Tuesday, August 18, 2020 11:18:26 PM

Synergy Management Custodian, set up Merger with #AmecaMining:

#AmecaMining Twitter Page: https://twitter.com/AmecaMining

From Stock Hobbit

From post by StervC - Sterling

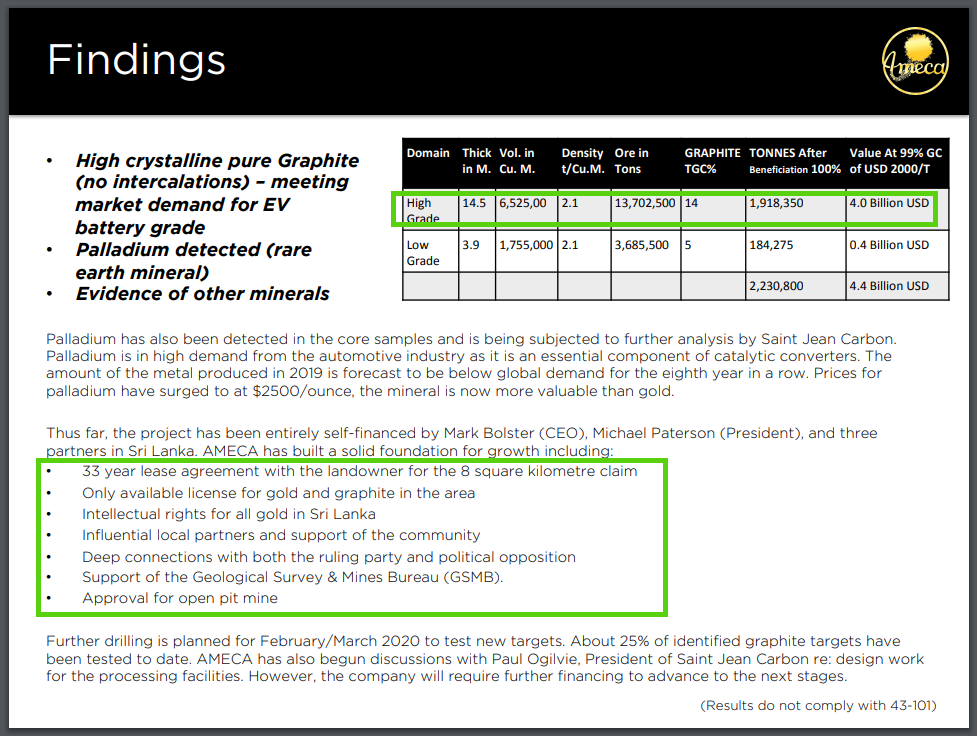

#AmecaMining has $4.4 Billion of Crystalline Pure Graphite. They have $4 Billion in High Crystalline Pure Graphite and $0.4 Billion in Low Crystalline Pure Graphite

We are waiting on STHC to close the acquisition of #AmecaMining next week as explained within the post below:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=157402706

Below is confirmation from the website of the $4.4 Billion of Crystalline Pure Graphite:

https://31f856b6-de57-4066-9e5f-3268e24b9557.filesusr.com/ugd/1416ce_e8499e2828bd46529d86241174d82b7d.pdf

$STHC #AmecaMining: Projected Revenues: $30 Million

Gold Found in Sri Lanka. $STHC / #AmecaMining is all over this!:

http://www.dailymirror.lk/print/front_page/Gold-deposits-found-in-Seruwawila/238-176357

$STHC: #AmecaMining - High Value Minerals:

High Value Minerals

Gold: Targeting goal of establishing multi-million oz gold resource. Visible gold in core samples. Early testing at shallow levels show the presence of gold (7 grams/tonne). Currently undertaking Phase 2 drilling to a depth of 200 metres. Fire assay will be available in 4-5 weeks. AMECA holds intellectual rights for all gold in Sri Lanka.

Platinum groups: High concentrations of palladium (5.67) found by Saint Jean Carbon in initial samples. Awaiting confirmation from Actlabs.

Rare earths: Very promising results from both a geological standpoint and potentially processing perspective. Testing at the certified labs of Saint Jean Carbon and Actlabs show high concentrations of multiple rare earths including: Europium (.9%), gadolinium (1.2%).

Graphite: Proven 2 million tonnes of extremely high (99.9%) purity. Graphite will not need to be subjected to many damaging processes required to obtain the purity required by end user. Ideal for the anodes of EV batteries. No intercalation with host rock means less processing and associated costs than North American deposits. 10 year, $20 million/year off-take agreement signed.

$STHC Transparency: Check out the Directors of Ameca....impressive

And each one can be contacted individually......

AMECA built by christinatbhotz.com ....she's done a Great job on their website!

Huge Market for $STHC - #AmecaMining Graphite:

$TSLA needs it, and India has a Huge Demand..and they're close to Sri Lanka

from post by BMoeSki...

I agree Telsa does require a ton of graphite for their batteries. But don't discount the HUGE EV company right there in India in their own backyard. Tata Group- https://www.tatamotors.com/ with an annual revenue of US $113 billion is home to some of India’s biggest companies. With a brand value of US $19.5 billion, Tata is easily the most valuable and recognizable brand names outside of the US. They are essentially the General Motors of India.

This photo is right from AMECA's website and even mentions TATA Motors. With this new find of the highest quality graphite right there in their own country, I don't think they're gonna let Telsa or anyone else win that battle. Either way, a bidding war would be a great thing for everyone.

Here's a pretty good read on graphite and the importance of it in EV Batteries:

http://www.northerngraphite.com/about-graphite/graphite-growth-markets/lithium-ion-batteries/

All about $STHC - #AmecaMining Graphite:

What every resource investor needs to know

What is lump or vein graphite?

Lump or vein graphite, as found in Sri Lanka, is usually found in high grade deposits and is highly sought after by both producers and customers. This is because purity is a key consideration. For producers, the higher the grade, the lower the milling and refining cost.

https://investorintel.com/technology-metals-intel/graphite-every-resource-investor-needs-know/?print=print

Natural graphite is a soft, black, naturally occurring metallic mineral, composed of the element carbon (a crystalline, allotropic form of carbon). Graphite is used as a solid lubricant, as a moderator in nuclear reactors… and in pencils. Both the European Union and the United States have named graphite as a critical mineral.

There are three types of natural graphite: amorphous, flake and vein. Amorphous graphite is a naturally occurring seam mineral formed from the geologic metamorphism of anthracite coal. This form of graphite is called amorphous because to the naked eye, macroscopic graphite crystals are not visible and, as a result, has an amorphous appearance. Amorphous graphite contains 70% to 75% carbon and is the most common type of graphite.

Flake graphite is a naturally occurring form of graphite. Its properties include high thermal and electric conductivity, and low spring-back (excellent molding characteristics). Flake graphite is 85% to 90% carbon and its used in many high-value applications including batteries, powder metallurgy, fuel-cell bipolar plates, coatings, thermal materials, friction moderators, electrically conductive materials, refractories, general lubricant applications, pencils, gaskets, rubber compounds, and other advanced polymer systems.

Vein graphite is a naturally occurring pyrolytic carbon. This form of graphite is deposited as solid graphite directly from a fluid phase, creating an extremely high degree of crystallinity. Vein graphite is utilized extensively in formed graphite products for electrical applications. High-quality electrical motor brushes and other current-carrying carbons are based on formulations using vein graphite. It is also used in friction applications, such as advanced brake and clutch formulations, as well as most applications that utilize flake graphite. Vein graphite is also the type of graphite used in pebble-bed nuclear reactors. Vein graphite is 90% to 96% carbon and is most valuable because it requires the least processing to achieve ultra high purity.

Natural graphite is used mostly in what are called refractory applications. Refractory applications are those that involve extremely high heat and, therefore, demand materials that will not melt or disintegrate under such extreme conditions. One example of this use is in the crucibles used in the steel industry. Such refractory applications account for the majority of the usage of graphite.

Flake graphite powder

It is also used to make brake linings (and other components in the automotive industry), lubricants and molds in foundries. Graphite also has a myriad of other uses in batteries, lubricants, fire retardants, and reinforcements in plastics. Industrial demand for graphite has been growing at about 5% per year for the past decade, due to the ongoing industrialization of China, India and other emerging economies. However, the blue-sky thinking for the graphite industry is the incremental demand that will be created by a number of green initiatives including lithium-ion batteries, fuel cells, solar energy, semi conductors, and nuclear energy. Many of these innovative applications have the potential to consume more graphite than all current uses combined.

The market for graphite exceeds 1 million tonnes per year, of which 60% is amorphous and 40% flake. Only flake graphite, which can be upgraded to 99.9% purity, is suitable for making lithium-ion batteries. The graphite market is almost as large as the nickel market (1.3 million tonnes per year), far larger than the markets for magnesium, molybdenum or tungsten, and more than 50 times the size of the lithium or rare earth markets.

Like uranium, there is a posted price for graphite, which provides a guideline with respect to longer-term trends, but transactions are largely based on direct negotiations between the buyer (or end user) and seller (producer). Graphite prices are also a function of flake size and purity with large flake (+80 mesh, +94% carbon) varieties commanding premium pricing. Prices exceeded USD$1,300 per tonne in the late 1980s, but crashed to USD$600 to $750 per tonne in the 1990s, as Chinese producers flooded the graphite market. During this period there was essentially no global exploration for graphite and, as a result, there are very few projects in the development pipeline.

Graphite prices did not start to recover until 2005 and easily surpassed previous prices, with premium product selling at close to USD$3,000 per tonne as the supply of large flake, high-carbon graphite was tight in early 2012. Price appreciation was largely a function of the commodity cycle and the industrialization of emerging economies, as new, high-growth applications such as lithium-ion batteries have not yet had a substantial impact on demand and consumption. Graphite prices have since come down by about a third, due to slower growth in China and economic weakness in the US and Europe. No new graphite mines were built during the last cycle and, according to commodity experts and industry analysts, the supply problem will become significantly more acute as economies recover.

It is estimated that the world reserves of graphite exceed 800-million tonnes. China is the most significant graphite-producing nation, providing nearly 50% of the US’s annual graphite demand. Flake graphite is also imported to the US from Brazil, Canada and Madagascar. Lump graphite is imported from Sri Lanka. Graphite resources in the US are very small. For a number of years, the US has not produced natural graphite and is completely dependent on the combination of imported, synthetic graphite and recycled graphite sources.

Graphite lubricants are for use in extremely high or low temperatures.

China produces over 80% of the world’s graphite supply. Approximately 70% of Chinese production is fine or amorphous (mainly low-carbon, low-value powder) graphite while 30% is flake. China produces some large flake graphite, but the majority of its flake graphite production is very small (in the +200 mesh range). China was responsible for the large decline in graphite prices in the 1990s as a substantial amount of product was dumped on the market; however, this is unlikely to be repeated due to the phenomenal growth in the Chinese domestic steel industry (which internally consumes a great deal of graphite). Furthermore, Chinese graphite is declining in quality and costs are increasing due to the effects of high grading and to tightening labor and environmental standards. The majority of Chinese graphite mines are small and many are seasonal. Easily mined surface oxide deposits are being depleted and mining is now moving into deeper and higher-cost deposits. China now has a 20% export duty on graphite, as well as a 17% VAT, and has instituted an export licensing system. The situation is being exacerbated by the modernization and consolidation of the Chinese graphite industry, which is eliminating marginal producers and may lead to lower production. In other words, China’s declining production, declining exports and increasing costs are creating serious graphite supply concerns for the rest of the world. It is anticipated that demand for high-purity natural graphite will outpace supply in the near future.

Three key factors that determine graphite price are flake size, grade and purity. Flake graphite is a naturally occurring form of graphite that is typically found as discrete ?akes ranging in size small, medium and large mesh (large ?ake size is needed for high-purity graphite). Flake graphite is in highest demand, due to its versatility, but it also in the lowest supply. As a result, flake graphite commands the highest premium, with larger flake sizes having higher prices than a smaller flake size of equal purity.

Graphite facts:

The term graphite (writing stone) was coined by Abraham Gottlob Werner in 1789

Most of the large-flake graphite deposits are found at or near surface and are amenable to open-pit mining; therefore, large-flake deposits generally make for low-cost mines

Graphite is relatively simple to mine

Graphite is used in pencils, where it is commonly referred to as lead (not to be confused with the metallic element lead)

There is no substitute for graphite in many technologies (i.e. lithium-ion batteries)

Graphite is the 15th most abundant mineral in the Earth’s crust

Because graphite doesn’t trade on an exchange, like copper futures or gold, end consumers must secure graphite feed from a producing mine

Graphite has three forms: diamonds, coal, and graphite

Graphite flake size is as important as carbon content; most high-tech manufacturers would prefer to use high-grade (94-99% graphitic carbon), large-flake (+80 mesh) graphite for their products

Graphite comes in the form of Carbon (C) and is often denoted as Cg, with the ‘g’ specifying the form of carbon

Graphite metallurgy is simpler to deal with than rare earths - it’s equally important, but less complex

Natural graphite is significantly less expensive than synthetic graphite

Graphite is an excellent conductor of heat and electricity and has the highest natural strength and stiffness of any material known today

Graphite maintains its strength and stability to temperatures in excess of 3,600°

Flake graphite is sought for its applications in new technologies, like lithium-ion batteries, fuel cells, solar panels, and vanadium redox batteries

Graphite is one of the lightest of all reinforcing agents and has high natural lubricity

Less than 50% of graphite produced is of the flake variety. That fact, coupled with the increased demand for this essential mineral, has seen flake graphite command a much higher price than fine-mesh or amorphous graphite

$STHC #AmecaMining. All about Gold in Sri Lanka:

https://raregoldnuggets.com/?p=2217

Newly Found Alluvial Gold Deposits in Sri Lanka

Rare Gold Nuggets

March 30, 2016

Sri Lanka is an important gold nation in Asia. For years, the country has been recording increased gold production with most of its gold being produced by small-scale artisanal miners.

With the growth in the value of gold in the international market, the mining sector is quite lucrative for investors and Sri Lanka is no exception. This is particularly because the government has been working with private sector companies to help growth the country’s mining sector.

Historic Gold Mining in Sri Lanka

Gold in Sri Lanka dates back many thousands of years ago. The earliest gold finds in the country to have ever been recorded was in about 8th century AD. This is in reference to the largest cast Ingot of gold recovered during the Abeyagiri excavations. During the Dutugemunu period in the second century BC, gold was mined in a plain near the Acaraviyya-gama where gold nuggets of different sizes were found.

The major gold rush in the recent history is the Mahaoya gold rush of the 1850s. This was started by Bradly, a British seaman who produced gold dust in Maha-oya near Colombo in the late 1840s. This spurred further migration to the area with more miners venturing out in search for gold.

Increased cases of deadly fever and frequent floods cut short the adventures of many miners during that time. Many lost their lives in search of their fortune and treasure in Sri Lanka.

Artisanal Miners on the Kelaniya River

More recently gold has been found on the Kelaniya River in the region near Colombo. With this find more locals are now actively engaged in artisanal gold prospecting along rivers and other river basins throughout the country.

Alluvial gold is being found in many of the waterways of this small country, and there is likely to be much more gold found in the near future with the high price of gold and more miners setting out in search or gold.

Considerable Gold Resources in Sri Lanka

Studies show that Sri Lanka has one of the largest gold deposits in Asia. Although limited commercial mining has taken place, the country has a significant amount of gold throughout its territories. Many of these are alluvial deposits that can be recovered by fairly simple mining methods.

According to a recent geological survey, there are gold deposits in Horana, Akuressa, Deniyaya and Nilwala-ganaga. In fact, the Gem and Jewelry Authority found gold in sand samples taken for Deniyaya recently. There were also a high amount of Uranium and Titanium in the samples.

Reports also indicate the presence of a 10 by 250 miles mineralization belt between Ambalantota and Seruwawila. This are rich gold resources that are yet to be exploited fully and offers a great opportunity for anyone interested in investing in the country’s gold sector. The region is also rich in other minerals such as magnetite, copper, iron and cobalt among others.

The Geological Survey and Mines Bureau of Sri Lanka have recorded gold finds in Kiriibbanara, Balangoda and several places close to the Manik and Walawe Rivers. There are also gold deposits in the central and southern parts of the country. Most of the gold in rivers and the concordant quart reefs is being mined by artisanal miners throughout the country.

The artisanal mining makes up the bulk of the country’s gold production.

Increase in Foreign Mining Investment

Today Sri Lanka is offering more attractive liberal regulations and tax incentives than it has in the past, with the aim of luring foreign investors to help revamp its gold mining sector. The government seeks to overhauls its investment infrastructure and to open up its mining sector to foreign business after several years of civil war.

This is a step in the right direction for the country as this will help put the country of Sri Lanka on the world map of major gold producers. With the nearby country of India being the world’s largest consumer of refined gold, new sources of gold on the market would be welcomed, particularly by India and China.

The country has great gold deposits, but not much of commercial mining is being done due to the effects of past civil war that scared off investors. With the return of peace, the country is now ready to take its place among the world’s major gold producers. With the right investments, it is quite possible that Sri Lanka could become one of the leading gold producers in Asia.

$STHC Balance Sheet from 10K (One CLEAN Company):

$STHC Convertible Note Status (They are CLEAN!).

From what I gather they had one back in 2015 and paid most of it off.

From the latest 10K:

KBM Worldwide September 5, 2014 convertible note.

On September 22, 2014 the Company received a note in the amount of $42,500 from KBM Worldwide, Inc. The note bears a simple interest of 8% per annum from the date hereof (the “Issue Date”) until it becomes due and payable, whether at maturity date on June 24, 2015. The note cannot be converted until 180 days from the Issue date as such the Company concluded that there is no embedded derivative on issuance date but at 180 th day it was a derivative. The note is convertible into shares of Common Stock, at 55% of the Market Price, which means the average of the lowest three trading price during the ten trading days prior to the conversion date.

The Company has determined that the conversion feature of the Note represents an embedded derivative since the Note is convertible into a variable number of shares upon conversion. Accordingly, the Note is not considered to be conventional debt and the embedded conversion feature must be bifurcated from the debt host and accounted for as a derivative liability. Accordingly, the fair value of this derivative instrument has been recorded as a liability on the balance sheet with the corresponding amount recorded as a discount to the Note. Such discount will be accreted from the issuance date to the maturity date of the Note. The change in the fair value of the derivative liability will be recorded in other income or expenses in the statement of operations at the end of each period, with the offset to the derivative liability on the balance sheet. The fair value of the embedded derivative liability was determined using the Black- Scholes valuation model on the 180 th day and April 30, 2015 with the assumptions in the table below.

The Company recognized a total $2,549 as a gain on derivative related to this convertible note. The Company calculated the liability as on March 23, 2015 and April 30, 2015. On March 23, 2015 the company recognized debt discount of $42,500, derivative liability of $167,231 and day one loss of $124,731 related to this convertible note. At April 30, 2015, the Company revalued the embedded derivative liability. For the period from March 23, 2015 (commencement date) to April 30, 2015, the Company decreased the derivative liability by $127,280, resulting in a derivative liability of $39,951 and a total net gain of $2,549. The Company recognized amortization of debt discount of $17,366 for the period end April 30, 2015.

z

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM