Sunday, August 30, 2020 2:19:15 PM

https://backend.otcmarkets.com/otcapi/company/financial-report/256635/content

Also, this particular paragraph is interesting given that it states their intentions to file an equity registration statement and that the financial statements don't reflect any potential changes to the balance sheet that would be the result of assuming the assets/liabilities of a private corporation such as WeTouch through a reverse merger:

"Management of the Company is making efforts to raise additional funding until a registration statement relating to an equity funding facility is in effect. While management of the Company believes that it will be successful in it's capital formation and planned operating activities, there can be no assurance that the Company will be able to raise additional equity capital, or be successful in the development and commercialization of the products it develops or initiates collaboration agreements thereon. The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern."

WeTouch was planning to raise up to $24 million AUD and go public on the Australian Stock Exchange a few years ago as per this prospectus dated May 16, 2017 but that hasn't materialized:

https://www.upcomingfloats.com.au/Prospectus/AUSTRALIA%20WETOUCH%20TECHNOLOGY%20LTD.PDF

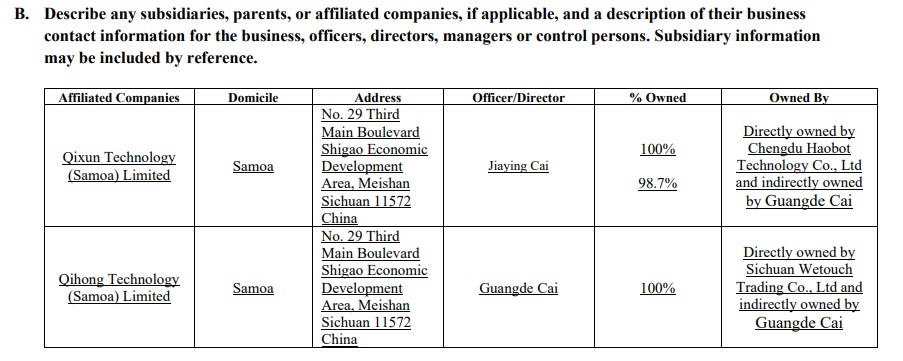

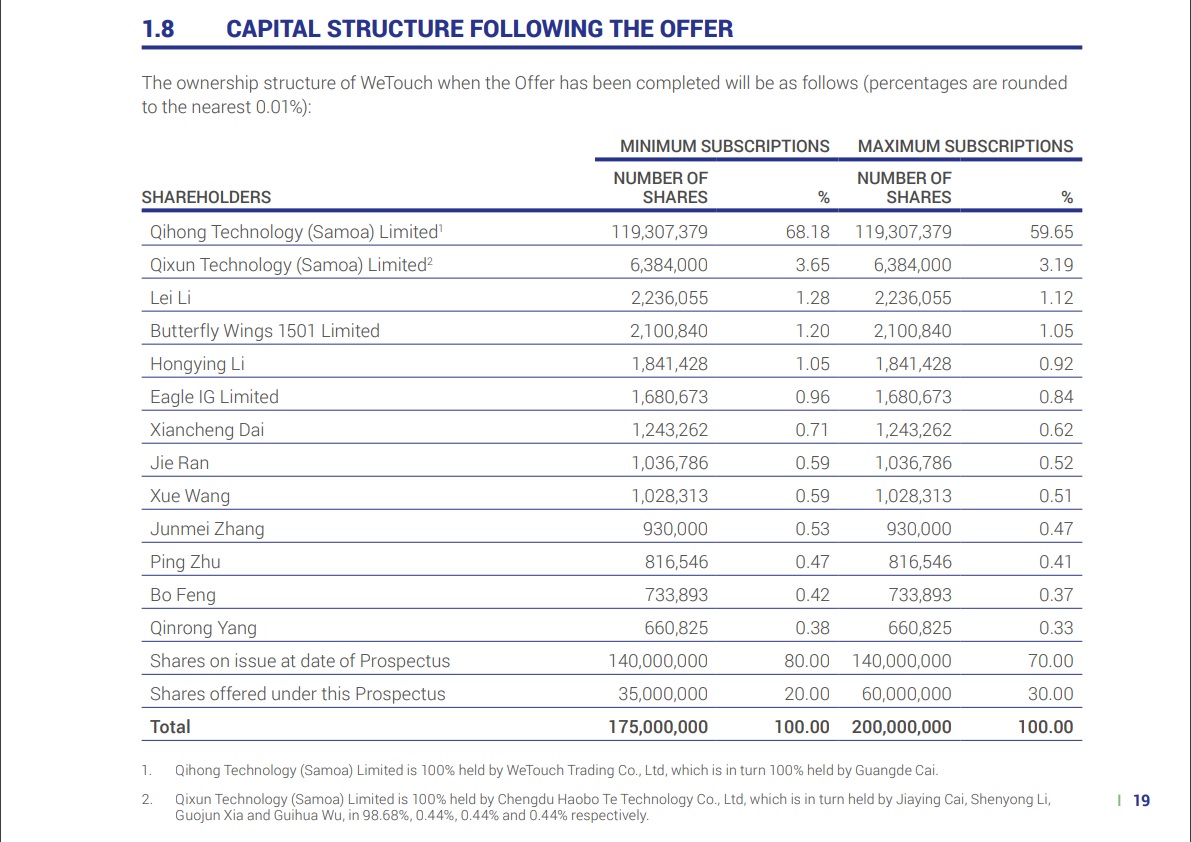

The ownership structure in the WeTouch prospectus details the same companies that Guangde Cai and Jiaying Cai indirectly control/own:

According to the financial statements, at the end of fiscal year 2016 the company had generated:

$21 million AUD in revenue resulting in a net profit of $7 million AUD.

Assets: $69 million AUD

Liabilites: $20 million AUD

Shareholder Equity: $49 million AUD

One can only imagine how much the company has grown since that time. $GLFW

Recent WETH News

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/19/2024 08:38:54 PM

- Wetouch Technologies Inc. Announces $15 Million Stock Buyback Program • PR Newswire (US) • 07/08/2024 01:30:00 PM

- WeTouch Technology Inc. CEO Zongyi Lian's Letter to Shareholders • PR Newswire (US) • 06/24/2024 01:30:00 PM

- WeTouch Announces First Quarter Fiscal Year 2024 Financial Results with Cash Reserves of $94.8 Million • PR Newswire (US) • 06/17/2024 01:45:00 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 06/14/2024 09:15:46 PM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 05/16/2024 08:30:05 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/16/2024 08:15:42 PM

- Wetouch Technology Inc. Unveils Cutting-Edge Second-Generation Touchscreen Products and Receives US $15M in Orders • PR Newswire (US) • 05/06/2024 01:45:00 PM

- Wetouch Technology Inc. Announces $56.3M USD Revenue Guidance for FY 2024, Reflecting 41% Growth Over FY 2023 • PR Newswire (US) • 04/22/2024 02:00:00 PM

- Wetouch Technology Inc. Preannounce Earnings for Fiscal Year 2023 • PR Newswire (US) • 04/01/2024 02:21:00 PM

- Wetouch Announces Strategic Collaboration with IDEC Corporation, Elevating Presence in Japanese Touch Display Market • PR Newswire (US) • 03/18/2024 01:17:00 PM

- WestPark Capital Announces Closing of $10.8 Million Public Offering of Common Stock for Wetouch Technology Inc (Nasdaq: WETH ) • Business Wire • 02/28/2024 02:00:00 PM

- Wetouch Technology Inc. Announces Closing of $10.8 Million Public Offering of Common Stock • GlobeNewswire Inc. • 02/23/2024 09:00:00 PM

- Wetouch Technology Inc. Announces Pricing of $10.8 Million Public Offering of Common Stock and Concurrent Uplisting to the Nasdaq Capital Market • GlobeNewswire Inc. • 02/21/2024 02:45:00 AM

FEATURED Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • Sep 24, 2024 8:50 AM

FEATURED Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM