Friday, August 07, 2020 12:53:46 PM

Synergy Management Custodian, set up Merger with Ameca Mining:

From post by StervC - Sterling

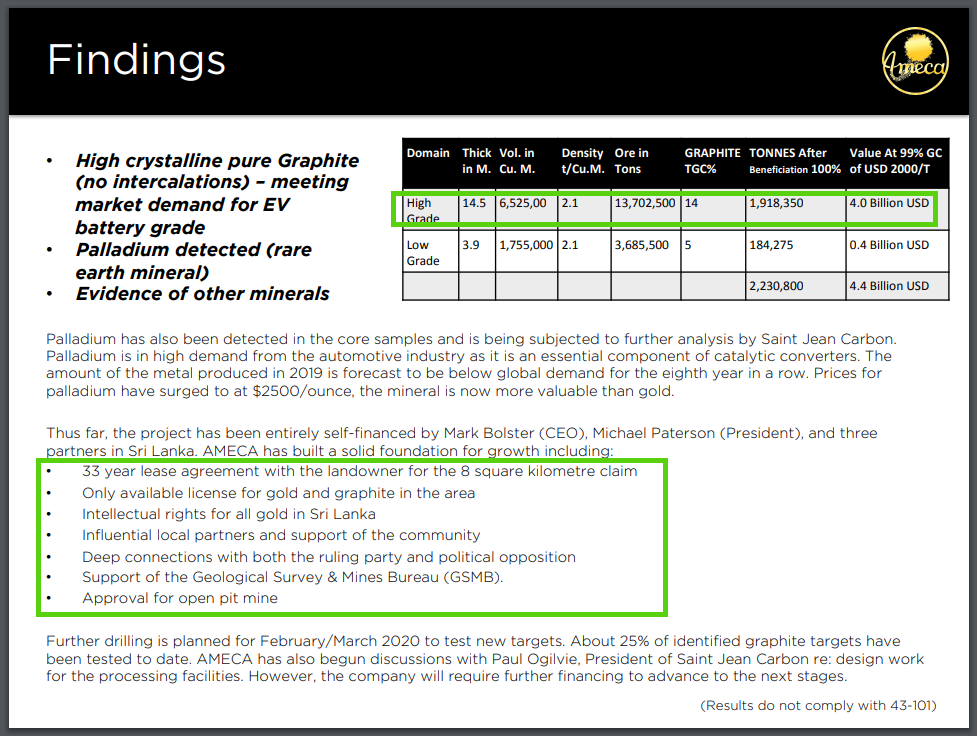

AMECA Mining has $4.4 Billion of Crystalline Pure Graphite. They have $4 Billion in High Crystalline Pure Graphite and $0.4 Billion in Low Crystalline Pure Graphite

We are waiting on STHC to close the acquisition of AMECA Mining next week as explained within the post below:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=157402706

Below is confirmation from the website of the $4.4 Billion of Crystalline Pure Graphite:

https://31f856b6-de57-4066-9e5f-3268e24b9557.filesusr.com/ugd/1416ce_e8499e2828bd46529d86241174d82b7d.pdf

$STHC Ameca Mining: Projected Revenues: $30 Million

$STHC: Ameca Mining - High Value Minerals:

High Value Minerals

Gold: Targeting goal of establishing multi-million oz gold resource. Visible gold in core samples. Early testing at shallow levels show the presence of gold (7 grams/tonne). Currently undertaking Phase 2 drilling to a depth of 200 metres. Fire assay will be available in 4-5 weeks. AMECA holds intellectual rights for all gold in Sri Lanka.

Platinum groups: High concentrations of palladium (5.67) found by Saint Jean Carbon in initial samples. Awaiting confirmation from Actlabs.

Rare earths: Very promising results from both a geological standpoint and potentially processing perspective. Testing at the certified labs of Saint Jean Carbon and Actlabs show high concentrations of multiple rare earths including: Europium (.9%), gadolinium (1.2%).

Graphite: Proven 2 million tonnes of extremely high (99.9%) purity. Graphite will not need to be subjected to many damaging processes required to obtain the purity required by end user. Ideal for the anodes of EV batteries. No intercalation with host rock means less processing and associated costs than North American deposits. 10 year, $20 million/year off-take agreement signed.

$STHC Transparency: Check out the Directors of Ameca....impressive

And each one can be contacted individually......

AMECA built by christinatbhotz.com ....she's done a Great job on their website!

$STHC Balance Sheet from 10K (One CLEAN Company):

$STHC Convertible Note Status (They are CLEAN!).

From what I gather they had one back in 2015 and paid most of it off.

From the latest 10K:

KBM Worldwide September 5, 2014 convertible note.

On September 22, 2014 the Company received a note in the amount of $42,500 from KBM Worldwide, Inc. The note bears a simple interest of 8% per annum from the date hereof (the “Issue Date”) until it becomes due and payable, whether at maturity date on June 24, 2015. The note cannot be converted until 180 days from the Issue date as such the Company concluded that there is no embedded derivative on issuance date but at 180 th day it was a derivative. The note is convertible into shares of Common Stock, at 55% of the Market Price, which means the average of the lowest three trading price during the ten trading days prior to the conversion date.

The Company has determined that the conversion feature of the Note represents an embedded derivative since the Note is convertible into a variable number of shares upon conversion. Accordingly, the Note is not considered to be conventional debt and the embedded conversion feature must be bifurcated from the debt host and accounted for as a derivative liability. Accordingly, the fair value of this derivative instrument has been recorded as a liability on the balance sheet with the corresponding amount recorded as a discount to the Note. Such discount will be accreted from the issuance date to the maturity date of the Note. The change in the fair value of the derivative liability will be recorded in other income or expenses in the statement of operations at the end of each period, with the offset to the derivative liability on the balance sheet. The fair value of the embedded derivative liability was determined using the Black- Scholes valuation model on the 180 th day and April 30, 2015 with the assumptions in the table below.

The Company recognized a total $2,549 as a gain on derivative related to this convertible note. The Company calculated the liability as on March 23, 2015 and April 30, 2015. On March 23, 2015 the company recognized debt discount of $42,500, derivative liability of $167,231 and day one loss of $124,731 related to this convertible note. At April 30, 2015, the Company revalued the embedded derivative liability. For the period from March 23, 2015 (commencement date) to April 30, 2015, the Company decreased the derivative liability by $127,280, resulting in a derivative liability of $39,951 and a total net gain of $2,549. The Company recognized amortization of debt discount of $17,366 for the period end April 30, 2015.

z

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM