Lawrence Lepard

75,450 views •Mar 23, 2021

https://www.youtube.com/watch?v=ytbCcnALSHQ

The Federal Reserve is out of tricks and the market smells inflation:

“Of course we will have inflation, we are coming out of a pandemic…

Ignore the man behind the curtain," market watcher Lawrence Lepard

says, describing the Fed’s facile narrative.

Speaking on gold, he tells our Daniela Cambone, "It's ridiculous;

gold should be at $5,000 dollars, but I want gold investors to know….

we are going to get paid and we will get paid huge." Lepard adds, "but

bullion banks are doing their thing and trying to sell at odd times."

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

$Monument Mining Has Seen its Gold Revenue Surge

Swiss Resource Capital AG

19.6K subscribers

https://www.youtube.com/watch?v=a3qrP2Y10M0

SmallCapPower

5.72K subscribers

In this interview at the PDAC 2020 convention, SmallCapPower spoke with

Monument Mining Limited (TSXV:MMY) President and CEO Cathy Zhai.

$Monument Mining has been successfully producing gold in Malaysia for

the past 10 years and now has a promising development project in

Western Australia.

Find out more about Monument Mining’s plans for 2020

by watching our interview.

https://www.youtube.com/watch?v=mRejQP-pbzA

FOR FURTHER INFORMATION visit the company web site at

http://www.monumentmining.com

or contact:

Richard Cushing, MMY Vancouver T: +1-604-638-1661 x102 rcushing@monumentmining.com

“Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”

Forward-Looking Statement

https://www.monumentmining.com/news-media/news/2021/monument-to-implement-value-creation-strategy/

$MMY Heap Leach Production Potential of Murchison;

$Kentor has done a decent analysis of the heap leaching potential

of the lower grade ores at Murchison.

As far as I know, we have the necessary heap leach equipment on hand

at $Burnakura for 2 million tons per year.

I used to own GGD which heap leaches very low grade tailings .....less

than 1 gm per ton

Agglomeration was necessary, as recoveries were greater once the head

grade ore was agglomerated with concrete.

However, agglomeration seems to be not needed very much for Burnakura

ore.

The other parameter is leach cycle time......the time required for the

gold to be leached out of the ore once placed on the heap pad.

I used 2 cycles per year.....ie about 150 days to maximize recovery

of gold.

However, Kentor shows about 24 days which I think must mean something

else , as that cycle is quite rapid.

So I use 2 cycles per year Of 500,000 tons of auriferous ore which means

1 million tons per year.

I will use an average of 0.9 gms per ton as head grade of the ore

placed on the heap leach pads.

So, that means 900,000 grams of contained gold on the heap leach pads

per year.

Recovery rates is about 90% for this grade of ore, so we end up

recovering about 800,000 grams of gold per year, which divided

by 31 gms per ounce means an annual production of about

25,000 ounces per year .

This is quite close to the 30,000 ounces recovered/ year by

Indee gold which used this same leach equipment which was

acquired by Kentor.

So, combining 40,000 ounces of high grade production from underground

ore through the Burnakura mill @ 300,000 tons per year.....see my

previous post..and 25,000 ounces of the lower grades from heap leach,

we have about 65,000 ounces of production per year .

Heap leach is cheaper than milling for obvious reasons .

So an AISC of $1000 per ounce for the two combined production methods

seems quite reasonable .

@$1800 POG, we are excess cash flowing about $50 million per year .

Our neighbour free cash flows $80 million per year

on 95,000 ounces .

This is good agreement .

KRR trades at 5.5 times its free cash flow.

This would imply..but degraded 4,5 times , for lower production ..a

fair value of about $225 million for our Murchison production,

employing fully our current milling and heap leach facilities .

But, we have in addition , that rich gold copper resource at the

Yagahong deposit of Gabathinia along with its other 6 pits none of

which have been fully explored or the possibility of

finding supergene ore.

So, our Murchison assets have superb value at current POG.

It's my analytical opinion, that the Greatest value of our Murchison

assets would accrue to us shareholders by spinning it out to us as

a new public listing, including the Tuckanara seed capital and JV ,

allocated perhaps 80% to shareholders and 20 % to our parent company.

Its a win win situation

$MMY- $70 mil in assets and only a $42 mil market cap? NO DEBT!

Way undervalued and oversold -

5 bagger + + + + ? or more -

https://www.monumentmining.com/

https://www.monumentmining.com/news-media/photo-gallery/

Imo! TIA

https://investorshub.advfn.com/Monument-Mining-TSXV-MMY-13403/

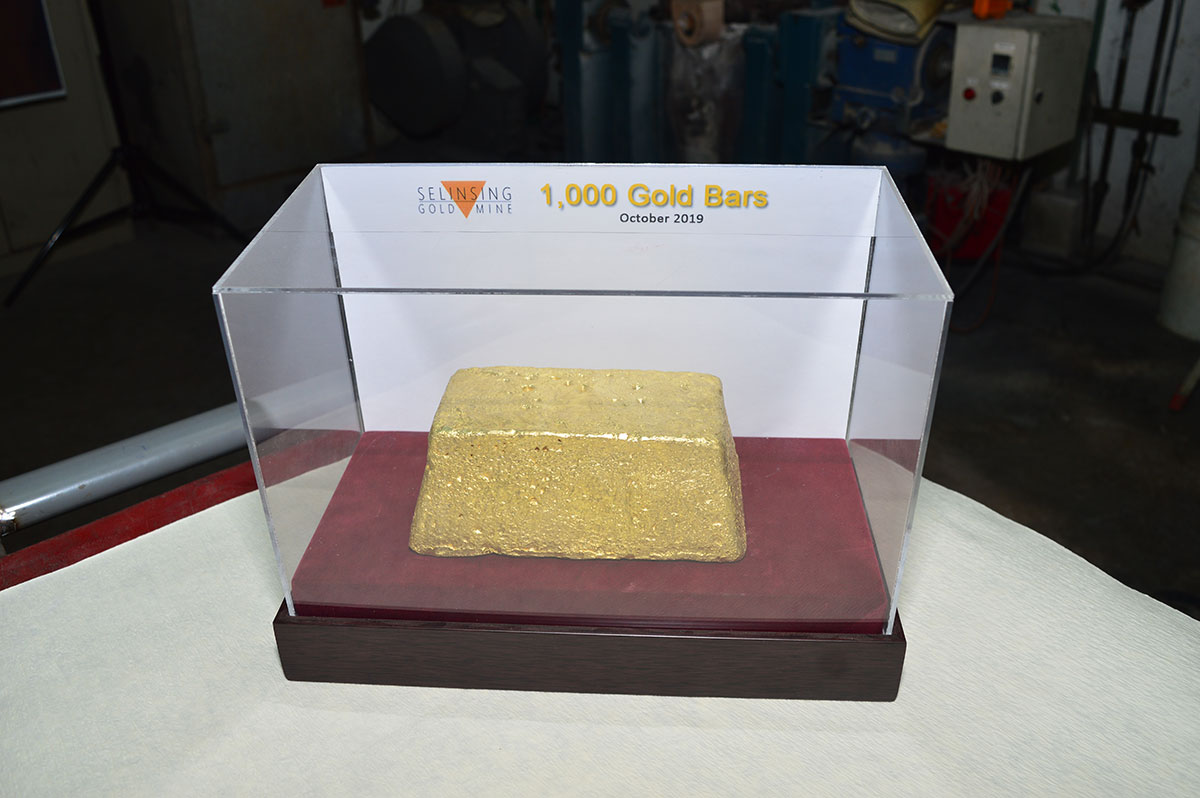

$Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new

great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future

years the weather is good no curtain needed -

$1,000th Gold Bar Pour Produced by MMY; Photo Gallery

https://www.monumentmining.com/news-media/photo-gallery/

$Market Cap $46 mil. - No Debt - someone has to be kidding

is it the fact ???

What a Great Gold Mines bargain

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered

Imo!

$Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit

Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

FEATURED BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • Jul 2, 2024 7:19 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM