Tuesday, February 23, 2021 4:51:54 AM

Targets $0.7697 / $0.8990

http://www.allotcbb.com/quote.php?symbol=AABB

I'll Alert you of stocks to Buy,

before the Run happens !

________________________________________________________________

AABB Security Details

Share Structure

Market Value1..........$1,059,704,377 a/o Feb 22, 2021

Authorized Shares..2,500,000,000 a/o Feb 22, 2021

Outstanding Shares.1,945,125,509 a/o Feb 22, 2021

-Restricted.............373,360,708 a/o Feb 22, 2021

-Unrestricted.........1,571,764,801 a/o Feb 22, 2021

Held at DTC...........1,196,665,844 a/o Feb 22, 2021

Float..............426,615,844 a/o Jul 30, 2020

Par Value 0.0010

https://www.otcmarkets.com/stock/AABB/security

https://www.otcmarkets.com/stock/AABB/news

https://www.otcmarkets.com/stock/AABB/disclosure

________________________________________________________________

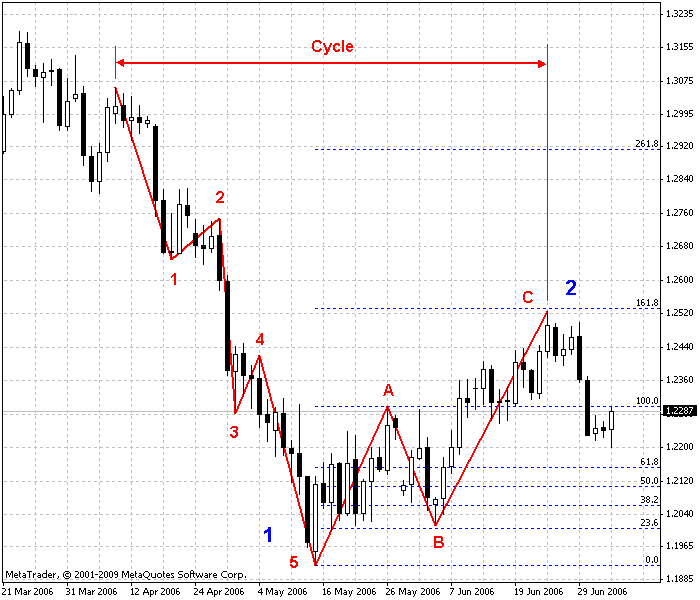

How Targets are Calculated

Fibonacci Numbers and Retrace Targets: Explained

________________________________________________________________

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

Fibonacci Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

_________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Chart

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

FEATURED ZenaTech, Inc. (NASDAQ: ZENA) First US Trial of IQ Nano Drone for Inventory Management • Oct 15, 2024 8:21 AM

Kona Gold Beverages, Inc. Announces Strategic Progress and Corporate Evolution • KGKG • Oct 15, 2024 9:00 AM

One World Products Secures First Order for Hemp-Based Reusable Containers, Pioneers Renewable Materials for the Automotive Industry • OWPC • Oct 15, 2024 8:35 AM

CBD Life Sciences, Inc. Announces Strategic MOU with U.S. Armed Forces for Groundbreaking Mushroom Supplement • CBDL • Oct 15, 2024 8:00 AM

HealthLynked Files Non-Provisional Patent for AI-Powered Healthcare Assistant, ARi • HLYK • Oct 15, 2024 8:00 AM

ZenaTech, Inc. (NASDAQ: ZENA) Launchs IQ Nano Drone for Commercial Indoor Use • HALO • Oct 10, 2024 8:09 AM