Friday, April 17, 2020 11:21:08 AM

TPTW - PCTL - Chart Comparison Analysis

________________________________________________________________

PCTL Security Details

Share Structure

Market Value1...........$3,754,596 a/o Jan 03, 2020

Authorized Shares..1,000,000,000 a/o Dec 17, 2019

Outstanding Shares...475,265,300 a/o Dec 17, 2019

Restricted............35,139,690 a/o Dec 17, 2019

Unrestricted.........440,125,610 a/o Dec 17, 2019

Float..............Not Available

Par Value 0.001

https://www.otcmarkets.com/stock/PCTL/security

https://www.stockscores.com/charts/charts/?ticker=PCTL

_________________________________________________________________

TPTW Security Details

Share Structure

Market Value1.........$1,923,277 a/o Apr 16, 2020

Authorized Shares 1,000,000,000 a/o Apr 01, 2020

Outstanding Shares..793,198,634 a/o Apr 09, 2020

Restricted.........116,816,683 a/o Apr 01, 2020

Unrestricted.......595,508,091 a/o Apr 01, 2020

Held at DTC........593,608,315 a/o Apr 01, 2020

Float...............73,118,465 a/o Jan 17, 2020

Par Value 0.001

https://www.otcmarkets.com/stock/TPTW/security

https://www.stockscores.com/charts/charts/?ticker=TPTW

_________________________________________________________________

How Targets are Calculated

Fibonacci Numbers and Retrace Targets: Explained

________________________________________________________________

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

Fibonacci Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

________________________________________________________________

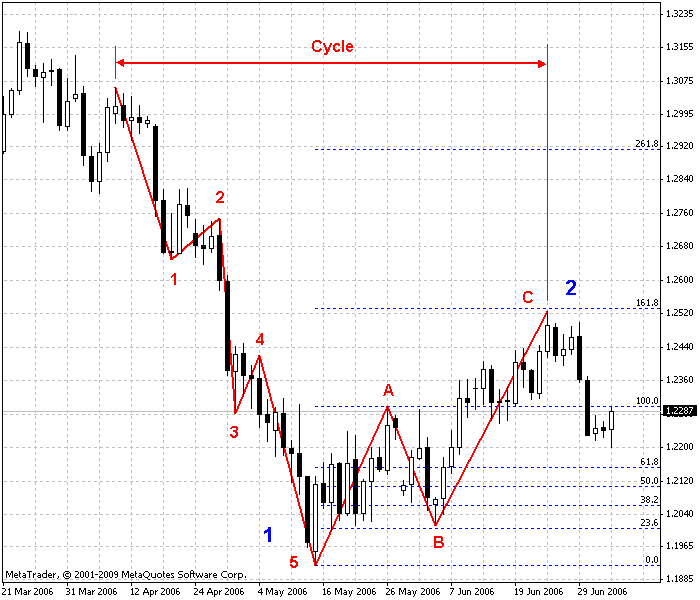

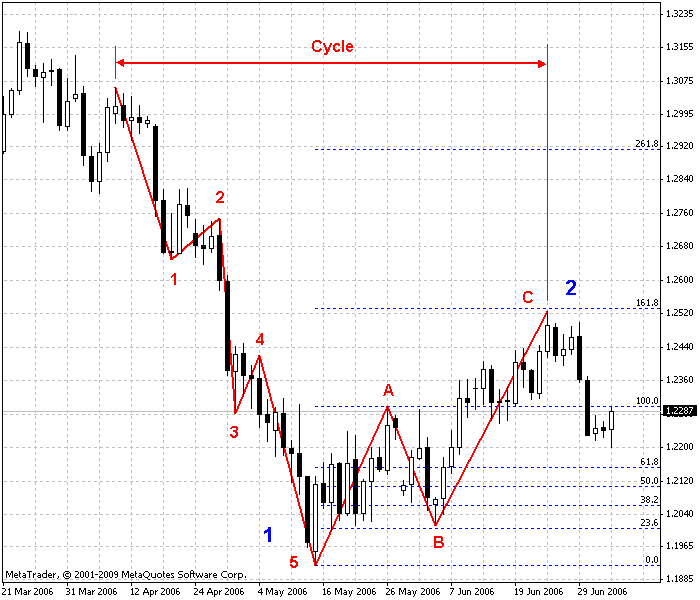

Buy after an Elliott Wave 5-Wave Decline

________________________________________________________________

The Elliott Wave 5-Waves Sequence

A Basic "A,B,C Corrective Wave"

https://www.metatrader5.com/en/terminal/help/objects/elliott/elliott_theory

________________________________________________________________

Elliott Wave Basics

http://www.acrotec.com/ewt.htm

Elliott Wave Theory

http://ta.mql4.com/elliott_wave_theory

Buy after an Elliott Wave,

5-Wave decline sequence !

A Basic "A,B,C Corrective Wave"

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

_________________________________________________________________

________________________________________________________________

Live! Charts

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Live! Charts

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

PCTL Security Details

Share Structure

Market Value1...........$3,754,596 a/o Jan 03, 2020

Authorized Shares..1,000,000,000 a/o Dec 17, 2019

Outstanding Shares...475,265,300 a/o Dec 17, 2019

Restricted............35,139,690 a/o Dec 17, 2019

Unrestricted.........440,125,610 a/o Dec 17, 2019

Float..............Not Available

Par Value 0.001

https://www.otcmarkets.com/stock/PCTL/security

https://www.stockscores.com/charts/charts/?ticker=PCTL

_________________________________________________________________

TPTW Security Details

Share Structure

Market Value1.........$1,923,277 a/o Apr 16, 2020

Authorized Shares 1,000,000,000 a/o Apr 01, 2020

Outstanding Shares..793,198,634 a/o Apr 09, 2020

Restricted.........116,816,683 a/o Apr 01, 2020

Unrestricted.......595,508,091 a/o Apr 01, 2020

Held at DTC........593,608,315 a/o Apr 01, 2020

Float...............73,118,465 a/o Jan 17, 2020

Par Value 0.001

https://www.otcmarkets.com/stock/TPTW/security

https://www.stockscores.com/charts/charts/?ticker=TPTW

_________________________________________________________________

How Targets are Calculated

Fibonacci Numbers and Retrace Targets: Explained

________________________________________________________________

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

Fibonacci Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

________________________________________________________________

The Elliott Wave 5-Waves Sequence

A Basic "A,B,C Corrective Wave"

https://www.metatrader5.com/en/terminal/help/objects/elliott/elliott_theory

________________________________________________________________

Elliott Wave Basics

http://www.acrotec.com/ewt.htm

Elliott Wave Theory

http://ta.mql4.com/elliott_wave_theory

Buy after an Elliott Wave,

5-Wave decline sequence !

A Basic "A,B,C Corrective Wave"

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

_________________________________________________________________

________________________________________________________________

Live! Charts

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Live! Charts

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

________________________________________________________________

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.