal on the next leg higher

As silver consolidates and digests the latest new high at $30.35 on February 1, the price is now over $4.50 below the most recent peak. Now could be the perfect time to purchase silver mining shares on a scale-down basis before the next leg to the upside.

Silver mining shares tend to outperform the price of silver on the upside and underperform during price corrections. Therefore, they act as leveraged tools for the silver market. Most leveraged products involve time decay as they use put and call options to create the gearing. However, silver mining shares have no expiration dates. The leverage comes from the ability to extract more silver at higher production costs from the earth's crust as the price of the metal appreciates.

The top holdings and fund summary for the ETFMG Prime Junior Silver Miners ETF product (SILJ) include:

Source: Yahoo Finance

SILJ has $808.861 million in assets under management. The ETF product trades an average of over 1.83 million shares each day and charges a 0.69% management fee.

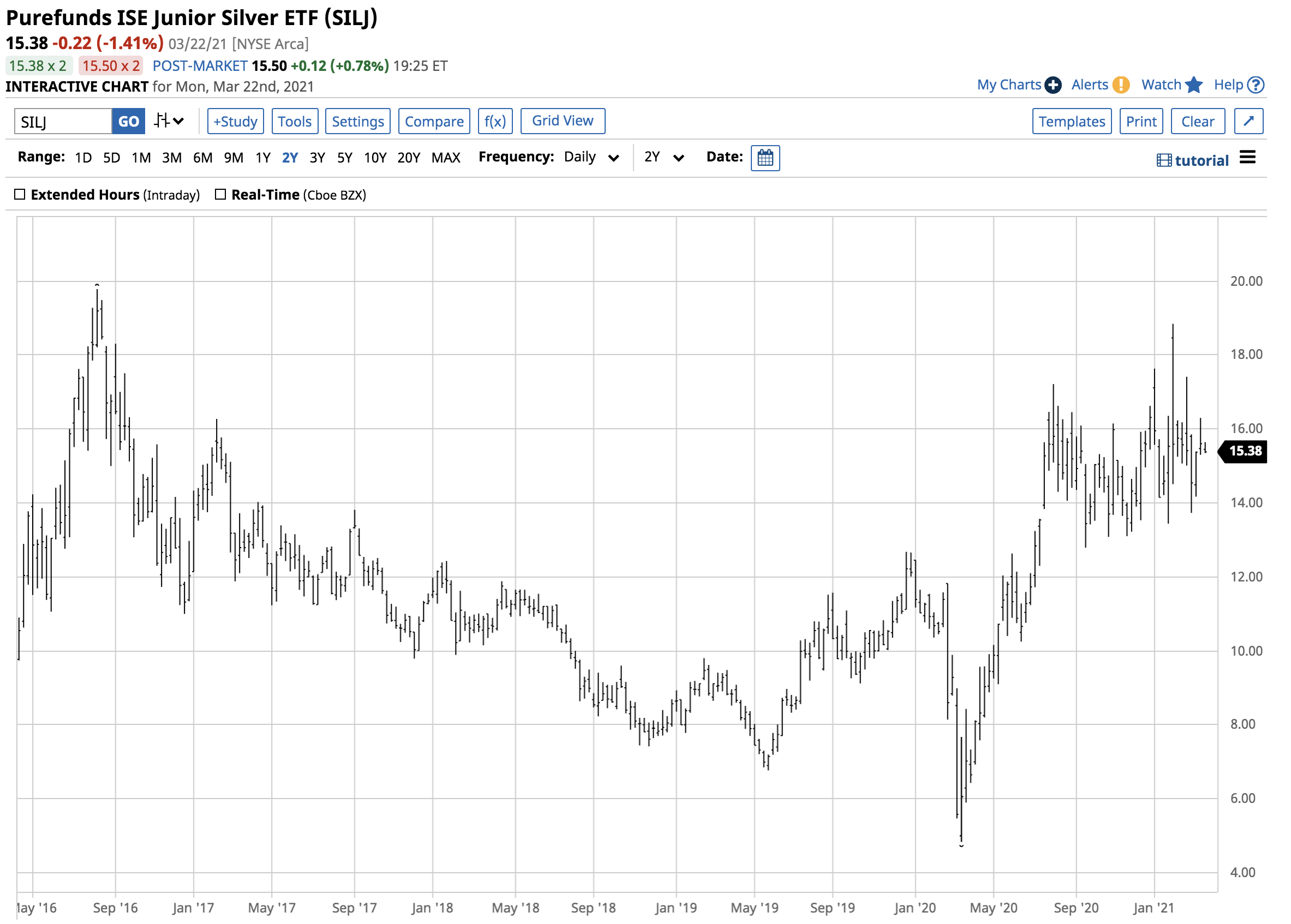

Nearby silver futures rose from $11.74 in March 2020 to a high of $30.35 on February 1, 2021, or 158.5%. Since then, silver fell to a low of $24.905 in early March or 17.94%.

Over the same period, the SILJ ETF rose from $4.84 to $18.84 per share or 289.3%. SILJ then fell to $13.73 per share or 27.1% lower than the February 1 high. The ETF offers market participants a leveraged risk position compared to the nominal price action in the silver futures market.

As silver consolidates, the precious metal could be a sleeping giant with incredible returns on the horizon in the coming months and years. I am a buyer of SILJ on a scale-down basis on price weakness as I expect higher highs in silver that will take the price to levels above the all-time 1980 peak at $50.36 per ounce. SILJ could turbocharge the percentage move in the silver market on the upside.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, foreign exchange, and precious metals. My weekly report covers the market movements of over 20 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders.

https://seekingalpha.com/checkout?service_id=mp_1066

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.