| Followers | 87 |

| Posts | 5520 |

| Boards Moderated | 2 |

| Alias Born | 07/06/2014 |

Sunday, June 14, 2020 3:21:53 PM

All,

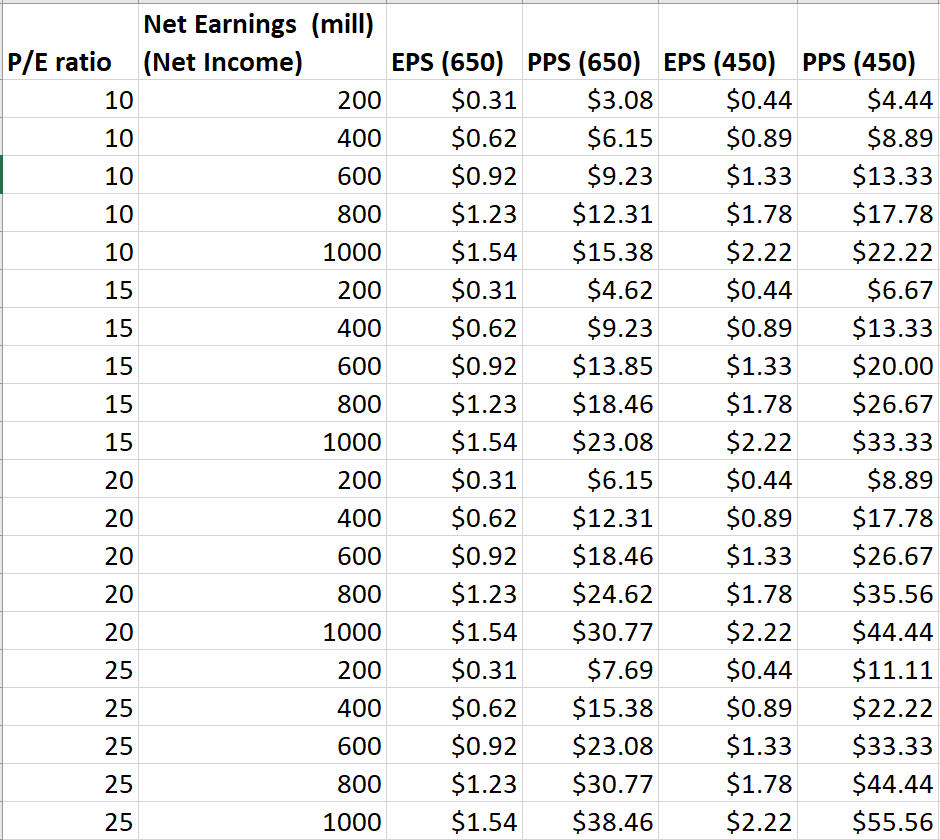

I have created the following table as a reference to how one might come up with PPS for Mirage. There are obviously a lot of variables here, but since PPS is often talked about in terms of PE ratio, I thought I would use that as a guide. As a reminder:

P/E ratio = Share price / EPS (earnings per share)

where EPS = Net Earnings / # shares outstanding

I assumed the outstanding count would climb to around 650 million, where 200 mill preferred shares are held by Ward and not traded, and so I also did a calculation based on 450 million also, but I tend to lean towards the 650 value.

The worst case scenario in the table is 200 mill net earnings and a P/E ratio = 10, yielding a $3 stock. I say worst case in light of P/E ratio where ratios of some large pipeline companies are as follows:

Energy Transfer (ET) 11

TC Energy (TRP) 13

kinder Morgan (KMI) 26

Enbridge (ENB) 42

Planes All American Pipe (PAA) n/a (loss)

Pembina Pipeline (PBA) 11

ONEOK (OKE) 17

As mentioned there are other factors such as debt or no debt that affect price, potential dividends, which we don't know right now, but this is a start.

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM