Sunday, May 17, 2020 7:41:57 PM

>>> Tracking Warren Buffett's Berkshire Hathaway Portfolio - Q1 2020 Update

Seeking Alpha

May 17, 2020

John Vincent

Long only, value, special situations, fund holdings

https://seekingalpha.com/article/4348288-tracking-warren-buffetts-berkshire-hathaway-portfolio-q1-2020-update

Summary

Berkshire Hathaway's 13F stock portfolio value decreased from ~$242B to ~$176B this quarter.

Their largest three holdings are at ~57% of the entire portfolio.

Berkshire Hathaway reduced Goldman Sachs stake to a minutely small position during the quarter. They also sold their large stake in the big-four airlines last month.

This article is part of a series that provides an ongoing analysis of the changes made to Berkshire Hathaway’s 13F stock portfolio on a quarterly basis. It is based on Warren Buffett’s regulatory 13F Form filed on 05/15/2020. Please visit our Tracking 10 Years Of Berkshire Hathaway's Investment Portfolio article series for an idea on how his holdings have progressed over the years and our previous update for the moves in Q4 2019.

During Q1 2020, Berkshire Hathaway’s (BRK.A) (BRK.B) 13F stock portfolio value decreased ~28% from $242B to $176B. The top five positions account for more than two-thirds of the portfolio: Apple Inc., Bank of America, Coca Cola, American Express, and Wells Fargo. There are 47 individual stock positions many of which are minutely small compared to the overall size of the portfolio.

Warren Buffett’s writings (pdfs) are a treasure trove of information and are a very good source for anyone starting out on individual investing.

Note: In Q1 2020, Berkshire Hathaway repurchased ~5.5M Class B Equivalent Shares for a total outlay of ~$1.2B. The average price paid was ~$215. Book Value as of Q1 2020 was ~$153 per share. So, the repurchase happened at ~140% of Book Value. The Class B shares currently trade at ~$169.

New Stakes:

None.

Stake Disposals:

Phillips 66 (PSX) and Travelers Companies (TRV): These two minutely small stakes were disposed during the quarter.

Stake Increases:

Delta Air Lines (DAL): DAL was a very small 0.19% position in Q3 2016. The stake saw a whopping ~850% increase in Q4 2016 at prices between $39 and $52. There was a ~20% increase in Q2 2018 at prices between $49 and $56 and that was followed with a ~8% increase in Q1 2019 at ~$49.50. This quarter also saw a marginal increase. The stock currently trades at $19.19.

Note: The entire ~11% of the business stake was disposed at ~$22 last month. This is compared to their overall cost-basis of ~$44 - lost around half their investment over a holding period of just over three years.

PNC Financial (PNC): The 0.50% PNC stake was established in Q3 2018 at prices between $134 and $146 and increased by just over one-third next quarter at prices between $110 and $140. The stock is now at $97.25. Q1 2019 also saw a ~5% stake increase and that was followed with a similar increase this quarter.

United Continental Holdings (UAL): A minutely small 0.18% UAL position as of Q3 2016 saw a huge ~540% increase in Q4 2016 at prices between $52.50 and $76. 2018 had seen a ~22% selling at prices between $63 and $98. It currently goes for $19.92. This quarter also saw a minor increase.

Note: The entire ~8% of the business stake was disposed at ~$28 last month. This is compared to their overall cost-basis of ~$55 - lost around half their investment over a holding period of just over three years.

Stake Decreases:

Goldman Sachs (GS): GS is now a minutely small 0.17% of the portfolio stake. It was established in Q4 2013. Berkshire received $5B worth of warrants to buy GS stock during the financial crisis (October 2008) at a strike price of $115 (43.5M shares) that was to expire October 1, 2013. Buffett exercised the right before expiry to start this long position. Recent activity follows: Q3 2018 saw a ~40% stake increase at prices between $220 and $243 while last quarter there was a ~35% selling at prices between $197 and $232. This quarter saw another ~85% selling at prices between ~$135 and ~$250. GS currently trades at ~$172. Their overall cost-basis was ~$127 per share.

JPMorgan Chase (JPM: The ~3% JPM stake was established in Q3 2018 at prices between $104 and $119 and increased by ~40% next quarter at prices between $92 and $115. There was another ~20% stake increase in Q1 2019 at prices between $97 and $107. The stock currently trades at ~$86. There was a ~3% trimming this quarter.

DaVita Inc. (DVA): DVA is a 1.65% of the portfolio position that was aggressively built over several quarters in the 2012-13 timeframe at prices between $30 and $49. The stock currently trades at ~$79 compared to Berkshire’s overall cost-basis of ~$45 per share. This quarter saw minor trimming.

Note: Berkshire’s ownership stake in DaVita is ~30%.

Verisign Inc. (VRSN): VRSN was first purchased in Q4 2012 at prices between $34 and $49.50. The position was more than doubled in Q1 2013 at prices between $38 and $48. The buying continued till Q2 2014 at prices up to $63. The stock currently trades at ~$217 and the position is at 1.31% of the portfolio (~10% of the business). This quarter saw minor trimming.

Southwest Airlines (LUV): LUV is a ~1% portfolio stake purchased in Q4 2016 at prices between $38.50 and $51 and increased by ~10% in the following quarter at prices between $49.50 and $59. Q2 2018 saw another ~20% stake increase at prices between $50 and $57. The stock is now at ~$24.

Note: The entire ~10% of the business stake was disposed at ~$30 last month. This is compared to their overall cost-basis of ~$42 - lost ~30% of their investment over a holding period of just over three years.

General Motors (GM): GM is a 0.88% of the 13F portfolio position that was first purchased in Q1 2012 at prices between $21 and $30. By Q3 2017, the position size had increased by around six-times (10M shares to 60M shares). Q4 2017 saw a reduction: ~17% selling at prices between $40.50 and $46.50. There was a ~38% stake increase in Q4 2018 at prices between $30.50 and $38.50. The stock currently trades at $22.63. Overall, Berkshire’s cost-basis on GM is ~$32. Last quarter saw a ~3% stake increase while this quarter there was marginal trimming. Berkshire controls ~5.2% of the business.

Liberty SiriusXM Group (LSXMA) (LSXMK): The tracking stock was acquired as a result of Liberty Media’s recapitalization in April 2016. Shareholders received 1 share of Liberty SiriusXM Group, 0.25 shares of Liberty Media Group and 0.1 shares of Liberty Braves Group for each share held. Berkshire held 30M shares of Liberty Media for which he received the same amount of Liberty SiriusXM Group shares. There was a ~40% stake increase in Q2 2017 at a cost-basis of ~$40 per share and the stock is currently at $31.44. This quarter saw marginal trimming.

Note: LSXMA/LSXMK is trading at a significant NAV-discount to the parent’s (SIRI) valuation.

Amazon.com (AMZN): AMZN is a 0.59% of the portfolio stake established in Q1 2019 at prices between $1500 and $1820 and increased by ~11% next quarter at prices between $1693 and $1963. The stock currently trades at ~$2410. There was marginal trimming this quarter.

Sirius XM Holdings (SIRI): The 0.37% SIRI stake was purchased in Q4 2016 at prices between $4.08 and $4.61. Q2 2017 saw selling: ~20% reduction at prices between $4.70 and $5.50. The stock is currently at $5.34. This quarter saw minor trimming.

American Airlines (AAL): AAL stake was first purchased in Q3 2016. The original purchase was at prices between $28 and $39 and doubled in Q4 2016 at prices between $36.50 and $50. The stock is now at ~$9. There was a ~3% trimming in Q2 2018 and a similar reduction next quarter. Last two quarters saw minor trimming.

Note: The entire ~10% of the business stake was disposed at ~$11 last month. This is compared to their overall cost-basis of ~$40 - lost around 75% of their investment over a holding period of just over three years.

Liberty Global PLC (LBTYA) (LBTYK): The position was established in Q4 2013 at prices between $37.50 and $44.50 (adjusted for the 03/2014 stock-split) and increased in the following two quarters at prices between $38.50 and $46. The three quarters thru Q1 2016 had also seen a combined ~30% increase at prices between $30 and $50. Q2 2016 saw a ~17% further increase at prices between $27 and $39. The stock is now at $21.36 and the stake is at 0.25% of the 13F portfolio. This quarter saw marginal trimming.

Axalta Coating Systems (AXTA): AXTA is a small 0.24% of the portfolio stake established in Q2 2015 at prices between $28 and $36 and increased by ~16% the following quarter at prices between $24.50 and $33.50. The stock currently trades at $19.70. Berkshire owns ~10% of the business. This quarter saw marginal trimming.

Teva Pharmaceuticals (TEVA): TEVA is a very small 0.22% of the portfolio stake established in Q4 2017 at prices between $11.20 and $19.33 and more than doubled next quarter at prices between $16.50 and $22. The stock currently trades at $11.21. This quarter saw marginal trimming.

Synchrony Financial (SYF): SYF is a 0.18% of the portfolio position purchased in Q2 2017 at prices between $26.50 and $34.50 and increased by ~20% the following quarter at prices between $28.50 and $31.25. The stock is now at $16.54. This quarter saw a ~3% trimming.

Note: Synchrony is the private label credit-card business split-off from GE that started trading in August 2014 at ~$23 per share.

Suncor Energy (SU): The 0.13% SU stake was purchased in Q4 2018 at prices between $26 and $40. Last quarter saw a ~40% stake increase at prices between $29 and $33. The stock is now well below those ranges at ~$16. There was marginal trimming this quarter.

Note: Suncor Energy has had a roundtrip in the portfolio. It was a 0.48% position purchased in Q2 2013 at prices between $27 and $32. That stake was disposed during Q2 & Q3 2016 at prices between $25.50 and $29.

Biogen Inc. (BIIB) and Liberty LiLAC Group (LILA) (LILAK): These two minutely small positions (less than ~0.10% of the portfolio each) saw marginal trimming this quarter.

Kept Steady:

Apple Inc. (AAPL): AAPL is currently the largest 13F portfolio stake by far at ~36%. It was established in Q1 2016 at prices between $93 and $110 and increased by ~55% the following quarter at prices between $90 and $112. Q4 2016 saw another ~275% increase at prices between $106 and $118 and that was followed with a stake doubling in January 2017 at prices between $116 and $122. There was another ~23% increase in Q4 2017 at prices between $154 and $176 and that was followed with a ~45% increase in Q1 2018 at prices between $155 and $182. Since then, the activity has been minor. The stock currently trades at ~$308.

Note: Berkshire’s overall cost-basis on Apple is ~$141 per share. They have a ~5.6% ownership stake in the business.

Bank of America (BAC): Berkshire established this large (top three) ~11% of the portfolio position through the exercise of Bank of America warrants. The warrants had a strike price of $7.14 compared to the current price of $21.44. The cost to exercise was $5B and it was funded using the $5B in 6% preferred stock they held. There was a ~30% stake increase in Q3 2018 at prices between $27.75 and $31.80 and a marginal increase next quarter. Q2 2019 also saw a ~4% stake increase.

Note: Berkshire’s overall cost-basis is ~$13 and ownership stake is 10.7%.

American Express (AXP) and Coca Cola (KO): These two very large stakes were kept steady during the last ~6 years. Buffett has said these positions will be held “permanently”. Berkshire’s cost-basis on AXP and KO are at around $8.49 and $3.25 respectively and the ownership stakes are at ~17.6% and ~9.4% respectively.

Wells Fargo & Co. (WFC): WFC is Buffett’s fifth-largest stake at 5.28% of the 13F portfolio. It is a very long-term stake. Recent activity follows: last year saw a ~25% selling at prices between $43 and $55. Berkshire’s cost-basis is at ~$24.50 and their ownership stake is 8.4%. The stock currently trades at $23.36.

Kraft Heinz Co. (KHC): KHC is currently a fairly large position at 4.59% of the portfolio. Kraft Heinz started trading in July 2015 with Berkshire owning just over 325M shares (~27% of the business). The stake came about because of two transactions with 3G capital as partner: a ~$4B net investment in 2013 for half of Heinz and a ~$5B investment for the acquisition of Kraft Foods Group in early 2015. Berkshire’s cost-basis on KHC is ~$30 per share compared to the current price of $29.20.

Moody’s Inc. (MCO): MCO is a ~3% of the 13F portfolio stake. It is a very long-term position and Buffett’s cost basis is $10.05. The stock currently trades at ~$251. Berkshire controls ~13% of the business.

US Bancorp (USB): The 2.60% USB stake has been in the portfolio since 2006. The original position was tripled during the 2007-2009 timeframe. It was then kept relatively steady till Q2 2013 when ~17M shares were purchased at prices between $32 and $36. H1 2018 had seen a ~16% increase at prices between $49 and $58 and that was followed with a ~25% increase in Q3 2018 at prices between $50 and $55. The stock is now at $30.68 and Berkshire’s cost-basis is ~$38. They control ~10% of the business. Q4 2018 and Q2 2019 also saw minor increases.

Bank of New York Mellon Corp (BK): BK is a 1.53% of the 13F portfolio stake. The bulk of the original position was purchased in Q2 2012 at prices between $19.50 and $25. Recent activity follows: 2017 saw a ~180% increase at prices between $43.50 and $55 while 2018 saw another one-third increase at prices between $44.50 and $58.50. The stock currently trades at ~$32. Berkshire’s cost-basis on BK is ~$46 per share and ownership stake is ~10%. For investors attempting to follow, BK is a good option to consider for further research.

Charter Communications (CHTR): CHTR is a 1.35% of the portfolio position. It was established during the last three quarters of 2014 at prices between $118 and $170. In Q2 2015, the position was again increased by ~42% at prices between $168 and $193 and that was followed with another ~21% increase the following quarter at prices between $167 and $195. The stock currently trades at ~$503 compared to Berkshire’s cost-basis of ~$178. The six quarters thru Q4 2018 had seen a combined ~25% selling at prices between $250 and $395 and that was followed with a ~20% reduction in Q1 2019 at prices between $285 and $366. Q2 2019 also saw a ~5% trimming.

Occidental Petroleum (OXY) and RH Inc. (RH): These were the two new positions in Q3 2019. Both were increased last quarter. The 0.32% of the portfolio OXY stake was purchased at prices between $42 and $53 and increased by ~150% last quarter at prices between $37 and $44. The stock currently trades at ~$14. The 0.15% of the portfolio RH position was established at prices between $119 and $174 and increased by ~40% last quarter at prices between $165 and $242. It is now at ~$155. Berkshire controls ~9% of the business.

Note: Berkshire also has warrants to purchase 80M shares of OXY at $62.50 per share. That came about as part of a $10B funding deal (perpetual preferred stock with 8% annual dividend) done in May last year. The dividend was paid in common stock rather than cash last month.

Store Capital (STOR): The 0.19% STOR stake was established in Q2 2017 in a private placement transaction at $20.25 per share. The stock is now at $17.15.

StoneCo Ltd. (STNE): STNE is a 0.18% position purchased in Q4 2018 at ~$21 per share compared to the current price of ~$22.

Note: Berkshire has a ~11% ownership stake in StoneCo. In October 2018, WSJ reported that Berkshire had invested ~$300M each in two Fintech’s – India’s Paytm and Brazil’s StoneCo (STNE). The Paytm investment was made in August 2018 while the STNE purchase was following its IPO in October 2018.

Restaurant Brands International (QSR): QSR is a 0.19% of the 13F portfolio position established in Q4 2014 at prices between $35 and $42. The stock currently trades at $51.42. It started trading in December 2014 following a merger/rename transaction between Tim Hortons and Burger King Worldwide.

Note: Berkshire’s stake in the business is ~4.2%.

Costco Wholesale (COST), Globe Life (GL), Johnson & Johnson (JNJ), Mondelez International (MDLZ), M&T Bank (MTB), MasterCard Inc. (MA), Kroger Company (KR), Procter & Gamble (PG), SPDR S&P 500 Index (SPY), United Parcel Service (UPS), Vanguard S&P 500 Index (VOO), and Visa Inc. (V): These are very small positions (less than ~0.5% of the portfolio each) were kept steady this quarter.

Note 1: Since November 2015, Warren Buffett is known to own ~8% of Seritage Growth Properties (SRG) at a cost-basis of $36.50 in his personal portfolio. It currently trades at $6.92. SRG is an REIT spinoff from Sears that started trading in July 2015.

Note 2: Berkshire Hathaway also has a 225M share position in BYD Company at a cost-basis of ~$1 per share (~$2 per share in terms of ADRs – BYDDY). The ADR currently trades at $11.20.

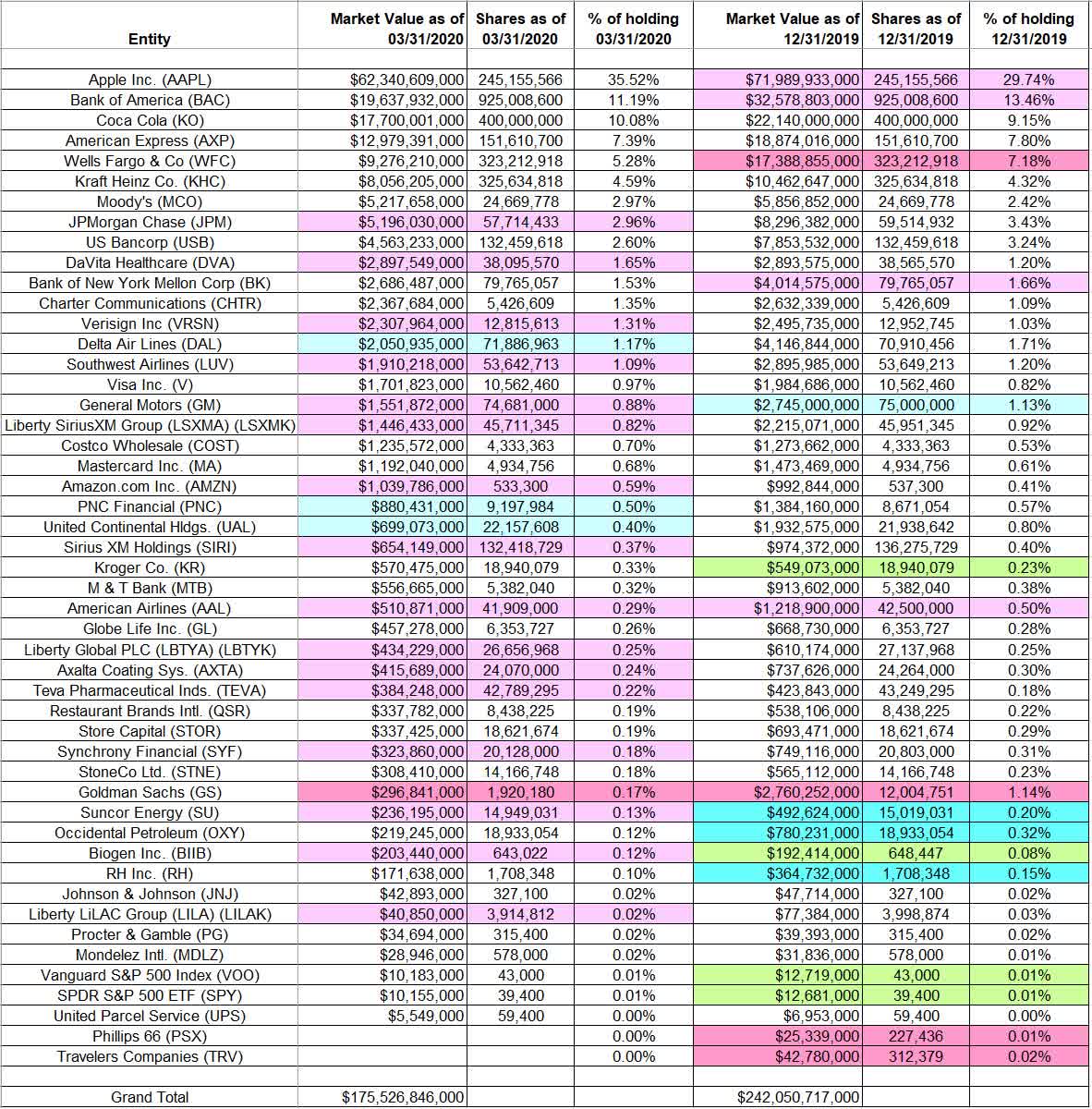

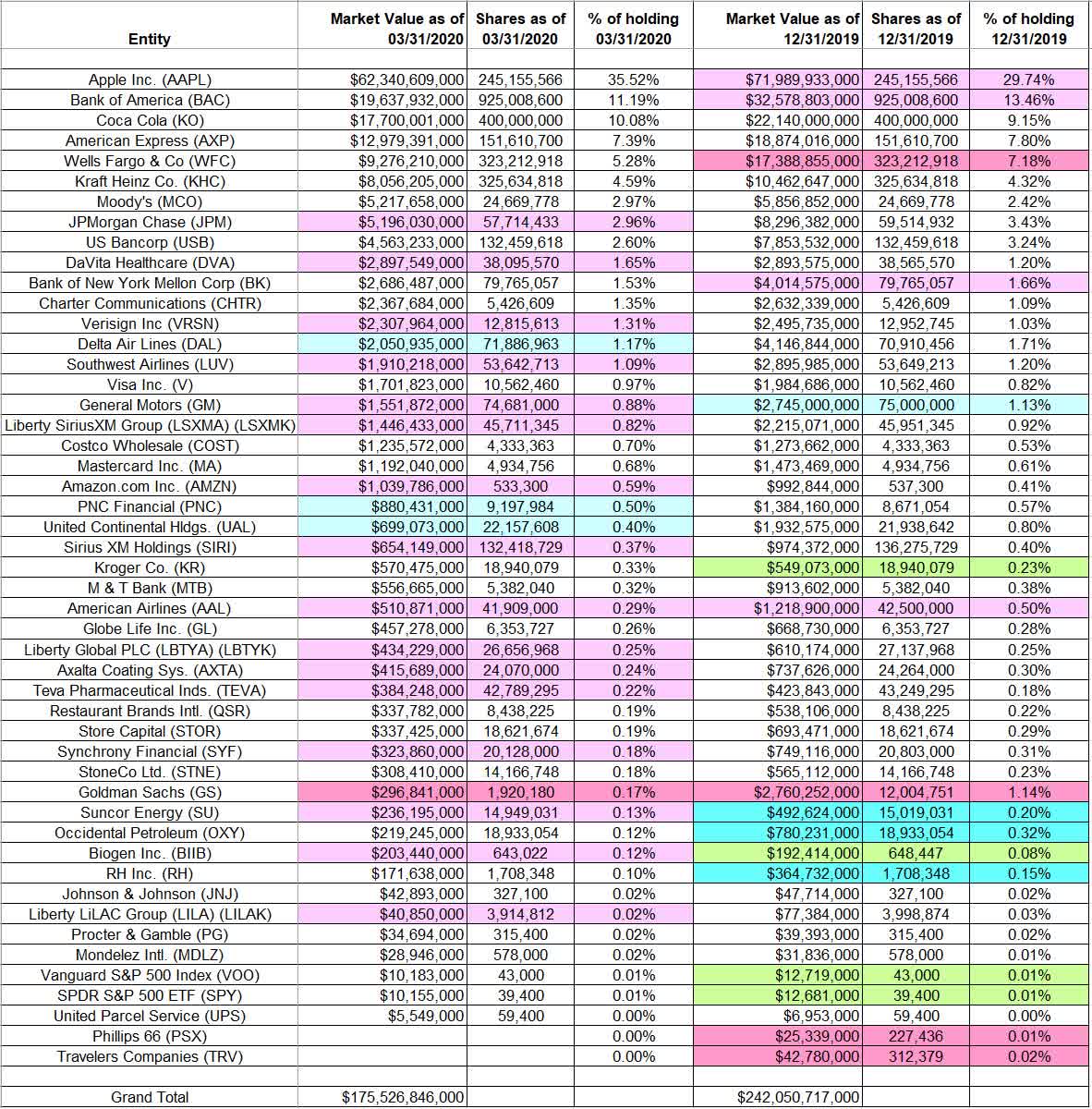

The spreadsheet below highlights changes to Berkshire Hathaway’s 13F stock holdings in Q1 2020:

<<<

Seeking Alpha

May 17, 2020

John Vincent

Long only, value, special situations, fund holdings

https://seekingalpha.com/article/4348288-tracking-warren-buffetts-berkshire-hathaway-portfolio-q1-2020-update

Summary

Berkshire Hathaway's 13F stock portfolio value decreased from ~$242B to ~$176B this quarter.

Their largest three holdings are at ~57% of the entire portfolio.

Berkshire Hathaway reduced Goldman Sachs stake to a minutely small position during the quarter. They also sold their large stake in the big-four airlines last month.

This article is part of a series that provides an ongoing analysis of the changes made to Berkshire Hathaway’s 13F stock portfolio on a quarterly basis. It is based on Warren Buffett’s regulatory 13F Form filed on 05/15/2020. Please visit our Tracking 10 Years Of Berkshire Hathaway's Investment Portfolio article series for an idea on how his holdings have progressed over the years and our previous update for the moves in Q4 2019.

During Q1 2020, Berkshire Hathaway’s (BRK.A) (BRK.B) 13F stock portfolio value decreased ~28% from $242B to $176B. The top five positions account for more than two-thirds of the portfolio: Apple Inc., Bank of America, Coca Cola, American Express, and Wells Fargo. There are 47 individual stock positions many of which are minutely small compared to the overall size of the portfolio.

Warren Buffett’s writings (pdfs) are a treasure trove of information and are a very good source for anyone starting out on individual investing.

Note: In Q1 2020, Berkshire Hathaway repurchased ~5.5M Class B Equivalent Shares for a total outlay of ~$1.2B. The average price paid was ~$215. Book Value as of Q1 2020 was ~$153 per share. So, the repurchase happened at ~140% of Book Value. The Class B shares currently trade at ~$169.

New Stakes:

None.

Stake Disposals:

Phillips 66 (PSX) and Travelers Companies (TRV): These two minutely small stakes were disposed during the quarter.

Stake Increases:

Delta Air Lines (DAL): DAL was a very small 0.19% position in Q3 2016. The stake saw a whopping ~850% increase in Q4 2016 at prices between $39 and $52. There was a ~20% increase in Q2 2018 at prices between $49 and $56 and that was followed with a ~8% increase in Q1 2019 at ~$49.50. This quarter also saw a marginal increase. The stock currently trades at $19.19.

Note: The entire ~11% of the business stake was disposed at ~$22 last month. This is compared to their overall cost-basis of ~$44 - lost around half their investment over a holding period of just over three years.

PNC Financial (PNC): The 0.50% PNC stake was established in Q3 2018 at prices between $134 and $146 and increased by just over one-third next quarter at prices between $110 and $140. The stock is now at $97.25. Q1 2019 also saw a ~5% stake increase and that was followed with a similar increase this quarter.

United Continental Holdings (UAL): A minutely small 0.18% UAL position as of Q3 2016 saw a huge ~540% increase in Q4 2016 at prices between $52.50 and $76. 2018 had seen a ~22% selling at prices between $63 and $98. It currently goes for $19.92. This quarter also saw a minor increase.

Note: The entire ~8% of the business stake was disposed at ~$28 last month. This is compared to their overall cost-basis of ~$55 - lost around half their investment over a holding period of just over three years.

Stake Decreases:

Goldman Sachs (GS): GS is now a minutely small 0.17% of the portfolio stake. It was established in Q4 2013. Berkshire received $5B worth of warrants to buy GS stock during the financial crisis (October 2008) at a strike price of $115 (43.5M shares) that was to expire October 1, 2013. Buffett exercised the right before expiry to start this long position. Recent activity follows: Q3 2018 saw a ~40% stake increase at prices between $220 and $243 while last quarter there was a ~35% selling at prices between $197 and $232. This quarter saw another ~85% selling at prices between ~$135 and ~$250. GS currently trades at ~$172. Their overall cost-basis was ~$127 per share.

JPMorgan Chase (JPM: The ~3% JPM stake was established in Q3 2018 at prices between $104 and $119 and increased by ~40% next quarter at prices between $92 and $115. There was another ~20% stake increase in Q1 2019 at prices between $97 and $107. The stock currently trades at ~$86. There was a ~3% trimming this quarter.

DaVita Inc. (DVA): DVA is a 1.65% of the portfolio position that was aggressively built over several quarters in the 2012-13 timeframe at prices between $30 and $49. The stock currently trades at ~$79 compared to Berkshire’s overall cost-basis of ~$45 per share. This quarter saw minor trimming.

Note: Berkshire’s ownership stake in DaVita is ~30%.

Verisign Inc. (VRSN): VRSN was first purchased in Q4 2012 at prices between $34 and $49.50. The position was more than doubled in Q1 2013 at prices between $38 and $48. The buying continued till Q2 2014 at prices up to $63. The stock currently trades at ~$217 and the position is at 1.31% of the portfolio (~10% of the business). This quarter saw minor trimming.

Southwest Airlines (LUV): LUV is a ~1% portfolio stake purchased in Q4 2016 at prices between $38.50 and $51 and increased by ~10% in the following quarter at prices between $49.50 and $59. Q2 2018 saw another ~20% stake increase at prices between $50 and $57. The stock is now at ~$24.

Note: The entire ~10% of the business stake was disposed at ~$30 last month. This is compared to their overall cost-basis of ~$42 - lost ~30% of their investment over a holding period of just over three years.

General Motors (GM): GM is a 0.88% of the 13F portfolio position that was first purchased in Q1 2012 at prices between $21 and $30. By Q3 2017, the position size had increased by around six-times (10M shares to 60M shares). Q4 2017 saw a reduction: ~17% selling at prices between $40.50 and $46.50. There was a ~38% stake increase in Q4 2018 at prices between $30.50 and $38.50. The stock currently trades at $22.63. Overall, Berkshire’s cost-basis on GM is ~$32. Last quarter saw a ~3% stake increase while this quarter there was marginal trimming. Berkshire controls ~5.2% of the business.

Liberty SiriusXM Group (LSXMA) (LSXMK): The tracking stock was acquired as a result of Liberty Media’s recapitalization in April 2016. Shareholders received 1 share of Liberty SiriusXM Group, 0.25 shares of Liberty Media Group and 0.1 shares of Liberty Braves Group for each share held. Berkshire held 30M shares of Liberty Media for which he received the same amount of Liberty SiriusXM Group shares. There was a ~40% stake increase in Q2 2017 at a cost-basis of ~$40 per share and the stock is currently at $31.44. This quarter saw marginal trimming.

Note: LSXMA/LSXMK is trading at a significant NAV-discount to the parent’s (SIRI) valuation.

Amazon.com (AMZN): AMZN is a 0.59% of the portfolio stake established in Q1 2019 at prices between $1500 and $1820 and increased by ~11% next quarter at prices between $1693 and $1963. The stock currently trades at ~$2410. There was marginal trimming this quarter.

Sirius XM Holdings (SIRI): The 0.37% SIRI stake was purchased in Q4 2016 at prices between $4.08 and $4.61. Q2 2017 saw selling: ~20% reduction at prices between $4.70 and $5.50. The stock is currently at $5.34. This quarter saw minor trimming.

American Airlines (AAL): AAL stake was first purchased in Q3 2016. The original purchase was at prices between $28 and $39 and doubled in Q4 2016 at prices between $36.50 and $50. The stock is now at ~$9. There was a ~3% trimming in Q2 2018 and a similar reduction next quarter. Last two quarters saw minor trimming.

Note: The entire ~10% of the business stake was disposed at ~$11 last month. This is compared to their overall cost-basis of ~$40 - lost around 75% of their investment over a holding period of just over three years.

Liberty Global PLC (LBTYA) (LBTYK): The position was established in Q4 2013 at prices between $37.50 and $44.50 (adjusted for the 03/2014 stock-split) and increased in the following two quarters at prices between $38.50 and $46. The three quarters thru Q1 2016 had also seen a combined ~30% increase at prices between $30 and $50. Q2 2016 saw a ~17% further increase at prices between $27 and $39. The stock is now at $21.36 and the stake is at 0.25% of the 13F portfolio. This quarter saw marginal trimming.

Axalta Coating Systems (AXTA): AXTA is a small 0.24% of the portfolio stake established in Q2 2015 at prices between $28 and $36 and increased by ~16% the following quarter at prices between $24.50 and $33.50. The stock currently trades at $19.70. Berkshire owns ~10% of the business. This quarter saw marginal trimming.

Teva Pharmaceuticals (TEVA): TEVA is a very small 0.22% of the portfolio stake established in Q4 2017 at prices between $11.20 and $19.33 and more than doubled next quarter at prices between $16.50 and $22. The stock currently trades at $11.21. This quarter saw marginal trimming.

Synchrony Financial (SYF): SYF is a 0.18% of the portfolio position purchased in Q2 2017 at prices between $26.50 and $34.50 and increased by ~20% the following quarter at prices between $28.50 and $31.25. The stock is now at $16.54. This quarter saw a ~3% trimming.

Note: Synchrony is the private label credit-card business split-off from GE that started trading in August 2014 at ~$23 per share.

Suncor Energy (SU): The 0.13% SU stake was purchased in Q4 2018 at prices between $26 and $40. Last quarter saw a ~40% stake increase at prices between $29 and $33. The stock is now well below those ranges at ~$16. There was marginal trimming this quarter.

Note: Suncor Energy has had a roundtrip in the portfolio. It was a 0.48% position purchased in Q2 2013 at prices between $27 and $32. That stake was disposed during Q2 & Q3 2016 at prices between $25.50 and $29.

Biogen Inc. (BIIB) and Liberty LiLAC Group (LILA) (LILAK): These two minutely small positions (less than ~0.10% of the portfolio each) saw marginal trimming this quarter.

Kept Steady:

Apple Inc. (AAPL): AAPL is currently the largest 13F portfolio stake by far at ~36%. It was established in Q1 2016 at prices between $93 and $110 and increased by ~55% the following quarter at prices between $90 and $112. Q4 2016 saw another ~275% increase at prices between $106 and $118 and that was followed with a stake doubling in January 2017 at prices between $116 and $122. There was another ~23% increase in Q4 2017 at prices between $154 and $176 and that was followed with a ~45% increase in Q1 2018 at prices between $155 and $182. Since then, the activity has been minor. The stock currently trades at ~$308.

Note: Berkshire’s overall cost-basis on Apple is ~$141 per share. They have a ~5.6% ownership stake in the business.

Bank of America (BAC): Berkshire established this large (top three) ~11% of the portfolio position through the exercise of Bank of America warrants. The warrants had a strike price of $7.14 compared to the current price of $21.44. The cost to exercise was $5B and it was funded using the $5B in 6% preferred stock they held. There was a ~30% stake increase in Q3 2018 at prices between $27.75 and $31.80 and a marginal increase next quarter. Q2 2019 also saw a ~4% stake increase.

Note: Berkshire’s overall cost-basis is ~$13 and ownership stake is 10.7%.

American Express (AXP) and Coca Cola (KO): These two very large stakes were kept steady during the last ~6 years. Buffett has said these positions will be held “permanently”. Berkshire’s cost-basis on AXP and KO are at around $8.49 and $3.25 respectively and the ownership stakes are at ~17.6% and ~9.4% respectively.

Wells Fargo & Co. (WFC): WFC is Buffett’s fifth-largest stake at 5.28% of the 13F portfolio. It is a very long-term stake. Recent activity follows: last year saw a ~25% selling at prices between $43 and $55. Berkshire’s cost-basis is at ~$24.50 and their ownership stake is 8.4%. The stock currently trades at $23.36.

Kraft Heinz Co. (KHC): KHC is currently a fairly large position at 4.59% of the portfolio. Kraft Heinz started trading in July 2015 with Berkshire owning just over 325M shares (~27% of the business). The stake came about because of two transactions with 3G capital as partner: a ~$4B net investment in 2013 for half of Heinz and a ~$5B investment for the acquisition of Kraft Foods Group in early 2015. Berkshire’s cost-basis on KHC is ~$30 per share compared to the current price of $29.20.

Moody’s Inc. (MCO): MCO is a ~3% of the 13F portfolio stake. It is a very long-term position and Buffett’s cost basis is $10.05. The stock currently trades at ~$251. Berkshire controls ~13% of the business.

US Bancorp (USB): The 2.60% USB stake has been in the portfolio since 2006. The original position was tripled during the 2007-2009 timeframe. It was then kept relatively steady till Q2 2013 when ~17M shares were purchased at prices between $32 and $36. H1 2018 had seen a ~16% increase at prices between $49 and $58 and that was followed with a ~25% increase in Q3 2018 at prices between $50 and $55. The stock is now at $30.68 and Berkshire’s cost-basis is ~$38. They control ~10% of the business. Q4 2018 and Q2 2019 also saw minor increases.

Bank of New York Mellon Corp (BK): BK is a 1.53% of the 13F portfolio stake. The bulk of the original position was purchased in Q2 2012 at prices between $19.50 and $25. Recent activity follows: 2017 saw a ~180% increase at prices between $43.50 and $55 while 2018 saw another one-third increase at prices between $44.50 and $58.50. The stock currently trades at ~$32. Berkshire’s cost-basis on BK is ~$46 per share and ownership stake is ~10%. For investors attempting to follow, BK is a good option to consider for further research.

Charter Communications (CHTR): CHTR is a 1.35% of the portfolio position. It was established during the last three quarters of 2014 at prices between $118 and $170. In Q2 2015, the position was again increased by ~42% at prices between $168 and $193 and that was followed with another ~21% increase the following quarter at prices between $167 and $195. The stock currently trades at ~$503 compared to Berkshire’s cost-basis of ~$178. The six quarters thru Q4 2018 had seen a combined ~25% selling at prices between $250 and $395 and that was followed with a ~20% reduction in Q1 2019 at prices between $285 and $366. Q2 2019 also saw a ~5% trimming.

Occidental Petroleum (OXY) and RH Inc. (RH): These were the two new positions in Q3 2019. Both were increased last quarter. The 0.32% of the portfolio OXY stake was purchased at prices between $42 and $53 and increased by ~150% last quarter at prices between $37 and $44. The stock currently trades at ~$14. The 0.15% of the portfolio RH position was established at prices between $119 and $174 and increased by ~40% last quarter at prices between $165 and $242. It is now at ~$155. Berkshire controls ~9% of the business.

Note: Berkshire also has warrants to purchase 80M shares of OXY at $62.50 per share. That came about as part of a $10B funding deal (perpetual preferred stock with 8% annual dividend) done in May last year. The dividend was paid in common stock rather than cash last month.

Store Capital (STOR): The 0.19% STOR stake was established in Q2 2017 in a private placement transaction at $20.25 per share. The stock is now at $17.15.

StoneCo Ltd. (STNE): STNE is a 0.18% position purchased in Q4 2018 at ~$21 per share compared to the current price of ~$22.

Note: Berkshire has a ~11% ownership stake in StoneCo. In October 2018, WSJ reported that Berkshire had invested ~$300M each in two Fintech’s – India’s Paytm and Brazil’s StoneCo (STNE). The Paytm investment was made in August 2018 while the STNE purchase was following its IPO in October 2018.

Restaurant Brands International (QSR): QSR is a 0.19% of the 13F portfolio position established in Q4 2014 at prices between $35 and $42. The stock currently trades at $51.42. It started trading in December 2014 following a merger/rename transaction between Tim Hortons and Burger King Worldwide.

Note: Berkshire’s stake in the business is ~4.2%.

Costco Wholesale (COST), Globe Life (GL), Johnson & Johnson (JNJ), Mondelez International (MDLZ), M&T Bank (MTB), MasterCard Inc. (MA), Kroger Company (KR), Procter & Gamble (PG), SPDR S&P 500 Index (SPY), United Parcel Service (UPS), Vanguard S&P 500 Index (VOO), and Visa Inc. (V): These are very small positions (less than ~0.5% of the portfolio each) were kept steady this quarter.

Note 1: Since November 2015, Warren Buffett is known to own ~8% of Seritage Growth Properties (SRG) at a cost-basis of $36.50 in his personal portfolio. It currently trades at $6.92. SRG is an REIT spinoff from Sears that started trading in July 2015.

Note 2: Berkshire Hathaway also has a 225M share position in BYD Company at a cost-basis of ~$1 per share (~$2 per share in terms of ADRs – BYDDY). The ADR currently trades at $11.20.

The spreadsheet below highlights changes to Berkshire Hathaway’s 13F stock holdings in Q1 2020:

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.