Wednesday, July 01, 2020 8:27:00 AM

*Revs Guidance (FY’21 fye 4-30-21): $76-81M. 4-30-20 Backlog=$65M

*Cash: 4-30-20: $36.3M

*As of 6-19-20: 56,511,294 shares o/s.

*10K/4-30-20 iss. 6-30-20: https://tinyurl.com/yak25nco

*Avid Total Revs May03-Apr20: $408.9M

*Avid’s website: https://avidbio.com (A/o 4-30-20, 222 full-time & 5 part-time emps)

This large post has 4 sections:

I. 6-30-20 Qtly. Earnings Conf. Call TRANSCRIPT (FY20/Q4 fye 4-30-20)

II. 6-30-20 CDMO Press Release: Q4/FY20 Earnings & Developments

IV. Updated Table of Avid Revenues By Quarter (May’06-Current)

III. Updated O/S Shares History Table – 2006-curr.

…Recall: Avid’s FY runs May-Apr, so FY’21 = May’20-Apr’21.

TRANSCRIPT 6-30-20 FY20/Q4 Earnings Conf. Call (fye 4-30-20):

Rick Hancock(Interim CEO), Daniel Hart(CFO), Tim Compton(CCO)

Q&A Analysts:

Matt Hewitt - Craig-Hallum Capital

Joe Pantginis - H.C. Wainwright

Jacob Johnson - Stephens

Link to webcast replay: http://ir.avidbio.com/events-and-presentations => https://edge.media-server.com/mmc/p/bt2399kr

CC TRANSCRIPT EXTRACTS – PREPARED REMARKS BY INT. CEO RICK HANCOCK:

OPENING:

“Thank you to everyone who has dialed in and to those who are participating today via webcast. Before addressing the company's financial and operational performance, I'd first like to welcome Nicholas Green to the Avid team. Nick has recently been appointed Avid's new CEO [6-23-20/PR: https://tinyurl.com/yczapcc7 ] and we are thrilled to have him onboard. Nick has more than 30 years of experience in the global pharmaceutical and healthcare services industry with significant expertise in the contract manufacturing of novel pharmaceutical products. His global pharmaceutical experience spans four continents having run 31 facilities in 9 countries in North America, South America, Europe, and Asia. Throughout his career, Nick has held a number of senior management roles for several contract manufacturing organizations and life science companies where he is credited with successfully building and expanding those businesses and delivering significant value for customers, patients, employees, and other stakeholders. We are very pleased to have Nick join Avid and we believe his experience will be highly valuable as the company grows both commercially and operationally. Nick's start date is July 30th, 2020. With his arrival, I will no longer be part of the company's day-to-day operations, but I will continue to support Avid as the Director on the company's Board and I look forward to working with Nick and this team going forward.

I'll now address the quarter. Avid's performance during Q4 partially offset the lower than expected revenues recorded during Q3. As discussed on our last earnings call, during Q3, the company experienced a problem with a specific piece of equipment. This resulted in a production interruption during Q3 and a deferral of some revenue for that period. While the interruption extended into Q4, additional unplanned revenue generating projects were initiated during the period, allowing the company to exceed its restated annual revenue guidance and end the year with a strong backlog. We are pleased to report that during Q4, we identified and mitigated the cause of the equipment problem responsible for this production interruption and we are currently in the process of confirming the successful remediation. During Q4, we also expanded our business development team and entered into a co-marketing partnership that we believe will provide another channel from which to fill capacity. Based on our customers' growing demand and our expanding business development activity, we believe that we will significantly increase capacity utilization in 2021 and beyond. Accordingly, we have entered into a new phase of planning for the expansion that will support our growing business in the years to come.”

POST HART/COMPTON:

“As a continuation of Tim's comments, I'd first like to address Avid's operations in context of the COVID-19 pandemic. Since the beginning of the pandemic, Avid management has closely monitored our production pipeline and the health of our workforce. We are pleased that to date, we have observed no material impact to our production programs for our supply chain and our employees remain healthy and highly productive. Management is taking every precaution and following state and local guidelines to ensure the continued safety and well-being of our team members and we are hopeful that our operations will remain uninterrupted. I'd like to reiterate that no work has been canceled or delayed due to the pandemic and we currently have no expectations that, that will change.

I will now comment further regarding last quarter's equipment issue and production interruption. Let me first confirm that the specific piece of equipment in question is now operational. However, this project is being executed in 3 phases: investigation, remediation, and confirmation. To date, we believe that we have successfully completed the first 2 stages by identifying and remediating the source of the problem. The company is currently progressing through the confirmation stage during which it is running multiple revenue generating production campaigns. While we are optimistic, the company will not be able to confirm the full resolution until it completes the confirmation stage, which we expect will be completed in the coming months.

As we look ahead, we believe that growing customer demand and our expanding business development activity will result in a need for additional capacity. In recent quarters, we have done much of the ancillary work that is required to support a more comprehensive expansion in the future. As we've addressed in prior calls, this work has included the enhancement of key systems and upgrades to general infrastructure. However, we are now taking additional steps to prepare for the growth opportunities we see ahead. While specific kick-off date has not been set for this expansion, we recognize that construction may take 18-24 months to complete. For that reason, we are undertaking the pre-engineering, design, and permitting work required to allow us to break ground on this project at the appropriate time.

Given this backdrop, I'm very pleased to announce that for FY2021, we expect to record revenue of $76-$81 million, representing growth of approx. 27-36% over FY2020 and as we continue to achieve revenue growth, we expect the improvement in margins to track accordingly.

In closing, I'd like to communicate our strong optimism for FY2021 and beyond. Despite the challenges of the third and fourth quarters of fiscal 2020, we finished strong with higher revenues than expected and a record-breaking backlog of business. We are preparing to welcome our new CEO, Nick Green, and we are confident that he will provide the vision and execution strategy to elevate Avid to the next level.

Our customer relationships are strong and forecasted demand is growing. Combined with our expanded business development activity, which we expect to generate an increasing number of projects from both existing and new customers, we believe that we are on a path to significantly increased capacity utilization. Accordingly, we are readying to kick-off an expansion that will allow us to meet the increasing demand of our ever-growing customer list. This concludes my prepared remarks for today. We can now open the call up to questions.”

READ the entire CC Transcript here:

https://www.fool.com/earnings/call-transcripts/2020/06/30/avid-bioservices-inc-cdmo-q4-2020-earnings-call-tr.aspx

= = = = = = = = = = = = = = = = = = = = = == = = =

6-30-20/PR: Avid Bioservices Reports Financial Results for Q4 FYE April 30, 2020, and Recent Developments

https://www.globenewswire.com/news-release/2020/06/30/2055808/0/en/Avid-Bioservices-Reports-Financial-Results-for-Fourth-Quarter-and-Fiscal-Year-Ended-April-30-2020-and-Recent-Developments.html

-- Appointed Nicholas Green as President & Chief Executive Officer

-- Recorded Q4 Revenue of $12.6 Million and Annual Revenue of $59.7 Million

-- Signed $23 Million in Business Orders and Achieved Record Backlog of $65 Million During Q4

-- Project Fiscal 2021 Revenue of $76-$81 Million

TUSTIN, June 30, 2020: Avid Bioservices, Inc. (NASDAQ:CDMO/CDMOP), a dedicated biologics contract development and manufacturing organization (CDMO) working to improve patient lives by providing high quality development and manufacturing services to biotechnology and pharmaceutical companies, today announced financial results for Q4 and full FY 2020, ended April 30, 2020.

HIGHLIGHTS SINCE JANUARY 31, 2020

“Q4 of fiscal 2020 was a very productive period, generating higher than anticipated revenues,” said Rick Hancock, Interim President and CEO of Avid. “As discussed previously, the production interruption and revenue deferral that took place during the third quarter of fiscal 2020 required the company to lower revenue guidance for the year. While this interruption caused us to fall short of our originally stated revenue guidance, the productivity during Q4 allowed us to exceed our re-stated guidance for the FY, sign $23 million in project expansion orders with existing customers during Q4, and end the FY with a strong backlog.

“Avid also significantly strengthened its management team in recent weeks. First, we were pleased to announce the appointment of Nicholas Green, as the company’s new President and CEO. Nick, who will join the team on July 30, comes to Avid with many years of experience driving growth and expansion for multiple key CDMOs around the world, and we are very pleased to have him leading the company’s future strategy.

[SEE: 6-23-20/PR: https://tinyurl.com/yczapcc7, and 2014 interview while CEO at Therapure: https://youtu.be/c3eRQ5M05i4 ]

“During Q4, the company also added two senior directors to our business development team with proven track records in growing CDMOs. They are responsible for driving business growth in North America, Europe and Asia. This expanded and highly experienced business development team has quickly elevated our level of engagement with both existing customers and prospective customers. Additionally, our new team is in discussions with multiple parties regarding potential novel programs to combat COVID-19, and we hope to have the opportunity to support the fight against this global pandemic. Based on this sharp increase in business development activity, combined with the growth of existing customer forecasts, we expect to significantly increase our capacity utilization in the quarters ahead.

“To accommodate this anticipated increase in demand, during Q4, the company initiated the pre-engineering, design and permitting work required to allow us to break ground on a facility expansion at the appropriate time. While a specific kick-off date has not yet been established for this expansion, we believe that customer demand will require additional capacity and we are actively moving forward to prepare for this growth opportunity.

“Regarding the equipment issue and production interruption that we reported last quarter, I can confirm that the specific piece of equipment in question is now operational. However, this project is being executed in three phases: investigation, remediation, and confirmation. We are currently progressing though the confirmation stage during which we are running multiple revenue-generating production campaigns to confirm the successful remediation of the equipment issue. We expect this work to be completed in the coming months.

“While we faced a number of challenges in fiscal 2020, we are very encouraged by the events of, and subsequent to, Q4. In particular, we are pleased to welcome a new and highly experienced CEO to lead Avid into its next phase of growth. During Q4, we also significantly strengthened our business development team, signed multiple project expansion orders with existing customers, and finished the year with a record $65 million backlog. The company continues to have strong relationships with its customers as evidenced by their forecasted growth in demand for fiscal 2021 and beyond, and we expect the number of projects from new customers to grow nicely moving forward. Finally, in the era of COVID-19, it is important to note that Avid, as a critical supplier, has lost no signed business during this period and continues to operate at full-scale while maintaining social distancing requirements. This is due in large part to our exceptional employees who have been diligent in their daily work and who remain productive and committed to excellence despite the hardships posed by the pandemic. We expect each of these factors to contribute to meaningful growth in fiscal 2021.”

FINANCIAL HIGHLIGHTS AND GUIDANCE

The company is providing revenue guidance for the full FY 2021 of $76 to $81 million.

Revenues for Q4 of fiscal 2020 were $12.6 million, a 26% decrease compared to revenues of $17.1 million recorded during Q4 of fiscal 2019. The year-over-year decline in revenue was primarily attributable to the interruption of production which began during the third quarter and continued into Q4 of fiscal 2020, as a result of a problem with a specific piece of equipment. Despite this decline, fourth quarter 2020 revenues were stronger than expected based on our revised guidance for the quarter due primarily to an increase in customer projects. For the full FY 2020, revenues were $59.7 million, an 11% increase as compared to revenues of $53.6 million in the prior year period. This increase was primarily the result of continued growth in the number and scope of customer projects.

As of April 30, 2020, revenue backlog was $65 million, an increase of 12% compared to $58 million at the end of the third quarter of fiscal 2020, and an increase of 41% compared to $46 million at the end of last FY. The company expects to recognize the majority of this backlog during fiscal 2021.

Gross margin for Q4 of fiscal 2020 was a negative 10% compared to a gross margin of 21% for Q4 of fiscal 2019. The decrease in gross margin for the 2020 quarter was primarily attributed to the costs associated with the production interruption described earlier, an increase in depreciation expense from the acquisition of new equipment, and a net decrease in revenue. Gross margin for the full FY 2020 was 7%, a decrease compared to 13% in the prior year period. This decrease was primarily due to higher facility and equipment related costs primarily associated with the production interruption during the second half of fiscal 2020, the planned growth costs associated with payroll and related costs, and an increase in depreciation expense from the acquisition of new equipment.

Selling, general and administrative expenses (“SG&A”) for Q4 of fiscal 2020 were $3.5 million, a slight decline compared to $3.6 million recorded for Q4 of fiscal 2019. For the full FY 2020, SG&A expenses were $14.5 million, a 13% increase compared to $12.8 million for the prior year. The increase in SG&A for the year was primarily attributed to employee separation-related expenses, recruiting fees and increased stock-based compensation. When excluding the separation-related expenses, SG&A increased 3% during fiscal 2020 as compared to the prior year.

For Q4 of fiscal 2020, the company recorded a consolidated net loss attributable to common stockholders of $6.2 million or $0.11 per share, as compared to a consolidated net loss attributable to common stockholders of $1.1 million or $.02 per share, for Q4 of fiscal 2019. For the full FY 2020, the company recorded a consolidated net loss attributable to common stockholders of $15.2 million or $.27 per share, compared to a consolidated net loss attributable to common stockholders of $8.9 million or $.16 per share, for fiscal 2019.

Avid reported $36.3 million in cash and cash equivalents as of April 30, 2020, a 12% increase as compared to $32.4 million as of the prior FY ended April 30, 2019. The company also achieved positive free cash flow, measured as the change in cash from operations net of capital expenditures, of $2.0 million for the full FY 2020.

More detailed financial information and analysis may be found in Avid Bioservices’ Annual Report on Form 10-K, which will be filed with the SEC today. [https://tinyurl.com/yak25nco ]

RECENT CORPORATE DEVELOPMENTS

* Appointed Nicholas (Nick) Green as President and CEO. Mr. Green has more than 30 years of experience in the industry. He has held a number of senior management roles, most recently serving as president and CEO of Therapure Biopharma, with prior positions as managing director of Nipa Laboratories Ltd., head of the Life Science Division of Clariant International Ltd. in the USA, President and CEO of Rhodia Pharma Solutions Ltd. and President of Codexis, Inc.’s Pharma Division. Mr. Green holds a BSc (Hons) in Chemistry from Queen Mary College in London and an MBA from the University of Huddersfield. [SEE 6-23-20/PR: https://tinyurl.com/yczapcc7 ]

* Significantly strengthened the business development team with the appointment of two senior directors with responsibility for driving CDMO business growth within North America, Europe and Asia. Jason C. Brady, Ph.D. serves as senior director of business development for eastern North America, as well as Europe. Sylvia Hinds serves as senior director of business development for western North America in addition to the Asia Pacific region.

* Signed project expansion orders for $23 million during the quarter with existing customers. During fiscal 2020, the company signed new business orders for $80 million as compared to $55 million during fiscal 2019.

* Entered into a co-marketing agreement with Aragen Bioscience, a leading contract research organization (CRO) focused on accelerating pre-clinical biologics product development to provide clients with an integrated “sequence-to-manufacturing” service. Under terms of the non-exclusive agreement, the companies will offer customers Aragen’s cell line development expertise integrated with Avid’s upstream and downstream process development and analytical services to drive efficiencies and reduce overall timelines for delivering CGMP bulk drug substances.

* Avid was named a recipient of five 2020 Contract Manufacturing Organization (CMO) Leadership Awards in the following categories: Capabilities, Expertise, Reliability, Compatibility and Service. Presented by the industry publication Life Science Leader and based on market research and surveys conducted by Industry Standard Research (ISR), these awards are intended to honor those companies in the contract manufacturing space that provide their customers with the industry’s highest level of service.

* Restored operation of the specific piece of equipment that caused an interruption of production in the third and fourth quarters of fiscal 2020. This project is being executed in three phases: investigation; remediation; and, confirmation. To date, Avid believes it has successfully completed the first two stages by identifying and remediating the source of the problem. The company is currently progressing through the confirmation stage, during which it is running multiple revenue-generating production campaigns. The company will not be able to confirm a full resolution until it completes the confirmation stage. It is expected that this work will be completed in the coming months.

* Initiated the pre-engineering, design and permitting work required to allow the company to break ground on a facility expansion at the appropriate time. While a specific kick-off date has not yet been established for this expansion, the company believes that customer demand will require additional capacity and Avid is proactively working to prepare for this growth.

CONFERENCE CALL

Avid will host a conference call and webcast this afternoon, June 30, 2020, at 4:30PM EDT (1:30PM PDT). To listen to the conference call, please dial (877) 312-5443 or (253) 237-1126 and request the Avid Bioservices conference call. To listen to the live webcast, or access the archived webcast, please visit: http://ir.avidbio.com/investor-events .

ABOUT AVID BIOSERVICES, INC.

Avid Bioservices is a dedicated contract development and manufacturing organization (CDMO) focused on development and CGMP manufacturing of biopharmaceutical drug substances derived from mammalian cell culture. The company provides a comprehensive range of process development, CGMP clinical and commercial manufacturing services for the biotechnology and biopharmaceutical industries. With 27 years of experience producing monoclonal antibodies and recombinant proteins, Avid's services include CGMP clinical and commercial drug substance manufacturing, bulk packaging, release and stability testing and regulatory submissions support. For early-stage programs the company provides a variety of process development activities, including upstream and downstream development and optimization, analytical methods development, testing and characterization. The scope of our services ranges from standalone process development projects to full development and manufacturing programs through commercialization. https://www.avidbio.com

Forward-Looking *snip*

AVID BIOSERVICES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except per share information)

Three Months Ended Twelve Months Ended

April 30, April 30,

2020 2019 2020 2019

Revenues $ 12,550 $ 17,055 $ 59,702 $ 53,603

Cost of revenues 13,849 13,407 55,770 46,379

Gross (loss) profit (1,299 ) 3,648 3,932 7,224

Operating expenses:

Selling, general and administrative 3,528 3,573 14,517 12,846

Loss on lease termination — — 355 —

Total operating expenses 3,528 3,573 14,872 12,846

Operating (loss) income (4,827 ) 75 (10,940 ) (5,622 )

Interest and other income, net 59 92 474 282

(Loss) income from continuing operations before income taxes $ (4,768 ) $ 167 $ (10,466 ) $ (5,340 )

Income tax benefit — 67 — 284

(Loss) income from continuing operations, net of tax (4,768 ) 234 (10,466 ) (5,056 )

Income from discontinued operations, net of tax — 102 — 841

Net (loss) income $ (4,768 ) $ 336 $ (10,466 ) $ (4,215 )

Comprehensive (loss) income $ (4,768 ) $ 336 $ (10,466 ) $ (4,215 )

Series E preferred stock accumulated dividends (1,442 ) (1,442 ) (4,686 ) (4,686 )

Net loss attributable to common stockholders $ (6,210 ) $ (1,106 ) $ (15,152 ) $ (8,901 )

Basic and diluted net (loss) income per common share attributable to common stockholders:

Continuing operations $ (0.11 ) $ (0.02 ) $ (0.27 ) $ (0.17 )

Discontinued operations — — — 0.01

Net loss per share attributable to common stockholders $ (0.11 ) $ (0.02 ) $ (0.27 ) $ (0.16 )

Weighted average basic and diluted shares outstanding 56,482 56,080 56,326 55,981

AVID BIOSERVICES, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except par value)

April 30, April 30,

2020 2019

ASSETS

Current assets:

Cash and cash equivalents $ 36,262 $ 32,351

Accounts receivable 8,606 7,374

Contract assets 3,300 4,327

Inventory 10,883 6,557

Prepaid expenses 712 709

Total current assets 59,763 51,318

Property and equipment, net 27,105 25,625

Operating lease right-of-use assets 20,100 —

Restricted cash 350 1,150

Other assets 302 302

Total assets $ 107,620 $ 78,395

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable $ 5,926 $ 4,352

Accrued payroll and related costs 3,019 3,540

Note payable 4,379 —

Contract liabilities 29,120 14,651

Operating lease liabilities 1,228 —

Other current liabilities 808 619

Total current liabilities 44,480 23,162

Operating lease liabilities, less current portion 21,244 —

Deferred rent, less current portion — 2,072

Other long-term liabilities — 93

Total liabilities 65,724 25,327

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.001 par value; 5,000 shares authorized;

1,648 shares issued and outstanding at respective dates 2 2

Common stock, $0.001 par value; 150,000 shares authorized;

56,483 and 56,135 shares issued and outstanding at respective dates 56 56

Additional paid-in capital 612,909 613,615

Accumulated deficit (571,071 ) (560,605 )

Total stockholders’ equity 41,896 53,068

Total liabilities and stockholders’ equity $ 107,620 $ 78,395

CONTACTS:

• Stephanie Diaz (Investors) Vida Strategic Partners 415-675-7401 sdiaz@vidasp.com

• Tim Brons (Media) Vida Strategic Partners 415-675-7402 tbrons@vidasp.com

- - - - - - - -

From 10-Q header: “As of June 19, 2020, there were 56,511,294 shares outstanding.”

- - - - - - - - - - - - - - - - -

Latest 10K 4-30-20 iss. 6-30-20 https://tinyurl.com/yak25nco (Cash 4-30-20=$36.3mm)

Latest 10Q 1-31-20 iss. 3-10-20 https://tinyurl.com/vkocrsg (Cash 1-31-20=$30.7mm)

ALL SEC filings for PPHM: http://tinyurl.com/6d4jw8

10-K: “As of 4-30-20, we employed 222 full-time & 5 part-time emps.” (2018: 185/1, 2019: 211/4)

= = = = = = = = = = = = = = = = = = = = = = = = = = = =

Updated PPHM REVS-BY-QTR TABLE, now thru FY20Q4(fye 4-30-20), per the 10K issued 6-30-20.

• Total Avid Revs since May’03: $408.9M

• 6-30-20: FY'21 (May'20-Apr'21) Avid revs guidance $76-81M (committed B/L=$65 at 4-30-20).

• Inventories at 4-30-20 total $10.9M, UP from $9.6M at 4-30-20.

Avid’s website: http://www.avidbio.com

AVID GROSS PROFITABILITY BY QTR: CONTRACT

QTR (1000’s) Rev$ COGS$ Prof$ GP% INVEN$ LIABILITIES*

FY13Q1 7-31-12 4,135 2,024 2,111 51% 5,744 16,280

FY13Q2 10-31-12 6,061 3,703 2,358 39% 5,426 14,721

FY13Q3 1-31-13 6,961 3,651 3,310 47% 4,635 11,790

FY13Q4 4-30-13 4,176 3,217 959 23% 4,339 12,230

FY14Q1 7-31-13 4,581 2,670 1,911 42% 5,679 12,692

FY14Q2 10-31-13 7,354 4,195 3,159 43% 4,033 11,126

FY14Q3 1-31-14 3,885 2,416 1,469 38% 5,224 12,975

FY14Q4 4-30-14 6,474 3,829 2,645 41% 5,530 11,001

FY15Q1 7-31-14 5,496 3,583 1,913 35% 5,998 10,896

FY15Q2 10-31-14 6,263 4,139 2,124 34% 5,379 11,161

FY15Q3 1-31-15 5,677 3,113 2,564 45% 6,148 14,063

FY15Q4 4-30-15 9,308 4,758 4,550 49% 7,354 17,993

FY16Q1 7-31-15 9,379 4,608 4,771 51% 10,457 17,890

FY16Q2 10-31-15 9,523 4,741 4,782 50% 12,554 24,623

FY16Q3 1-31-16 6,672 3,896 2,776 42% 15,189 37,851

FY16Q4 4-30-16 18,783 9,721 9,062 48% 15,189 39,630

FY17Q1 7-31-16 5,609 3,062 2,547 45% 25,274 43,262

FY17Q2 10-31-16 23,370 15,441 7,929 34% 25,924 44,908

FY17Q3 1-31-17 10,747 7,974 2,773 26% 33,829 52,577

FY17Q4 4-30-17 17,904 11,782 6,122 34% 33,099 45,517

FY18Q1 7-31-17 27,077 20,448 6,629 24% 24,235 27,755

FY18Q2 10-31-17 12,782 16,242 -3,460 -27% 16,518 20,611

FY18Q3 1-31-18 6,819 10,951 -4,132 -61% 14,218 24,235

FY18Q4 4-30-18 6,943 8,904 -1,961 -28% 16,129 27,935

FY19Q1 7-31-18 12,589 11,397 1,192 9% 9,168 17,994

FY19Q2 10-31-18 10,178 9,844 334 3% 9,736 17,307

FY19Q3 1-31-19 13,781 11,731 2,050 15% 8,660 14,620

FY19Q4 4-30-19 17,055 13,407 3,648 21% 6,557 14,651

FY20Q1 7-31-19 15,254 14,168 1,086 7% 8,031 18,104

FY20Q2 10-31-19 18,313 14,953 3,360 18% 7,809 22,199

FY20Q3 1-31-20 13,585 12,800 785 6% 9,565 26,355

FY20Q4 4-30-20 12,550 13,849 -1,299 -10% 10,883 29,120

*7-31-18 10Q: “prior-yr amts related to (deferred revenue

+ cust deposits) now reclass’d as contract liabilities.”

Rev$ COGS$ Prof$ GP%

FY13 TOTAL: 21,333 12,595 8,738 41%*

FY14 TOTAL: 22,294 13,110 9,184 41%*

FY15 TOTAL: 26,744 15,393 11,151 42%*

FY16 TOTAL: 44,357 22,966 21,391 48%*

FY17 TOTAL: 57,630 38,259 19,371 34%*

FY18 TOTAL: 53,621 56,545 -2,924 -5%*

FY19 TOTAL: 53,603 46,379 7,224 13%*

FY20 TOTAL: 59,702 55,770 3,932 7%*

*Avid Net-Profit(Selling/G&A) not split out from PPHM-Corp. in the fin’s.

AVID TOTAL REV’s BY YEAR):

FY04 4-30-04 3,039 (Avid-Revs didn’t incl. Avid’s Gov’t work)

FY05 4-30-05 4,684

FY06 4-30-06 3,005

FY07 4-30-07 3,492

FY08 4-30-08 5,897

FY09 4-30-09 12,963

FY10 4-30-10 13,204

FY11 4-30-11 8,502

FY12 4-30-12 14,783

FY13 4-30-13 21,333

FY14 4-30-14 22,294

FY15 4-30-15 26,744

FY16 4-30-16 44,357

FY17 4-30-17 57,630

FY18 4-30-18 53,621

FY19 4-30-19 53,603

FY20 4-30-20 59,702

**TOTAL: 408,853 (5/1/2003–4/30/20)

.

QTLY. NET PROFIT/LOSS BY QTR:

(“attributable to common stockholders”; ie, incl. PREF Div’s**)

**2-11-14: PPHM Raises $16.2M, 700k Pref. Shares w/10.5% DIV.

FY16Q1 7-31-15 -15,101,000

FY16Q2 10-31-15 -14,578,000

FY16Q3 1-31-16 -18,227,000

FY16Q4 4-30-16 -13,264,000

FY17Q1 7-31-16 -12,437,000

FY17Q2 10-31-16 -4,498,000

FY17Q3 1-31-17 -9,216,000

FY17Q4 4-30-17 -6,714,000

FY18Q1 7-31-17 -2,647,000

FY18Q2 10-31-17 -14,066,000

FY18Q3 1-31-18 -12,446,000

FY18Q4 4-30-18 +1,578,000 <=includes $9,154,000 income from disc. operations.

FY19Q1 7-31-18 -3,403,000

FY19Q2 10-31-18 -2,893,000

FY19Q3 1-31-19 -2,581,000

FY19Q4 4-30-19 -1,106,000

FY20Q1 7-31-19 -4,606,000

FY20Q2 10-31-19 -1,872,000

FY20Q3 1-31-20 -3,546,000

FY20Q4 4-30-20 -6,210,000

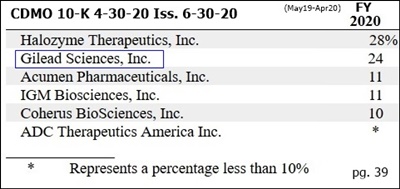

Period(10-K) Halozyme Gilead Acumen IGM Coherus ADC-Ther. Others

FYE 4-30-14 91% 8%

FYE 4-30-15 79% 9%

FYE 4-30-16 69% 26% 5%

FYE 4-30-17 58% 16% 26% 16%

FYE 4-30-18 55% 22% 9% 14%

FYE 4-30-19 30% <10% <10% 13% 21% 36%

FYE 4-30-20 28% 24% 11% 11% 10% <10% --

...(cust. splits not given in 7-31-18+ 10Q’s)

7-8-19/PR: Avid Signs New Top10 Global Pharma [GILEAD] https://tinyurl.com/yyq8zgb9

- - - - - - - - CDMO’s Fiscal Qtr’s (FY runs May – April):

FY’17-Q1 = q/e 7-31-16 – rep. 9-8-16 Thu (after mkt)

FY’17-Q2 = q/e 10-31-16 – rep. 12-12-16 Mon (after mkt)

FY’17-Q3 = q/e 1-31-17 – rep. 3-13-17 Mon (after mkt)

FY’17-Q4 = q/e 4-30-17 – rep. 7-14-17 Fri (after mkt)

FY’18-Q1 = q/e 7-31-17 – rep. 9-11-17 Mon (after mkt)

FY’18-Q2 = q/e 10-31-17 – rep. 12-11-17 Mon (after mkt)

FY’18-Q3 = q/e 1-31-18 – rep. 3-12-18 Mon (after mkt)

FY’18-Q4 = q/e 4-30-18 – rep. 7-16-18 Mon (after mkt)

FY’19-Q1 = q/e 7-31-18 – rep. 9-10-18 Mon (after mkt)

FY’19-Q2 = q/e 10-31-18 – rep. 12-10-18 Mon (after mkt)

FY’19-Q3 = q/e 1-31-19 – rep. 3-11-19 Mon (after mkt)

FY’19-Q4 = q/e 4-30-19 – rep. 6-27-19 Thu (after mkt)

FY’20-Q1 = q/e 7-31-19 – rep. 9-5-19 Thu (after mkt)

FY’20-Q2 = q/e 10-31-19 – rep. 12-9-19 Thu (after mkt)

FY’20-Q3 = q/e 1-31-20 – rep. 3-10-20 Tue (after mkt)

FY’20-Q4 = q/e 4-30-20 – rep. 6-30-20 Tue (after mkt)

= = = = = = = = = = = =

“Going Concern” stmt. ELIMINATED from 10-K iss. 7-11-13 (included 2012);

... RE-INSTATED in 10-K iss. 7-14-17 (included 2017 & 2018);

… ELIMINATED again from 10-K iss. 6-27-19 (currently 2019).

CASH a/o 1-31-14: $63.2M

CASH a/o 2-15-14: $79.7M

CASH a/o 4-30-14: $77.5M

CASH a/o 6-30-14: $78.3M

CASH a/o 7-31-14: $73.3M

CASH a/o 10-31-14: $64.4M

CASH a/o 1-31-15: $55.2M

CASH a/o 4-30-15: $68.0M

CASH a/o 7-31-15: $59.0M

CASH a/o 10-31-15: $72.0M

CASH a/o 1-31-16: $67.5M

CASH a/o 4-30-16: $61.4M

CASH a/o 7-31-16: $44.2M

CASH a/o 10-31-16: $49.5M

CASH a/o 1-31-17: $41.5M

CASH a/o 4-30-17: $46.8M

CASH a/o 7-31-17: $37.3M

CASH a/o 10-31-17: $27.7M

CASH a/o 1-31-18: $17.9M

CASH a/o 2-28-18: $41.7M

CASH a/o 4-30-18: $42.3M

CASH a/o 7-31-18: $37.5M

CASH a/o 10-31-18: $32.7M

CASH a/o 1-31-19: $27.8M

CASH a/o 4-30-19: $32.4M

CASH a/o 7-31-19: $28.9M

CASH a/o 10-31-19: $34.0M

CASH a/o 1-31-20: $30.7M

CASH a/o 4-30-20: $36.3M

CDMO - O/S Shares History (’06–curr.)

Click here for 4/30/06–12/8/16 Peregrine Pharm. share history: https://tinyurl.com/y76cbyt5

**PPHM shares were 1:5 R/S eff. 10-19-09 (~237mm/$.64=>~47.4mm/$3.20) http://tinyurl.com/ykuw588

**PPHM shares were 1:7 R/S eff. 7-10-17 (315mm/$.606=>45mm/$4.24) http://tinyurl.com/ycohqn6j

1-31-17: 271,068,464 +13,926,930 (1-31-17 10Q iss. 3-13-17)

3-10-17: 297,709,478 +26,641,014 (“ “ “)

4-30-17: 44,014,040(x7)=308,098,280 +10,388,802 (4-30-17 10K iss. 7-14-17)

7-10-17: 45,069,188 +1,055,148 (“ “ “)

7-31-16: 45,094,154 +24,966 (7-31-17 10Q iss. 9-11-17)

8-25-17: 45,096,081 +1,927 (8-25-17 Amended 10K http://tinyurl.com/yb5jq7vc )

9-6-17: 45,096,081 nochg (7-31-17 10Q iss. 9-11-17)

10-31-16: 45,172,632 +76,551 (10-31-17 10Q iss. 12-11-17)

11-27-17: 45,210,608 +37,976 (14A/Proxy iss. 12-7-17 https://tinyurl.com/y7qprpg9 )

12-6-17: 45,212,760 +2,152 (10-31-17 10Q iss. 12-11-17)

1-8-18: 45,253,038 +40,278 (2-8-18 13D https://tinyurl.com/ya43sc3r )

1-31-18: 45,257,180 +4,142 (1-31-18 10Q iss. 3-12-18)

...2-20-18: Avid Raises ~$21.8M net, selling 10,294,445sh.@$2.25 (underwriter: Wells Fargo)

…... 8-K: https://tinyurl.com/ya3nenth 424B5: https://tinyurl.com/ycpshgxl

3-7-18: 55,552,233 +10,295,053 (1-31-18 10Q)

4-30-18: 55,689,222 +133,989 (4-30-18 10K)

7-10-18: 55,793,107 +103,885 (4-30-18 10K)

9-5-18: 56,001,456 +208,349 (7-31-18 10Q)

10-31-18: 56,063,488 +62,032 (10-31-18 10Q)

12-3-18: 56,067,867 +4,379 (10-31-18 10Q)

1-31-19: 56,072,291 +4,424 (1-31-19 10Q)

3-4-19: 56,074,509 +2,218 (1-31-19 10Q)

6-14-19: 56,137,724 +63,215 (4-30-19 10K)

8-31-19: 56,237,674 +99,950 (7-31-19 10Q)

11-30-19: 56,338,143 +100,469 (10-31-19 10Q)

3-2-20: 56,482,154 +144,011 (1-31-20 10Q)

6-19-20: 56,511,294 +29,140 (4-30-20 10K)

Recent CDMO News

- Avid Bioservices Reports Financial Results for Third Quarter Ended January 31, 2024 • GlobeNewswire Inc. • 04/24/2024 09:25:33 PM

- Avid Bioservices Announces Receipt of Deficiency Notice from Nasdaq Regarding Late Form 10-Q • GlobeNewswire Inc. • 03/20/2024 11:00:10 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/07/2024 11:30:11 AM

- Avid Bioservices Announces Pricing of Private Placement of Convertible Notes • GlobeNewswire Inc. • 03/07/2024 04:58:48 AM

- Avid Bioservices Announces Proposed Private Placement of Convertible Notes • GlobeNewswire Inc. • 03/06/2024 09:32:07 PM

- Avid Bioservices Announces Certain Preliminary Financial Results for Third Quarter Ended January 31, 2024 • GlobeNewswire Inc. • 03/06/2024 09:31:28 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/06/2024 09:30:18 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 01/26/2024 09:57:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 12:34:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:39:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:38:30 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:37:38 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:36:27 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:35:47 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/11/2024 12:56:02 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 01/08/2024 09:32:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:56:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:55:07 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:53:58 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:51:57 AM

- Form SC 13G - Statement of acquisition of beneficial ownership by individuals • Edgar (US Regulatory) • 12/19/2023 09:05:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:34:08 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:33:03 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:32:11 AM

FEATURED NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM