Wednesday, August 12, 2020 9:32:27 PM

>>> How to invest for income now

Tactical multi-asset investing takes on low rates and bad news

BY ADAM KRAMER, PORTFOLIO MANAGER,

FIDELITY VIEWPOINTS

05/01/2020

Key takeaways

Multi-asset income strategies may help investors seek income despite low interest rates.

Professional investment managers may find opportunities when markets misprice assets in reaction to bad news.

Opportunities exist now in investment-grade corporate bonds, high-yield bonds, dividend-paying stocks, convertible bonds, and Treasury inflation-protected securities.

With interest rates at historic lows and some companies reducing or eliminating dividends, it's a challenging time for investors who seek income from their portfolios. Challenging, though, is not the same as impossible. A professionally managed, tactical approach to income investing that can look for opportunities in a wide variety of asset classes may help income-seeking investors achieve their goals, despite low rates.

In fact, economic uncertainty and anxiety about the spread of COVID-19 make this a good time for tactical investing. That's because when uncertainty is high, markets may temporarily misprice assets based on short-term events and overlook other factors, such as how much investors might earn over a longer term on those assets.

For professional managers who can identify those mispricings, the combination of abundant bad news and the freedom to invest in a wide variety of assets can present opportunities. Rather than overreact to bad news, tactical managers can seek assets they believe have the potential to outperform if the bad news "turns out not to be so bad after all." Even if reality turns out as negative as markets expect, prices shouldn't fall much because investors anticipated it. Keeping an eye out for mispricings can also help avoid assets where not enough bad news may be priced in and prices are too high.

Looking for opportunities

The forces that drive financial markets are always in motion. Economic growth increases and slows. Investors' enthusiasm for certain asset classes or companies rises and falls. New technologies arise, while older ones fade away. Unforeseeable events can act on global economies in unexpected ways. Because market conditions constantly change, the investments that deliver the highest returns today may not be the ones that do so next month or next year. That's why multi-asset income strategies that can invest across a wide variety of asset classes may be able to deliver more consistent returns and a better balance between risk and return than those with fewer options to choose from.

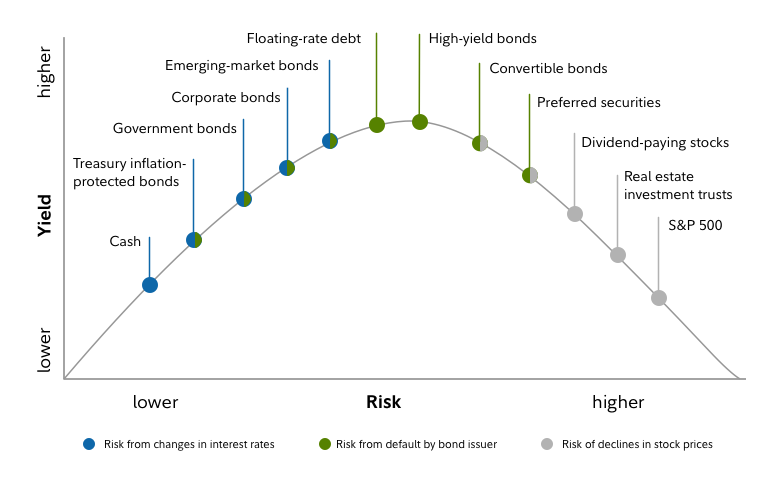

How yields and risks of popular investment choices compare

The data in the chart is described in the text.

For illustrative purposes only.

Source: Fidelity Investments

The chart above depicts general long-term directional and ranking relationships among a number of asset classes on the dimensions of yield and beta. Beta is estimated in comparison to US common stocks as represented by the S&P 500 index. The relationships and relative rankings among these asset classes will vary over time.

Finding opportunities now

As the US Treasury, Federal Reserve, and federal government continue to be pragmatic and supportive of the economy, the coronavirus pandemic has created opportunities within many income-oriented US asset class. As concerns over the economic impact of the virus's spread prompted many investors to sell assets, prices of many bonds as well as stocks dropped to levels not seen since the global financial crisis. Assets sold off with little regard for fundamentals and since then, professional investment managers have been buying those that offer income and value on the expectation that if events turn out better than expected, their prices could rise in addition to paying interest and dividend income.

While many companies' operations have been severely reduced, dividend-paying US large-cap stocks present opportunities for managers of income strategies who practice careful security selection and seek companies with strong balance sheets that pay sustainable dividends. Many of these stocks' prices fell significantly during widespread selling that accompanied the spread of COVID-19 around the world. They include consumer staples, pharmaceuticals, and information technology companies, and also companies in sectors such as materials and energy that have historically performed well as the economy emerges from recession.

Some dividend-paying stocks related to the transportation of oil and refined products also offer opportunities. Oil tanker operators are an example of how the ability to spot mispriced assets can benefit income-seeking investors. Theirs were among the first stocks to move lower as the coronavirus spread in China and oil demand fell. Oil production cuts are generally a negative for oil tankers because there's less cargo for them to carry. However, demand and prices have fallen faster than production, and oil companies are storing crude oil on ships. That means more need for ships than expected. Despite plunging global oil demand, these companies will soon start declaring their first quarter dividends and should have a much better situation than previously expected.

Preferred stocks have been very expensive but are now priced near their historical averages. Most US preferreds are in banks which are in much better shape than they were during the financial crisis.

Remember, though, as we've seen this year, stock markets are volatile and can decline significantly.

Many high-quality companies' investment-grade corporate bonds offer opportunities, including those from defense contractors, regulated utilities, and large US banks. Many of these bonds are now selling at discounts. Unusually, these bonds' prices fell along with stocks during the March COVID-19-related sell-off. Since then, prices of many highly rated bonds have recovered, but BBB-rated investment-grade corporate bonds offer both attractive prices and income, with many yielding near 4%, as of April 29, 2020.

Some high-yield bonds with credit ratings of BB and B also present opportunities, particularly those issued by cable, telecommunications, packaging, and industrial companies. Many of these bonds are selling at a discount, with yields of 6% and 9%, respectively, as of April 29, 2020.

To be sure, bonds of less than investment-grade quality involve greater risk of default or price changes due to changes in the credit quality of the issuer. Because of these risks, careful security selection by professional managers is important.

Convertible bonds issued by companies in industries such as technology and health care, whose underlying stocks had been expensive are currently more reasonably priced, at close to their averages over the past 25 years. Many new bonds offering attractive yields are being issued as companies seek to adjust to the new COVID-19 reality.

Convertible bond prices can fall if interest rates rise and stock prices decline, but they are less sensitive to such changes than both stocks and traditional corporate bonds. While bad news can help create opportunities, too much of it can have the opposite effect. Too much bad news has been priced into US Treasurys, which have rallied and no longer look attractive. While they can act as hedges to protect investors in down markets, they currently offer little yield.

Treasury inflation protected securities (TIPS), which adjust to the consumer price index, can be an attractive alternative to Treasurys. When real yields move lower, TIPS have historically done well. In the COVID-19 world, financial markets are pricing in very little future inflation due to falling oil prices and reduced business and consumer spending. This is reflected in declining real yields which give TIPS a better balance between risk and reward than nominal Treasuries looking out over the next year or two.

Finding ideas

Investors interested in these strategies should research professionally managed mutual funds. You can run screens using the Mutual Fund Screener on Fidelity.com. Below are the results of some illustrative mutual fund screens (these are not recommendations of Adam Kramer or Fidelity).

Multi-asset class income funds

Fidelity funds

Fidelity® Multi-Asset Income Fund (FMSDX)

Non-Fidelity funds

BlackRock Multi-Asset Income Portfolio (BAICX)

American Century Multi-Asset Income Fund (AMJVX)

Invesco Multi-Asset Income Fund (PIAFX)

<<<

Tactical multi-asset investing takes on low rates and bad news

BY ADAM KRAMER, PORTFOLIO MANAGER,

FIDELITY VIEWPOINTS

05/01/2020

Key takeaways

Multi-asset income strategies may help investors seek income despite low interest rates.

Professional investment managers may find opportunities when markets misprice assets in reaction to bad news.

Opportunities exist now in investment-grade corporate bonds, high-yield bonds, dividend-paying stocks, convertible bonds, and Treasury inflation-protected securities.

With interest rates at historic lows and some companies reducing or eliminating dividends, it's a challenging time for investors who seek income from their portfolios. Challenging, though, is not the same as impossible. A professionally managed, tactical approach to income investing that can look for opportunities in a wide variety of asset classes may help income-seeking investors achieve their goals, despite low rates.

In fact, economic uncertainty and anxiety about the spread of COVID-19 make this a good time for tactical investing. That's because when uncertainty is high, markets may temporarily misprice assets based on short-term events and overlook other factors, such as how much investors might earn over a longer term on those assets.

For professional managers who can identify those mispricings, the combination of abundant bad news and the freedom to invest in a wide variety of assets can present opportunities. Rather than overreact to bad news, tactical managers can seek assets they believe have the potential to outperform if the bad news "turns out not to be so bad after all." Even if reality turns out as negative as markets expect, prices shouldn't fall much because investors anticipated it. Keeping an eye out for mispricings can also help avoid assets where not enough bad news may be priced in and prices are too high.

Looking for opportunities

The forces that drive financial markets are always in motion. Economic growth increases and slows. Investors' enthusiasm for certain asset classes or companies rises and falls. New technologies arise, while older ones fade away. Unforeseeable events can act on global economies in unexpected ways. Because market conditions constantly change, the investments that deliver the highest returns today may not be the ones that do so next month or next year. That's why multi-asset income strategies that can invest across a wide variety of asset classes may be able to deliver more consistent returns and a better balance between risk and return than those with fewer options to choose from.

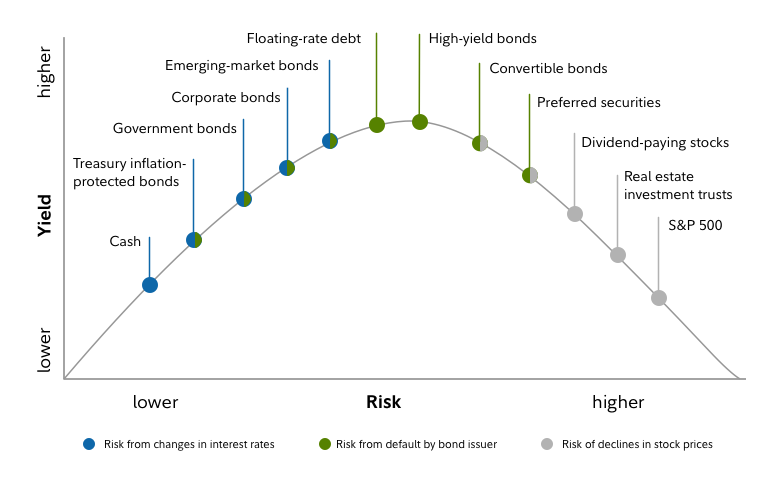

How yields and risks of popular investment choices compare

The data in the chart is described in the text.

For illustrative purposes only.

Source: Fidelity Investments

The chart above depicts general long-term directional and ranking relationships among a number of asset classes on the dimensions of yield and beta. Beta is estimated in comparison to US common stocks as represented by the S&P 500 index. The relationships and relative rankings among these asset classes will vary over time.

Finding opportunities now

As the US Treasury, Federal Reserve, and federal government continue to be pragmatic and supportive of the economy, the coronavirus pandemic has created opportunities within many income-oriented US asset class. As concerns over the economic impact of the virus's spread prompted many investors to sell assets, prices of many bonds as well as stocks dropped to levels not seen since the global financial crisis. Assets sold off with little regard for fundamentals and since then, professional investment managers have been buying those that offer income and value on the expectation that if events turn out better than expected, their prices could rise in addition to paying interest and dividend income.

While many companies' operations have been severely reduced, dividend-paying US large-cap stocks present opportunities for managers of income strategies who practice careful security selection and seek companies with strong balance sheets that pay sustainable dividends. Many of these stocks' prices fell significantly during widespread selling that accompanied the spread of COVID-19 around the world. They include consumer staples, pharmaceuticals, and information technology companies, and also companies in sectors such as materials and energy that have historically performed well as the economy emerges from recession.

Some dividend-paying stocks related to the transportation of oil and refined products also offer opportunities. Oil tanker operators are an example of how the ability to spot mispriced assets can benefit income-seeking investors. Theirs were among the first stocks to move lower as the coronavirus spread in China and oil demand fell. Oil production cuts are generally a negative for oil tankers because there's less cargo for them to carry. However, demand and prices have fallen faster than production, and oil companies are storing crude oil on ships. That means more need for ships than expected. Despite plunging global oil demand, these companies will soon start declaring their first quarter dividends and should have a much better situation than previously expected.

Preferred stocks have been very expensive but are now priced near their historical averages. Most US preferreds are in banks which are in much better shape than they were during the financial crisis.

Remember, though, as we've seen this year, stock markets are volatile and can decline significantly.

Many high-quality companies' investment-grade corporate bonds offer opportunities, including those from defense contractors, regulated utilities, and large US banks. Many of these bonds are now selling at discounts. Unusually, these bonds' prices fell along with stocks during the March COVID-19-related sell-off. Since then, prices of many highly rated bonds have recovered, but BBB-rated investment-grade corporate bonds offer both attractive prices and income, with many yielding near 4%, as of April 29, 2020.

Some high-yield bonds with credit ratings of BB and B also present opportunities, particularly those issued by cable, telecommunications, packaging, and industrial companies. Many of these bonds are selling at a discount, with yields of 6% and 9%, respectively, as of April 29, 2020.

To be sure, bonds of less than investment-grade quality involve greater risk of default or price changes due to changes in the credit quality of the issuer. Because of these risks, careful security selection by professional managers is important.

Convertible bonds issued by companies in industries such as technology and health care, whose underlying stocks had been expensive are currently more reasonably priced, at close to their averages over the past 25 years. Many new bonds offering attractive yields are being issued as companies seek to adjust to the new COVID-19 reality.

Convertible bond prices can fall if interest rates rise and stock prices decline, but they are less sensitive to such changes than both stocks and traditional corporate bonds. While bad news can help create opportunities, too much of it can have the opposite effect. Too much bad news has been priced into US Treasurys, which have rallied and no longer look attractive. While they can act as hedges to protect investors in down markets, they currently offer little yield.

Treasury inflation protected securities (TIPS), which adjust to the consumer price index, can be an attractive alternative to Treasurys. When real yields move lower, TIPS have historically done well. In the COVID-19 world, financial markets are pricing in very little future inflation due to falling oil prices and reduced business and consumer spending. This is reflected in declining real yields which give TIPS a better balance between risk and reward than nominal Treasuries looking out over the next year or two.

Finding ideas

Investors interested in these strategies should research professionally managed mutual funds. You can run screens using the Mutual Fund Screener on Fidelity.com. Below are the results of some illustrative mutual fund screens (these are not recommendations of Adam Kramer or Fidelity).

Multi-asset class income funds

Fidelity funds

Fidelity® Multi-Asset Income Fund (FMSDX)

Non-Fidelity funds

BlackRock Multi-Asset Income Portfolio (BAICX)

American Century Multi-Asset Income Fund (AMJVX)

Invesco Multi-Asset Income Fund (PIAFX)

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.