Wednesday, July 29, 2020 5:49:00 PM

I also think people are just not thinking through where we will be politically IF there is a landslide against Trump, the house republicans and the senate republicans.

Fair point. If Congress passes a law nationalizing FnF and zeroing out current shareholders, there is basically nothing we could do about it. Right now the juniors and commons are worth nothing in liquidation or receivership because of the liquidation preference of the seniors.

Forget political capital in that scenario, we are actually talking reputational capital -- will Trump and Mnuchin want to be labelled as rewarding hedge fund buddies in a last minute, lame duck, move? You can see the headlines -- the "Biggest heist in US history" etc etc And what do they get back? Nadda -- nothing but trouble... And these folks are very transactional

I've heard this argument before, but I don't agree with it. A big reason is that the tax bill in 2017 was a far, far bigger giveaway to the rich than any recap and release of FnF could ever be. If this administration truly feared such headlines I don't think they would have pushed that bill through so aggressively.

What kind of blowback could this administration face in the lame duck period anyway? The man at the top is slammed by the media all the time, what would be any different?

What is more interesting is whether a SCOTUS victory does much if Biden is in power? Can a Biden administration just continue the conservatorship, and refuse to pay divvies on pref, for ever? What forces them to change?

The only legal, conforms-to-the-contract backward remedy I can see the Supreme Court granting is Treasury returning $130B to FnF, the NWS is gone for good, but the seniors stay in place.

As such, I don't see the government risking a final ruling because it would be a huge, huge political black eye. The only way to avoid it, though, is to agree to cancel the seniors instead.

One irony here is that if Trump really does go scorched-earth in the lame duck period, he could just have Mnuchin cancel the warrants to deny Biden's administration the money. As much as that would cause common nonsense rejoicing, it actually removes the floor for the re-IPO price and opens the door for a re-IPO under $1 because at that point, there would be no reason to not just do a massive, recap-FnF-all-at-once common share offering. If the perceived market cap is $200B and they raise close to that amount, the existing commons would be left with crumbs. There would also be no reason not to offer the juniors an extremely generous conversion because it couldn't dilute Treasury warrants that don't exist.

An amusing possibility I saw mentioned somewhere was that FHFA could have the OTC just halt trading on FnF shares for a few weeks while the cases are settled and the SPSPAs are amended. Then if they also offer the junior-to-common conversion (with a short deadline) during the halt, the public would likely never realize just how much of a gain the juniors made.

Sorry to be so negative, I have been "worst case" assessing all my holdings recently, alongside "blue sky" scenarios...

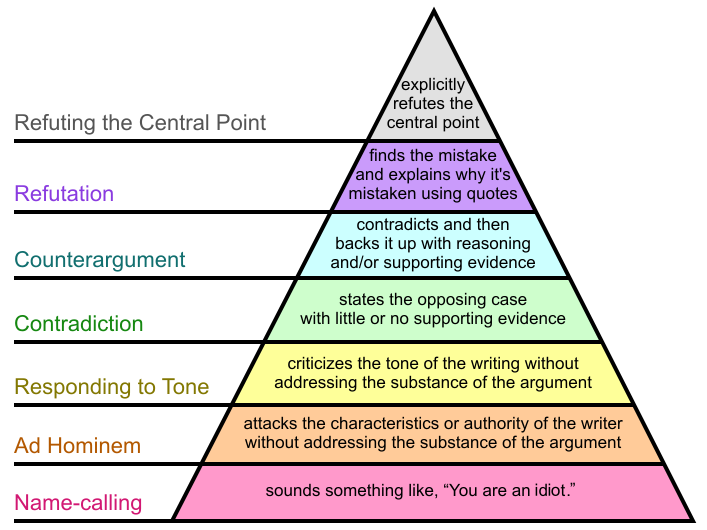

No need for apologies. Opposing views make a market, and it's always good to sharpen one's views against them rather than the all-too-common (pun intended) resorts to ad hominems.

Avant Technologies and Ainnova Tech Form Joint Venture to Advance Early Disease Detection Using Artificial Intelligence • AVAI • Nov 12, 2024 9:00 AM

Swifty Global Announces Launch of Swifty Sports IE, Expanding Sports Betting and Casino Services in the Irish Market • DRCR • Nov 12, 2024 9:00 AM

Oohvie App Update Enhances Women's Health with Telemedicine and Online Scheduling • HLYK • Nov 11, 2024 8:00 AM

SANUWAVE Announces Record Quarterly Revenues: Q3 FY2024 Financial Results • SNWV • Nov 8, 2024 7:07 AM

DBG Pays Off $1.3 Million in Convertible Notes, which Retires All of the Company's Convertible Notes • DBGI • Nov 7, 2024 2:16 PM

SMX and FinGo Enter Into Collaboration Mandate to Develop a Joint 'Physical to Digital' Platform Service • SMX • Nov 7, 2024 8:48 AM