| Followers | 680 |

| Posts | 141274 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Thursday, November 19, 2020 8:04:49 AM

By: Schaeffer's Investment Research | November 18, 2020

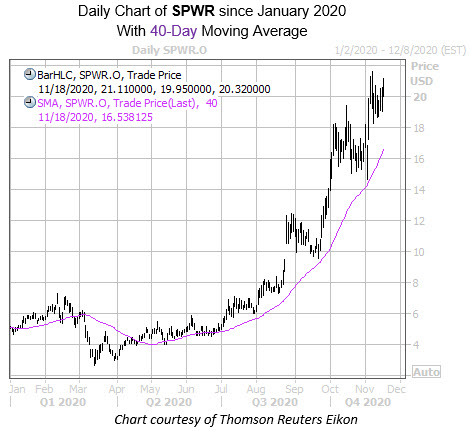

• SPWR recently grabbed a five-year high

• There is plenty of room for analyst upgrades as well

SunPower Corporation (NASDAQ:SPWR) has so far enjoyed a strong November, as renewable energy stocks enter the spotlight thanks to President-elect Joe Biden. Furthermore, data from Schaeffer's Senior Quantitative Analyst Rocky White suggests the stock could see more tailwinds ahead.

SunPower stock scored a five-year high of $21.60 on Nov. 9. What's more, this peak comes amid historically low implied volatility (IV), which has been a bullish combination for SPWR in the past. More specifically, there were two other instances when the stock was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) sat in the 20th percentile of its annual range or lower -- as is the case with the stock's current SVI of 84%, which ranks in the 12th percentile of its 12-month range.

One month after these signals, the equity averaged a return of 26.5%. From its current perch at $20.32, a move of similar magnitude would put the stock around $25.70, territory not seen since June of 2014. SPWR has had an impressive run since its March 16 low of $2.63, with pullbacks contained by its 40-day moving average.

A short squeeze could act as a catalyst as well. Short interest fell by 8.4% during the most recent reporting period, however, the 38.24 million shares sold short still account for 47.2% of the stock's available float. In other words, it would take nearly five days to buy back these bearish bets, at SunPower stock's average pace of trading.

There is still a surprising amount of room for upgrades as well, seeing as nine of the 11 analysts in coverage sport a "hold" or worse rating on the security. Meanwhile, SPWR's 12-month consensus price target of $16.24 is a 20.1% discount to current trading levels, which could mean bull notes are overdue in the form of price-target hikes.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

FEATURED POET Announces Design Win and Collaboration with Foxconn Interconnect Technology for High-speed AI Systems • May 14, 2024 10:09 AM

FEATURED Element79 Gold Corp Reports Exceptionally High-Grade Results from Lucero • May 14, 2024 7:00 AM

VAYK Added New Manager for Expansion into $64 Billion Domestic Short-term Rental Market • VAYK • May 14, 2024 9:00 AM

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM