| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Friday, December 18, 2020 4:56:22 PM

By: Erin Swenlin | December 18, 2020

* (Click Read Full Story »»» at the bottom of the page for the charts to appear on the post)

If you have attended the free DecisionPoint.com Trading Room or your a DecisionPoint Diamonds Report subscriber, you'll know that I have been very bullish on renewable energy stocks since the beginning of autumn. While they can be very volatile, overall they are an industry group that is flourishing and if you can take those ups and downs it will continue to be a prosperous sector.

Originally, Renewable Energy had been listed as part of the Energy sector on StockCharts. Since then it has been moved to the Technology sector where it has found a home among other outperformers. Technology's one failing is that it is a 'leading' sector--meaning it generally picks the direction for the overall market. That works well most of the time as it outperforms in bull markets; however, when the market gets toppy like it is right now, you're now exposed to positions in a sector that will likely lead to the downside.

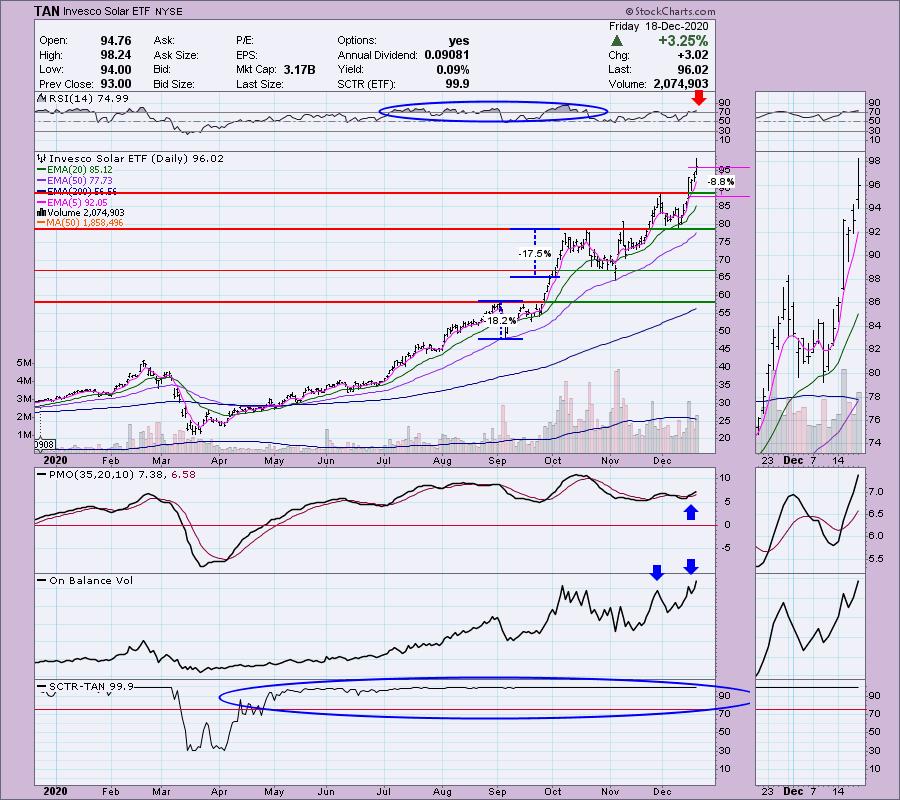

This is why I like solar. I believe it is a 'teflon' area of the market that will enjoy a rising trend for many years to come as renewable energy technology continues to improve and become the norm with new homes being built with solar, more electric vehicles on the road, etc. There is the addition of a Biden administration that is going to be adding more money to these companies to speed up innovation. Let's look at TAN, one of the Renewable Energy ETFs. Full disclosure I own this particular ETF.

It has made a great run, but I don't think it's over. There is the problem of an overbought RSI, but as you can see, overbought conditions can persist for weeks and even months. The last two times it declined from overbought RSI conditions, it pulled back about 18% and then resumed the rally. You need to be prepared for those heavy pullbacks in this sector. As long as price remains above the 50-EMA, the trend seems very safe. I set a stop on TAN just below support at the November top, but as I noted above you may need to accept deeper pullbacks. There is a PMO BUY signal and we can see from the OBV that price is following volume. We have higher OBV tops that coordinate with higher price tops. The PMO is not overbought even though price is which makes it more attractive. The SCTR at 99.9 for months is a testament to how strong this ETF is within the universe of all ETFs

SunPower Corp. (SPWR)

EARNINGS: 2/10/2021 (AMC)

SunPower Corp. engages in the design, manufacture and deliver of solar panels and systems. It operates through the SunPower Energy Services and SunPower Technologies segments: The SunPower Energy Services Segment deals with the sales of solar energy solutions in the North America region including direct sales of turn-key engineering, procurement and construction. The SunPower Technologies Segment involves technology development, worldwide solar panel manufacturing operations, equipment supply to resellers, commercial and residential end-customers outside of North America. The company was founded by Thomas L. Dinwoodie, Robert Lorenzini and Richard M. Swanson in April 1985 and is headquartered in San Jose, CA.

I covered SunPower Corp back on September 30th for Diamonds subscribers. Below is my commentary:

9/30: "This area of the market has been enjoying a huge rally. It has broken out of a bullish falling wedge and has now popped above the September top. It was up much higher than this intraday so this mid-day pullback could work to our advantage. The PMO is rising nicely and isn't that overbought. The RSI has remained strong along with the SCTR. Volume has been pouring in and price is following that volume based on the OBV breaking to a new high with price."

Here is the same chart today. SPWR has enjoyed a 103% gain since I presented it. The PMO has just triggered a BUY signal. The RSI is getting overbought, but the PMO is not overbought which tells me there is more upside on this stock. Notice that our stop level was never hit.

Conclusion: If this type of analysis is appealing to you, join me in the free trading room on Mondays. Registration links are above. I've been talking about solar in those free trading rooms as well. Overall I do believe that the renewable energy group is teflon. I believe that while it will take some punches when the market does, overall I expect the long-term rising trend to remain intact.

Happy Charting! - Erin

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM