March 1, 2021

View PDF

Gross Revenue of $6.84 Million and Cash Cost of US1,103/Oz

Vancouver, B.C., March 1, 2021,

https://www.monumentmining.com/news-media/news/2021/monument-reports-second-quarter-fiscal-2021-q2-2021-results/

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its second quarter

production and financial results for the six months ended

December 31, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“During the first six months of fiscal 2021, the Company has completed

the economic valuation of each of its wholly-owned projects, closed the

Tuckanarra JV Transaction, and streamlined the gold portfolio by

entering into the definitive agreement to sell the Mengapur base metal

project subsequent to the second quarter.

Upon closing the Mengapur transaction, the Company’s strategy will be to

“Unblock the Value” with the proceeds from the transaction available to

advance the Company’s gold portfolio in Western Australia and Malaysia,

and to support corporate development.”

Second Quarter Highlights:

3,754 ounces (“oz”) of gold sold for $6.84 million

(Q2 2020: 4,473oz for $6.61 million);

Average quarterly gold price realized at $1,889/oz

(Q2 2020: $1,486/oz);

Cash cost per ounce sold was $1,103/oz

(Q2 2020: $903/oz);

Gross margin increased by 5% to $2.69 million

(Q2 2020: $2.57 million);

2,963oz of gold produced

(Q2 2020: 4,827oz);

All-in sustaining cost (“AISC”) increased to $1,601/oz

(Q2 2020: $1,245/oz);

Sold 80% interest in Tuckanarra Project to Odyssey to advance

exploration; and

Completed due diligence on the Mengapur Transaction.

$Monument Mining: Gold Focused Producer in Western Australia and

Malaysia, Implementing Value Created Strategy

•Mar 10, 2021

Swiss Resource Capital AG

19.6K subscribers

https://www.youtube.com/watch?v=a3qrP2Y10M0

$Monument’s primary Selinsing Gold Mine in Malaysia and

Murchison Gold Project in Western Australia

hold total 1.2 million current gold resources

of which over 0.5 million are measure and indicated

over land tenue of 410 sqkm.

$Selinsing Gold Mine has produced 321,694 ounces for

$441.6 million in revenue and

cash cost of $520 per ounce in past 10 years

through a 1M tpa capacity mill;

the mine has another 6 years of life of mine

production.

$Murchison Gold Project has over 381,000 ounces of gold resources

with a 260,000 tpa mill well maintained and

a full functional camp.

A $10 million two-year regional exploration plan is underway

to lift gold inventory and potentially establish

the Murchison a corner stone project.

Divesting of Mengapur base mental project in Malaysia

allows Monument to be re-rated at the rising gold market and

fund its value creation growth strategy including

potential acquisition of the high quality gold assets.

https://www.youtube.com/watch?v=a3qrP2Y10M0

$Monument Mining has been successfully producing gold in Malaysia for

the past 10 years and now has a promising development project in

Western Australia.

$MMY Heap Leach Production Potential of Murchison;

It's decent analysis of the heap leaching potential

of the lower grade ores at Murchison.

As far as I know, we have the necessary heap leach equipment on hand

at $Burnakura for 2 million tons per year.

However, agglomeration seems to be not needed very much for Burnakura

ore.

So I use 2 cycles per year Of 500,000 tons of auriferous ore which means

1 million tons per year.

I will use an average of 0.9 gms per ton as head grade of the ore

placed on the heap leach pads.

So, that means 900,000 grams of contained gold on the heap leach pads

per year.

$Recovery rates is about 90% for this grade of ore, so we end up

recovering about 800,000 grams of gold per year, which divided

by 31 gms per ounce means an annual production of about

25,000 ounces per year.

This is quite close to the 30,000 ounces recovered/ year by

Indee gold

$So, combining 40,000 ounces of high grade production from underground

ore through the Burnakura mill @ 300,000 tons per year.....see my

previous post..and 25,000 ounces of the lower grades from heap leach,

we have about 65,000 ounces of production per year.

Heap leach is cheaper than milling for obvious reasons.

So an AISC of $1000 per ounce for the two combined production methods

seems quite reasonable .

@$1800 POG, we are excess cash flowing about $50 million per year .

This would imply..but degraded 4,5 times , for lower production ..a

fair value of about $225 million for our Murchison production,

employing fully our current milling and heap leach facilities .

We have in addition , that rich gold copper resource at the

Yagahong deposit of Gabathinia along with its other 6 pits none of

which have been fully explored or the possibility of

finding supergene ore.

So, our Murchison assets have superb value at current POG.

Its a win win situation

By nozzpack

$MMY- $70 mil in assets and only a $42 mil market cap? NO DEBT!

Way undervalued and oversold -

5 bagger + + + + ? or more -

IMO!

https://www.monumentmining.com/

https://www.monumentmining.com/news-media/photo-gallery/

Imo! TIA

https://investorshub.advfn.com/Monument-Mining-TSXV-MMY-13403/

$Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new

great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future

years the weather is good no curtain needed -

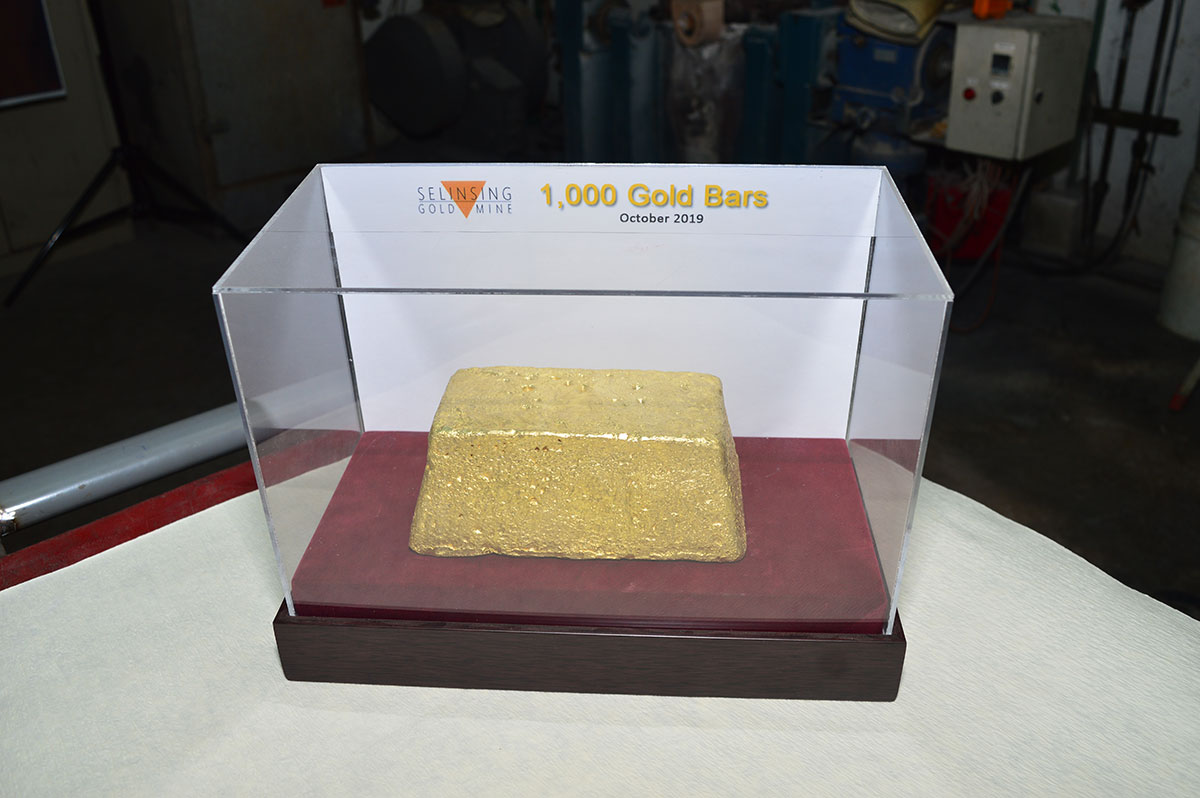

$1,000th Gold Bar Pour Produced by MMY; Photo Gallery

https://www.monumentmining.com/news-media/photo-gallery/

$Market Cap $46 mil. - No Debt - someone has to be kidding

is it the fact ???

What a Great Gold Mines bargain

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered

Imo!

$Selinsing Gold Mine

$The Selinsing gold mine is an operating high-grade gold mine at Bukit

Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM